Spencer Platt/Getty Images News

The Financial Stability Board, the international body that monitors the global financial system and provides recommendations, has moved Bank of America (NYSE:BAC) to a lower category on its “too big to fail” list of banks. France’s Crédit Agricole (OTCPK:CRARF) advanced to a higher category.

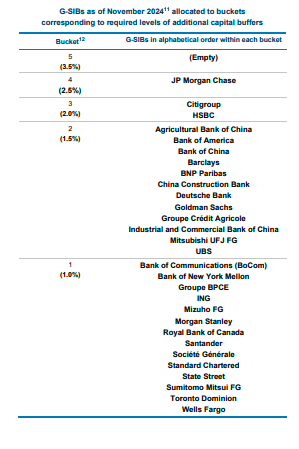

The categories, or “buckets,” are based on the additional capital buffers required for 29 global systemically important banks (GSIBs).

“The changes reflect the effects of changes in underlying activity of banks, with the complexity category being the largest contributor to score movements,” the FSB said.

“The higher loss absorbency requirement established with this list will be effective beginning January 1, 2026 if there is a bucket increase,” it added, referring to Crédit Agricole (OTCPK:CRARF), which was moved to bucket two.

After BofA (BAC) was moved to bucket two, only Citigroup (C) and HSBC (HSBC) remain in bucket three. JPMorgan (JPM) continues to be the top GSIB in bucket four, while the top bucket five remains unoccupied.

The FSB, based in Basel, Switzerland, was established by the G20 in 2009 to promote global financial stability in the wake of the 2007–2008 financial crisis.

Take a look at the FSB’s updated list:

(Note – The percentages in parentheses are the required level of additional common equity loss absorbency as a percentage of risk-weighted assets that each G-SIB will be required to hold in 2026)