Summary:

- Amazon’s core retail business shows strong growth and profitability, driven by increased product selection, enhanced Prime benefits, and logistics optimization.

- Despite a weak macro environment, Amazon is well-positioned for long-term growth with e-commerce penetration expected to rise and expanding into new markets like grocery and pharmacy.

- AWS continues to drive significant growth, especially in AI, thanks to its customer-centric approach, innovation, and strong execution, despite increased competition.

HJBC

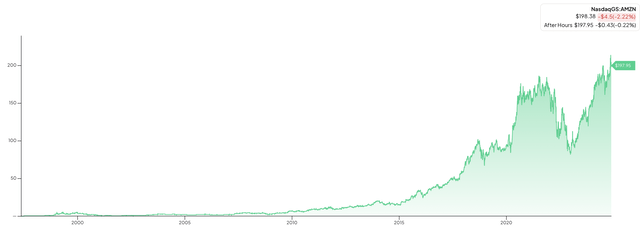

Amazon.com, Inc. (NASDAQ:AMZN) (NEOE:AMZN:CA) has been one of the best-performing stocks since its inception, compounding at over 31% yearly for 27 years. This strong performance has been driven by fundamental growth as the company expanded from selling books to over 12 million products while also expanding into other businesses.

Amazon share price since Inception (FinChat.io)

In this article, I will outline why I believe Amazon’s stock is a hold despite strong fundamental performance.

Q3 Results

In Q3, Amazon reported an 11% revenue increase, slightly accelerating from Q2 and beating analysts’ expectations by $1.59B. Operating income increased 55.6% to $17.4B. This improvement was driven by all three segments improving profitability.

Segment review

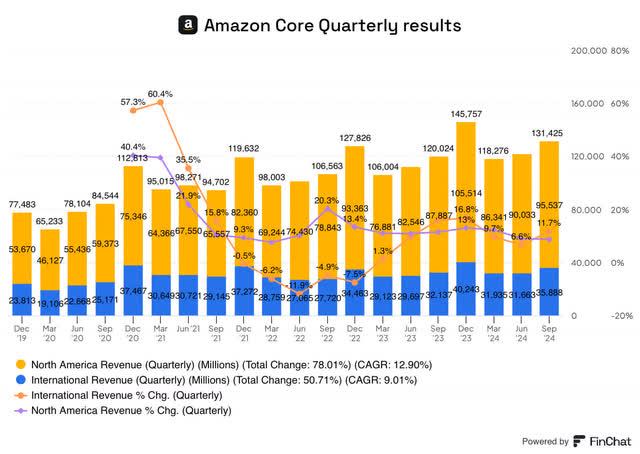

Diving deeper into the three segments. North America, the largest segment, had the weakest results. Revenue grew 8.7%, a sequential slowdown from Q2 and Q1, likely driven by a weaker consumer and lower-priced ASPs, offset by strong advertising growth of 18.8%. North American operating income grew 31.5%, adding roughly $1.3B to the bottom line, driven by regionalisation improvements and increased contributions from ads.

Amazon retail results (FinChat.io)

International grew 11.7% in the quarter, almost doubling its growth rate sequentially. Profitability was also a standout with operating income reaching $1.3B, up from -$95m last year. The improvement was due to individual markets reaching profitability.

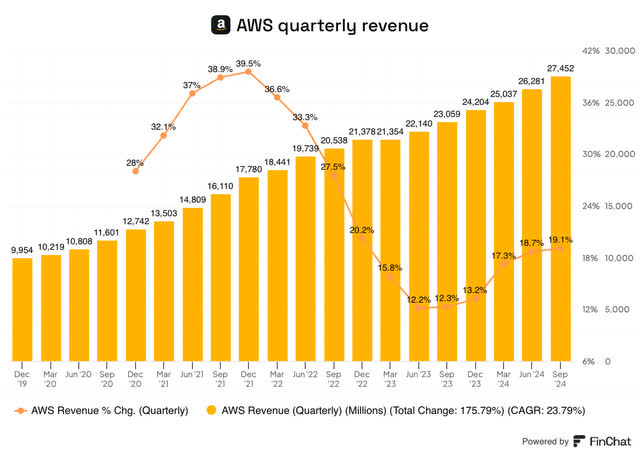

AWS grew 19.1% in Q3 to $27.4B, it’s the 4th quarter of sequential acceleration, although the acceleration is slowing down QoQ. Similar to the other segments, operating income grew dramatically by 49.8% to just under $10.5B, driving the majority of the group’s operating income growth in the quarter. The improvement was due to a number of short term and longer-term factors. AWS continues to benefit from accounting changes extending the useful life of servers, while cost optimisation and headcount moderation likely lead to more sustainable profitability improvements.

Ads

Although Ads is incorporated into the North American & International segments, I believe it’s important to highlight the progress here given the increasing importance to both revenue (roughly 10%) and profitability (not disclosed, but it likely contributes significantly more than 10%). Ads revenue grew 18.8% in Q3 to $14.3B.

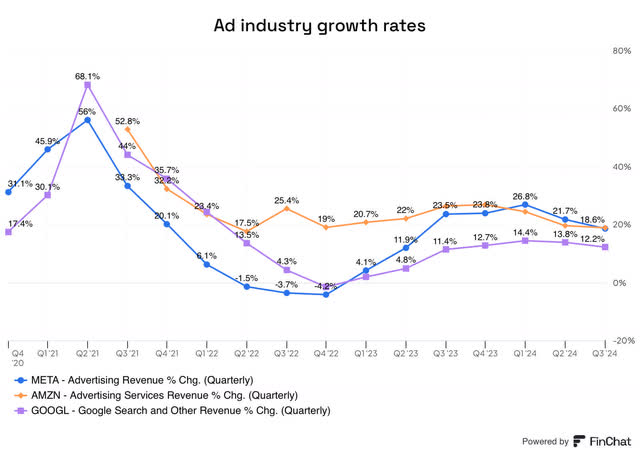

Ad industry growth rates (FinChat.io)

Although ads revenue sequentially slowed down, the company continues to grow at a faster pace than ad giants Meta (META) & Alphabet (GOOGL), who grew 18.6% and 12.2% respectively. This growth rate likely illustrates the company is gaining share within the ad market, demonstrating the value the company provides to advertisers. Profitability likely improved as well, with the company being able to leverage its large IT infrastructure to provide incremental ads at very little cost.

Core Results beyond the numbers

Beyond the weak core retail financial results, Amazon continues to fuel the core flywheel by improving product selection by adding new brands such as Estée Lauder, Kate Spade and All Saints, keeping prices sharp, and enhancing Prime member benefits such as introducing fuel-saving offers across 7,000 fuel locations and speeding up delivery times. The effect of these actions increases consumer loyalty beyond the quarterly results, positioning the company for long-term growth and creating a virtuous cycle of increasing orders and enhancing benefits, making the company very difficult to compete with & lengthening the business’s lifecycle.

Cautious Macro environment

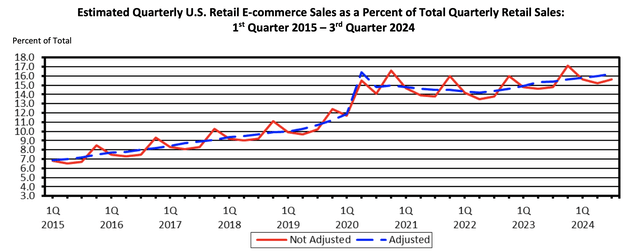

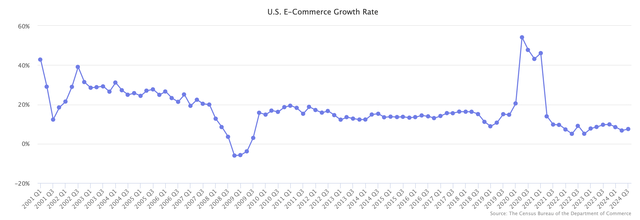

The consumer environment remains weak as consumers continue to trade down & adjust shopping patterns to key retail holidays. E-commerce penetration is also a headwind for Amazon currently, US E-Commerce penetration was 16.2% of total US retail sales in Q3 2024, this has remained roughly flat for the past 4 years due to the COVID-induced spike and demand-pull forward.

US E-commerce penetration (Census Bureau of the Department of Commerce)

Although the environment remains weak, over the long term, consumer habits will likely normalise, while E-commerce growth is forecast to grow at over 8% annually vs roughly 2% for physical retail sales, suggesting E-commerce penetration will accelerate again, with some forecasts expecting penetration to reach 20% by 2028, providing a long-term tailwind for Amazon.

Market share

Amazon already commands a large part of the market, with estimates its market share could be as much as 40%. Despite the strong position, the company continues to gain market share, likely benefitting from its maniacal customer focus, increased product selection and enhanced member benefits.

Industry E-commerce sales grew by 7.4% in the quarter, while Amazon’s North America segment grew by 8.7%.

US E-commerce growth rate (Marketplace Pulse)

Amazon’s outperformance becomes even larger when accounting for volume growth, unit sales grew 12% in Q3, meaning Amazon continues to gain market share on a volume basis at a wide margin vs peers when accounting for underlying consumer demand.

Going forward

Beyond the macro environment, several company indicators give me confidence that Amazon is well-positioned to accelerate growth in the future.

Unit Growth vs revenue

First is the fact that unit growth grew faster than headline sales. Consumers are buying more lower-priced essential goods; this is a temporary headwind for revenue growth. However, in the longer term, this is an important positive indicator for the company. Consumer willingness to buy more essential lower-priced goods from Amazon suggests the company is well positioned to take share from baskets that would have typically been bought in a supermarket.

To accommodate the lower-priced goods, Amazon continues to make progress in lowering the cost of serving from roughly $4 to $3.55 in 2023 and likely even lower now, thanks to further logistics improvements. As Amazon continues to lower the cost to serve, this will allow the company to profitably deliver lower-priced items that they previously couldn’t, further expanding the product assortment the company can sell, expanding the TAM and allowing the company to gain share from brick-and-mortar over the long term.

The combination of consumers buying more essential goods and a lower cost to serve allows the company to expand meaningfully into the $841B grocery market. Amazon has historically not gained much traction in this segment, likely due to the higher cost to serve, reducing the available product assortment. However, with these changes, I expect Amazon to see greater success in this area.

Prime

Prime membership figures are an important indicator to determine how consumers perceive the value Amazon is providing. In Q3, Prime membership growth accelerated, suggesting more consumers see Amazon as the primary place to shop.

Increased Prime membership is significant for the financials as well, not only does Amazon receive subscription revenue, but Prime members also spend more per year. On average, in 2019, a US consumer spent $600 per year on Amazon, while Prime members spent roughly $1400, over double. Since then, this figure has likely increased dramatically. This is potentially important to the retail financials, with an accelerating membership base, it signals a potential revenue acceleration as new consumers make use of their prime benefits.

Delivery speed

The third indicator is logistics optimisation; this has resulted in higher margins in the short term, but more importantly, faster delivery speeds, which continue to get faster every year. 72% of consumers consider delivery speed when making a purchase; this top-of-mind consideration will likely result in accelerated sales as delivery speeds continue to get faster, benefitting from continued progress in delivery optimisation with the introduction of Robotics and eventually drones over the long term.

Similar to reducing the cost to serve, faster delivery speeds will likely expand Amazon’s TAM, in this case with Pharmacy. The online Pharmacy segment is a big segment for Amazon to disrupt. The high cost & long wait times of traditional pharmacies provide an unsatisfactory customer experience. Bloomberg reported the average cost of prescription medicine was roughly $1,400 per person per year. Currently, a consumer would have to go to a Walgreens (WBA) or CVS (CVS) and wait in a long line 3–5 days after the initial order to allow for the pharmacy to prepare & dispense the medication.

Amazon has been making progress in this area, with several acquisitions dating back to PillPack in 2018. The company’s national logistics infrastructure and maniacal focus on improving the customer experience positions the company well. Amazon is already positioned first & second (PillPack and Amazon Pharmacy) in consumer satisfaction of online pharmacies. The company rolled out same-day delivery in several major cities in March and announced plans to launch same-day delivery to over half the population in 2025. This superior delivery time differentiates the company from legacy peers. Amazon is well positioned to continue to gain market share in this large market with its differentiated offering and the consumer trust it has garnered over decades.

Not only do these same-day delivery centres allow the company to expand into new markets, but they further accelerate delivery times of the existing Amazon service, enhancing customer satisfaction.

End Result

The result of these factors should result in accelerated growth, an expansion of TAM and an increase in market share within an increasingly penetrated E-commerce industry over the long term, providing the company with a long path for potential growth in the future.

Long-Term Thinking

Amazon famously thinks very long-term, this is a competitive advantage in a world becoming increasingly short-term orientated. The result of this long-term thinking is the birth of now significant businesses like AWS, Ads, Prime and devices such as Kindle & Alexa.

Beyond the already established businesses, Amazon has ventures in Kuiper & Zoox, among others. Although the majority of these many ventures will likely fail, the ability of Amazon to experiment & willingness to fail skews the odds in Amazon’s favour for a few experiments to succeed, driving outsized returns for the business over the long term.

AWS

Increasingly important

From a starting point of 0, AWS is becoming an increasingly important part of the overall Amazon picture. On an LTM basis, AWS contributed 16.5% of total revenue, up from 15.7% last year. It’s important to note that this increasing contribution is during the slowest growth period in AWS history. AWS is even more important to the bottom line, AWS contributed over 60% of operating income. This significant contribution was driven by significant EBIT growth over the past several years. If AWS continues to grow like I expect it to, the segment will continue to contribute an increasing amount to the bottom line as they achieve operating leverage, driving outsized growth.

AWS quarterly revenue (FinChat.io)

AWS has been successful in revolutionising IT infrastructure because of its customer obsession, strong execution, innovation and security reliability and uptime track record. In the next section, I will explain why I believe AWS is well-positioned to continue to sustain high levels of growth and effectively compete against its biggest rivals Microsoft (MSFT) and Alphabet (GOOG).

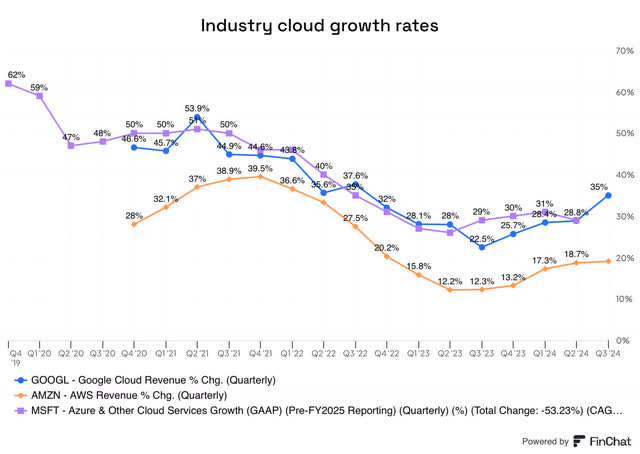

Market share

It’s no secret that AWS’ largest competitors, Microsoft Azure and GCP, have been growing faster than Amazon over the long term, this is due to AWS starting from a much larger base than its competitors, with competition playing catch up. In recent years, all 3 cloud providers have seen slowing revenue growth due to customers changing from growing cloud usage to optimisation of the current usage, causing a temporary slowing of demand.

Cloud industry growth (FinChat.io)

During the slowdown, AWS, on the surface, potentially lost market share at an accelerated rate vs competitors as Amazon’ growth slowdown was more pronounced. However, I don’t believe this to be true, Amazon’s long-standing philosophy of saving customers’ money likely led to AWS going the extra mile to save money for customers. Microsoft and Alphabet likely didn’t go to the same lengths for customers as Amazon did, giving the illusion Amazon lost an increasing amount of market share. However, the enhanced customer savings Amazon gave their customers likely positions the company better to win additional revenue in the future because of the increased customer ROI and loyalty created during this period. Over time, customers will likely reward this customer-centric behaviour with incremental spending on AWS, leading to market share clawback over time.

AI

Despite investor’s fears about AWS’ positioning within the AI industry, I believe AWS is positioned to win over the long term. It’s no surprise considering Amazon’s customer-centric DNA that Amazon is once again focusing on the consumer. The company is investing in multiple areas to provide consumer value. Custom silicon saves companies money, while applications like Bedrock and SageMaker are helping democratise foundation models. The company is also using its core competencies to build apps where it can add value, while acknowledging most use cases will be created by external companies and facilitating these companies to succeed on their platform.

This approach is yielding positive results, with AI revenue within AWS already reaching multi-billion dollars and growing triple digits, likely representing 2-4% of AWS total revenue. Applications like SageMaker are also resonating with consumers, with it being voted the top AI cloud platform. I expect Amazon to continue to see success, AWS has released twice as many features as the other two leading cloud platforms combined over the past 18 months, similar to the company’s long-term bets, I expect a few of these features to drive the majority of growth while many will fall by the wayside, this experimentation culture is what will lead to the company winning over the long term. This culture of experimentation and willingness to fail sets up the company to see sustained long-term success within AI, which will become an increasing portion of AWS financials over time, fuelling long-term growth.

Increase investments

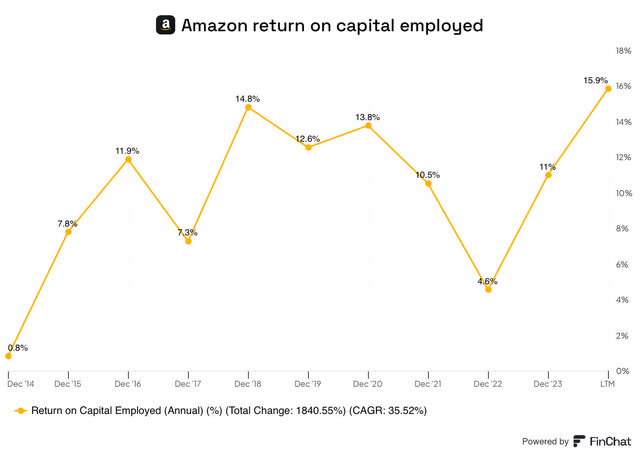

One of the main concerns for investors is increased capex, which has become a trend among big tech over the past several quarters. Amazon is no different from this, with capex expected to hit $75B in 2024. Of this $75B, I expect the majority to be going towards AWS, with the incremental $15B of capex vs 2023 likely attributable to AI investments (at least), with other investments such as same day facilities and project Kuiper production likely making up the small portion not going towards AWS.

Increased investments could lead to lower profitability and impact the company’s ability to reward shareholders, on the other hand, the investments could lay the building blocks for continued business growth in the future. I believe both to be true, the increased investments will likely slow EBIT growth in the short term while AI monetisation continues to ramp. However, as I explained earlier, AWS has taken a very customer-centric approach to AI, and they are seeing the benefits, which I expect to continue. Another important factor to consider is the front loading of investments to get the significant amount of infrastructure in place, this means that capital intensity should decrease as a percentage over time.

Amazon return on capital employed (FinChat.io)

Investors should also take confidence in Amazon’s track record that increased investments are a good use of capital. Amazon’s track record of long-term thinking, innovating and successful business building, along with a return on capital employed that is at an all-time high, should allow management the trust to see these investments through. I expect long-term investors will be rewarded for their patience.

Risks

Valuation

The primary reason I am not buying Amazon currently is the valuation. Amazon is a difficult company to value for two reasons. First is the arguably unrelated and different business models within the group. Second, Amazon’s focus on growth and willingness to make big long-term bets, likely hides the true steady state profitability within each segment.

Historically, a retailer would be valued on a price/sales basis. This type of valuation could still be used on Amazon today. However, due to the increasing portion of sales (currently 25%) being made up by non-retail, high margin business, makes price/sales less useful than previously. Although I still believe it to be a useful indicator vs historical prices.

Amazon reached $84 per share in late 2022, since then, shares have risen to around $200. This price rise has brought the P/S ratio in line with historical trends.

Amazon historical PS ratio (FinChat.io)

Sum of the parts

The other way to value Amazon would be on a sum of the parts basis.

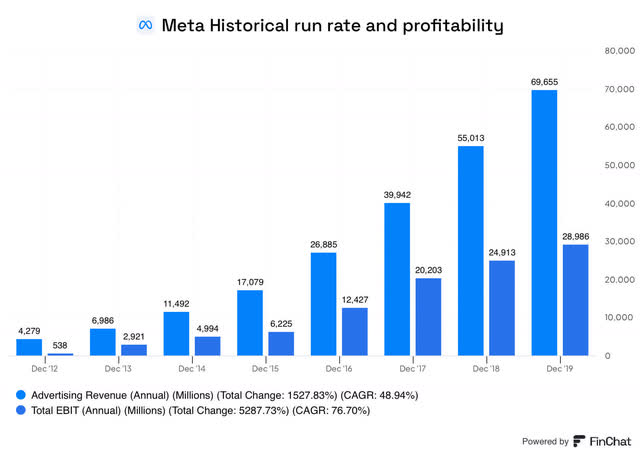

On the retail side, Amazon has $463.6B in revenue and $22.2B in operating income, including ads. Ads profitability isn’t disclosed, making it difficult to know how much it contributes. However, I estimate it to be around $10.5B, a 20% operating margin business, this is likely a conservative number. When looking at Meta in 2018, the company had a similar revenue run rate of $55B, however operating margins were 45%.

Meta Historical run rate and profitability (FinChat.io)

If Amazon had similar profitability today, not unplausible, Ads would make up over 100% of retail operating income. Why is this important? The retail and Ads businesses have different growth rates, the more income attributable to ads will likely result in faster income growth in the future, compared to the same income being attributable to retail. My conservative figure therefore allows for potential upside. Beyond this, I will separate the two segments into retail and Ads. Retail has revenue of $410B and an estimated $10-12B in operating income, while ads has $53B in revenue and an estimated $10.5B in income.

On the retail side, I will use Walmart (WMT) as a comparison. I explained earlier that historically retail is valued on a P/S ratio. Historically, Walmart has traded between 0.7x-1.1x sales.

Walmart historical Price/Sales (FinChat.io)

I believe Amazon is deserving of a premium of this valuation. The company has a dominant market share of 40% in the US & dominant position in other geographies, strong growth prospects outlined earlier and a global network infrastructure. I believe the high end is a fair place to value Amazon, giving the E-commerce business a value of $450B.

In 2018 on a similar run rate to Amazon today, Meta’s market value was close to $600B. Given Amazon’s growth rate, growth opportunities and likely profitability, I believe it’s reasonable to give a valuation that is based off this number. Due to the unknown profitability, I believe a value of $450B for ads is a conservative yet fair number.

The final piece is AWS, the segment currently has an LTM EBIT of $36.3B. While some analysts argue that AWS is worth over $1T, this would value the business at around 30x earnings, I believe this to be aggressive. Given the size of the business, it would make more sense to value the business between 20-25x earnings. This would give AWS a valuation range between $725B & $900B.

When adding the sum of these parts, I come to a valuation between $1.625T & $1.8T, against a stock value of $2.12T ($200 share price), demonstrating Amazon is likely trading above its fair value today.

Despite a premium valuation which could result in short-term volatility, I continue to believe that Amazon will reward long-term investors, driven by strong fundamental growth outlined earlier. The retail business continues to have strong fundamental tailwinds that should drive growth for a long time, coupled with long-term bets driving incremental growth over the very long term, these fundamentals are likely to outperform those of the benchmark S&P 500

Competition

Amazon is facing increased competition in cloud and retail; I outlined the competition within cloud earlier and why I expect Amazon to win out in the long term.

On the retail side, Walmart is likely the biggest threat to Amazon, the company is expanding its E-commerce focus, including its own membership scheme. The company is also focused on delivering at faster speeds, with Walmart partnering with companies to trial drone delivery, potentially leapfrogging Amazon. Walmart likely has an advantage in grocery & other essential items due to its stronghold in brick & mortar retail, making the jump to E-commerce a natural stepping stone.

The other competitive threat is Temu (PDD), Temu entered the US in September 2022. The website offers goods at a much cheaper price than competitors; however, items are lower quality and delivery times can be between 4 & 22 days, significantly longer than Amazon. Temu will likely be making inroads into the price conscious consumer, especially in the current environment with consumers trading down. This potentially takes incremental dollars away from Amazon, who is known for quality, reliability, and speed.

Amazon will likely see heavy competition in new businesses when they launch, such as, from SpaceX’s Starlink with Project Kuiper & Waymo with Zoox adding to future competition. This competition will likely continue to increase as the company continues to see success.

Despite the increasing competition there are several reasons I believe the company will continue to succeed.

Operating Philosophy

As I have mentioned in this article, Amazon’s culture of customer centricity, innovation, long-term thinking, experimentation, and the willingness to fail is a competitive advantage. Instead of focusing on competitors, Amazon focus on providing the customer with a superior experience that sets it apart. This culture has been demonstrated by its superior track record; I expect this to continue.

Built Different

Amazon has been built structurally different from competitors by using Primitives, giving the company a competitive advantage. Primitives are what Amazon calls the small foundational building blocks that the company is built on, such as logistics, picking and search. By building on these blocks from the bottom up it allows the company to be more agile, it also allows new businesses to be built far more quickly by plugging in the already built building blocks where needed. This structural advantage allows the company to respond quicker to threats, innovate more quickly and optimise each building block for better execution.

Growing Markets

Despite competition likely getting stronger and more sophisticated over time, the markets that Amazon operates in are also large and growing. These large, growing markets mean that multiple companies will likely grow and succeed without cannibalising each other just yet, Although this may change in the future.

Conclusion

To conclude, The strong and improving fundamentals driven by a core retail business that continues to execute well, deliver more value to customers and expand into new sectors for disruption. The company continues to invest in long-term bets driven by AWS continuing to accelerate and remain well positioned to continue growing into the large cloud industry and the large AI opportunity ahead. Despite these strong fundamentals, I continue to believe the company is a Hold.

The company’s valuation is no longer cheap, and likely commands a justifiable premium to the S&P 500. The company will also face increasing competition going forward in all sectors and increased investments potentially pressuring short-term profitability. Despite this, I believe the company is well positioned to compete successfully and continue growing over the long term.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.