Summary:

- Super Micro Computer is undervalued with a fair value of $70.05 per share, implying an 84% increase, driven by reaching compliance with NASDAQ listing requirements, multiple expansion, and high expected growth.

- SMCI is well-positioned to capitalize on the growing demand for AI infrastructure with their Direct Liquid Cooling technology and broader IT solutions. A key proof of it is the NVIDIA partnership.

- Despite past accounting irregularities and delisting risks, Super Micro’s leadership can be trusted to bring the company back on track.

- Super Micro went from one of the stock market darlings to maximum pessimism in only 8 months, while the business is scaling at unprecedented rates. This presents an opportunity.

- Super Micro has multiple catalysts in place for significant growth in price per share.

Editor’s note: Seeking Alpha is proud to welcome Silviu Manole as a new contributing analyst. You can become one too! Share your best investment idea by submitting your article for review to our editors. Get published, earn money, and unlock exclusive SA Premium access. Click here to find out more »

Erik Isakson

Context

Super Micro Computer, Inc. (SMCI) aka Super Micro is seeing a major crash since the Hindenburg Research group published a comprehensive paper hinting to accounting irregularities. On the 27th of August, when the research was published, share price of Super Micro was $55.

The fears were accentuated on the 30th of October, when Ernst & Young resigned as their auditor, compounding the concerns that Super Micro will not be able to meet the requirements to maintain its NASDAQ listing.

Over the past two weeks, there were some important developments as the company appointed new auditor BDO USA and filed a compliance plan with Nasdaq announcing its intentions to file 10-K for the fiscal year ended June 30, 2024, and a quarterly report ending September 30, 2024, in time to avoid delisting.

Important, Super Micro was delisted from NASDAQ on the 24th of August 2018 primarily due to its failure to comply with the exchange’s listing rules, specifically Rule 5250(c)(1), which requires timely filing of financial reports with the SEC. NASDAQ relisted Super Micro on the 14th of January 2020. Since the 24th of August 2018 to today, the company returned ~23X to the investors, and if we consider the company peak in March 2024, the stock would have returned ~68X.

I am a long-term investor looking for companies with the potential to grow 2X to 10X in the next 18 to 60 months, based on my thesis Super Micro is one of them. Usually, these opportunities appear when the market is at its highest level of pessimism; however, that point is already behind us and Super Micro’s share price has rebounded significantly. I missed the initial rebound because it took me a week to research and write the article.

The Business Is Wonderful

Super Micro is a leading provider of high-performance server and storage solutions, with a strong focus on energy efficiency and innovation. Direct Liquid Cooling (DLC) plays a crucial role in their offerings, providing efficient, high-performance cooling solutions that enable the deployment of dense, powerful computing infrastructure. DLC technology not only enhances performance and reliability but also contributes to significant energy savings and environmental benefits, positioning Super Micro as a key player in the evolving landscape of data center technology.

For context, DLC accounted for 70% of Super Micro’s sales last quarter, and its volume has skyrocketed to at least 10x what it was a year ago. Going forward, the company expects 15% to 30% of new data centers in the next year to use liquid-cooled infrastructure, which would be a true sign of exponential growth.

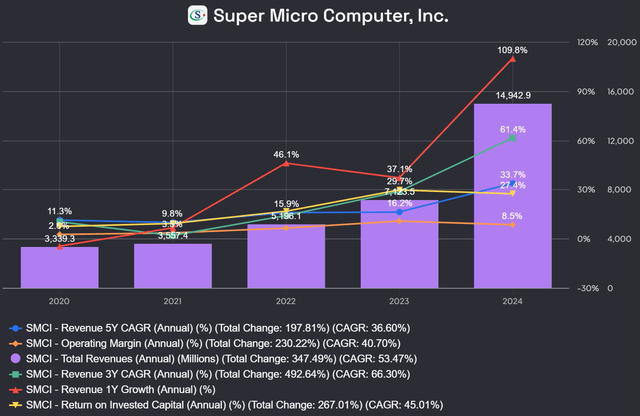

Additionally, let me give you a few numbers that speak loud in terms of the business success:

- Revenue 4Y CAGR: 36.6% and 110% YoY Growth.

- ROIC: 27.4%, impressive.

SMCI Key Financials (FinChat.io)

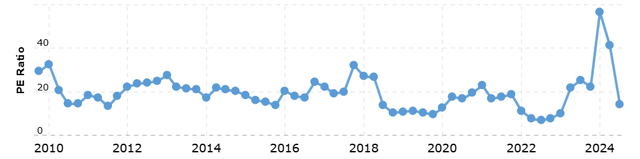

- P/E is remarkably low for such a company

P/E is very low for this kind of company, Super Micro’s ~15 P/E is very attractive vs. its historic ~20 median. I look at a forward P/E of 25-30, which seems fair and justified considering the company’s strong fundamentals and long growth runway. The multiple expansion is fundamental to my valuation thesis.

SMCI Long Term P/E Ratio (Macrotrends.net)

Three-Part Investment Thesis

1. Why do I Believe Accounting Irregularities will be cleared?

As the major issue we can identify with the company at this point is accounting irregularities, I use common sense in my arguments that makes me believe that time will prove the company financials are credible and is only a matter of time until they will regain full compliance with NASDAQ requirements:

- Charles Liang is a business genius, leading Super Micro for the past 30+ years successfully. He has skin in the game, owning 11.8% of the company.

- As for David Weigand, the Chief Financial Officer, he has served in senior leadership positions at many reputable companies with pristine track record – positions usually under tight oversight and compliance requirements.

- BDO USA accepted to be the new auditor, which is a sign that their diligence on the company books is positive, and they trust management for long-term cooperation.

Delisting Risk is Real

Delisting risk is real, but delisting is an opportunity if you buy with 18-60 months’ time horizons. Why? Because if a company is delisted from a major exchange and moves to over the counter (OTC), regulations often require institutions to sell off their holdings. Additionally, individual investors might sell because their brokers do not support OTC trading. Choose a broker that trades OTC shares, sooner or later, Super Micro will be listed again on NASDAQ if this risk materializes.

2. Multiple Catalysts in Place for Significant Share Price Appreciation

I will elaborate a few, the ones with the highest impact on share price:

High:

- Regain compliance with NASDAQ requirements.

Medium to High:

- Super Micro has solutions ready for the upcoming Blackwell GPU chips from NVIDIA, which are expected to drive stronger demand and revenue growth once available.

- Continued collaboration with NVIDIA on new product developments.

Medium:

- Datacenter Building Block Solutions (DCBBS) and Super Cloud Composer (SCC). These solutions provide end-to-end management and automation for liquid-cooled datacenters, accelerating the adoption of Super Micro’s direct liquid cooling (DLC) technology.

3. Attractive Valuation with Strong Growth Potential

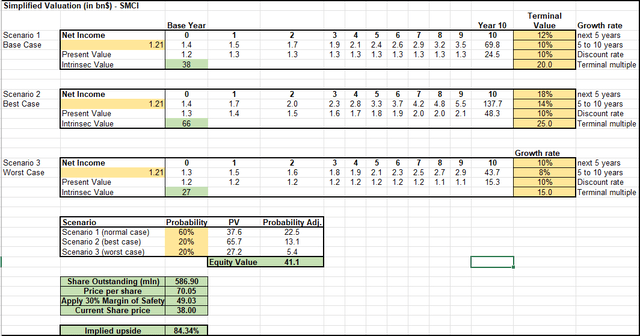

My intrinsic valuation shows you the significant undervaluation of the business with a fair value of around $70.05 per share, which is an 84% implied share price increase. If we apply a 30% margin of safety, the company is undervalued with 23% upside.

SMCI Intrinsic Valuation (Personal)

Usually, I use FCF to evaluate the intrinsic value of a company, but in Super Micro case, I use Net Income because FCF is not reflecting the actual business performance as the company has been experiencing very high growth rates, over 100% year-over-year. This rapid growth has necessitated significant investments in inventory and accounts receivable, which has negatively impacted cash flow.

Final Thoughts And Contrarian View

Mister Market is overestimating the impact of accounting irregularities and discounting the massive tailwinds the company has, as a result, Super Micro is a case where multiple catalysts converge to create outsized growth potential. With its robust fundamentals, leadership in booming AI and strong partnerships with NVIDIA, strong management alignment, Super Micro has the hallmarks of a company that can deliver 2X to 10X returns over the next 18-60 months.

Investors should weigh the following risks against Super Micro:

- NASDAQ Delisting: An inability to remain compliant with listing requirements by February 2025 as per the last NASDAQ deadline may trigger a stock sell-off by institutions and investors alike.

- Valuation Optimism: My positive outlook is built assuming sustained high growth. As reflected above, I believe this is possible looking at the company tailwinds.

- Sector cyclicality: Super Micro conducts its business in a sector that is cyclical. Some theorize we may already be at the top, which could shrink demand in the short term.

- Growth Management: The company still faces the challenge of sustaining very high growth in operations, supply chain, and market share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SMCI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.