Summary:

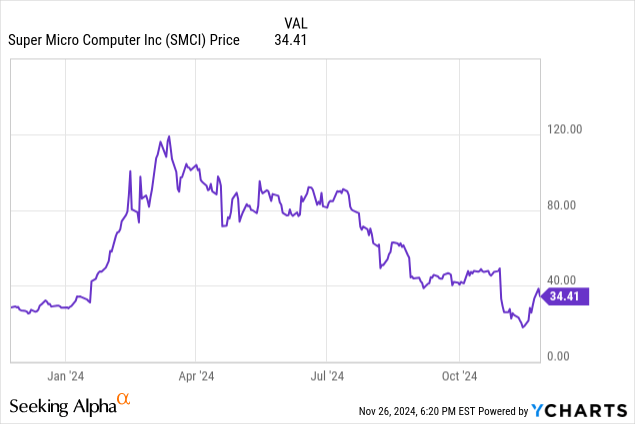

- Super Micro Computer is up nearly 100% over the last two weeks.

- BDO has been appointed auditor and a compliance plan has been filed to NASDAQ.

- Accounting concerns and a deterioration in operating results remain key risks.

CasarsaGuru

Super Micro Computer (NASDAQ:SMCI) shares have gone on a blistering rally the last two weeks, nearly doubling from 52-week lows, as the market has become more optimistic about the company’s ability to weather the recent storm of issues. While Super Micro has appointed a new independent auditor and has filed a compliance plan with the NASDAQ, the risks here remain more prominent than the reward, in my opinion, and investors should consider capitalizing on these recent gains to make an exit.

I have been in the bear camp on SMCI since September, when I wrote an article recommending a Sell after the news first broke that the company was delaying regulatory filings and was also the subject of a Department of Justice probe into potential accounting irregularities and sanctions violations. The stock dropped nearly 60% in the ensuing weeks but has now recovered to just a 20% loss since that article’s publication, which can be read here.

Since the end of September, Super Micro has lost an independent auditor and gained a new one, announced lackluster preliminary Q1 results, filed a compliance plan with the NASDAQ, and the stock has been the beneficiary of a major short squeeze. The one thing I can guarantee in the weeks ahead is volatility, and so the question becomes: what should investors do now?

BDO To The Rescue?

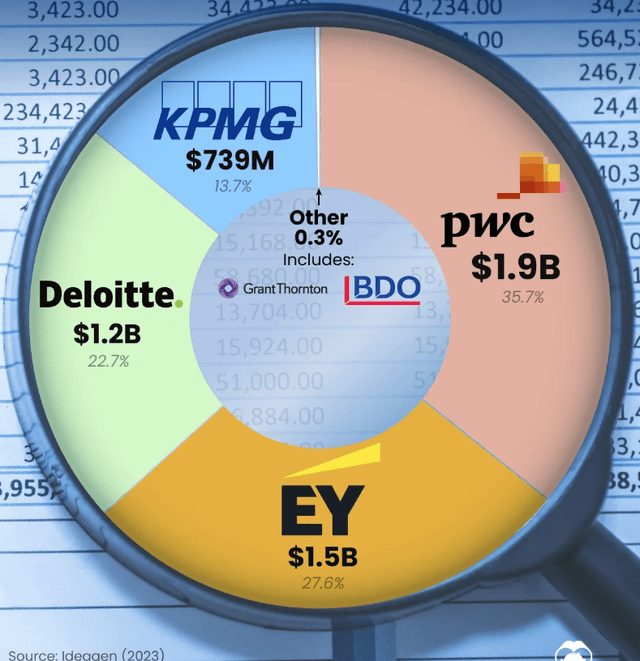

Let’s start with what I consider to be the most important news, which is that Super Micro has secured an independent auditor in BDO USA. The good news is that this will potentially allow the company to prepare and file financial statements that could restore investor confidence and allow it to remain listed on the NASDAQ. The bad news is that BDO is considered a second-tier accounting firm that has seen issues with declining audit quality in recent years. Further, of the total audit fees paid by companies in the S&P 500 (SPY), all non-Big 4 firms like BDO earned around 0.3% of the total combined.

So while hiring BDO is a positive development, this isn’t exactly a game-changer. I’ve seen speculation on Seeking Alpha forums and elsewhere that BDO would not have agreed to take the job if indeed there were accounting violations, so just the action of accepting the contract is a bullish indicator in and of itself. However, it seems that pre-screening for potential issues, was not part of the arrangement, as Super Micro disclosed in an 8-K on November 18th. I’ll include the full quote here for completeness and to avoid confusion:

During the fiscal years ended June 30, 2024 and 2023 and the subsequent interim periods through November 18, 2024, neither the Company nor anyone on its behalf has consulted with BDO regarding: the application of accounting principles to a specific transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company’s financial statements, and neither a written report nor oral advice was provided to the Company that BDO concluded was an important factor considered by the Company in reaching a decision as to any accounting, auditing, or financial reporting issue…

There doesn’t appear to be any indication that the issues that led the previous auditor, Ernst & Young (“EY”), to resign are suddenly resolved in the eyes of BDO. I think BDO is simply happy to take a look at Super Micro’s books in the hopes of adding a large company to its client list (especially stealing one from the Big 4). In the best-case scenario, the books check out and BDO gains a significant and loyal customer, and in the worst-case scenario, BDO can just follow EY’s lead and resign, taking a small ding to a reputation that was already second-tier.

Now comes the interesting part: audited financial statements are a requirement for Super Micro to remain listed on a major exchange and to remain in compliance with the terms of the debt on its balance sheet. Will BDO give the green light, or will it sound the alarm (again)?

There is also the matter of the DoJ probe, which is reportedly looking into areas similar to the ones now at question over the auditor saga (i.e. accounting violations). I have mentioned in previous articles that this probe is likely to hang over the stock like a dark cloud, capping upside potential and keeping shares from building momentum. The very public escalation of these governance issues since the probe was first reported by the Wall Street Journal will only amplify that chilling effect, in my opinion.

Damage Already Done

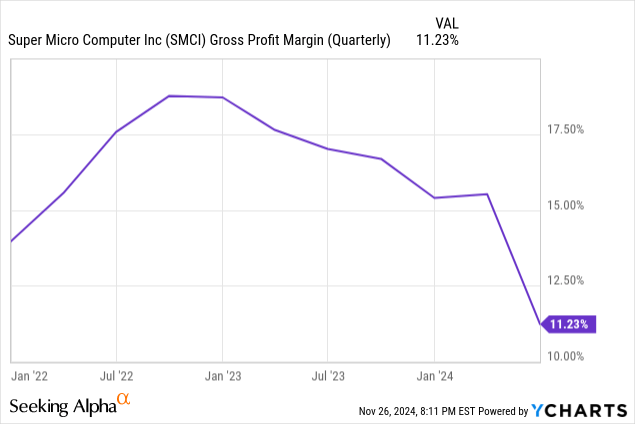

These internal problems have begun to have a material impact on Super Micro’s operating results in a way that could have lasting effects even in the best-case scenario where everything gets back on track and no major violations are uncovered. There’s never a great time to become embroiled in a potential accounting snafu, but objectively the worst time would be right before the most important product launch in the company’s history.

I am, of course, referring to the servers that house Nvidia’s (NVDA) newly introduced Blackwell GPUs, which would have almost certainly driven Super Micro to record financial results. Instead, Nvidia has been forced to reroute some orders to other server makers to minimize disruption to the AI supply chain in response to Super Micro’s ongoing issues. Super Micro claimed on its Q1 earnings call that it has seen no negative allocations.

Regardless, this erosion of trust and the damage to the company’s brand will endure, and every server that the company doesn’t sell is a potential customer that instead goes with and sticks with a competitor. As volume production of Blackwell ramps up, Super Micro will be left further and further behind if it does not turn things around and fast.

In the company’s preliminary Q1 results, it guided for revenue of $5.8 billion for the upcoming quarter (Q2), which was more than 15% lower than consensus estimates for $6.86 billion. Typically, a mismatch that is substantial between expected results and actual results indicates a miscalculation in the supply-demand dynamics and an over-allocation of inventory. It’s hard to know whether this miss is from rerouted orders or from something related to the accounting issues, but either way, it is a significant cause for concern.

With this mismatch comes a significant potential risk: impairment. The company has ramped up for production in anticipation of Blackwell and, if inventory balance is indeed an issue, it will have to either clear that inventory at reduced prices, which will hurt margins, or take an impairment charge. This is extremely concerning for a company that was already facing margin pressure before these latest issues arose:

I’m seeing a lot of folks talking up the company’s financial results, valuation ratios, etc. in support of buying SMCI at current prices. The fact of the matter is, no one outside the company knows whether those have any actual basis in reality. Sure, there’s upside potential if you guess that everything is above board and ends up being right, but that’s closer to a lotto ticket than an investment.

I know many investors have a cost basis that is much, much higher than the current level, and it’s easy to get stuck in a mindset where you hold and just hope it recovers. The sunk-cost fallacy is probably one of the most well-known and discussed terms in investing circles, but in my experience, one of the hardest to actually correct and overcome. While holding might end up being the right call somewhere down the line, I don’t think the risk-reward profile favors keeping SMCI at this point in time. Now that this dead cat has seen a significant bounce, I think investors should consider making their way towards the exit.

Investor Takeaway

SMCI has seen a significant run-up in the last couple of weeks as bullish news including a new independent auditor and a NASDAQ compliance plan have set off a rally aided by a bit of a short squeeze. While the stock has bounced off lows, major risks remain: the new auditor, BDO, must still clear Super Micro’s financial statements, revenue is being revised down, inventory levels are in danger of rising, margins are still in decline, and the DoJ probe looms.

Shares could jump on good news and might even keep some upward momentum going into the end of the year, but ultimately, I think the risks are too high to recommend holding or buying. I think investors should consider taking advantage of this jump to find another stock worth investing in, and I am reiterating a Sell.

Thanks for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.