Summary:

- Ardmore Shipping’s strategic advantage lies in its eco-friendly fleet and operational flexibility, enabling it to capitalize on shifting market dynamics between chemical and petroleum products.

- Q3 results showed double-digit growth in revenue and EPS, along with improved TCE rates and record-low breakeven levels.

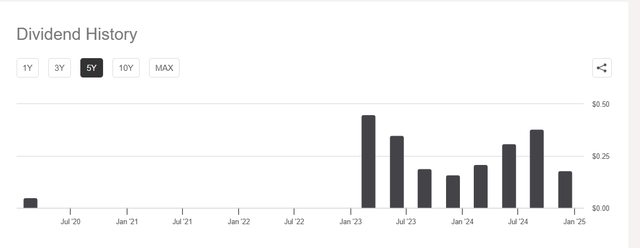

- Ardmore’s balance sheet has strengthened, reducing debt from $97 million to $23 million, and rewarding shareholders with consecutive dividend payouts.

- Despite a recent sell-off and an RSI of 10.43, the stock is significantly undervalued compared to peers with similar growth metrics.

bfk92/E+ via Getty Images

Ardmore Shipping Corporation (NYSE:ASC) is a $500 million maritime transporter that works primarily in transporting chemicals and petroleum products with its fleet of 26 vessels. These include four chartered-in vessels, and range from between 25,000 to 50,000 deadweight tonnes.

Strategically, the company is focused on achieving an eco-friendly, fuel efficient edge, which in turn translates into optimized operational metrics. Similarly, the company’s acquisition strategy is geared towards expanding its fleet to include eco-design carriers, either new, second-hand, or those that can be upgraded to Eco-mods.

Its competitive moat lies in its ability to leverage the overlap between chemical and petroleum products, and demonstrate operational flexibility accordingly, shifting between each product type in terms of favorable market supply and demand dynamics. I believe that it is through this advantage, the company demonstrated resilience in a cyclically weak quarter and a high interest rate environment.

During Q3, Ardmore not only brought in double-digit jumps in its top and bottom-lines, but also saw its TCE drive on upwards, while its breakeven level has been pushed to a new historical low. Moreover, its balance sheet is also very robust, and the company’s prospects seem promising, both in the short- and long-term, based on robust demand drivers.

With all these strengths, ASC shows signs of being significantly undervalued compared to its peers in the industry, based on its growth metrics. Moreover, the stock recently experienced a hard sell-off which brought its RSI down to 10.43, which I believe will be corrected during the week.

I rate ASC as a buy.

Performance Assessment

Ardmore has a strong track record, especially in terms of the growth it has achieved in the last few years. It has more than tripled its EBITDA in the last three years, bringing the trailing total to over $176 million. This three year trailing EBITDA growth rate is the fourth highest among Oil and Gas Storage and Transportation Stocks, which includes a total of 55 companies.

During FQ3 2024, Ardmore Shipping reported $61.54 million in quarterly revenue, which was slightly lower than its expectation of $61.75 million, whereas its quarterly EPS of $0.55 was in line with the guidance it had set. On the topline, the company saw a 10.6% climb, while the bottom line surged 12.18%, YoY. A double digit jump on the top and bottom lines are generally very good indicators on performance.

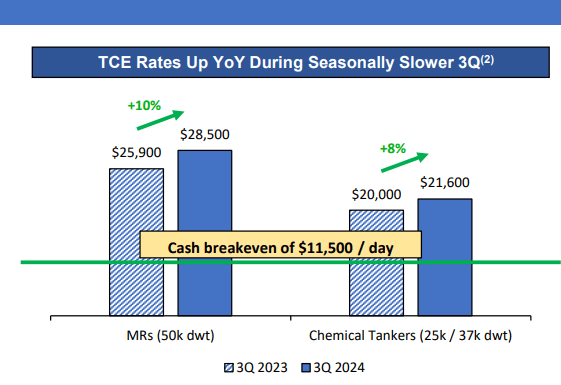

Additionally, the company has also been doing well on other operational metrics. For instance, it saw the Time Equivalent Charter (TCE) rates for both its medium range (MR) and chemical tankers increase during the quarter, compared to FQ3 2023. This was impressive as Q3 has always been seasonally slower for the company.

Investor Presentation

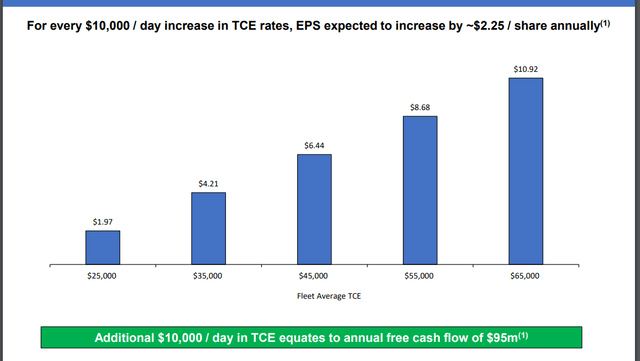

Although sequentially these figures are down from the second quarter’s average TCE rate of $37,762, in terms of YTD stats, TCE is up by 17% on average, compared to the first nine months of 2023. On the chemical tanker side, Q4 will actually bring in improved results as Ardmore’s chemical tankers have been booked for 55% of Q4, at $25,150. Over the long-term, this uptrend is extremely reassuring, especially since every $10,000 increase in TCE directly results in an additional free cash flow of $95 million, as well as an EPS jump of $2.25:

Investor Presentation

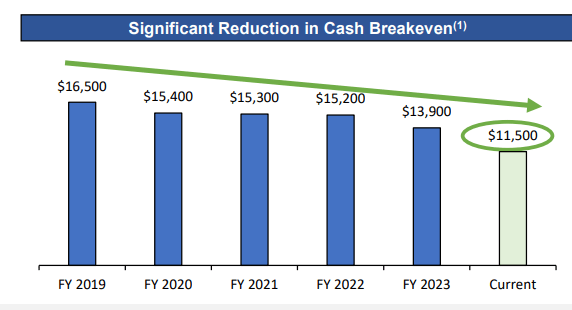

Ardmore’s strong execution is further reflected in its tight control on cost through various optimizing efforts. In fact, the company’s breakeven of $11,500 per day is a record low in all its history, showcasing the company’s operational flexibility, as well as resilience, even in a high-interest rate environment:

Investor Presentation

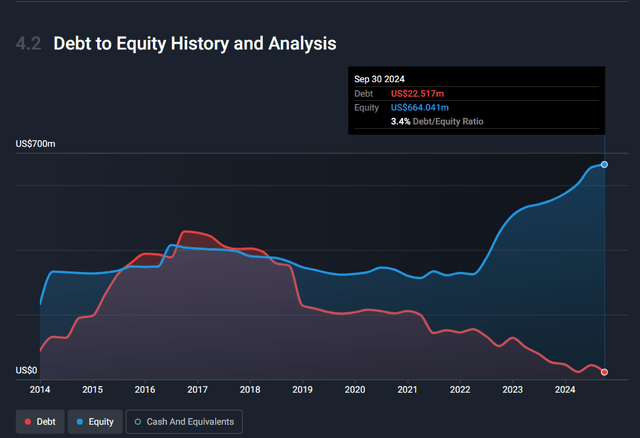

The long-term trend we see above in the consistent and sustained lowering of the breakeven level over the years is a big positive, and I believe it strengthens Ardmore’s moat and subsequently its competitive position. In addition to operating cost control, another driver for this optimization has been ASC’s strategic focus on lowering its debt burden, which results in lower interest payments. In fact, looking at the data, I see strong correlation in the company’s reducing breakeven level and the strengthening of its balance sheet:

SimplyWall.st

Between Q3 2024 and 2023, ASC brought down its total debt from $97 million to almost $23 million. With this improved financial position, the company rewarded its shareholders with its eighth consecutive dividend payout, which was equivalent to one-third of total earnings. At present, its forward yield is equal to 6.12%, but its payment structure of being a fixed proportion of earnings makes it one that grades low on safety and consistency:

Seeking Alpha

Since its re-initiation of the dividend payouts, the company had paid out ~15% of its total market cap (as of November 6) back to its shareholders.

Overall, the company’s fundamentals look quite solid, and its strategic initiatives seem to be bearing fruit. Looking ahead, Ardmore’s prospects, both in the short and long-term appear to be quite promising. In the near-term, despite crude oil prices being near the low end of the range since late 2021, there have been reports that Saudi Arabia is likely to abandon its unofficial $100 per barrel price in order to increase production into 2025 in order to maintain its market share, and has the backing of OPEC+. This increase in supply is a direct short-term driver for petroleum product marine transporters like Ardmore Shipping. Moreover, the resilience in the US economy driven by strong consumer trends, falling inflation and improving jobs data further bodes well for the company.

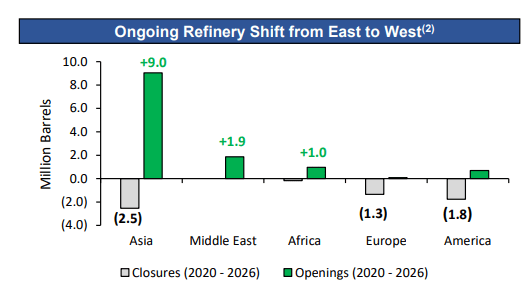

In addition to near-term trends, there are also longer-term drivers which are reassuring. There is a noticeable ‘West to East’ trend seen in oil refineries and petrochemical facilities.

Investor Presentation

Over the longer-term, this shift seeing increased capacity in Eastern regions, coupled with closures in Europe and America, is understandably expected to increase the demand of long-haul ton miles, causing an incremental surge over time. This trend is further boosted by increasing importance of biofuels, and more regulatory complexities which could favor efficient and compliant players such as Ardmore Shipping.

Overall, the broad picture looks promising to me, and I believe with these growth drivers and the company’s strong execution, we will see a further enhancement on the company’s operational metrics over time.

Valuation Assessment

Early in May, when ASC released its strong Q1 results, bulls in the market rushed the stock, taking it up from the $17 territory to over $24, over a period of 2 weeks. Following this rapid surge, which took the stock up to its 52-week-high, ASC initiated a sustained downward trend, which can be seen in its price chart:

Finviz

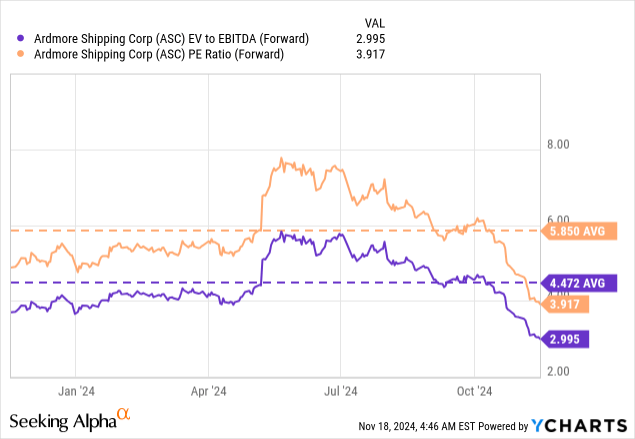

Fast-forward to November. Despite the strong progress, it seems the company’s Q3 earnings were not taken well by the market, as it coincided with ASC’s price breaking through the downward sloping resistance level. I believe this selloff has made the stock valuable again.

YCharts

This would not be surprising as the company’s RSI level, at the time of writing this article is only 10.43, which points to a severe overselling, so I expect a short-term correction soon.

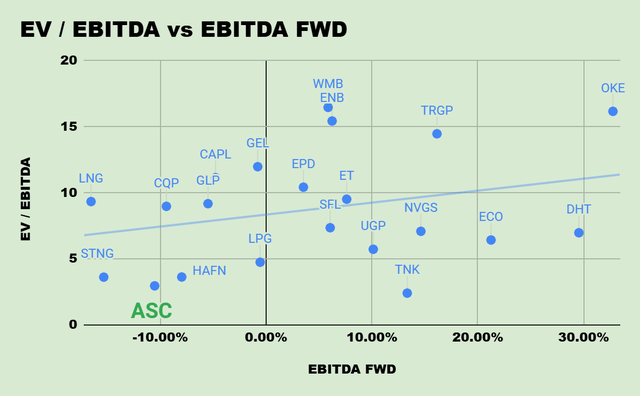

In order to determine the valuation of Ardmore Shipping Corporation, I have gone with my preferred method of valuation of gauging the relationship between value and growth, as assigned by the market, and how ASC stands in terms of this:

Author

As we can see above, there is a significant discrepancy in ASC’s EV/EBITDA ratio of 2.96, in terms of its growth in EBITDA. Even though the company is expected to see a 10.5% drop in its EBITDA during the next year, its ratio is still significantly lower than what the value of the line of best fit would suggest. For instance, CQP with a forward EBITDA growth of -9.43% has an EV/EBITDA (fwd.) ratio of 10.55, which is about 3.6 times more than ASC’s ratio, despite having a very similar growth rate.

When coupled with the short and long-term demand drivers, and the company’s improving operational trends, I see current price levels as a bargain, and a good opportunity to enter a long position into the stock. For these reasons, I rate the stock as a buy.

Risk

While I am quite confident on my thesis about ASC, of course my analysis is not without risk. One red flag that pinches me is how little skin in the game insiders have. Total insider ownership is about 5.5%, which is below what I am comfortable with, especially for a company with a market cap below $500 million.

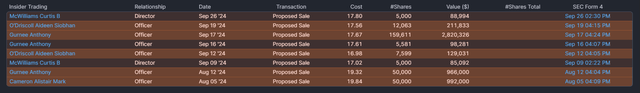

To make matters worse, there has been strong selling activity in the last few months, which only adds to my concern. The founder of the company, Anthony Gurnee, in particular, disposed nearly $4 million worth of shares in the company, and announced his departure from the company.

Finviz

While Gurnee’s retirement is not of particular concern, his decision to liquidate a major chunk of his holdings is. With the company’s operational trends looking promising, I would expect insiders to be the first to load up on ASC stock, anticipating a higher intrinsic value than the market price reflects.

Takeaway

Ardmore Shipping’s operations demonstrate robust progress and resilience despite cyclical and macroeconomic headwinds. In addition to the impressive double-digit jumps on the top and bottom lines, the company’s operational trends are encouraging. When coupled with the strengthening balance sheets, the appeal continues to add up.

With such promising trends and improving prospects, I fail to see alignment with the market’s pricing of the stock. I think ASC is seriously undervalued, and current levels represent a great opportunity for entry into this marine transporter. I rate the stock as a buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.