Summary:

- Ardmore Shipping reported a strong 2Q24 with a 31% revenue increase and 165% net income growth.

- ASC’s dividend yield is 7.02% (trailing LTM) and its payout ratio is 26.3%. For 2Q24, the company announced a quarterly dividend of $0.38/share.

- ASC has enough liquidity to improve its shareholder return policy and invest in newer ships.

- I anticipate declining revenue and profit for 3Q24. Ardmore’s rating is changed to Hold from Buy.

rgaydos

Note: I previously covered Ardmore Shipping (NYSE:ASC). In my previous note, I discussed the company’s fleet and financials, and product tanker market. At the time of the publication, ASC scored 94% in PNAV and 13% in gross LTV. I gave ASC a Buy rating.

In today’s note, I review ASC 2Q24 results and the company’s rating.

Introduction

ASC is a niche tanker company focused on MR and Handysize product tankers. Recent quarters have been fruitful for product tanker shipowners. In its latest report, ASC reported impressive figures: Revenue grew by 31%, and net income by 165%. What is disappointing is the lack of share buybacks. The company has enough liquidity to initiate a share repurchase program and increase dividend distributions.

The 3Q24 report is coming in early November. I anticipate EPS contraction due to lower TCE for MR and Handy tankers. In my opinion, we may see EPS below analysts’ consensus.

Ardmore Fleet

ASC has 16 MRs and 6 Chemical tankers. The average fleet age is 10.1 years. In 2Q24, the company took delivery of a 2017 Korean-built MR tanker, Ardmore Gibraltar. Only 23% of Ardmore’s fleet has scrubbers, but the company is taking steps in that direction. 50% of its MR tankers have scrubbers. ASC announced $15 million in CAPEX for efficiency-enhancing technologies like scrubbers.

The operating figures for 2Q24 are as follows: $37,762/day TCE and $12,650/day breakeven cash flow. For 3Q24, 45% of its fleet is booked at $33,700/day TCE.

ASC is alone in its league. Other product tanker owners, such as Scorpio Tankers (STNG), Hafnia (HAFN), and TORM plc (TRMD), own large and diverse fleets, so a direct comparison is not fair. On the other hand, no other company is focused on MR tankers. That said, 2Q24 TCE realized by ASC is competitive with its peers. For reference, STNG realized $38,813/day TCE and Hafnia $39,244/day. ASC has the most conservative balance sheet in the group. Therefore, the company keeps a very attractive breakeven cash flow.

In the long term, I would like to see more acquisitions of newer vessels with scrubbers. Environmental regulations will become stricter, so newer and more efficient vessels are a must. In the long term, they will provide shipowners with a competitive edge, resulting in higher day rates and improved fleet utilization.

2Q24 Results Review

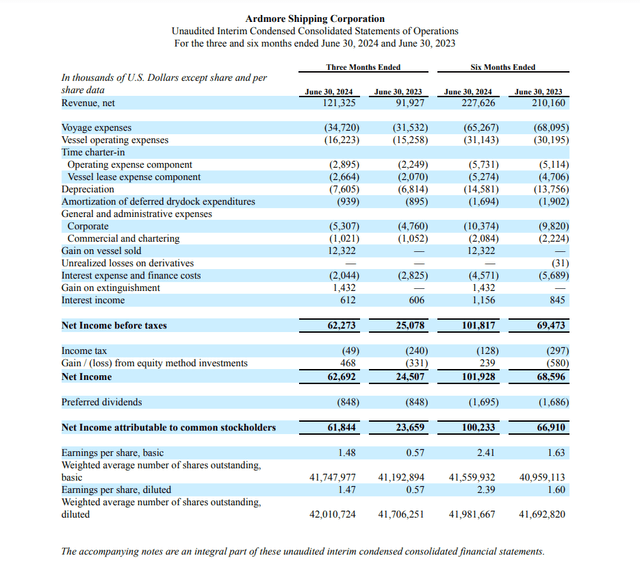

Ardmore reported successful 2Q24. The image below from the 2Q24 report shows the latest income statement.

For 2Q24, the company realized net revenue of $121 million, compared to $91.9 million in 2Q23. Higher day rates were the main contributor. For 2Q24, the company reported $37,762/day, compared to $26,541/day for 2Q23. Ardmore employed 24 ships in the spot market, compared to 26 in 2Q23.

Voyage expense grew by $3.2 million YoY up to $34.7 million in 2Q24. The prime driver is higher port and agency expenses. Operating expenses increased by 6.0% YoY to $16.2 million in 2Q24.

For 2Q24, ASC reported $48.4 million operating cash flow and $50.0 million operating income, the latter of which increased by 84% year over year. ASC incurred $2.0 million in gross interest expenses for the same period. Higher revenues and relatively stable voyage and operating expenses led to a 165% increase in 2Q24 net income compared to 2Q23. ASC reported $47.4 million in cash, $1.5 million in long-term leases, and $44.2 million in long-term debt.

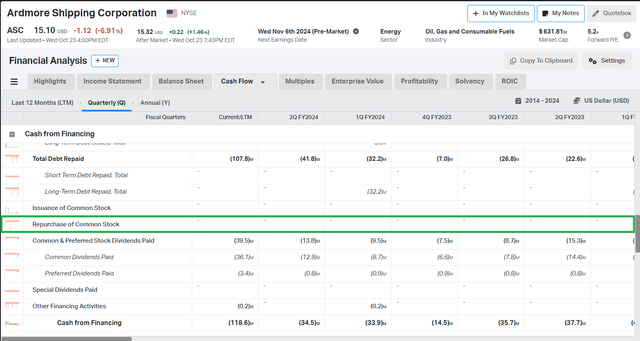

Ardmore is not the best dividend company among tanker shipowners. Considering its deleveraged balance sheet, ASC has the option to increase dividends or repurchase shares. The company announced a $50 million buyback program in September 2023. As shown in the table below, it has not repurchased stock since then.

ASC dividend yield is 7.02% (trailing LTM), and its payout ratio is 26.3%. For 2Q24, the company announced a quarterly dividend of $0.38/share.

3Q24 Guidelines

ASC reported employing its MR tankers at $33,700/day in 3Q24, 22% lower than in 2Q24. 45% of MRs are booked for 3Q24. Chemical tankers are also employed at lower TCE in 3Q24 compared to 2Q24. According to the 2Q24 presentation, 50% of the Handy tankers are booked for 3Q24.

That said, I anticipate declining revenue and profit for 3Q24. The next earnings report will be published on November 06. I expect EPS GAAP in the $0.55-$0.60 range. The analyst’s consensus is for $0.71 EPS GAAP. If my expectations become fact, the ASC share price may fall further.

Valuation

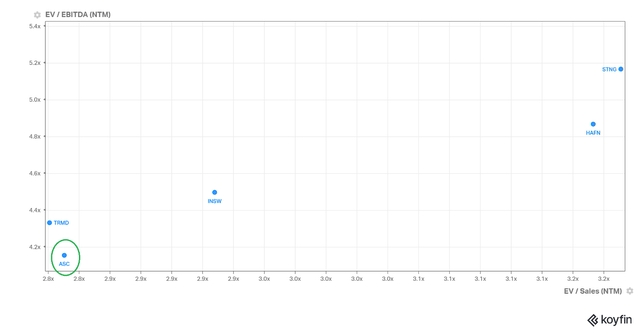

ASC trades at 2.8 EV/Sales and 4.2 EV/EBITDA, making it the cheapest among its peers.

The recent pullback in tanker stocks resulted in lower multiples across the segment. I believe Mr. Market discounts ASC more because of its mediocre shareholders’ return policy compared to the other product tanker owners.

Based on PNAV, ASC is cheaper, too. Inputs for the NAV equation are:

- Fleet replacement value: $810 million

- Current assets: $142 million

- Total Liabilities: $87 million

- Total Debt: $53 million

Ardmore’s market cap is $631 million, and NAV is $865 million, resulting in a 73% PNAV and 7% gross LTV. This valuation is comparable to Hafnia’s 73% PNAV. Scorpio trades at 62%, and TORM trades at 83%. In summary, all product tankers are attractive at that valuation.

Product Tanker Market Review

Tanker rates depend on geopolitical chaos. In that case, the Middle East crisis. At some point, the Red Sea will become accessible again for global tanker fleets. Nevertheless, I do not expect a resolution in the coming quarters. Therefore, tanker rates will stay elevated for longer.

Another factor is the refining capacity. The geography of refining products supply has changed since the start of the Ukraine war. Besides that, the refining capacity is growing at a stable rate in the East.

Below is a quote from a Fitch article on China:

China’s crude oil processing throughput decreased in 1H24, with the spread between crude prices and oil products narrowing on weakening demand. We expect oil product demand to stay weak in 2H24. Monthly consumption of refined oil products fell yoy from April to July 2024, with diesel experiencing the largest drop. We expect China’s refinery capacity to approach 1,000 million tonnes per annum (mtpa) by the end-2024, from 950mtpa at the end-2023, on the completion of significant expansion and greenfield capacity.

I believe these are short-term headwinds. As noted, the long-term trend of growing Chinese refinery capacity is still intact. India is also expected to increase significantly its refining capacity in the following years. In other words, the demand for clean tankers is robust.

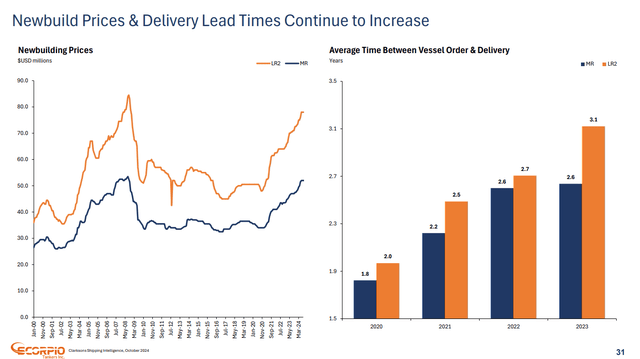

Now, let’s look at the other side of the equation: Vessel supply. The chart below from Scorpio’s latest presentation shows the growth in new building prices and delivery lead times.

YoY, the lead times have been growing at an impressive rate. Shipyards are preoccupied with LNG/LPG carriers, car carriers, and containers.

The product tanker order book is 17%. However, the MR order book is 11%. The average MR fleet age is 13.6 years, and nearly 40% of the present fleet is over 15 years. An aging fleet, low order book, and lack of available shipyard slots are long-term tailwinds for MR tankers.

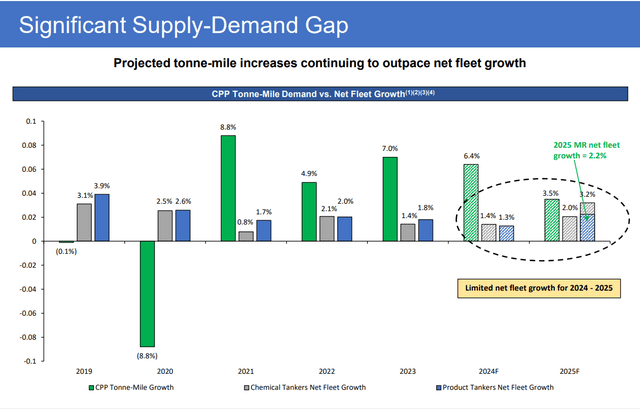

The following chart from ASC’s 2Q24 presentation sums it up:

The tonne-mile demand growth rate exceeds the fleet growth rate. This is a good enough reason to consider product tankers attractive.

Risks

One of the prime risks for any shipowner is a weak day rate. As discussed in the previous section, I believe the long-term trend is intact, and the present weakness is due to short-term factors.

Ardmore bears minimum financial risk, considering its deleveraged balance sheet and adequate liquidity. Its fleet is neither old enough to say no nor young enough to ignore the operating risk. With its spare firepower, ASC can upgrade its fleet with newer ships with scrubbers. In the long term, it will pay off.

In summary, the ASC idea comes with relatively low downside risk. Of course, this does not mean risk-free play. Shipping stocks are volatile, and double-digit declines in a matter of weeks are not surprising.

Investor Takeaway

I sold my Ardmore shares because I see value in other places. Scorpio, Hafnia, and TORM are more appealing.

I expect lower revenue and profits for 3Q24. If EPS drops below analysts’ consensus, ASC’s share price will continue to fall. At 60-65%% PNAV, I would consider ASC attractive again.

ASC has enough liquidity to improve its shareholder return policy and invest in newer ships. That said, I changed Ardmore’s rating from Buy to Hold.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.