Summary:

- Ardmore Shipping Corporation operates a fleet of 26 Medium-Range product and chemical tanker vessels.

- Ardmore Shipping has positive net cash, low cash breakeven and a young fleet.

- The tanker market is currently dislocated, ensuring day rates remain high for the next quarters.

CHUNYIP WONG/E+ via Getty Images

A couple of weeks ago, on July 31st, 2024, Ardmore Shipping Corporation (NYSE:ASC) – a product and chemical tanker operator – released its earnings report for the second quarter of 2024. Both revenues and net income surpassed analysts’ expectations, leading to a roughly 4% increase in the stock price on the same trading day. In this article, I will provide an overview of Ardmore Shipping—a company I have not previously covered—and offer my rating recommendation.

If you’re interested in other oil tanker stocks, you might want to check out my previous articles on Teekay Tankers, International Seaways, and Scorpio Tankers.

About Ardmore Shipping

Ardmore Shipping Corporation is a publicly traded company on the NYSE market and is specialized in transporting petroleum products and chemicals. The company owns and operates a fleet of modern, eco-design vessels specifically designed to carry refined petroleum products like gasoline, diesel, and jet fuel, as well as a variety of chemicals and vegetable oils. Ardmore Shipping’s fleet mainly consists of medium-range (MR) tankers, which are versatile and capable of handling a diverse range of cargoes. The company’s emphasis on eco-design vessels underscores its commitment to fuel efficiency and environmental sustainability—critical factors in the global shipping industry today. The fleet’s average age is 9.8 years, and it is composed of 26 vessels divided as follows:

- 20 MR (Medium Range) tankers with a deadweight tonnage of 45,000 dwt on average

- 4 vessels with a 25,000 dwt (all built in Japan in 2015)

- 2 vessels with 37,000 dwt (all built in Korea in 2015)

Ardmore Shipping operates on a global scale and serves key trade routes across the Atlantic Basin, Asia, and other major markets. The company’s business model combines time charters (2 vessels), where vessels are leased for set periods, with spot market operations (24 vessels), where vessels are hired on a voyage-by-voyage basis. This flexibility enables Ardmore Shipping to capitalize on favorable market conditions while managing the risks associated with market fluctuations.

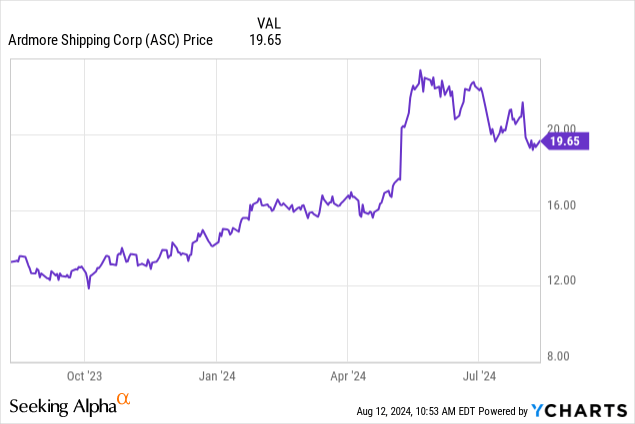

Ardmore Shipping stock price

Ardmore Shipping is currently trading at $19.3 per share, giving it a market capitalization of $808 million. Since the start of 2024, the stock has risen by approximately 37%, with a similar year-over-year increase of 40%. The 52-week low of $11.85 per share occurred on October 4th, 2023, while the 52-week high of $23.38 per share was touched on May 21st, 2024. At the current price, the stock is trading at a 17% discount from its 52-week-high. The standard deviation is $3.31 per share, representing about 17% of the current stock price.

Ardmore Shipping Q2-2024 results

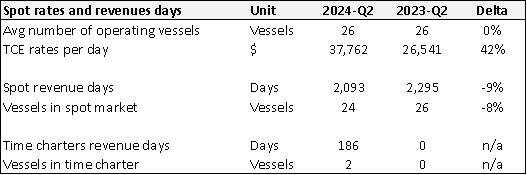

Ardmore Shipping’s revenues for Q2-2024 increased by 33% year-over-year from $91 million to $121 million due to a combined effect of increased spot day rates, decreasing spot revenue days and the addition of 2 vessels under time charter. Indeed, during Q2-2024, spot rates averaged $37,762/day, up 42% year-over-year, leading to an increase in revenues of about $30 million. In the same period, there was a decrease in spot revenue days, from 2,295 days in Q2-2023 to 2,093 in Q2-2024 that resulted in a revenue decline of about $7.9 million: this drop in revenues was, however, counterbalanced by the employment of 2 vessels under time charter, compared to none in Q2-2023, that generated extra revenues for $7.3 million.

Ardmore Shipping

Moving to the cost side, total operating expenses (OpEx) for Q2-2024 were $58 million, down 6% from the $63 million of one year earlier. The most relevant cost items were voyage expenses ($35 million) which increased by 10% y-o-y due to the increase of port and agency expenses and vessel expenses ($16 million) which increased by 7% y-o-y. Total OpEx for Q2-2024 was positively impacted by a $12 million gain on a sold vessel, the Ardmore Seafarer, that was sold for a total of $27 million.

Net income was positive at $63 million, up 156% y-o-y due to the increase in revenues and the decrease in OpEx.

Ardmore Shipping’s cash flows, debt and liquidity

For the six months ending June 30th, 2024, cash flow from operations amounted to $98 million. This figure was driven by net income, adjusted for a $12 million non-cash gain from the Ardmore Seafarer and an increase in receivables by $19 million, partially offset by a $10 million decrease in payables. Cash flow from investing activities was negative, totaling -$28 million. This was primarily due to the $27 million received from the sale of the Ardmore Seafarer and a $57 million payment for acquiring vessels and equipment. In Q2-2024, Ardmore Shipping not only sold the Ardmore Seafarer but also purchased the 2017 Korean-built MR product tanker, Ardmore Gibraltar.

Cash flow from financing activities was negative at -$68 million, mainly driven by the following transactions:

- $42 million repayment of finance leases,

- $30 million revolver repayments,

- $29 million proceeds from revolving credit facilities, and

- $22 million in cash dividend payments.

Regarding debt, as of the end of Q2-2024, Ardmore Shipping had drawn $44 million from three revolving loan facilities. With a cash position of $47 million, the company holds a net cash position of approximately $3 million. Additionally, under the existing revolving facilities, Ardmore Shipping has access to a further $207 million, ensuring adequate liquidity. The first debt repayments are scheduled for 2025, amounting to roughly $3 million, with $42 million due in 2027.

Product and chemical tanker fundamentals

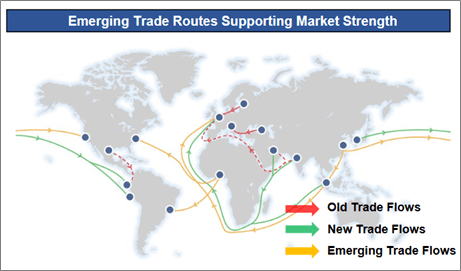

Ardmore Shipping is operating in the oil product and chemical tanker markets that are currently in a disrupted situation whereby demand for tankers is high and availability is low, thus pushing tanker rates at historically high prices and supporting free cash flow generation for companies such as Ardmore Shipping.

Demand for oil and chemical tankers has been increasing for multiple reasons:

- The conflict between Russia and Ukraine completely changed the hydrocarbon and chemical products trade from Russia to the EU. As a consequence, the EU has to source the products from the US and the Middle East, thus leading to longer average tonne-mile demand.

- In addition, the recent instability in the Middle East, with the Houthi’s attacks on ships crossing the Suez Channel, has led many vessel operators to prefer circumnavigating the Cape of Good Hope, thus adding even more pressure on routes.

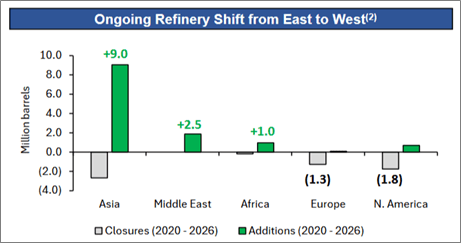

- Moreover, there is an ongoing trend of petrochemical expansion in the East of the World (Asia, Middle East, Africa) and refinery closures in the West (Europe, North America) that will also contribute to increasing demand for tankers.

Ardmore Shipping Ardmore Shipping

On the other side, the availability of tankers is limited due to few orders being placed in the past couple of years and shipyards being now full of orders for the next 2-3 years with different categories of ships.

As a result, the product and chemical tankers are a scarce resource and their value, expressed by the day rates, is going to remain high until the situation goes back to normal.

Ardmore Shipping’s strengths

What I appreciate about Ardmore Shipping is its low cash breakeven rate of $12,650 per day, which the company has consistently reduced, enhancing its resilience. A lower cash breakeven allows the company to be more profitable at current-day rates and provides greater protection if those rates decline. For example, a $10,000 increase in TCE would result in an additional earnings per share of approximately $2.30.

Moreover, the company is cash-positive, meaning it holds more cash than debt, and it has a strong liquidity position with about $207 million available under its revolving credit facilities. Additionally, Ardmore Shipping’s fleet is relatively young (average age of 8.9 years) and this will help to minimize the amount of capex needed to renovate the fleet.

Risks for Ardmore Shipping

One key factor to consider when discussing Ardmore Shipping is that, as of today, only 9 out of its 26 vessels are equipped with scrubbers. The company plans to install scrubbers on 4 more vessels in 2025, leaving 13 vessels that may still require them. Consequently, it’s reasonable to anticipate that the company will need to make further investments in the coming quarters to ensure its fleet complies with ESG regulations.

Conclusion

I highly recommend investing in Ardmore Shipping, as the company operates in a favorable market and boasts strong fundamentals. With no debt, a low cash breakeven day rate, and a young fleet, Ardmore Shipping is well-equipped to successfully navigate the financial market.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.