Summary:

- Ardmore Shipping operates a global tanker fleet primarily in mid-range transportation services, focusing on container-stored goods and chemical transportation.

- The company has shown positive performance for shareholders in the last five years, with a strong cash cushion and ability to pay dividends.

- ASC has adapted to global shifts in the maritime shipping industry, re-routing supply lines and controlling controllable factors to maximize profitability.

- This article covers ASC as well as the global shipping market and its need for adaptation in the new macro environment we find ourselves.

Stewart Sutton

Introduction

Ardmore Shipping (NYSE:ASC) operates a global tanker fleet, primarily in the mid-range transportation services sector. Its business lies not in the things it ships, but in the ships themselves, as it sells the transportation of goods. These goods range the gambit, but their bread and butter is chemical transportation.

Their ships average nine-ish years old, with the youngest medium-range (“MR”) tanker’s maiden voyage happening in 2017, and its oldest in 2013. It operates twenty-two ships, all of Japanese or Korean make. Primarily, its fleet consists of 50K DWT MRs, of which it has sixteen.

For those of you fluent in maritime jargon (don’t worry, I’m only conversational in it), a “50K DWT MR” is a “medium-range ships that can carry fifty-thousand ‘deadweight’ tons of goods.”

Performance

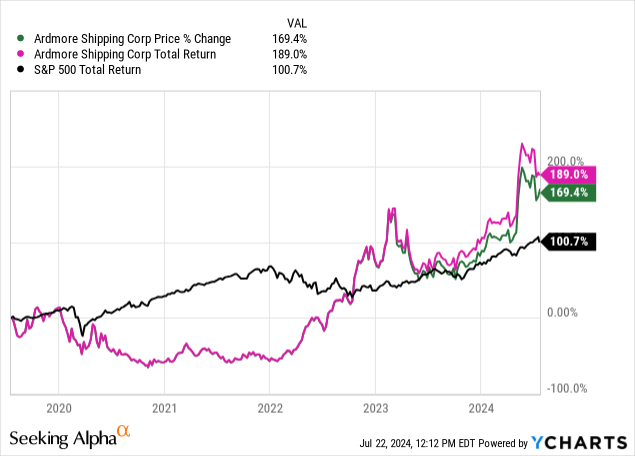

In the last five years, the stock has been on a roller coaster, but has performed positively for shareholders. ASC has been on a major upswing since bucking its negative trend post-pandemic, eclipsing the S&P 500’s return post-2022.

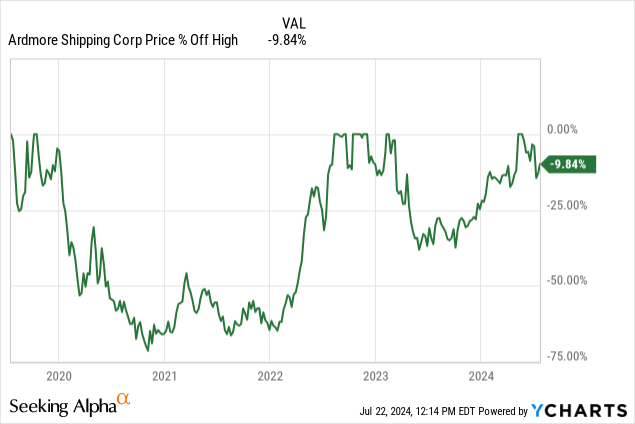

The stock was far, far from its highs following the pandemic, with global shipping disrupted and much of their business inoperable through no fault of their own. I have to tip my hat to those who were confident enough to buy a few years ago with those near 70% drawdowns. Ardmore wasn’t on my radar at the time.

While we are nowhere near those same drawdowns today, that doesn’t mean that the business can’t still be worthwhile. It did survive that drawdown, to be fair, and is on the upswing again toward new highs.

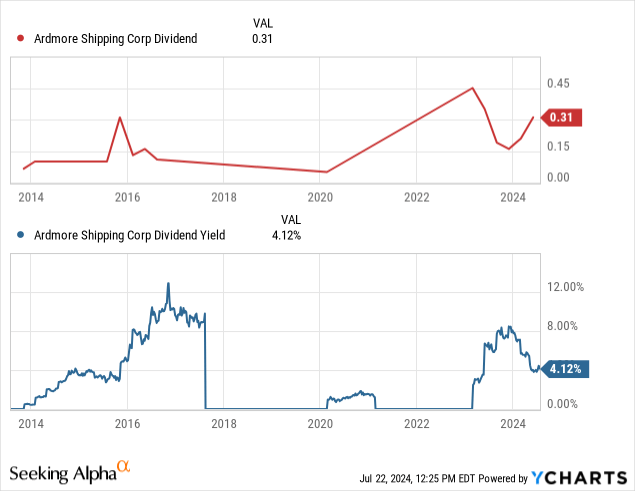

One of the major draws to shipping companies is their ability to pay hefty dividends while still being able to grow quickly. This is due to the cash-heavy nature of their business crossing paths with the fact that deploying cash in shipping can be logistically difficult. Because of this, it’s best for shareholders often if these companies distribute their leftover cash. This means that while we may expect a nice 4% dividend from ASC, as we see currently, that dividend is volatile and may change at any time, or disappear if more cash is needed than expected.

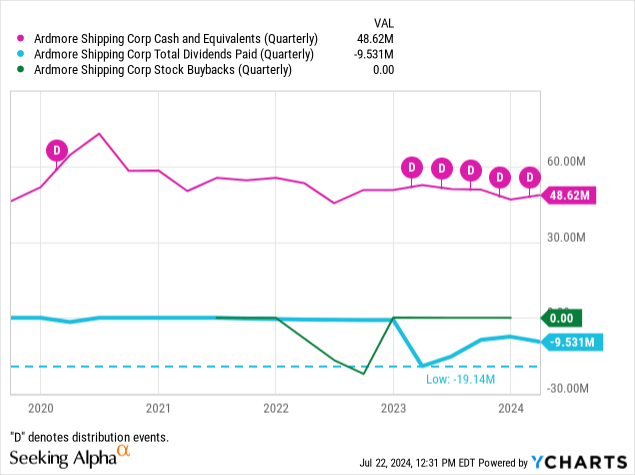

Despite this, ASC has a nice cash cushion that they have been building. It far exceeds both their average dividends paid out as well as their buybacks. Currently, they have enough cash on hand to pay out double the dividend.

See below that during the turbulence of the last five years (the next section will have more on that), ASC stopped paying out dividends and instead did nothing until 2022, introduced some buybacks, and then began paying dividends regularly starting last year.

Adapting to Global Shifts

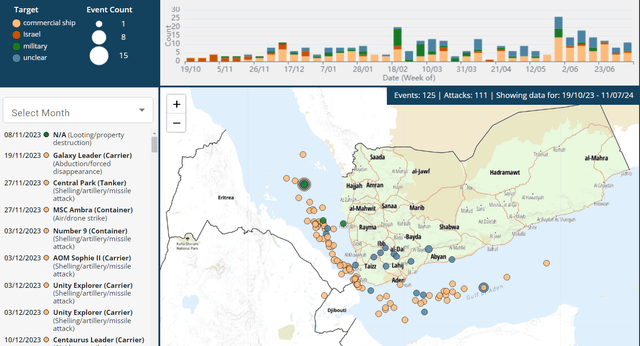

The maritime shipping industry has been racked over and over by macro shifts in the last five years. Pandemic-related supply chain disruptions, a ship getting caught for weeks in the Suez Canal, embargos from the West against oil and gas exporter giant, the Russian Federation; ongoing attacks on trade ships through the Red Sea by Islamist militants, a drought in the Panama Canal, and the volatile price of ship fuel all have contributed to the entire industry having a rough last few years.

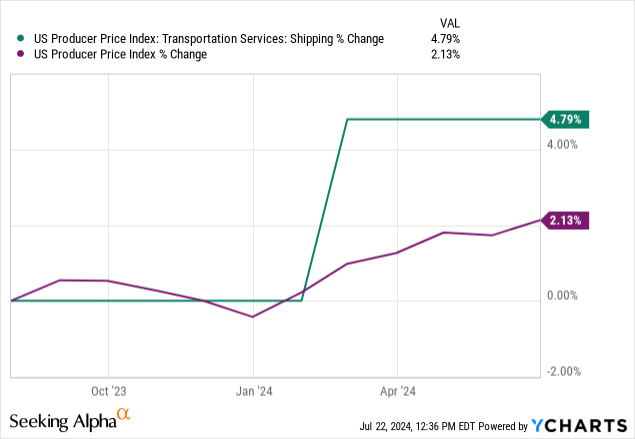

This all has contributed to the rising cost of shipping services, which, in the last year, has increased twice as much as the overall producer price index.

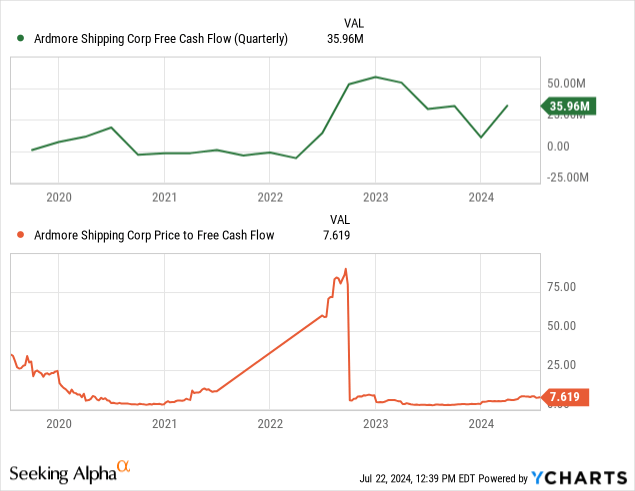

This is not a bad thing for ASC, since it has been able to profit off of this change. It has adapted to many of the macro landscape changes described above and has come out the other side with a much stronger cash flow position than it had pre-pandemic. This hasn’t been appreciated by the market, as shown in the suppressed price-to-FCF ratio relative to the increase in FCF, as shown below by the chart below.

New Routes

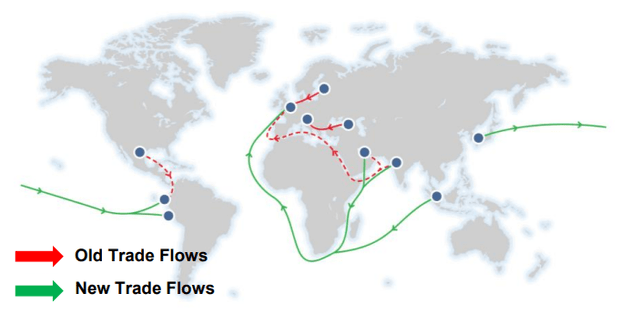

Part of the adaptations made by ASC for the new landscape is re-routing its supply lines. Many of the issues I mentioned at the beginning of this section have caused ships to be routed thousands of miles away from their old routes.

To avoid the Suez Canal as a vulnerable chokepoint and the adjacent Red Sea as a hotbed for indiscriminate, Islamist violence, ships have begun routing around Africa and the Cape of Good Hope.

To avoid the vulnerable chokepoint of the Panama Canal, goods are being shipped out of Pacific-facing Ecuadorian ports instead of US or Mexican ports on the Gulf of Mexico. Inflows from East Asia through the same port are then trafficked on land through the Americas to avoid slowdowns from the depleted water levels.

Embargoed Russian ports out of the Black and Baltic seas means some shipping no longer goes through the chokepoints of the Bosporus Strait in Turkey, or the Kiel Canal in the Danish Straits.

This shift has created a new map of trade routes, with the innovative new routes designed to minimize delays and to “control the controllable.”

Figure 1 (Ardmore Shipping Co.)

Controlling the Controllable

I first heard this phrase in an interview with a former Navy SEAL, and he spoke about it as a tactic used by the military. Exert as much control as possible on things that you can control, and focus all other effort on minimizing exposure to uncontrollable factors.

If you’re not sure whether your ship will be hit with Iranian-supplied Houthi missiles, just don’t sail into the Red Sea at all. There are no Houthi militants of note in South Africa, so your ship won’t need to be prepared for that issue. This may seem like a no-brainer move, but traffic through this region has not stopped. Neither have the attacks.

Traffic through the Suez Canal has dropped 66% this year, despite 12% of the world’s supply of oil passing through it still.

The traffic that is being diverted is those companies trying to minimize threats to their business, like ASC. Timing this strategy is very important for ASC moving forward, as it needs to continue to adapt to the geopolitical and global macro landscape. So far, they have impressed me with their ability to adapt.

Demand is Staying Strong

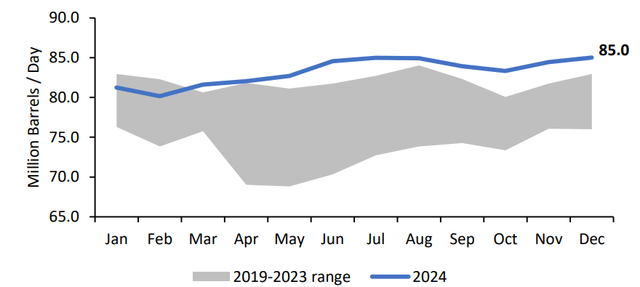

The demand for transportation has increased, with this year’s barrels-per-day being run from refineries exceeding the upper bounds of the last five years’ range, indicating increased demand from before.

Figure 3 (Ardmore Shipping Co.)

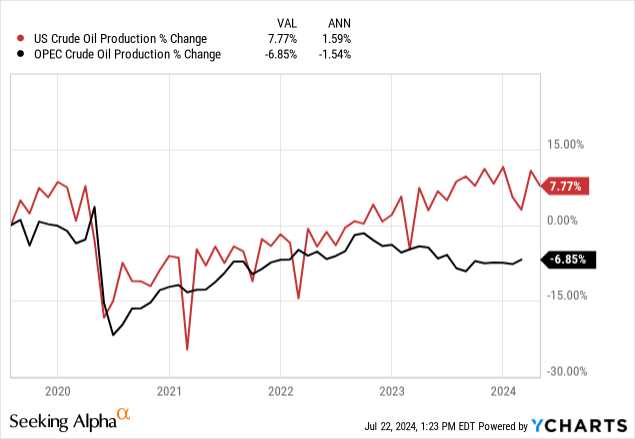

This comes even as OPEC oil production has slowed, since Ardmore operates primarily with American clients, and is less affected by shifts in foreign production. American production of oil is at an all-time-high, and the “energy reality” of needing oil today in order to build cleaner, green systems will cause demand for oil to stay strong moving forward, in my opinion.

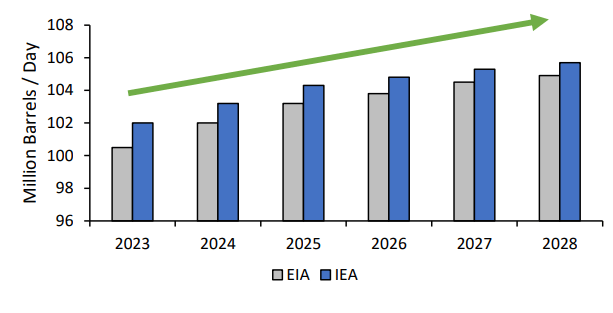

The EIA and IEA, energy forecasting associations, agree with me that we should expect to see a continued, steady rise in oil demand through the next four years.

Figure 4 (Ardmore Shipping Co.)

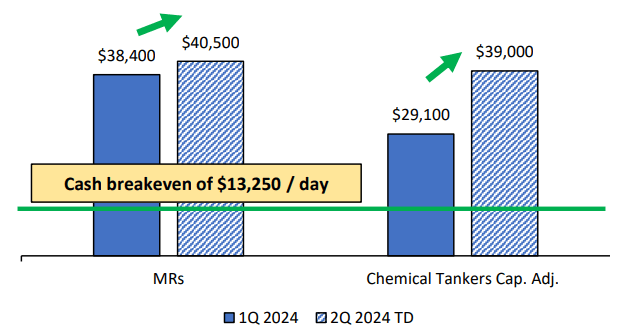

This increase in demand, the growth of which has exceeded global oil production since the divergence of US and OPEC oil production (shown above starting last year), has caused ASC’s fleet to become more profitable than before. The daily intake of cash is expected to improve by 5.3% for MRs and 29% for chemical tankers, as shown below.

Figure 5 (Ardmore Shipping Co.)

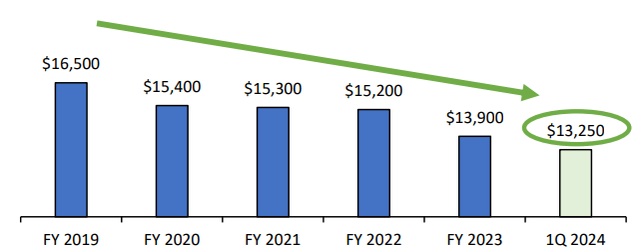

This jump in expectations is a good sign for ASC, since seasonally we should expect the opposite. Normally, in Q2, we see a decrease in demand for LNG and oil, as less the global north relies less on indoor heating. The difference from and defiance of the seasonality shifts boils down to increases in ASC’s profit margins and a decrease in its cash breakeven amount, which has been on a downtrend.

Figure 6 (Ardmore Shipping Co.)

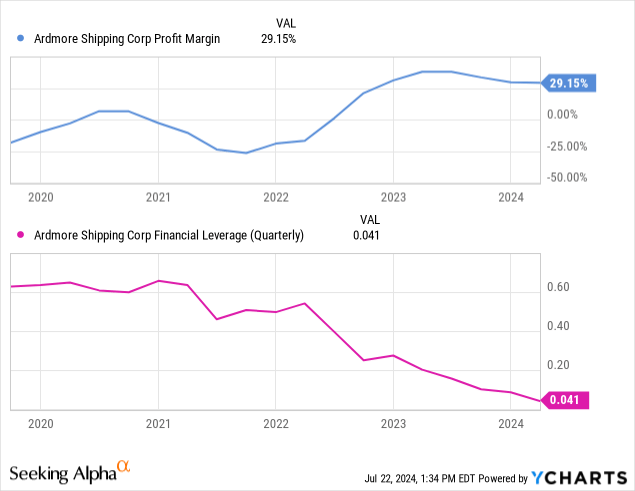

These profit margins are increasing despite a de-leveraging that has taken place in line with rate hikes. ASC did not want to pay out too much on its debt, so it has dramatically reduced its leverage, down by almost 85% in the last five years.

When rates ease up in the next few years, something I wrote about recently, as the Fed expects that to happen in 2026, this low leverage will allow Ardmore to replace the older end of its fleet, which today is still in good condition. This is somewhat lucky timing, but also good strategy on management’s part.

Valuation

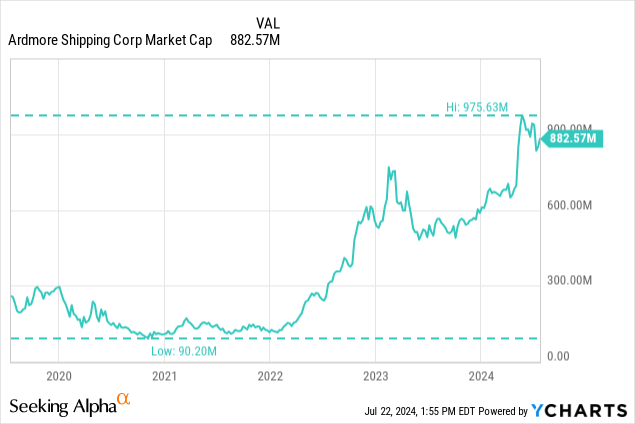

ASC is very close to joining the billion-dollar club, and its market cap is near an all-time-high, although so is the overall market’s so this tracks with general stock trends. What was not a general stock trend was how quickly ASC rose from its lows, being worth $90M (they had almost $50M in cash-on-hand at the time) to its current-day 882M. This growth is unprecedented in its history, and is a show of how its changing strategy and adaptations to market conditions have fueled its rise.

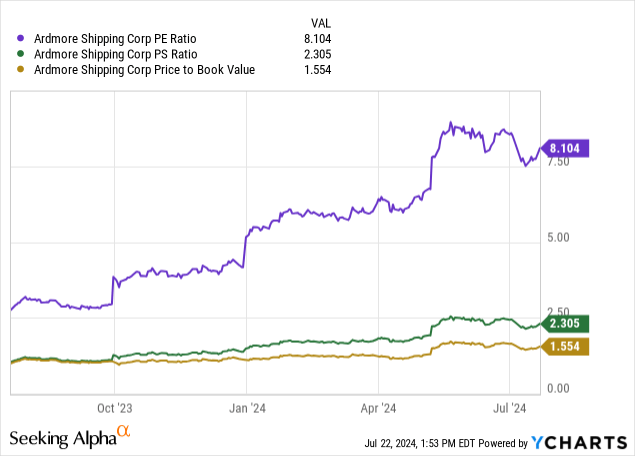

Its price-to-earnings ratio is lower than the market average of 12.85, which means that they are “cheap” from that perspective. Their price-to-sales ratio is around market average, if not a little above, as is their price-to-book ratio. These metrics paint a more mixed story of ASC’s stock.

Risks Remain in Shipping

You can’t control everything, and so it is important that investors beware of several potential risks that loom ahead.

- A Troubled History

- ASC has a history of paying dividends on and off and could cut their payments in the case of a need for cash like the 2020 pandemic

- ASC also has a history of underperformance, only recently bucking that trend

- Militant Attacks Continue Indefinitely

- It is unclear how soon ships may be able to safely return to the Red Sea, and the alternate shipping routes may become global norms, which will cause additional congestion in these areas, which translates to lost profits

- Ships Age Out

- In the next few years, ASC will need to retire some of its older vessels from 2012

- If this is not done so in a profitable manner, and a new replacement ship is cost-prohibitive at the time, this could cause major delays in operations and a degradation of profits

- While newer ships often offer more space and better efficiency, they are also large upfront costs and capital sinks for many years before the return-on-investment occurs

- In the next few years, ASC will need to retire some of its older vessels from 2012

- OPEC Oil Drought

- If OPEC tries to push the price of oil higher past $90/barrel long term (a target OPEC wants to hit), this could benefit ASC in the short term with their spot exposure, but harm them in the long term due to the rising costs of operations

- This could potentially be a trap for investors if the price of the stock spikes based on its increased exposure to a higher spot price for oil, despite that leading to a decline in profitability long term due to rising fuel costs for the fleet

- If OPEC tries to push the price of oil higher past $90/barrel long term (a target OPEC wants to hit), this could benefit ASC in the short term with their spot exposure, but harm them in the long term due to the rising costs of operations

Conclusion

Ultimately, I am considering taking a small position in Ardmore Shipping because of its ability to adapt to changing macro and market conditions and its below-market valuation on price-to-earnings. It is clear that Ardmore is ramping up to be a very profitable company moving forward, with a yield that should stay above 4% if management gets what they want.

I recommend that investors gauge their risk very closely with this investment, as shipping companies can be very volatile. I am keeping my potential allocation to ASC to 1% of my equity portfolio and recommend very aggressive investors allocate no more than 5%.

Thanks for reading.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in ASC over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.