Summary:

- The current condition surrounding Procter & Gamble stock reminds me of the wisdom of buying wonderful businesses at fair prices rather than fair businesses at wonderful prices.

- The recent stock price pullback offers this wonderful business at a fair price.

- Besides fair valuation, other positives include consistent EPS growth potential, the effectiveness of the ongoing restricting plan, and margin expansion potential.

RobsonPL

PG stock: previous thesis and new development

I last wrote on Procter & Gamble stock (NYSE:PG) back in May 2024 and argued for a BUY rating. As you can see from the screenshot below, that article was titled “Procter & Gamble Stock Has Broken Out (Technical Analysis)”. As the title suggests, it focused on the technical analysis of PG’s trading patterns. The key points highlighted in the article were that “PG stock has successfully broken through a multi-year resistance level near $155 and technical indicators suggest near-term momentum and higher prices”.

Since that writing, there have been some new developments, both in terms of its stock prices and also business fundamentals. Therefore, it is the goal of this article to perform a reexamination of the stock given these developments. In contrast to the technical-oriented approach used in the last article, this article will be focused on the business fundamentals.

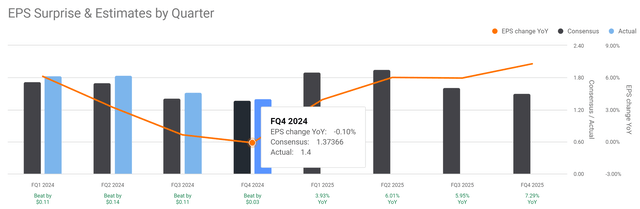

The most important development since my last writing on the business fundamentals is the release of its FY 2024 Q4 and full-year earnings report (ER) in my view. Overall, I think PG put in a good showing both for the quarter and also the full fiscal year of 2024. I will detail the highlights in the next session. The company reported robust earnings growth per share of 12% YOY (excluding restructuring expenses and a $1 billion after-tax asset impairment charges). As shown in the next chart, its Q4 EPS came in at $1.4, a positive EPS surprise of $0.03 vs. the consensus EPS estimate for FQ4 2024 was $1.37.

In terms of the stock prices, the stock prices have indeed staged a sizable rally after my last article, reaching an all-time high of about $178. The stock prices have pulled back a little bit from the ATH to the current level of around $168.

Against this backdrop, the thesis of this article is to reiterate my earlier BUY rating. In the remainder of this article, I will argue the recent price pullback has offered an attractive entry point for this blue-chip dividend champion.

PG stock: EPS growth outlook

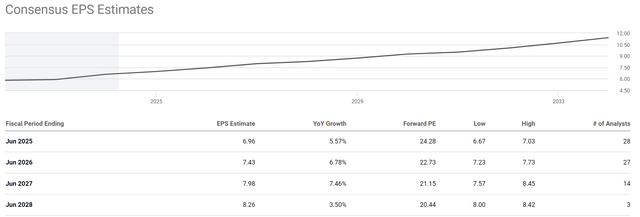

Looking ahead, I expect the company to continue its growth at a healthy pace in FY 2025. Management expects organic sales will increase 3%-5% in fiscal 2025, and I am optimistic for the fiscal 2025 results to come in near the top of the company’s guidance ranges for reasons to be discussed in a minute. Looking further out, the chart below shows the consensus EPS estimates for PG stock in the next 4 years. As seen, its EPS is expected to grow steadily from $6.96 in fiscal year 2025 to $8.26 in fiscal year 2028, translating into an annual growth rate of about 6% on average in CAGR terms. I consider this a very healthy pace for a sector leader with PG’s scale, and see good catalysts for this projected growth rate to materialize.

Among the various growth drivers, the company’s ongoing portfolio restructuring plan is at the top of my list. As a background, in December 2023, the company started a limited portfolio restructuring plan. Part of this plan involves exiting some challenging overseas enterprise markets. Following this plan, P&G liquidated assets in Nigeria by the end of fiscal 2024 and completed the divestiture of its Argentina holdings in July 2024.

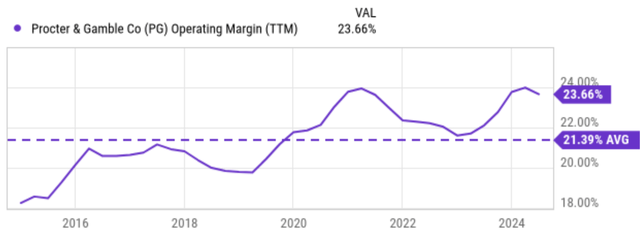

These restructuring efforts most likely – in my view – will lead to noticeable charges in fiscal 2025 and impact its bottom line. However, I think the long-term effects should be very positive. I expect these efforts to enable PG to better improve its productivity and expand its margin in the years to come. As an example, the chart below illustrates the operating margin of PG stock in the past 10 years, from 2014 to 2024. The operating margin fluctuated over the period but maintained a general upward trend. In 2014, the margin started around 18% and gradually increased to the current level of 23.66%. Note that the margin was at a temporary bottom in 2023 when the restructuring plan started (around 21.4%). The margin has expanded by more than 220 basis points since then.

PG stock is fairly valued

In terms of valuation, if you recall from an earlier chart, the current forward P/E ratio is 24.28 only (based on its FY 2025 EPS projection) thanks to the recent price pullback. This is a very reasonable level both in absolute terms and relatively in my view given the quality of the business. Thanks to the earnings growth outlook, the FWD P/E is very likely to shrink steadily in the years to come (e.g., consensus forecast points to be FY2 FWD P/E of 22.73 in 2026).

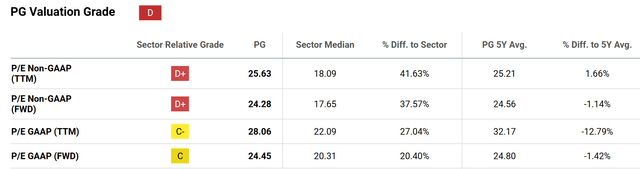

In relative terms, the chart below provides a better context of PG stock’s valuation grade. As seen, its current FWD P/E ratios (both in GAAP and non-GAAP terms) are below its 5-year averages slightly. To wit, its FWD P/E ratio in non-GAAP is about 1.1% below its 5-year average and about 1.4% below its 5-year average in GAAP terms, indicating fair valuation.

PG stock: Other risks and final thoughts

In terms of downside risks, currency effects are very likely to remain a headwind in my view. As aforementioned, management expects organic sales to increase by 3%-5% in fiscal 2025, and I expect the actual earnings to be near the upper end of this range. However, given PG’s global exposure and the uncertainties surrounding the dollar with multiple rate cuts expected, its growth might be reduced (by about 1% in my estimate to be in the range of 2%-4%) once adjusted for currency effects. Exiting markets like Argentina with high currency volatility should help to reduce such risks going forward.

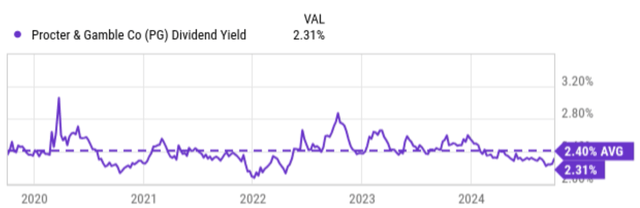

As a second downside risk, the stock is trading at a substantial premium relative to its peers in the sector. If you recall from an earlier chart, its non-GAAP P/E (TTM) of 25.63 is more than 41% above the sector median of 18.09. Given its dividend aristocrat status, its dividend yield provides further insights into the valuation. The chart below illustrates its dividend yield in the past 5 years from 2020 to 2024. As seen, its current yield of 2.31% is slightly below the average dividend yield of 2.40%, indicating some degree – a slight degree – of overvaluation.

All told, despite the mixed signal of valuation across various metrics (P/E, dividend yields, etc.), the overall picture in my mind is a wonderful business for sale at a fair price under current conditions. My view is that the positives far outweigh the negatives under current conditions. To recap, the key positives on my list are the healthy and consistent EPS growth, the effectiveness of the ongoing restricting plan, and the margin expansion potential. As such, I see a skewed reward/risk curve and reiterate my earlier BUY rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.