Summary:

- NVIDIA’s market cap has surpassed Apple and Microsoft, but I still see growth potential, valuing it at $189 per share, a 42% premium.

- NVIDIA’s exceptional financial performance is driven by explosive GPU demand for AI, with significant revenue and margin growth, and strategic share repurchases.

- NVIDIA’s platform strategy, including CUDA and AI data centers, creates high switching costs and long-term partnerships, ensuring sustained demand and competitive advantage.

- Despite supply chain and concentration risks, NVIDIA’s diversified market presence and continued GPU demand support my bullish outlook and valuation.

Antonio Bordunovi

Overview

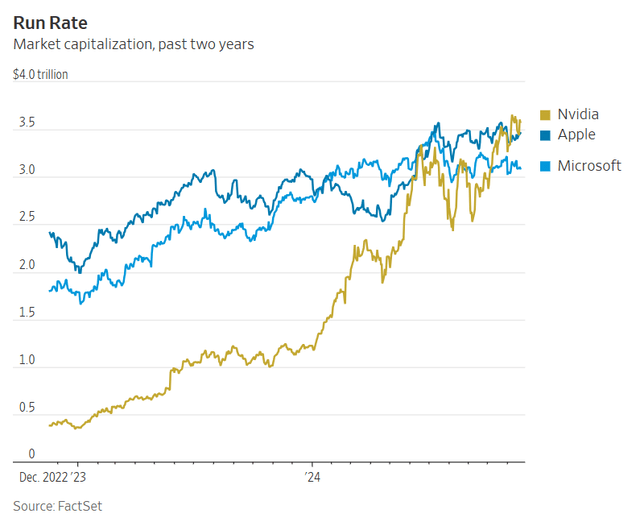

NVIDIA’s (NASDAQ:NVDA) (NEOE:NVDA:CA) market capitalization has grown until it surpassed Apple’s and Microsoft’s (Figure 1). Some analysts and investors think that it is time to sell. The average recommendation from Seeking Alpha analysts is to hold the stock.

I believe there is still potential for growth. I value the company as $189 per share, a 41% premium over its current stock price. It could seem like an exaggeration, but I have my argument. Nvidia’s performance has been spectacular in terms of revenue and margin because it is not a product company but a platform with network effects. Besides, Nvidia is operating in several markets with high potential.

I consider its complex supply chain and the problems of the new technology weaknesses. The new Blackwell system probably suffered heating issues. What worries me most is the high degree of concentration on clients, the market, and providers.

Financial performance

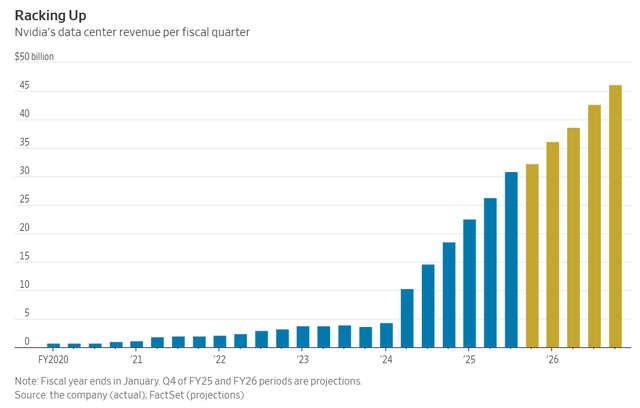

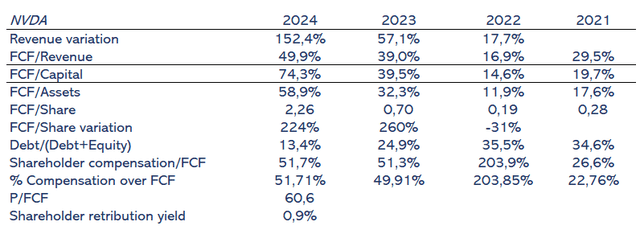

I am going to analyze financial variables annually, considering 12 trailing months. Nvidia’s financial performance has been exceptional. Free cash flow per share, which is cash flow available to shareholders, has grown from $0.28 per share in 2021 to $2.26 per share in 2024. That means a 224% year-to-year growth rate in 2024 and 260% in 2023. This incredible growth is due to explosive demand for GPUs in Generative AI models.

The company has obtained those results, capturing this high demand, increasing revenue from $24.3 billion in 2021 to $113.3 billion in 2024. The company has managed to increase gross margins from 64.3% in 2021 to 76%.0 in 2024. The company is getting scale and operating leverage, reducing operating expenses over revenue from 29.1% in 2021 to 13.1% in 2024. Even capital efficiency is seen when CAPEX over revenue has decreased from 5.6% in 2021 to 2.1% of total revenue.

It is very difficult to achieve such growth. Typically, a company must initially increase its costs significantly to earn more in the future. In this case, significant revenue growth is linked to increased profits.

The timing of its share repurchases probes management’s sensitivity to shareholders. We can consider 2024 as a year of “expensive” stock, and the company has compensated shareholders with 51.7% of free cash flow, down from a “cheaper” 2022 soared to 293.9%. So, Nvidia repurchases its stock when it is cheap.

Some critics of AI have said that scale has stalled and that models have used all the available data on the Internet. The point is that several techniques are needed to scale the models, requiring more GPUs. For example, it can use data synthetically created by AI or new types of thought, like inference time scaling. So, I foresee more growth ahead. I still see growth in the inference use of GPUs as more enterprises and consumers use AI:

It is not a product company; instead, it is a platform.

Nvidia goes beyond merely selling products; they package their GPUs with software frameworks, SDKs, and services to create an AI platform. One of the key elements of this platform is CUDA (Compute Unified Device Architecture), a proprietary software that simplifies development on Nvidia’s GPUs. This software essentially locks developers into Nvidia’s ecosystem. With a shared programming language for all versions of Nvidia GPUs and a market share of nearly 80%, the cost of learning a different language is often deemed not worth it for developers. As developers continue to use CUDA, their investments in time and effort increase the switching costs, making it less likely for them to transition to a different platform.

Nvidia is an ecosystem of partners made up of developers, hyperscalers, enterprises, and the interrelation of industries like AI, gaming, automotive, and healthcare. As more developers use Nvidia’s platform—around 4 million are currently using it—there is more value for enterprises because more AI applications are being developed. As more enterprises use the platform, there are more incentives for hyperscalers to buy Nvidia’s GPUs.

Nvidia’s strategy to transform data centers into AI factories is well-crafted to create a compelling competitive position. Using GPUs in the same physical location is better for Nvidia. After acquiring Mellanox, Nvidia has the best and fastest solutions for connecting GPU servers. If GPUs are closest together, Nvidia’s solution is better for the client, and it is better to train AI models. Nvidia also develops proprietary AI frameworks like NVIDIA AI Enterprise and Omniverse. This strategy generates software closer to the final user and, with recurring revenues from software licensing and services, turns customers into long-term partners. The software creates a virtual collaboration platform and digital twins.

Optionality

Nvidia’s explosive growth is due to the AI data center segment. However, investing in Nvidia provides many more options in other markets. One of the most promising markets for the future is robotics. The current market size is $11 billion, with a CAGR growth rate of 33%, as expected. I see more potential and could reach higher growth rates. Those devices will be very AI-intensive, especially for machine vision, real-time decision-making, and autonomous navigation. Its applications are broad-based and fit every industry and every house. Nowadays, the market is fragmented, and I expect to concentrate on a few providers: a few operating systems and a few AI chips. Nvidia is a clear winner. This same platform, the Jetson platform, is designed for edge computing to deploy AI models on devices with minimal latency.

Automotive is also a hot market that will evolve into autonomous driving, also called advanced driver-assistance systems (ADAS), and Nvidia’s GPUs are essential for that purpose. It requires GPUs to process vast amounts of real-time data from sensors like cameras, light detection and ranging systems, and radar. It is expected to grow 10% annually, reaching $70 billion in 2027. Nvidia was created for gaming, and this is an important market. Its current growth rate is not too high at 7% per year. However, I see it linked to the Metaverse, which is currently irrelevant, but significant developments can push the industry faster: Apple’s Vision Pro and Meta glasses.

Other segments, like High-Performance Computing (HPC) and specialized design, are smaller. My point is that Nvidia is like buying options in different promising markets that can boost the stock price if this market starts growing exponentially, as the AI data center markets have done with generative AI.

Valuation

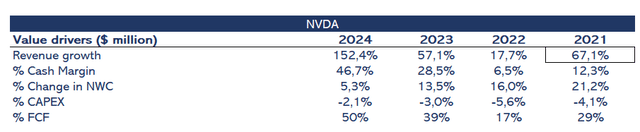

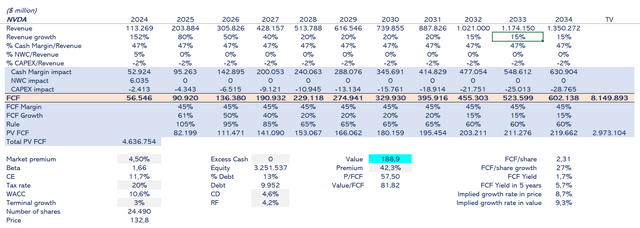

Figure 4 shows the company’s value drivers, considering a year as the last four quarters to capture the latest information. Regarding margins, I utilize a measure I call Cash Margin, which involves adjusting net income for non-cash items such as amortization and depreciation, stock-based compensation, and deferred income tax.

There is a lot of uncertainty about its revenue growth. In my arguments, the main issue is that Nvidia has the potential to grow much more. In my model, I assume the growth rate will decrease to 80% in trailing 2025 from 152% and will decrease fast to 15% in 2030 and later to 10%. It is a conservative estimation, which could be a floor in the evolution.

I maintain a 47% cash margin, even though we have seen that it has been improving due to its platform nature and the high discrepancy between demand and supply of GPUs. So, this estimation is also conservative. Investment needs, net working capital and CAPEX, are low, and I project the historical values over revenue.

Cash flows will be discounted at a 10.6% WACC because the beta is 1.66. The risk-free rate is 4.2%. The company’s leverage is 13% of total capital. The perpetual growth rate is set at 3%.

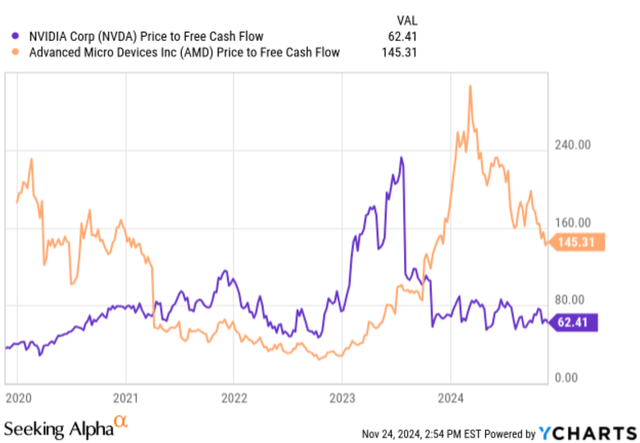

Figure 5 shows that my value estimate is $189 per share, a 42% premium over its current stock price. My implied multiple Price to Free Cash Flow is 82, meaning I will keep growing the multiple to a level even lower than AMD (Figure 6). My valuation supports the hypothesis that Nvidia will grow at high rates due to permanent high GPU demand.

Supply chain and overheating issues in Blackwell

Designing cutting-edge GPUs is not easy, but manufacturing them is harder. Nvidia depends on suppliers who don’t have experience with such advanced technology (no one has it!). Nvidia provides the engineering capacity to work with those suppliers with a competent team, but scaling those systems takes time and coordination in a complex network. Any disruption could cause a loss of $400 million a day.

TSMC and Samsung operate almost at full capacity and have highly competitive order management systems, serving clients like Apple, AMD, and Qualcomm. This situation gives these companies a favorable bargaining position. Currently, the scarcity of GPUs mitigates these issues, but it could become a disadvantage for Nvidia in a more mature market where supply matches demand.

The Blackwell system is thought to have heating problems in some circumstances. It is composed of 72 GPUs, and this integration is unstable. Blackwell delivery is late by at least a quarter. I estimate that this delay will result in a loss of $10 billion in revenue per quarter. However, I trust management comments and delay for another quarter has a probability of less than 10%.

Excessive concentration

Nvidia is fairly diversified across geographies, with 58% of revenue outside the US. However, revenue from China is 20% of total revenue, and tariffs and regulatory restrictions could threaten this demand.

However, 46% of total revenue is made from four clients. You don’t have to investigate much to identify them: Microsoft, Meta, Google, and Amazon. That means that Nvidia is exposed to a favorable bargaining position from those clients. Nowadays, it is not a problem due to the scarce nature of GPUs, but in a more mature market, it is a headwind.

There is also concentration risk in the supply chain. Taiwan Semiconductor Manufacturing Company (TSMC) manufactures cutting-edge GPUs, including the A100, H100, and incoming Blackwell. TSMC holds about 57% of the market share in semiconductor manufacturing. The same happens to memory manufacturing, where most of it is delegated to Samsung Electronics. This concentration is intensified with political risk and tensions between China and Taiwan.

Conclusion

If you thought you were too late to invest in Nvidia, I would say that you are right. You have lost a historical rise in the stock. However, you can still benefit from another appreciation. I estimate Nvidia is worth $189 per share, representing a 42% premium over its current stock price. The implied price-to-free cash flow multiple (P/FCF) in this valuation is 82, which means the stock’s multiple will converge to the same as that of AMD, and even lower. My underlying hypothesis is that demand for GPUs will still be hot in the coming years.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.