Summary:

- Nvidia remains a dominant monopolist with impressive financials, but faces potential future threats from major tech companies collaborating to undermine its market position.

- Despite slowing revenue growth, NVDA maintains strong margins and a growing cash pile.

- Long term we rate at “Do Nothing” rating due to the stock’s already significant run-up, but short-term trading opportunities exist with careful downside protection – as we explain below.

- We believe NVDA’s valuation at 47x TTM unlevered pretax FCF is reasonable, supporting potential upside to $165-200/share.

BING-JHEN HONG

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Please read our full disclaimer here.

Old Line Monopolies, Read It And Weep

A hundred years ago (in 1984), the federal government decided to take an ax to AT&T (T) because unless you knew a guy who knew a guy, you couldn’t get an international call connected to any country smaller than maybe Germany, and once you did get a connection, the call cost you more than a small sedan, particularly because it would take place at a time when your overseas friend was asleep, and you had to call someone else to go wake them up and talk to you. Oh, also because Bell Labs. Which it turned out already had invented basically Internet 2.0 by maybe 1980 but hadn’t told anyone. Not least because of all the fat profits AT&T was making on X.25 lines. Anyway, for all these reasons and more, the sleepy ole utility called AT&T was broken up into small pieces and everyone was better off for it. You see this same initiative at work with Google (GOOG) (GOOGL) right now (current Administration) and you see the same gunning for Meta Platforms (META) too (incoming Administration). Everyone hates monopolies.

Except Nvidia (NASDAQ:NVDA) shareholders. Because this is the finest monopoly ever created. The company, as you know, makes chips. Woot. Clever chips, no doubt, but that’s not the whole story. The whole story is that a generation of developers have been trained on the company’s software platform, and that a generation of customers have been Pavlov’d into only buying Nvidia because, er, nobody ever got fired for buying Nvidia.

The genius of Jensen Huang is many levels deep, from painting a picture of the future to designing the ecosystem that serves that vision to selling the things required to deliver that vision to all the while telling everyone he is leading them to a better place. Whilst clicking in 61% TTM unlevered pretax free cash flow margins (AT&T could only dream of that even when they had you paying them half your first paycheck for line rental). And while sat atop a ginormous pile of cash – currently around $30bn net of debt.

Oh also, the only company that can remotely hold a candle to NVDA GPUs, AMD (AMD), is run by… his cousin, Lisa Su. Yes, really.

One day, the people who really hate NVDA, which is all the companies currently forking over a gigazillion dollars per year just to stack Jensen Processing Units in case they need them one day – this being your Microsofts (MSFT), your METAs, your Amazons (AMZN) and so forth – one day these companies will work together to undermine and deflate and ruin NVDA, most likely by agreeing on a new development platform to which they all contribute intellectual property, and by agreeing standard chip design elements that they can partner with suppliers from ARM to INTC and TSM and beyond to actually make … and basically rolling their own. They will probably own equity in the company (companies) that make and sell the new Not-Vidia chips when they come. I don’t think these big companies are going to be held hostage again. I think they are playing nice because they have to, all the while looking for ways to knife NVDA in the back when it’s not looking.

Jensen Huang knows this, because he is a genius, and so everything he does is designed to extend the monopoly just a little longer. It won’t last forever because monopolies in tech never do, but it’s not going away tomorrow.

Look Away Now If You Don’t Care For Self Congratulations

We’ve had a superb run in our NVDA stock research. We rated the name at Accumulate between $10-15/share, on a split-adjusted basis. We rated it at Hold from $15/share to about $145/share. We moved to Distribute at $145, that being 10-15x up on the entry price range, earlier in November. And after the earnings print we moved to “Do Nothing” rating. Why “Do Nothing?” Because the stock was at $145 and I thought the stock had upside to $165, maybe $200, and downside to maybe $120. So, $25 of downside vs. $20-35 of upside, not very compelling risk/reward. Nothing to do with the superb print today, just that the stock has run up already.

Now What?

Today the stock is at $135, so, maybe $15 of downside vs. $30-65 of upside, better odds. If trading the stock (as opposed to owning it long term) then they aren’t bad odds for a buy in my book – being careful to protect the downside with stops, of course, and to actually cash the gains you’re targeting too. As for long-term ownership of the name, well, I sold my long-term positions down over recent weeks and don’t plan to go back yet. That may change in the future, but for now, with semiconductors deciding whether their fate lies on the moon or at the gates of the underworld, I’m happy to just trade NVDA short term.

And So To Earnings

Let’s look at the numbers first. Then we’ll do charts and suchlike.

TL:DR – Headlines

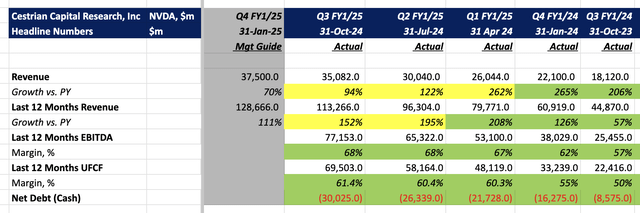

NVDA Financial Summary (Company SEC Filings, YCharts.com, Cestrian Analysis)

Revenue growth is declining, inevitably; margins are holding up great and the cash pile just keeps growing. Double-plus-good on any standards. The great print wasn’t enough to moon the stock because of that slowing growth.

Financial Fundamentals

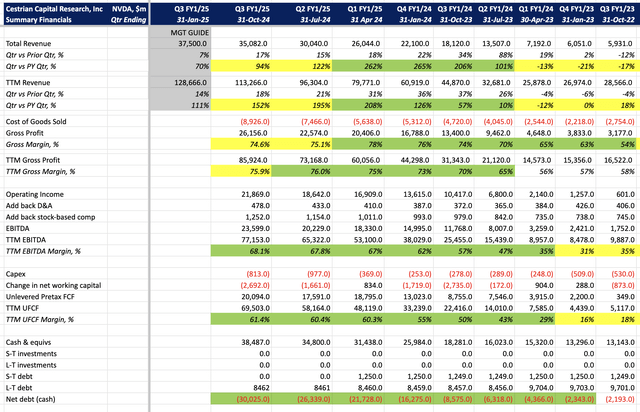

NVDA Financial Fundamentals (Company SEC Filings, YCharts.com, Cestrian Analysis)

Valuation Analysis

47x TTM unlevered pretax FCF is not expensive for this thing. You’ll pay 25x for an ex-growth defense contractor.

NVDA Valuation Analysis (Company SEC Filings, YCharts.com, Cestrian Analysis)

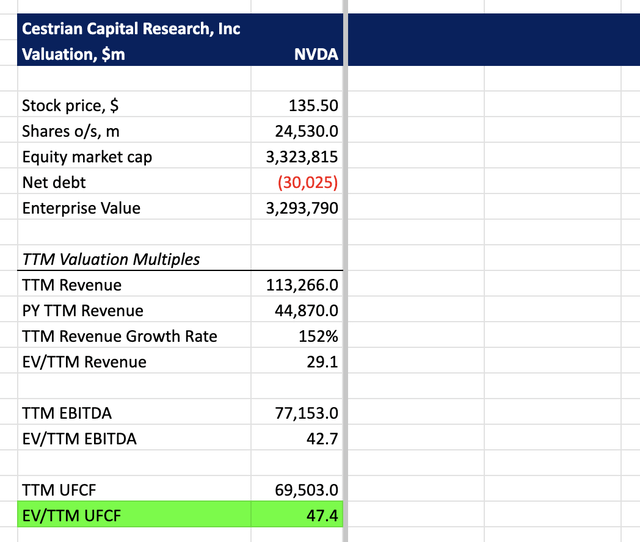

Longer-Term Stock Chart

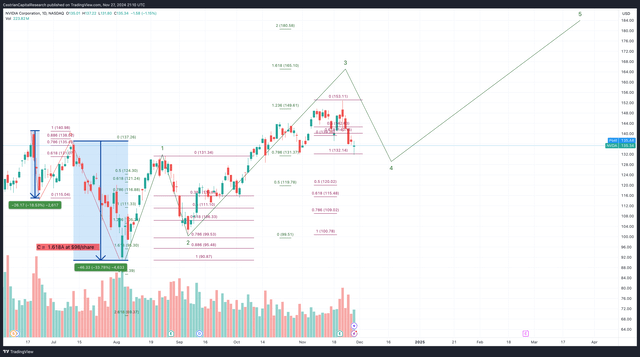

Here’s our take on the larger degree. This is the basis for my view that the stock on this timeframe has, I think the upside to between $165-200/share, and downside to maybe $120/share, in both cases just considering “reasonable” outcomes, i.e. neither hubris nor demolition derby in the market.

NVDA Long Term Chart (TrendSpider, Cestrian Analysis)

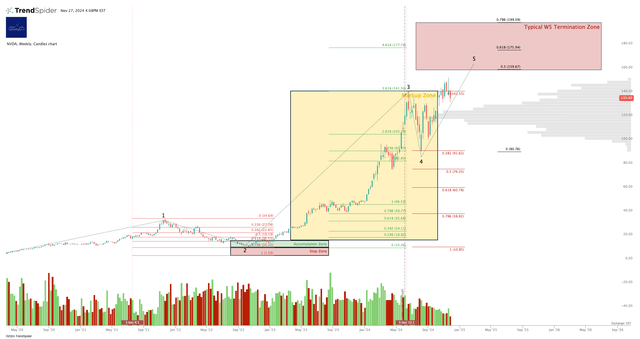

And zooming in here’s how the name looks to me in the smaller degree. Holding over $131 today was bullish in this analysis by the way.

NVDA Short Term Chart (TradingView, Cestrian Analysis)

Stock Rating

So, rating?

- Long term, our “Do Nothing” rating remains for now.

- Short term I think there is a nice risk/reward on offer as a long trade, as discussed above.

Any points, comments, questions, anything, reach out in comments below. Thanks as always for reading our work!

Alex King, Cestrian Capital Research, Inc – 27 November 2024

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDL, SOXL, INTC either through stock ownership, options, or other derivatives.

Business relationship disclosure: See disclaimer text above. Please read the full disclaimer. In addition, Cestrian Capital Research, inc is a TrendSpider affiliate partner. If you purchase a TrendSpider subscription using a link we provide, we may receive a referral fee.

Cestrian Capital Research, Inc staff personal accounts hold long positions in, inter alia, NVDL, SOXL, INTC.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.