Summary:

- Dell’s ISG segment grew 34% YoY, driven by a 58% surge in server and networking revenue.

- Dell shipped $2.9 billion in AI servers during Q3 FY25, with a backlog reaching $4.5 billion.

- CSG revenue declined 1% YoY as consumer sales fell 18%, offset by a 3% rise in commercial PCs.

- Dell’s AI solutions, including the industry-leading XE9680, outshine Super Micro with unmatched density, liquid cooling efficiency, and turnkey integration.

- Dell’s 25% ISG growth forecast appears conservative, given the AI server market’s 35% CAGR and robust enterprise demand.

Hispanolistic

Investment Thesis

While most of the world is racing for AI, few companies are as pivotal in the quiet AI ecosystem as Dell Technologies (NYSE:DELL). Much of the attention has fallen on software giants like OpenAI, or chip leaders like Nvidia (NVDA); however, Dell has emerged as a backbone of AI infrastructure. Dell cashes in on the AI boom with leadership in servers, networking, and storage.

DELL has been up some 24% since our recent bullish call, but crashed yesterday following the earnings release due to the weakness in the PC market. The PC market is currently experiencing a delayed refresh cycle, with enterprises postponing upgrades despite an aging install base and the impending Windows 10 end-of-life in 2025.

While commercial PC demand has shown some stabilization, enterprises are aligning refresh plans with anticipated launches of AI-enabled PCs, expected in early 2025. Consumer demand remains weak, but upcoming innovations in AI-driven hardware, improved battery life, and software upgrades are poised to trigger a significant rebound in the PC market next year.

Following the post-market dip, I doubled down on Dell, as the projected 25% ISG growth appears conservative compared to the AI server market’s CAGR of 35%, which represents nearly half of Dell’s revenue. These factors strengthen my conviction in Dell’s ability to outperform and deliver sustained long-term growth.

Dell’s AI-Powered Growth Surges: Record Earnings Signal Bright Future

Dell Technologies announced strong third-quarter results for fiscal year 2025 and positioned itself well in both the emerging AI and traditional server markets. Revenue was $24.4 billion, up 10% year-over-year, fueled by record growth in the Infrastructure Solutions Group (ISG), while diluted EPS increased 14% to $2.15. Operating income increased 12% to $2.2 billion, with improved gross margins in servers and lower operating expenses.

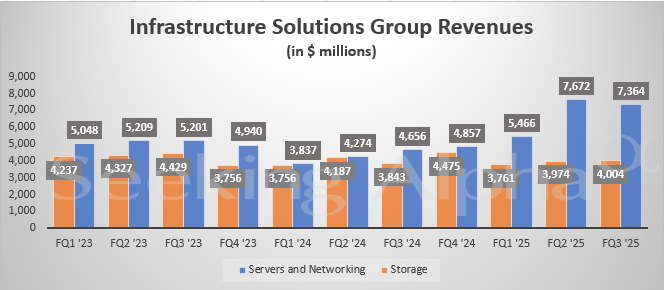

ISG, in fact, did quite well: revenue came in at $11.4 billion, up 34% year to year, as server revenue jumped 58% – driven by an intense AI-optimized server and a remarkable traditional server demand. Besides, Dell shipped $2.9 billion of servers for AI during Q3 of the fiscal year. Indeed, its AI server backlog piled up to $4.5 billion, up from increased traction among both enterprise customers and cloud ones. Storage revenue in ISG increased only 4% on the back of double-digit growth in demand for midrange offerings, such as PowerStore and PowerFlex.

Not surprisingly, Dell’s ISG revenue declined 2.4% quarter-over-quarter in Q3 FY’25 due to the seasonal enterprise spending patterns causing a natural slowdown after robust Q2 growth. Additionally, a significant portion of demand shifted to Blackwell-based AI servers, delaying revenue recognition as production ramps up. Traditional server growth also showed signs of moderation, slightly offsetting the strong AI server demand.

seekingalpha.com

Client Solutions Group (CSG), the part of Dell’s PC business, was down a bit by 1% at $12.1 billion with commercial up 3%, but offset by the consumer sales drop of 18%. Dell still predicted a strong refresh cycle in PC demand next year due to Windows 10 end-of-life and the arrival of AI-enhanced PCs.

Dell issued Q4 revenue guidance in a range of $24 billion to $25 billion, up 10% year-over-year, with ISG expected to increase in the mid-20% range. Besides, the company expects long-term tailwinds from AI server demand, an aging traditional server and PC install base, and enterprise refresh cycles. With a strong pipeline and expanding portfolio of AI-optimized solutions, Dell is well-positioned to capture growth opportunities while it maintains disciplined cost management to protect margins.

Dell XE9680 vs. Super Micro: The Battle for AI Server Supremacy

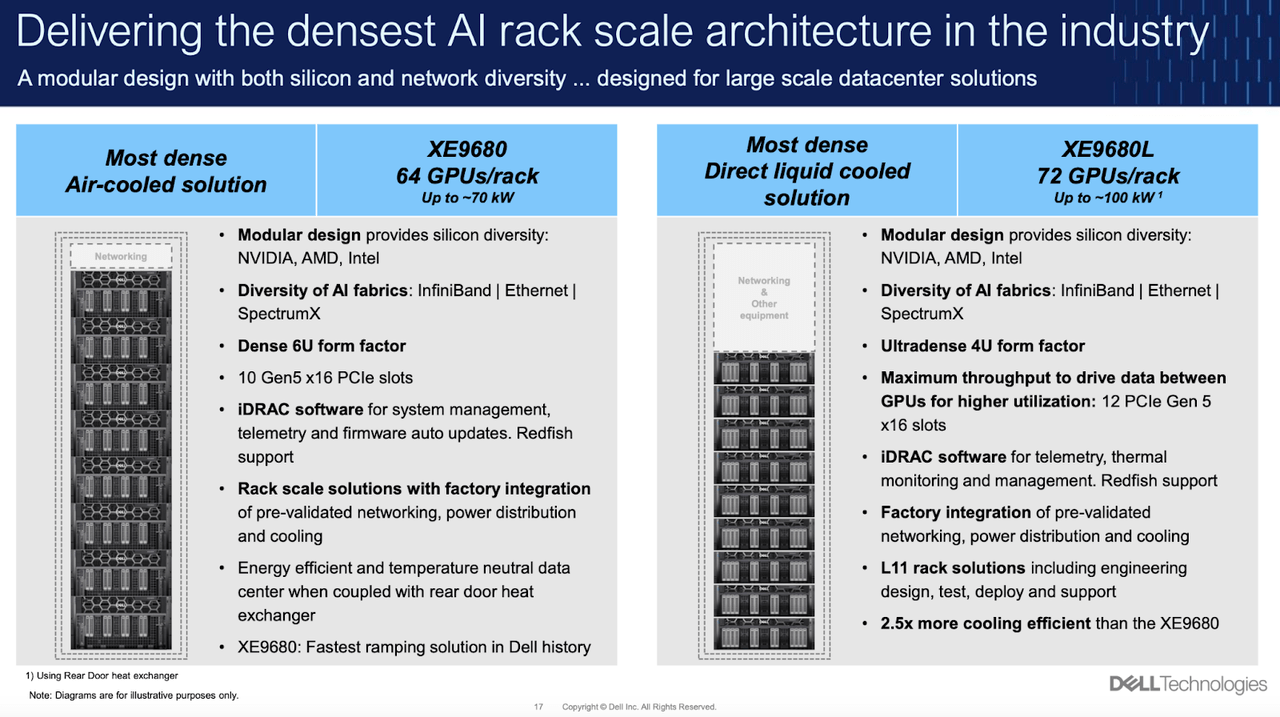

The Dell XE9680 (air-cooled) and XE9680L are liquid-cooled, leading AI rack-scale systems for high-performance data centers that drive demanding AI workloads. These modular configurations bring up to 72 GPUs per rack-together, making them the densest currently available in the market. This technology will support options for GPU options from Nvidia, AMD (AMD), and Intel (INTC) with advanced connectivity through InfiniBand and SpectrumX for speedier data transfer.

Both Dell XE9680 AI rack solutions and Super Micro (SMCI) AI servers target high-power performance for a great deal of today’s AI workloads. However, Dell put lots more focus on density, power efficiency, and integrated solutions to make the product differentiated. It goes up to 64 GPUs in the air-cooled version, maximum, and 72 GPUs for the liquid-cooled XE9680L to become the highest-density in the industry. This makes Dell an ideal option for AI data centers that have huge computational requirements but are space-constrained.

In contrast, Super Micro emphasizes cost-efficiency and flexible scalability, exemplified by its SYS-420GP-TNR, which supports up to 10 GPUs per chassis. This approach appeals to smaller enterprises and hyperscalers, prioritizing adaptability and cost-effectiveness rather than extreme density.

Efficiency in cooling is where Dell’s XE9680 decidedly leads. Liquid-cooled XE9680L is 2.5x more energy-efficient compared to air-cooled systems, which allows for higher-level thermal management and, in turn, better reliability for resource-intensive workloads. Admittedly, Super Micro can also offer liquid cooling on some models, although generally, their designs are air-cooled. Advanced integration of thermal solutions may not be as mature or present in Dell’s offerings.

Furthermore, Dell’s factory-integrated systems with networking, power distribution, and iDRAC software pre-validated for telemetry and management are turnkey for the enterprise. Super Micro, although customizable, usually requires more integration by the customer and therefore Dell’s approach is a little more appetizing when it comes to seamless deployment in mission-critical environments.

Dell has made gains in ultra-dense and performance-critical configurations, protecting its reputation among enterprises and its strategic partnerships with Nvidia, AMD, and Intel. Strong proprietary integration with power-efficient solutions puts Dell in a leading position among Tier 1 hyperscalers and enterprises.

Meanwhile, Super Micro remains solid for budget-conscious customers, as well as for those seeking modular, scalable systems without extreme density or leading-edge cooling needs. For those organizations placing a greater emphasis on density, energy efficiency, and turnkey solutions, Dell’s XE9680 takes the cake, but for budget-conscious flexibility, Super Micro is at the top of its game.

New Beginning for PCs: AI-Enhanced Systems Arrive

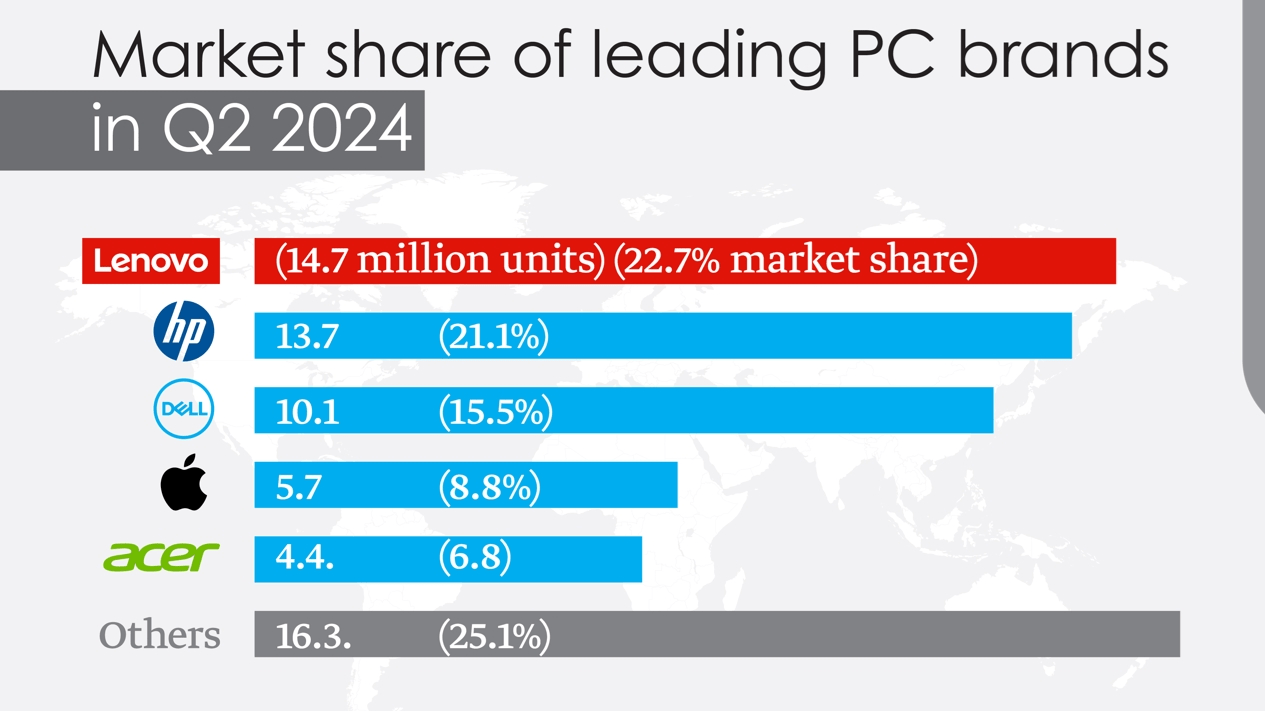

Despite existing challenges, the PC market may be at an inflection point. Personal computers are readying for localized AI capability with Intel’s INTC Core Ultra and AMD’s (AMD) Ryzen AI processors hitting the market. These could start up a multi-year refresh cycle as businesses and consumers seek out systems that can handle AI tasks more suitably. For enterprises, in particular, this marks an opportunity to refresh their fleets, especially as AI-powered productivity tools go mainstream. With a 15.5% share in the global PC market, Dell finds itself in the box seat as this next wave of demand hits.

aletihad.ae

Concluding Thoughts

Overall, Dell Technologies’ overall revenue growth outlook remains strong, propped up by the stellar performance of its ISG, expected to grow 25% YoY (way below the and largely offsetting the minor 1% decline in its CSG. With ISG accounting for almost half of Dell’s revenue and benefiting from surging AI and data center demand, the company’s weighted average revenue growth is projected at approximately 11%. This places Dell in high-growth markets, such as AI servers and cloud solutions, and positions it well to continue revenue growth amidst headwinds in the consumer and commercial PC markets.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DELL, SMCI, NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.