Summary:

- Energy Transfer is a core holding in my portfolio.

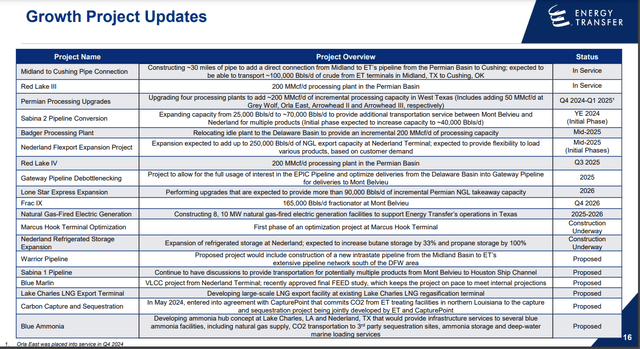

- The company has major growth projects set to be placed into service soon, which should be tangible growth catalysts.

- Energy Transfer is a financially stable business with a secure 6.7% distribution yield.

- Units of the partnership could still be priced at a 7% discount to fair value.

- Energy Transfer looks positioned to produce nearly 45% cumulative total returns through 2026.

A pipeline construction site running through a rural area. tibu

For years now, the midstream industry has generally held my attention. This is because the industry is critical to the modern economy. Trying to live as our ancestors did a handful of generations ago without fossil fuels would be very difficult.

According to Enterprise Products Partners’ (EPD) November 2024 Investor Presentation, more than 96% of manufactured goods are touched by oil and gas via petrochemicals. That includes electronics, asphalt, medicines, just about all plastics, and cosmetics.

Energy Transfer (NYSE:ET) is another one of the major midstream players that makes our lives possible. When I last covered ET with a buy rating in August, I appreciated its record-breaking second-quarter operating results. The upgrade from Moody’s to a Baa2 (BBB equivalent) corporate credit rating was another positive. The valuation was the factor that sealed the deal on my buy rating.

In recent months, I have boosted my stake in ET by almost 80% with purchases in the $16 and low-$17 range. This has pushed the partnership up to my ninth-biggest holding and 2.2% of my total portfolio value.

Today, I’m maintaining my buy rating for ET. The company continued its momentum in the third quarter, again shattering numerous partnership records. ET also has multiple growth projects that will be coming online in the quarters ahead to sustain growth. The distribution is adequately covered by distributable cash flow and can keep rising. Finally, ET’s valuation still comes with some decent upside.

More Operational Records For Energy Transfer In Q3

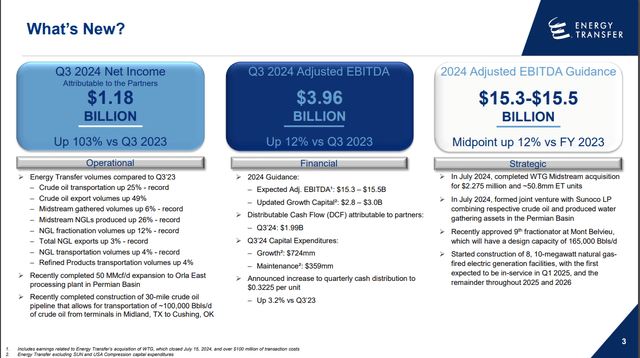

ET November 2024 Investor Presentation

Earlier this month, ET reported its third-quarter earnings. The company’s total revenue made its way 0.2% higher over the year-ago period to $20.8 billion in the quarter. That missed the Seeking Alpha analyst consensus for the quarter by $820 million.

ET’s operational results during the third quarter were quite impressive. The partnership’s crude oil transportation volumes climbed by 24.6% year-over-year to a new partnership record of over 7 million barrels a day. That was attributed to continued growth in gathering systems and contributions from recently acquired assets.

ET’s crude oil exports jumped by 49% over the year-ago period in the third quarter. Per Co-CEO Tom Long’s opening remarks during the Q3 2024 Earnings Call, this was driven by the acquisitions of the Crestwood and WTG assets. Crude oil transportation throughput on ET’s base business was up 4%, though, which shows a healthy demand for its services.

Midstream gathered and produced volumes respectively grew by 6.1% and 25.9% year-over-year for the third quarter. These were also new partnership records. NGL production rose thanks to recently acquired assets and higher Permian plant utilization.

ET’s NGL transportation and fractionation volumes also respectively rose by 3.5% and 12% over the year-ago period during the third quarter. These also represented new partnership records. Higher volumes from the Permian region, on its Mariner East pipeline system and Gulf Coast export pipelines made the former possible. The latter was due to the commissioning of the eighth fractionator in August 2023.

The company’s adjusted EBITDA surged 11.8% year-over-year to almost $4 billion in the third quarter. The unit count was 8.6% higher over the year-ago period because of acquisitions, but that’s still decent on a per-unit basis.

ET November 2024 Investor Presentation

In the years to come, ET has plenty of fuel for additional growth. As Seeking Alpha analyst Steven Fiorillo so aptly put it in a recent article, midstream could be positioned to thrive even more with the incoming Trump administration. That’s because the regulatory rollbacks likely to be delivered by the administration should be a boon to domestic production. This could come with headwinds to upstream companies via lower commodity prices amid a potential supply glut.

That doesn’t matter so much for Energy Transfer, though, because the vast majority of its contracts (~90%) are fee-based. This means the company has a toll-booth business model. The more energy it moves through its infrastructure, the more it gets paid.

That comes on top of a promising pipeline of growth projects already under construction. These include the relocation of the idle Badger Processing Plant to the Delaware Basin. This is expected to add another 200 million cubic feet per day of cryogenic processing capacity to ET’s network upon the expected in-service date in mid-2025. Frac 9 also remains on track to be completed in Q4 2026. That would add another 165,000 of fractionation capacity at Mont Belvieu. This would bring the total fractionation capacity to over 1.3 million barrels per day at Mont Belvieu.

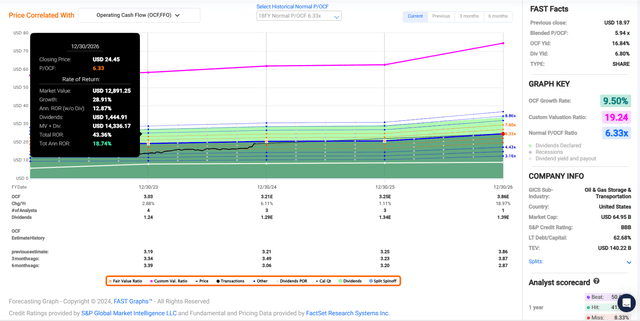

As a result, it’s being forecasted that ET’s operating cash flow per unit will rise by 1.1% in 2025 to $3.25. Another 19% surge in OCF per unit to $3.86 is the FAST Graphs analyst consensus for 2026.

ET’s financial situation is holding steady as well. The company continues to expect its leverage ratio to be on the low end of its targeted range of between 4.0x and 4.5x in 2024. That’s a low enough leverage ratio to justify BBB or BBB equivalent credit ratings on stable outlooks across the board from S&P, Moody’s, and Fitch (unless otherwise sourced, all details in this subhead were according to ET’s Q3 2024 Earnings Press Release, ET’s November 2024 Investor Presentation, and ET’s Q3 2024 10-Q Filing).

Energy Transfer Could Be Set Up For Almost 20% Annual Total Returns

Units of ET have generated 25% total returns compared to the 13% total returns of the S&P 500 index (SP500) since my last article. While I’d be looking to add to my position in the $17 range again, ET is a respectable deal here in the low-$19s.

That’s because the partnership’s units are trading at a forward P/OCF ratio of 5.9. This is less than its historical average P/OCF ratio of 6.3 per FAST Graphs. The company’s 9.5% annual forward OCF per unit growth outlook demonstrates that it has plenty of growth ahead of itself. Additionally, the bullish case could be made that ET could re-rate higher than its historical P/OCF ratio. This is thanks to its improved corporate credit rating and deleveraging efforts.

For the sake of conservatism, however, I’ll assume a fair value P/OCF ratio of 6.3. The calendar year 2024 is just about 92% finished. That means another 8% of 2024 and 92% of 2025 are on the way in the next 12 months. This gives me a forward 12-month OCF per unit input of $3.25.

Using my fair value multiple, I compute a fair value of almost $21 a unit. Relative to the $19 unit price (as of November 26th, 2024), this is a 7% discount to fair value. If ET meets the growth consensus and reverts to fair value, it could have a 43% upside ahead by the end of 2026. That would be 19% annual total returns for the next couple of years, which certainly isn’t shabby.

A Solid Mix Of Starting Income And Growth

ET’s 6.8% forward distribution yield isn’t the 8%-plus yield that it was just months ago. However, it is still meaningfully higher than the energy sector median of 4.2%. That’s enough for Seeking Alpha’s Quant System to hand out respective B+ and B grades for forward distribution yield and overall distribution yield.

ET’s distribution is also self-sustaining. This is because the company generated almost $6.4 billion in distributable cash flow through the first nine months of 2024. Against the $3.3 billion in distributions paid to partners in that time, this equates to a distribution coverage ratio of nearly 2. That amount of retained DCF alone is enough for ET to just about cover its capex spending. This supports ET’s targeted annual distribution growth rate of 3% to 5% for the long haul. That makes the distribution safe and provides a nice combo of both starting income and growth potential in my opinion.

Risks To Consider

ET is a midstream operator that keeps delivering for unitholders. There are still risks associated with an investment in the partnership, however.

As I outlined in my previous article, ET is highly resistant to downturns in energy markets. It isn’t bulletproof, though. Perpetually low energy prices could hurt its more financially stretched customers, which could raise the risk of default. Such events could weigh on ET’s financial results at least temporarily if they materialized.

Like any other midstream company, it could be hurt by regulatory setbacks and legal challenges. Any inability to finish major projects on time and within budget could hurt ET’s future growth.

The company is also a frequent target of attempted cyber breaches because of its status as a big midstream player. If any of these cyber breaches found major success, that could disrupt ET’s operations. It could also result in potential fines/penalties if the company was found to be negligent.

One last risk to ET is the possibility that an increasing frequency of natural disasters could interrupt its operations. If significant natural disasters happen, the partnership could experience a significant increase in commercial insurance coverage rates. ET’s infrastructure could also be damaged beyond commercial insurance coverage, which could harm its financial prowess.

Summary: A Blue-Chip With High-Teens Annual Total Return Potential

ET is firing on all cylinders, and it looks like it can keep up the momentum in the years to come. The balance sheet is decent, and the distribution is easily supported by DCF. ET’s valuation isn’t the bargain that it was not long ago, but it is sufficient that 40%+ cumulative total returns could be ahead for the partnership through 2026 in my opinion. That’s why I’m standing by my buy rating.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ET, EPD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.