Summary:

- I regret selling Meta Platforms too early, missing out on significant gains as shares surged from $98.45 to $559.60.

- Meta’s quarterly revenue hit a record $40.59 billion, driven by a surge in advertising revenue and user growth, especially on the Threads platform.

- Despite heavy losses in Reality Labs, Meta remains attractively priced due to its strong cash flows and substantial returns to shareholders.

- While the easy money has been made, Meta’s growth and financial health justify maintaining a ‘buy’ rating for now.

Derick Hudson

If you haven’t had any regrets from your investing journey yet, it just means you haven’t been investing very long. We all end up making mistakes, and I don’t know about you, but those mistakes stay with me. Back in October of 2022, I ended up being one of the only investors in the market that was bullish about Facebook parent Meta Platforms (NASDAQ:META). The bottom had fallen out from the stock and shares were trading at under $100. To be precise, the weighted average price of my purchases was $98.45. At the time, I wrote about how attractive the company was, even rating it a ‘strong buy’.

Starting in early February of 2023, I began selling off my ownership stake in the business. And by early March, I was out completely. My weighted average price of a sale was $186.62, resulting in a gain of 89.6%. For such a short window of time, that was a tremendous amount of upside. But I regret not buying as much as I did. I also regret not purchasing call options in it. And finally, I regret selling it at all. As of this writing, shares are $559.60, meaning that I left a lot of money on the table.

As of this writing, shares of the company are up 471% since I initially rated it a ‘strong buy’ back in October of 2022. And even since I last reaffirmed it as a ‘buy’ prospect in early August of this year, shares are up 7.4%. That does trail the 7.8% increase seen by the S&P 500 over the same window of time. But I would make the case that, if given more time, the company will prove itself as an outperformer. Based on the most recent data available, as well as how shares are currently priced, I believe that the company deserves the ‘buy’ rating I recently had it at.

Shares have more upside

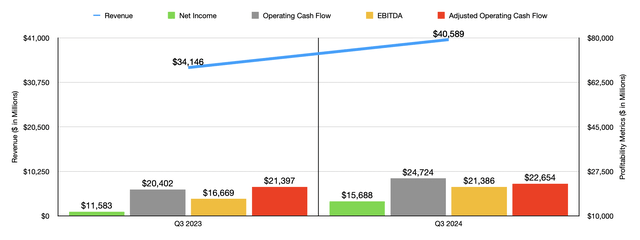

Fundamentally speaking, things are going really well for shareholders of Meta Platforms. When I last wrote about the company, investors had access to data covering through the second quarter of 2024. Results now extend through the third quarter. During the most recent quarter, revenue for the company was $40.59 billion. That’s 18.7% above the $34.15 billion the company reported the same time last year. This growth has been driven by a surge in advertising revenue, with sales of $39.89 billion coming in 18.6% above the $33.64 billion reported at the same time in 2023. In fact, the revenue the company reported for the latest quarter was the highest in its history.

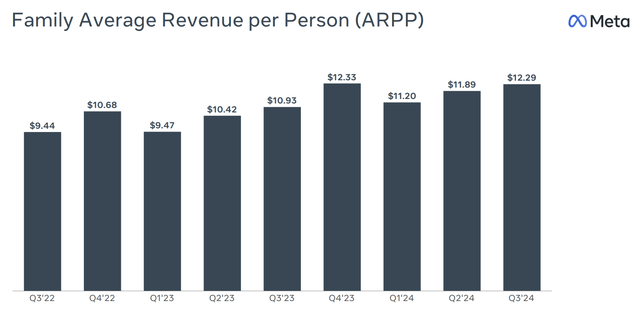

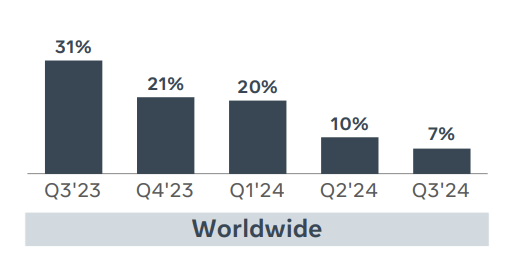

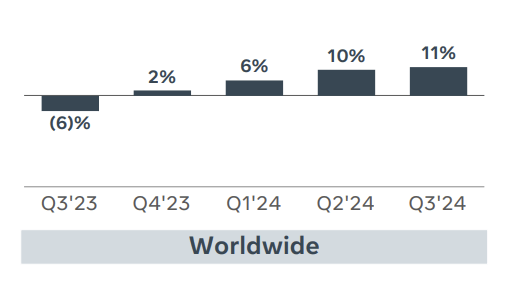

Year over year, the company has benefited quite a bit from a rise in average revenue per person, or what management calls ARPP. During the most recent quarter, this was $12.29. I believe this is the second best quarter in the company’s history in that regard. It also happens to be a whopping 12.4% above the $10.93 generated per person on its platform the same time last year. There were a couple of different contributors to this increase. On a year over year basis, the company experienced an 11% rise an average price per ad. It also saw a 7% growth in ad impressions. However, it is worth noting that this increase in ad impressions is the lowest that it has had in some time. In fact, after hitting 34% year over year back in June of 2023, the business has experienced sequential declines in each subsequent quarter.

Meta Platforms

*Ad Impressions Change Year-Over-Year

Meta Platforms

*Average Price / Ad Change Year-Over-Year

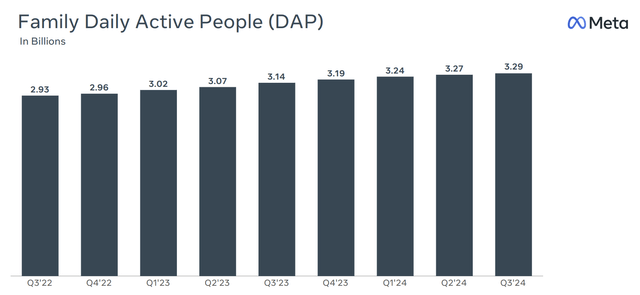

For its family of apps, Meta Platforms has also seen continued user growth. It hit an all-time high of 3.29 billion users in the most recent quarter. That was up from 3.27 billion reported for the second quarter of the year. It also represented an increase of 4.8%, or roughly 150 million, compared to the 3.14 billion that the business had at the end of the third quarter of 2023.

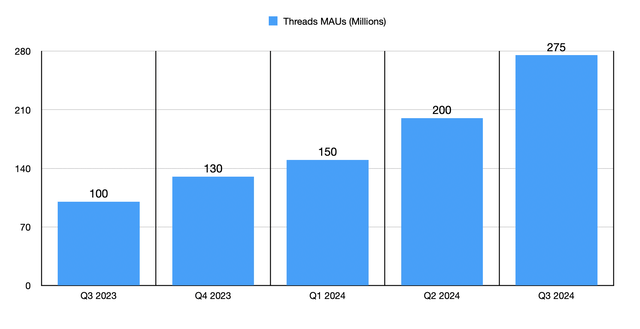

Speaking of user growth, one area where the company has really shown progress is when it comes to its Threads platform. After Twitter, now known by many as X, was sold off to Elon Musk, Meta Platforms launched Threads in an attempt to capitalize on Twitter’s slow-motion crash. Advertisers and users left the platform because of how toxic they viewed the environment and because of a dislike of Musk’s support of Donald Trump.

That exodus seems to be continuing today. Since management stopped reporting on it, we don’t know how large Twitter is today. We also don’t know how many monthly active users the company had right before it went private. We do know that it had around 229 million daily active users, though. By comparison, Threads has now grown to 275 million monthly active users. That’s up from 200 million in the second quarter of this year, and it compares to the 100 million that the platform had in the third quarter of 2023. Management said recently that the number of daily active users is now growing by around 1 million each day.

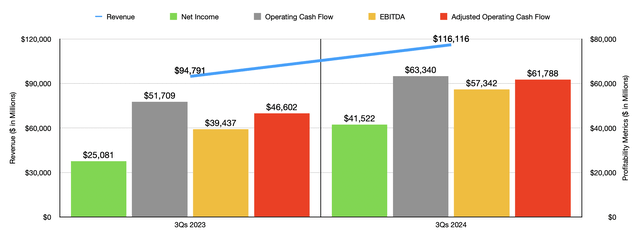

Growth in revenue and the drivers behind it have also increased profitability for the business. Net income jumped from $11.58 billion to $15.69 billion year over year. That’s growth of 35.4%. Operating cash flow expanded from $20.40 billion to $24.72 billion. If we adjust for changes in working capital, we get a slightly smaller increase from $21.4 billion to $22.65 billion. Meanwhile, EBITDA for the company expanded from $16.67 billion to $21.39 billion. In the chart above, you can also see financial results for the first nine months of 2024 compared to the same time in 2023. Revenue, profits, and cash flows, are all up materially year over year.

When it comes to valuing the company, I do think that we need to make some allowances. The primary driver that sent shares of the company tumbling a couple of years ago involved the firm’s decision to continue investing heavily into Reality Labs. This is the company’s augmented reality initiative. My rationale for being bullish about Meta Platforms, despite the fact that the company is losing a ton of money on this, was that shares were attractively priced even with these investments and that we would see one of two scenarios. Either Reality Labs would succeed and generate tremendous additional upside for the company, or it would eventually be shuttered and cash flows for shareholders would be drastically increased as a result. I saw this as a no-brainer.

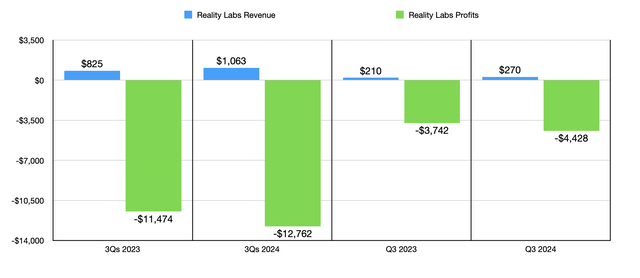

Even throughout this year, Reality Labs has proven to be a costly initiative. In the most recent quarter, it generated revenue of only $270 million. That compares to the $210 million reported at the same time last year. Over the same window of time, its operating losses worsened from $3.74 billion to $4.43 billion. And for the first nine months of this year, the $12.76 billion and losses generated by the operation was far worse than the $11.47 billion reported one year ago. Moving forward, these losses will probably continue to grow for some time. But management views this as a long-term play that it hopes will eventually succeed tremendously.

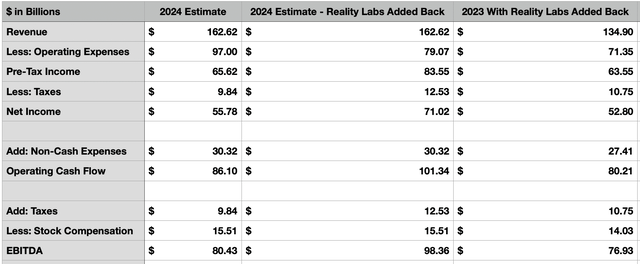

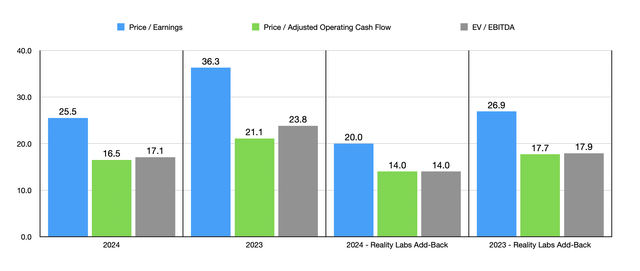

Because of this dual path that we are on, either one where the platform fails, or where it succeeds, I do think it would be appropriate to value Meta Platforms both with and without these losses factored in. In the table above, you can see financial data for the company, as well as projections for 2024, that factor in both of these scenarios. In the table below, you can also see what this means for the valuation of the company. Even with the losses associated with Reality Labs, Meta Platforms seems to me to be attractively priced, at least considering that we are talking about a massive industry leader that can be adequately described as a cash cow.

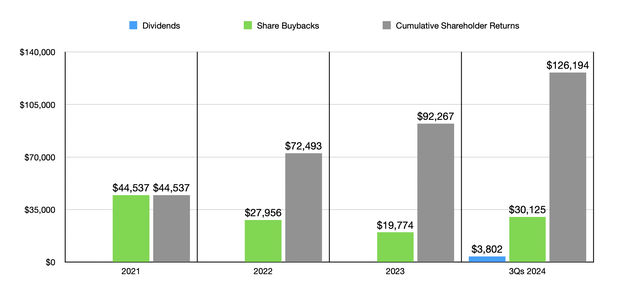

Another thing to take into consideration when evaluating the company is that management is making major investments to grow the company while also simultaneously returning a lot of capital to shareholders. This year alone, the business is planning to spend between $38 billion and $40 billion on capital expenditures. But already in the first nine months of the year, it has paid out $3.80 billion in dividends and has repurchased $30.13 billion worth of stock. If we add this into the picture, then from 2021 through the end of the most recent quarter, management has returned $126.19 billion to shareholders. And with my own model suggesting tremendous cash flows this year and with the likelihood of additional growth next year, this number will only increase.

Takeaway

To be clear, I think that the easy money has definitely been made when it comes to Meta Platforms. In fact, I would argue that the company probably is not terribly far off from justifying a downgrade to a ‘hold’ rating. But when you consider how the stock is priced, when you look at its recent growth and cash flows, and you look at its return to shareholders, it’s difficult to be anything other than bullish. So for now, I am keeping it rated a ‘buy’.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!