Summary:

- Devon Energy is undervalued, trading at just 3.5x operating cash flow, with a fair value estimate of $82 per share, offering significant upside potential.

- Despite recent underperformance, DVN’s fundamentals are strong, with record-breaking production and efficiency gains, particularly in the Delaware Basin.

- The company plans to return up to 70% of free cash flow to shareholders through dividends and buybacks, promising substantial returns at higher oil prices.

- Devon’s stock is volatile and best suited for risk-tolerant investors, while more conservative investors might prefer peers like Diamondback Energy and EOG Resources.

Bet_Noire

Introduction

I love the energy sector.

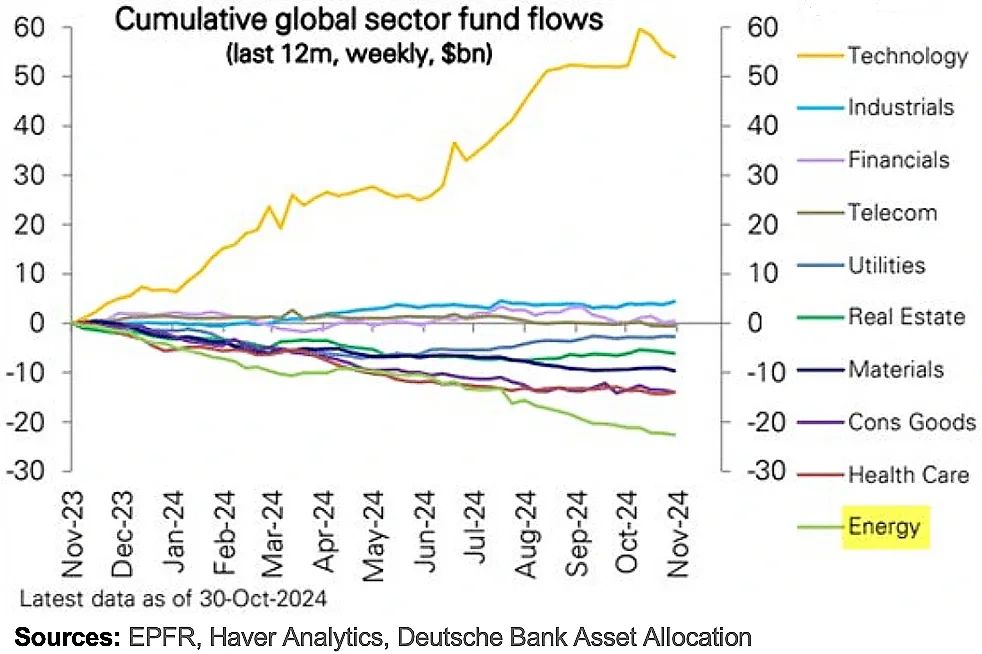

By now, I doubt will come as a surprise to many readers. The main reason for that is its valuation. In a market with a lofty valuation, the energy sector truly stands out. As the chart below shows, energy funds have seen nonstop cash outflows since at least the end of 2023, as investors all piled into technology stocks. In fact, the majority of S&P 500 sectors have seen consistent outflows.

Deutsche Bank

With that said, if something is cheap and “unloved,” it doesn’t automatically make it a good investment. Although I do not have scientific research to back this up, I believe buying cheap investments just because they are cheap is a fantastic strategy to massively underperform the market on a long-term basis.

That said, fundamentals are quite attractive, as Bison Interest wrote in its recent update (emphasis added):

Beyond 2025, oil demand is projected to keep rising, and with declining OPEC production and slowing non-OPEC production growth, the supply shortfalls seen in 2024 may persist. Given the inelastic nature of oil demand, such conditions would trigger significant price volatility. For example, from December 2020 to May 2022, an average global inventory draw in petroleum and other liquids products of 1.34 mbd drove WTI prices from $41 to $110.

[…] With the latest global inventory withdrawals averaging 0.91 mbd in Q3 2024 and WTI trading at $68 as of the week ending November 15, we see market fundamentals aligning for a potential similar bull run in 2025 and beyond. – Bison Interest

Personally, I have 38% of my entire portfolio invested in energy. However, before you call me crazy, please know that 30 of these 38 points come from two Permian Basin landowners: Texas Pacific Land (TPL) and LandBridge (LB).

These companies do not produce oil and gas. They own land and mineral rights, allowing them to generate ultra-high margin income from drilling and surface royalties.

One of their biggest “tenants” is Devon Energy (NYSE:DVN), which currently accounts for 14% of Texas Pacific Land’s completed wells, making it critical to my biggest investment.

Additionally, Devon Energy is an oil and gas producer I have been very bullish on for a long time. My most recent article was published on August 12. Since then, shares have lost 15% of their value, as the market was not yet willing to jump back into upstream equities. While my land investments went through the roof, investors were not ready to buy producers.

That provides opportunities, as I like Devon’s valuation even more at current prices.

So, in light of its latest 3Q24 earnings and other critical developments, let’s dive into the details, as I update my Strong Buy rating for the Oklahoma-based driller.

‘Nobody’ Wants Devon Energy

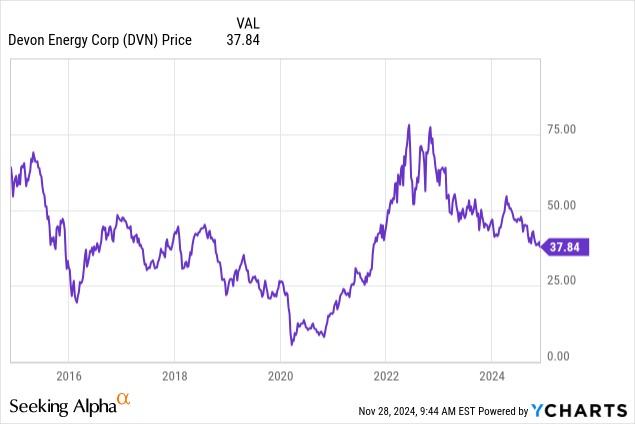

As the chart above shows, Devon has not generated any shareholder value (ignoring dividends) over the past ten years (and before that). This is mainly due to the devastating impact of the shale revolution on the company and its peers.

While the shale revolution turned the United States into the biggest oil producer in the world, it hurt its producers because aggressive supply growth made oil prices extremely fragile.

The good news is that this ended after the pandemic, causing Devon’s stock price to explode higher. Unfortunately, since 2023, the stock has been in a steady downtrend, mainly pressured by weak global cyclical demand, uncertainty regarding OPEC’s production cuts, and challenges in high-demand markets like China.

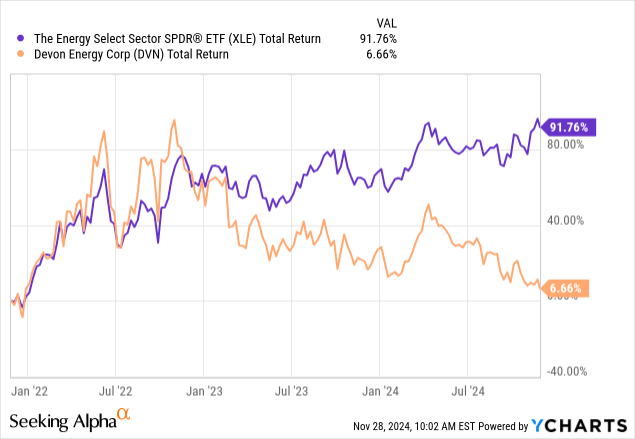

Additionally, investors distrusted Devon Energy. As we can see below, in January 2023, the stock started to diverge from the energy ETF (XLE), as investors preferred much larger energy companies.

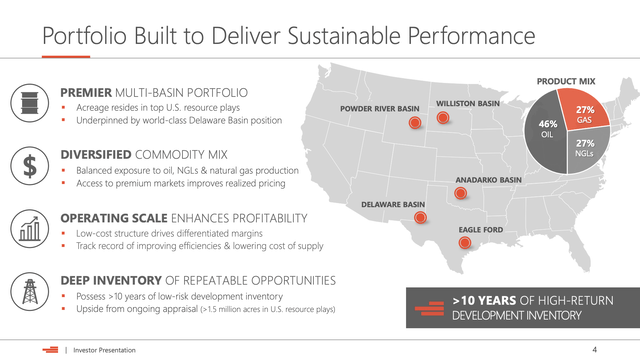

One reason is its production mix.

More than a quarter of its production consists of natural gas. While I’m bullish on this sector, it was one reason why investors ignored the stock.

- Natural gas prices were very weak most of the time this year. Oil-heavy producers were simply more attractive.

- Because natural gas in the Permian Basin is exploding, regional prices (Waha Hub) were negative, as there was not enough takeaway capacity. The chart below shows this quite clearly.

Energy Information Administration

The good news is that these problems are slowly being sold, supported by massive pipeline projects like the Matterhorn (it went online recently), the Warrior Pipeline, the Blackcomb Pipeline connecting supply to the Gulf Coast, and others.

Energy Information Administration

This benefits Devon Energy and my investments in TPL and LB, as better egress capacity allows producers to consistently boost output.

In general, the Devon Energy bull case is looking better.

The Devon’s Efficiency Gains Are Impressive

Although it is perfectly valid to make the case that some pure-play Permian producers are better than Devon, I believe Devon has gotten too cheap, as its business is much better than its stock price suggests.

For starters, it produced a record-breaking 728,000 BOE per day in the third quarter. BOE stands for “barrels of oil equivalent.” This is 12% higher compared to the prior-year quarter. Roughly 46% came from crude oil production. It’s also the third consecutive quarter of higher-than-expected output, supported by the company’s productivity gains in the Delaware Basin and a good performance in all of its five production areas.

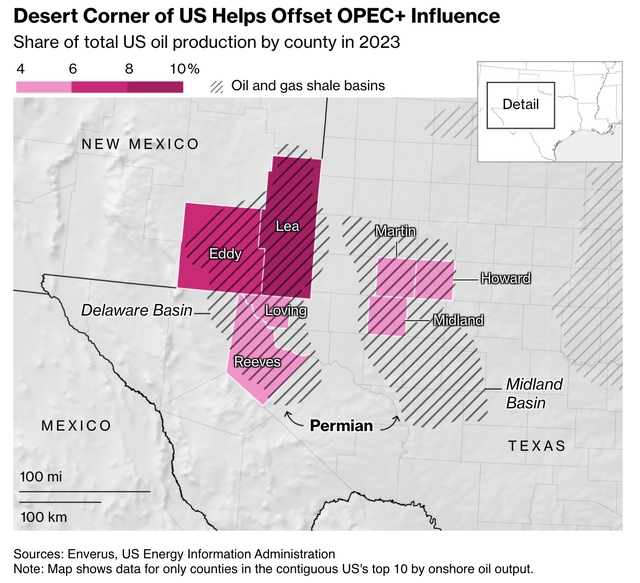

As the map above shows, the Delaware Basin is a part of the Permian. In fact, it’s one of two major production areas. The other is the Midland Basin. The Delaware Basin is my favorite basin, as it is home to low-cost reserves and benefits from the fact that most good spots are still undrilled.

This is also one of the reasons why the company raised its full-year production guidance to an average of 730,000 BOE, a 12% increase over its original budget.

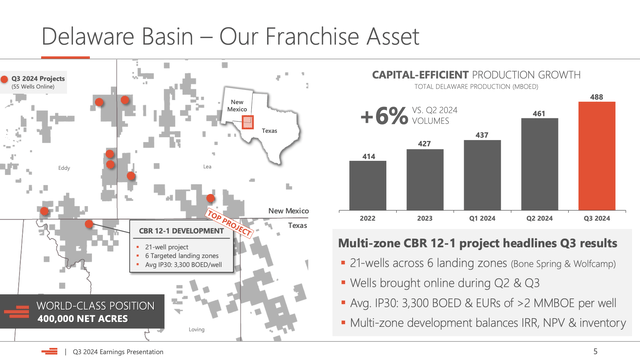

As we can see above, the company produced 488,000 BOE per day in the Delaware Basin, 6% more compared to the prior quarter. This is supported by major assets in Eddy and Lea Country, two of the best drilling spots in the United States. They are also critical to total American oil and gas output, as the overview below displays quite well (it also shows the Delaware/Midland parts of the Permian).

Unsurprisingly, Devon allocated roughly 60% of its capital to this area, investing in 55 new wells to target the Woldcamp, Bone Spring, and Avalon formations. According to Devon, these wells exceeded expectations, with an average 30-day production rate of more than 3,100 BOE per day per well.

In general, Delaware Basin productivity is 20% better compared to last year, supported by simul-frac techniques that are adopted by all major producers. Thanks to these tailwinds, the company was able to reduce its rig count from 16 to 15, with plans to reduce that number to 14 next year, while maintaining the same production levels.

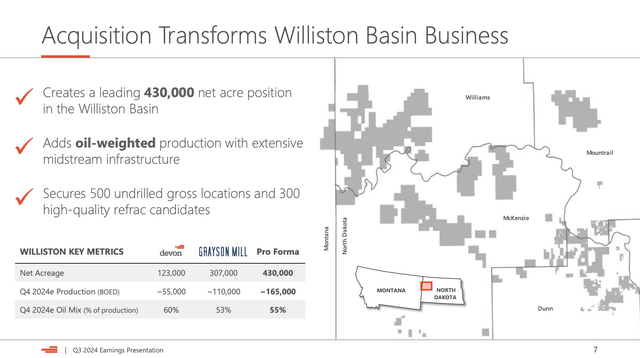

With that said, the company has more than ten years’ worth of high-quality drilling inventory. While that’s a good number, it’s below the numbers of some of its largest peers. This requires M&A.

This year, Devon bought Grayson Mill in the Williston Basin, which the company calls its best integration to date. In that area, it currently runs three rigs with plans to maintain this level of activity. The deal also adds 500 undrilled locations, which bodes well for future output.

So, what does this mean for shareholders?

Devon Shareholders Remain In A Great Spot

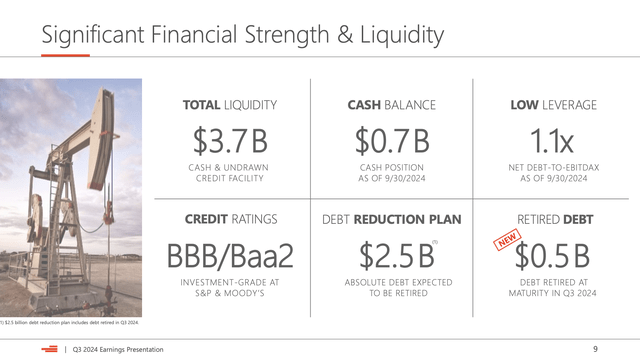

Devon has a favorable leverage ratio of slightly more than 1x EBITDA, thanks to efforts to retire close to half a billion in senior notes this year. Going forward, the company is going to maintain a balanced approach, reducing debt and rewarding shareholders, with the goal of lowering debt by $2.5 billion.

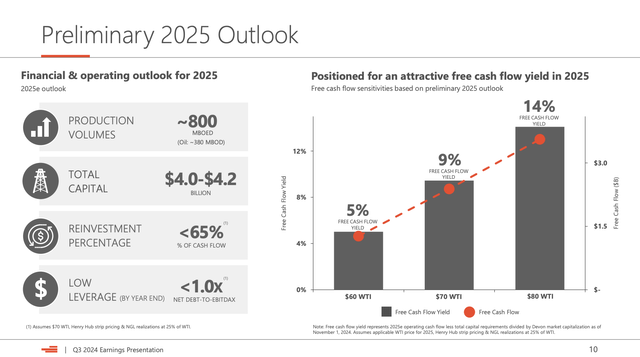

Beyond debt reduction, 70% of its free cash flow will be used for shareholder distributions, including share buybacks of up to $300 million per quarter in 2025. This would translate to almost 5.0% of its current market cap.

With that said, at $70 WTI, the company expects to generate a free cash flow yield of roughly 9%. This is based on its November 1 stock price, which was a dollar higher than the current price ($38). At $80 WTI, the free cash flow yield is 14%.

In other words, applying the 70% rule, at $80 WTI, the company can return cash equivalent to 10% of its current market cap. That makes it highly attractive.

It is also the result of a very attractive valuation.

Valuation

As I am bullish on oil, the company’s favorable free cash flow outlook is enough reason to stick to my Strong Buy rating.

However, there’s more to it.

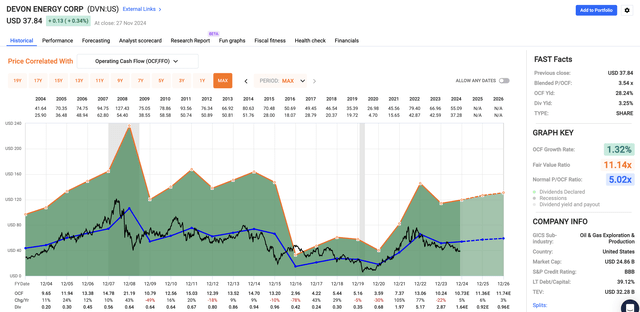

Using the FactSet data in the chart below, Devon Energy trades at a blended P/OCF (operating cash flow) ratio of just 3.5x. This is significantly below its average of 5.0x, which is already very low. In most of my articles, I give high-quality drillers a multiple of at least 7-8x OCF.

While the company has shortcomings like below-average reserves (compared to high-quality peers), non-Permian operations, and elevated natural gas production, I believe none of these warrants a valuation this low.

Applying a 7x multiple gives the company a fair stock price target of $82, more than 100% above its current price.

Hence, Devon remains one of my favorite oil stocks going forward.

However, it should only be considered by investors who aren’t afraid of volatile stocks. If you’re not in that group, please stay away from the company, as it’s not for the faint of heart.

Takeaway

Devon Energy remains one of my top oil stock picks despite its recent underperformance. While the market has somewhat avoided Devon due to weak natural gas prices and a preference for larger producers, its fundamentals tell a different story.

With record-breaking production, significant efficiency gains, and improving pipeline capacity, Devon is positioned to thrive as energy market conditions improve.

Moreover, its valuation, trading at just 3.5x operating cash flow, offers tremendous upside potential, with a fair value estimate of $82 per share, which is more than double the current price.

However, Devon’s volatility means it’s best suited for risk-tolerant investors.

For those who can handle the swings, I maintain my Strong Buy rating, as this stock offers a compelling mix of growth, income, and value.

However, for more conservative investors, I prefer its peers, Diamondback Energy (FANG) and EOG Resources (EOG).

Pros & Cons

Pros:

- Attractive Valuation: Devon trades at just 3.5x operating cash flow, significantly below its historical average and my fair value estimate. In general, I believe energy is one of the most attractive places to be.

- Strong Production Growth: Record-breaking output, especially in the Delaware Basin, is supported by advanced drilling techniques and efficiency gains.

- Shareholder-Friendly Strategy: The company aims to return up to 70% of free cash flow via dividends and buybacks, which offers potential double-digit cash returns at higher oil prices.

- Improved Fundamentals: Increasing pipeline capacity and disciplined capital allocation improve the long-term outlook.

Cons:

- High Volatility: Devon’s stock is not for the faint of heart, with frequent swings tied to commodity prices.

- Natural Gas Exposure: Over a quarter of its production comes from natural gas, which has been under significant pricing pressure.

- Reserve Limitations: Devon’s drilling inventory trails some peers, which requires M&A to sustain long-term growth.

- Market Sentiment: Investors have favored larger, more oil-heavy producers, leaving Devon overlooked despite its strengths.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TPL, LB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.