Summary:

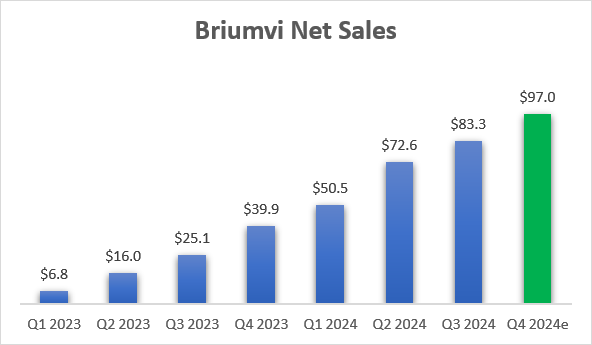

- TG Therapeutics, Inc. reported a modest Q3 beat and raised the full-year net sales guidance range for Briumvi by $7.5 million at the mid-point.

- The results were slightly underwhelming but generally in line with management expectations of a softer Q3.

- Now we wait for the important updates in early 2025 — preliminary Q4 net sales of Briumvi, the guidance for 2025, and the preliminary results from subcutaneous Briumvi’s trial.

- I expect the FY 2025 net sales guidance range to be at or slightly below the analyst consensus as the company sets the stage to beat and raise throughout the year.

- The company set expectations for a once every two-month dosing schedule for subcutaneous Briumvi, and I would consider quarterly dosing a clear win.

mohd izzuan

TG Therapeutics, Inc. (NASDAQ:TGTX), aka TG, reported a small revenue beat for the third quarter and raised the full-year net sales guidance range for Briumvi by $7.5 million at the mid-point of the range. These results are slightly underwhelming and came at the low end of the estimate range I provided in my September article and below my estimate for a $10 million increase for the full-year guidance.

However, there is no need for concern as Briumvi’s growth trajectory remains healthy, and management did say on the Q2 earnings call that Q3 will be softer in terms of sequential growth and followed by a stronger Q4. It is also worth mentioning that TG started the year with a wide guidance range of $220-260 million. It should end the year with more than $300 million in net sales, and the management team has learned to play the expectations game well since introducing quarterly guidance for the first time one year ago.

The new full-year guidance range also implies healthy growth in the fourth quarter. It is entirely possible that management left some room for outperformance when it reports the preliminary Q4 net sales ahead of the J.P. Morgan Healthcare conference in January. The company also guided for preliminary results from the phase 1 trial of subcutaneous Briumvi in early 2025, which suggests we may see this update at the conference as well.

I reduced my position in TG ahead of the earnings report, as market sentiment appeared too optimistic, despite management providing cautious remarks about the quarter. However, it remains one of the largest positions in my portfolio and I remain bullish on the company’s long-term growth prospects and will be looking to add back to my position in the following weeks or months.

TG slightly exceeded Q3 revenue estimates and increased the full-year guidance range to $300-305 million

The company delivered on its promise of having a softer Q3 in terms of sequential growth rates. Q3 net sales grew 15% sequentially to $83.8 million, after increasing 27% and 44% sequentially in Q1 and Q2, respectively. This was near the low end of my $83-86 million estimate range, and it was not unusual, as TG noticed this kind of seasonality even last year, the first year of Briumvi’s commercial availability. On the earnings call, Chief Commercial Officer Adam Waldman said that July and August were soft, but that growth picked up in September and that they saw record monthly patient enrollments in October.

These comments implied that TG is not seeing a meaningful impact from the availability of Roche’s (OTCQX:RHHBY) Ocrevus Zunovo, the subcutaneously administered version of Ocrevus. Waldman later confirmed in the Q&A section that they are not seeing an impact from this launch to date. These are still early days for Ocrevus Zunovo since it was only approved in mid-September, but so far, so good, as far as Briumvi’s growth trajectory is concerned.

The full-year guidance range for Briumvi was increased from $290-300 million to $300-305 million, a $7.5 million increase at the mid-point of the range, and implies Q4 net sales will be in the $94-99 million range.

TG Therapeutics earnings reports and management guidance

I expected an increase of $10 million in the full-year net sales guidance range at the mid-point if sales were in line with my estimate range. So, this is slightly underwhelming. However, as mentioned in the introduction, this is possibly the management team setting itself up for a good start of 2025 with a revenue beat when it preannounces the Q4 Briumvi sales ahead of the conference in early January.

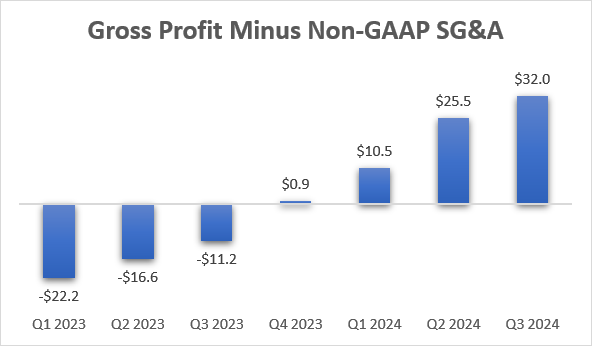

GAAP profitability reached – TG needs to spend more on Briumvi

TG is spending very little on promotion of Briumvi. Non-GAAP SG&A expenses were only $33.2 million in the third quarter and Briumvi is already a significantly profitable product – gross profit minus non-GAAP SG&A already reached $32 million in the third quarter TG even reached GAAP profitability in the quarter.

TG Therapeutics earnings reports, author’s calculations

However, I am not praising TG – I believe the company can and should spend more on promotion of Briumvi. It has broad coverage now, it is gaining traction in community centers and hospitals, and it should now do more on the direct-to-consumer (“DTC”) side to activate patient demand.

Management says they are starting to do that, but given the modest increases in spending, it seems a very modest effort.

With positive cash flows and $341 million in cash and equivalents at the end of Q3 (and a net cash position of $91 million), TG is in good financial shape and can afford to spend more on Briumvi and to execute its $100 million share buyback program. The 10-Q is not filed yet, and I cannot see how many shares the company bought back since starting the program in early August. However, management said on the earnings call that the repurchased amounts were minimal and that would be normal since sentiment was positive in the past three months.

Preliminary phase 1 results of subcutaneous Briumvi represent the next important catalyst for TG

CEO Weiss said on the earnings call that he expects the company will report the preliminary phase 1 results of subcutaneous Briumvi in early 2025. If we are to trust this statement, this too could happen just ahead of the J.P. Morgan Healthcare Conference in January.

Weiss has been setting expectations for several quarters now, and he again confirmed that the company’s goal is to have a dosing schedule that is less frequent than once a month and through the use of an autoinjector. This would allow it to compete effectively with Novartis’ (NVS) Kesimpta which uses an auto-injector and is administered once a month at home. On the Q3 earnings call, he reiterated these expectations:

So, I mean, ideally, it would be as less frequently as possible. I think sort of a minimum bar would be certainly every other month, I think, is the minimum bar that we’re targeting. And anything less frequent than that, we think would be fantastic. And we’ll be obviously working towards that, of course. But no promises. But yeah, the minimum profile, I think would be every other month is the target for that.

I believe that even once a month would make subcutaneous Briumvi a competitive product, and would be happy with either every two-month dosing, and more so with quarterly dosing. I do not know what is the bioavailability of subcutaneous Briumvi, but it seems feasible that the 450mg intravenously administered maintenance dose can be split into three bi-monthly subcutaneous doses.

If all goes well in the phase 1 trial, TG plans to start the registrational trial of subcutaneous Briumvi in mid-2025. As I mentioned in my August article, I expect a phase 3 trial that is similar to Ocrevus Zunovo’s phase 3 trial. There would be enrollment of 200 to 250 patients of SC Briumvi compared to IV Briumvi, a 12-week non-inferiority primary endpoint, and SC Briumvi could hit the market between mid-2027 and early 2028.

Other pipeline updates

The first clinical trial of azer-cel is expected to start by the end of the year in progressive forms of multiple sclerosis. If successfully brought to market, azer-cel could be a natural extension of TG’s reach in the multiple sclerosis market without cannibalizing Briumvi.

TG is taking its time to start a trial in the second indication of Briumvi in an autoimmune disease (outside multiple sclerosis) and we still do not know which indication it is. CEO Weiss previously mentioned rheumatoid arthritis as a possible indication, but perhaps a better use of capital is a trial in generalized myasthenia gravis. Amgen (AMGN) recently reported positive phase 3 results of Uplizna which is also a B cell depleting antibody like Briumvi, although its target is CD19 and not CD20. Rituximab, which is an earlier generation CD20 antibody, has also generated positive (and sometimes mixed) results in gMG patients, and is being used off-label for gMG.

gMG may also be a good shot on goal for azer-cel which is a CAR T cell therapy with CD19 as the target, and maybe both Briumvi and azer-cel can be explored in gMG. Azer-cel could actually make more sense for gMG than Briumvi. It is a considerably smaller market than multiple sclerosis, and the reason Uplizna can become a multi-billion blockbuster drug in gMG is because its price is nearly 5x the price of Briumvi. Azer-cel’s price is also likely to be multiples of Briumvi. But even at Briumvi’s net price, the U.S. gMG market alone is $4-5 billion if we take the estimated addressable market of 80,000 to 100,000 patients.

Conclusion

Briumvi slightly exceeded analyst expectations in the third quarter, and it was a softer quarter as the company said it would be. Now we wait for the important updates at the start of 2025:

- The preliminary Q4 results and the preliminary net sales guidance for Briumvi for 2025. The revenue current consensus for Q4 2024 is $98.7 million and the consensus for 2025 is $506 million, but there could be some modest royalty revenue from partner Neuraxpharm in the 2025 consensus as well. I expect Q4 net sales to be in the $100-105 million range. The start of the year is more about the management team setting expectations for 2025 so that it can beat and raise throughout the year. As such, I expect the 2025 sales guidance for Briumvi to be in line with the Street consensus or somewhat below it and that the mid-point of the 2025 net sales guidance range for Briumvi will be between $480 million and $500 million.

- The preliminary results from the phase 1 trial of subcutaneous Briumvi (although this update may not come at the J.P. Morgan Healthcare Conference in January). The important updates here are the estimated dosing frequency and safety and tolerability. On dosing frequency, the base case is every two months (set by CEO Weiss, and even monthly dosing is acceptable as far as I am concerned) and the bullish case is every three months. On safety and tolerability, we want to see low frequency (20% to 30%) of mild to moderate injection site reactions. This should be a significant de-risking event for the subcutaneous program, and I believe this update is more significant for the long-term outlook than the preliminary Q4 results or the FY 2025 net sales guidance.

- We may also see the company announce another in-licensing deal, like it did last year with azer-cel. However, I do not count this as a catalyst for the stock, but rather another possible announcement with a likely neutral effect on the stock.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TGTX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article reflects the author's opinion and should not be regarded as a buy or sell recommendation or investment advice in any way.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

I publish my best ideas and top coverage on the Growth Stock Forum. If you’re interested in finding great growth stocks, with a focus on biotech, consider signing up. We focus on attractive risk/reward situations and track each of our portfolio and watchlist stocks closely. To receive e-mail notifications for my public articles and blogs, please click the follow button. And to go deeper, sign up for a free trial to Growth Stock Forum.