Summary:

- TG Therapeutics’ Q3 earnings missed EPS expectations, primarily due to higher non-cash compensation and increased R&D investments, despite Briumvi’s revenue growth.

- Briumvi, a CD20-directed monoclonal antibody for multiple sclerosis, generated $83.3 million in Q3, showing a 15% QoQ growth but a deceleration in revenue growth.

- The Company raised its full-year revenue guidance to $300-305 million, indicating confidence in Briumvi’s market performance despite competitive pressures from Ocrevus and Kesimpta.

- Despite Q3 volatility and slowing QoQ growth, I maintain a “buy” rating on TGTX, emphasizing its potential in a diversified, barbell portfolio.

Dilok Klaisataporn

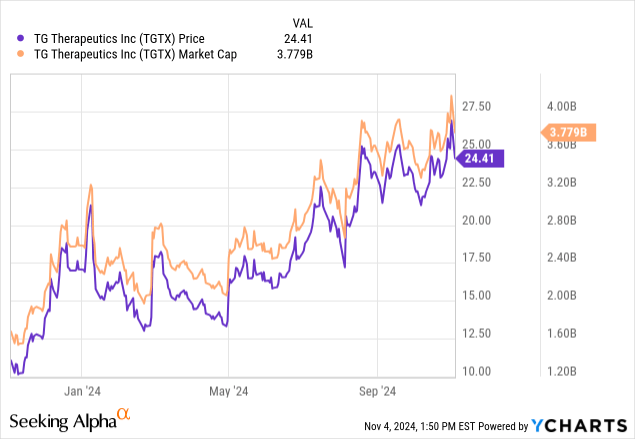

TG Therapeutics (NASDAQ:TGTX) stock has risen 5% since my rating upgrade to “buy” in August following their Q2 results, which saw its multiple sclerosis treatment, Briumvi (ublituximab), generate $72.6 million in revenue and a net income of $6.9 million. After reporting Q3 earnings today, TGTX is off nearly 10%. Let’s try to figure out why this is and if any updates merit a change in my thesis.

For some background, Briumvi is a CD20-directed monoclonal antibody for the treatment of relapsing forms of multiple sclerosis [RMS]. It received FDA approval in December 2022. Because Briumvi is a biologic, it is entitled to 12 years of market exclusivity in the US, preventing biosimilar competition until late 2034, although TG has secured a number of patents that may extend its protection through 2042. Briumvi competes against other CD20-targeting therapies, like Roche’s (OTCQX:RHHBY) Ocrevus and Novartis’ (NVS) Kesimpta. Briumvi’s competitive pricing strategy, combined with its efficacy and safety profile, aims to capture a meaningful share of the RMS market, which is projected to reach $38 billion by 2032 after growing at a CAGR of 7.9%.

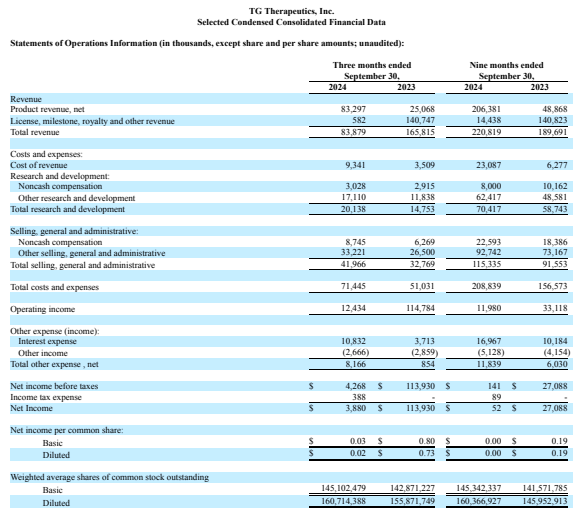

In Q3, TG reported $83.9 million ($83.3 million for Briumvi) in revenue (15% QoQ growth), which beat estimates by ~$2 million. However, Q3 EPS of $0.02 fell short of the analyst expectations of $0.03. Subsequently, net income was just $3.9 million for the quarter, a decrease from Q2. Moving forward, the company raised its full-year revenue guidance from “$290 to $300 million” to “$300 million to $305 million.”

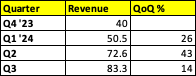

Looking back on the last four quarters, $83.9 million in Q3 revenue represents a notable deceleration in QoQ growth.

Author

Investors are free to read into this as they wish.

From looking at the income statement, the miss on EPS can be attributed to higher non-cash compensation (employee compensation that is not paid out in cash but rather in the form of stock) and R&D investments.

TG Therapeutics

As the company grows, we can expect non-cash compensation to rise, but it probably rose higher than expected relative to the QoQ growth for Briumvi. Also remember that while non-cash compensation impacts operating expenses and net income, it does not represent a direct cash outflow, making this less impactful on cash flow statements.

On the R&D front, TG is ramping efforts to trial “azer-cel, an off-the-shelf allogeneic CD19 CAR T-cell therapy for the treatment of autoimmune diseases.” The FDA has cleared its IND, and the company expects to begin a Phase 1 study in late 2024 or early 2025. Meanwhile, TG is working on developing a subcutaneous form of ublituximab for RMS, which will compete directly with Kesimpta, another subcutaneous treatment. A Phase 1 clinical trial began recently. However, unless subcutaneous ublituximab proves to be superior to Kesimpta in some way, it is difficult to see TG’s therapy having a significant impact on Kesimpta’s market share many years after Kesimpta’s approval and market entrenchment. Finally, the company highlighted their efforts to support “rapid 30-minute Briumvi infusions.” While this cuts the time for intravenous administration and is more convenient, I don’t believe this will have much impact on Briumvi’s market share.

Financial Health

At the time of writing, TG has not yet released its official 10-Q. Within their earnings press release (Form 8-K), the company indicates that they have $341.041 million in cash, cash equivalents, and investment securities. Total assets were $586.014 million. Total equity was $192.157 million.

Regarding cash runway, TG states that their cash position, alongside the expected revenues from Briumvi, “will be sufficient to fund our business based on our current operating plan.”

TGTX Stock: Faces Q3 Market Pushback as Briumvi Battles for Market Share

TG Therapeutics’ Q3 earnings have not been well received by the market.

However, this type of volatility is not atypical for TGTX, which has a beta of 1.86.

Investors want to see the company become comfortably profitable, which is not yet happening. QoQ revenue growth is decelerating, and profits owing to R&D efforts and increased non-cash compensation remain low. Importantly, Briumvi is performing well in the market, and its growth continues to outpace its SG&A costs. However, the market for RMS remains highly competitive. Novartis’ Kesimpta grew to $838 million in Q3 (28% YoY). Roche’s Ocrevus generated nearly $2 billion in Q3 (11% YoY). Keep in mind that both of these therapies have been on the market longer than Briumvi, having been approved in August 2020 and March 2017, respectively. So while Briumvi has delivered steady revenue growth for TG, it has not yet significantly disrupted the established market share of Ocrevus and Kesimpta.

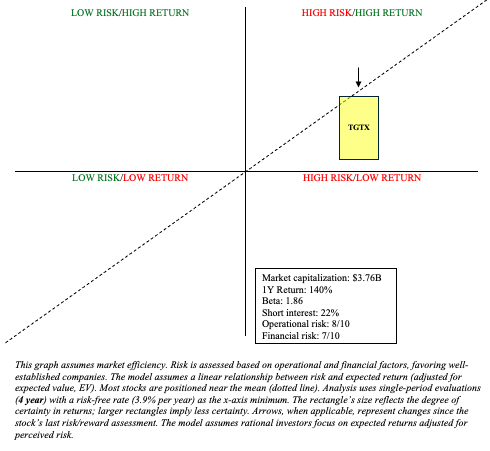

Turning to the risk/reward chart, TGTX is just as risky as it was prior to Q3 earnings. Its market capitalization is slightly higher, and Briumvi’s earnings potential hasn’t meaningfully changed. All of this taken into consideration supports a slight adjustment down on the vertical axis (representing potential returns).

Author

To conclude, I believe TGTX is appropriately valued based on its risk/reward potential, and its stock will remain volatile due to the inherent uncertainty associated with small-cap biotechnology companies. Q3 deserves some nuance, but it does not change much. So I am sticking with “buy” on TGTX stock. This is, of course, in the context of a barbell portfolio, and investors should avoid allocating too much to any single stock, such as TGTX.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article is intended to provide informational content and should not be viewed as an exhaustive analysis of the featured company. It should not be interpreted as personalized investment advice with regard to "Buy/Sell/Hold/Short/Long" recommendations. The predictions and opinions presented are based on the author's analysis and reflect a probabilistic approach, not absolute certainty. Efforts have been made to ensure the information's accuracy, but inadvertent errors may occur. Readers are advised to independently verify the information and conduct their own research. Investing in stocks involves inherent volatility, risk, and speculative elements. Before making any investment decisions, it is crucial for readers to conduct thorough research and assess their financial circumstances. The author is not liable for any financial losses incurred as a result of using or relying on the content of this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.