Summary:

- Shares of TG Therapeutics made new 52-week highs this week, helped in part by new Briumvi data presentations at ECTRIMS and despite Roche receiving FDA approval for Ocrevus Zunovo.

- Ocrevus Zunovo’s convenience profile does not look threatening and Roche believes it represents an incremental growth opportunity, primarily in treatment centers where IV infusions are not possible.

- Convenience should also be the third consideration for patients, after efficacy and safety, and Briumvi’s position on both still looks strong.

- The new Briumvi data at ECTRIMS reinforce that switching from other multiple sclerosis therapies is seamless, and that the IV infusion of Briumvi can be completed in 30 minutes.

- The focus now turns back to quarterly earnings updates from TG and its two key competitors.

mkurtbas/iStock via Getty Images

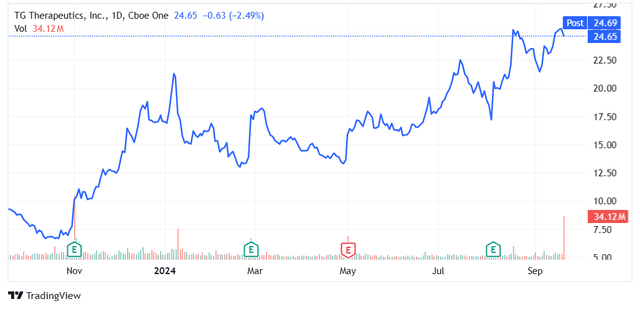

Shares of TG Therapeutics (NASDAQ:TGTX) made new 52-week highs this week, driven (at least in part) by additional data of Briumvi that I believe put the company in an even better position to take market share from competitors in the following years, and despite Roche (OTCQX:RHHBY) receiving FDA approval for Ocrevus Zunovo, the subcutaneously administered version of the drug that is considered a threat to Briumvi.

I was saying since last year that Ocrevus is not the threat that TG bears are portraying it to be, and Roche’s approval press release confirms that the convenience of Ocrevus Zunovo is not really that much better than Briumvi’s IV infusions. Roche itself does not see Ocrevus Zunovo as a game changer, and instead, they see it as an incremental opportunity to expand access to the drug to treatment centers where there is no infrastructure for intravenous administration of the drug.

I continue to see TG as very well positioned for continued shareholder value creation based on Briumvi, and see additional long-term upside based on the company being able to successfully develop a subcutaneous version of Briumvi, the expansion of Briumvi into other indications, and pipeline expansion through business development.

Ocrevus Zunovo is not a major threat to Briumvi

I have been saying this since my re-initiation article from last year, but need to reiterate it after the recent developments – Ocrevus Zunovo is not a major threat to Briumvi.

The approval press release from Roche says the following:

After the first dose, the time for treatment with Ocrevus Zunovo could be as little as 55 minutes. Patients will be required to take premedications at least 30 minutes prior to each dose. Following the first dose, patients will be monitored by their HCP for at least 60 minutes. Patients will be monitored for at least 15 minutes post-injection for subsequent doses.

Ocrevus Zunovo is administered by a healthcare provider and it takes approximately 10 minutes. And the volume of the drug is considerable at 23ml, and it is more of a subcutaneous infusion than a simple injection under the skin.

The fact is that Ocrevus Zunovo is more convenient than the IV-administered Ocrevus. The IV version also needs premedications at least 30 minutes prior to each dose, and then, the administration is either 2 hours if patients can tolerate it and if they did not have serious infusion reactions before, and the regular IV infusion time is 3.5 hours, followed by one hour of patient monitoring. This is for maintenance dosing every six months and Ocrevus otherwise has two loading doses two weeks apart with half the (maintenance dose) administered.

And then, there are the injection site reactions to Ocrevus Zunovo – 49% of patients had injection reactions after the first injection, and “47% and 11% experienced at least one local injection reaction and one systemic injection reaction, respectively.” 73% of injection reactions were mild and 27% were moderate in severity.

And how does IV-administered Briumvi compare to Ocrevus Zunovo?

Premedications are also required 30 minutes before the administration of Briumvi and it also has the loading doses two weeks apart like IV Ocrevus (the first is 150mg and the second is the maintenance dose of 450mg), and then, each subsequent infusion lasts one hour. Patient monitoring is required for the first two doses and only at the physician’s discretion thereafter.

Infusion reactions occurred at a similar rate to Ocrevus Zunovo – 48% overall, with 43% after the first infusion, 10% after the second and 8% after the third.

So, in terms of time it takes to complete maintenance dosing, Ocrevus Zunovo is at approximately 55 minutes, Briumvi at approximately 1.5 hours, IV Ocrevus between 3.5 hours and 5 hours.

I believe that Novartis’ (NVS) Kesimpta remains the most convenient subcutaneously administered solution for multiple sclerosis patients. Yes, it is given every month instead of every six months, but the volume is only 0.4ml and it takes about 15 seconds to administer the drug at home with a simple autoinjector. I believe Kesimpta will remain the subcutaneous CD20 drug of choice for the foreseeable future, unless TG manages to develop a similar subcutaneous product presentation that is administered as frequently or less frequently than Kesimpta.

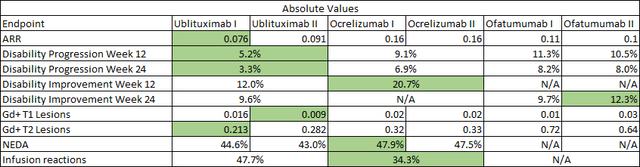

I should emphasize that these are just convenience comparisons that should only be considered after efficacy and safety. Briumvi still carries the lowest absolute annualized relapse rate (‘ARR’) in its label, and Kesimpta and Briumvi have a safety advantage in terms of no labeled risk of higher incidence of breast cancer that Ocrevus’ label carries. I believe this should be a significant consideration for the female multiple sclerosis population and this is a population where women outnumber men by 4 to 1.

Briumvi (ublituximab) label, TG Therapeutics press releases, Ocrevus (ocrelizumab) phase 3 trial publication in NEJM, Kesimpta (ofatumumab) phase 3 trial data publication in NEJM Briumvi (ublituximab) label, TG Therapeutics press releases, Ocrevus (ocrelizumab) phase 3 trial publication in NEJM, Kesimpta (ofatumumab) phase 3 trial data publication in NEJM

Overall, I do not see the approval and launch of Ocrevus Zunovo as a significant change to the multiple sclerosis treatment landscape. Roche itself considers Zunovo as an incremental opportunity of approximately $2 billion a year and primarily in the setting where the IV infusion infrastructure does not exist. From Roche’s second quarter earnings call:

We expect that Ocrevus subcut represents an incremental CHF2 billion in sales opportunity and we expect this to be increasingly visible in the coming quarters as we are already starting to see some strong pickup in our very early launch countries in the EU.

Briumvi will not be available in such treatment centers anyway, or until it successfully develops a subcutaneous version of Briumvi.

New Briumvi data strengthen its value proposition

TG presented additional data of Briumvi this week at the ECTRIMS conference that strengthen its long-term prospects and that could further boost its convenience compared to both IV Ocrevus and Zunovo.

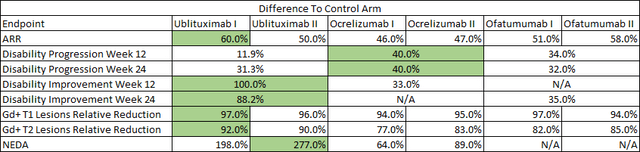

The ENHANCE study is evaluating the efficacy, safety, and tolerability of switching from a previous disease-modifying therapy to Briumvi, and it is also exploring the elimination of the initial 150mg dose in B-cell depleted participants and shorter infusion durations for the full 450mg maintenance dose at week 24.

The updated data reinforce the initial findings that patients can safely switch from another CD20 (Ocrevus in this case), that they can skip the 150mg loading dose and go straight to the 6-month maintenance dosing regimen.

The data also showed that the majority of patients were able to receive Briumvi in 60 minutes, and that even a 45-minute and a 30-minute infusion time is possible, albeit with a slight increase in incidence of grade 1 infusion reactions (itching, throat irritation, and headache). However, this is a small sample of 12-13 patients and 10% infusion reaction rate would be roughly in line with Briumvi’s label (infusion reactions occurred in 8% of patients at week 24, or the third infusion).

TG Therapeutics ECTRIMS poster presentation

The ENHANCE trial data point to a seamless transition from other MS therapies, including Ocrevus. The 30-minute infusion also seems feasible and could further improve the convenience of IV-infused Briumvi while we wait for TG to develop the subcutaneous version.

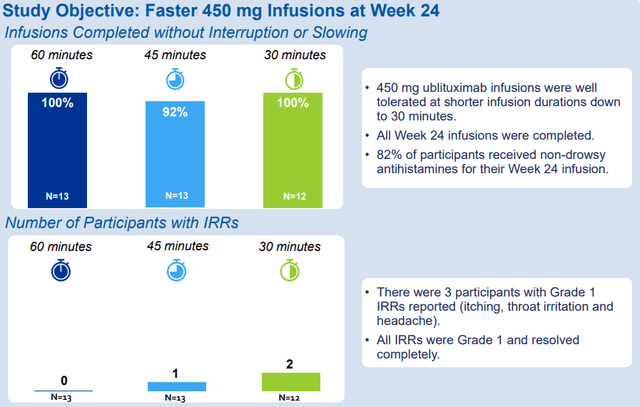

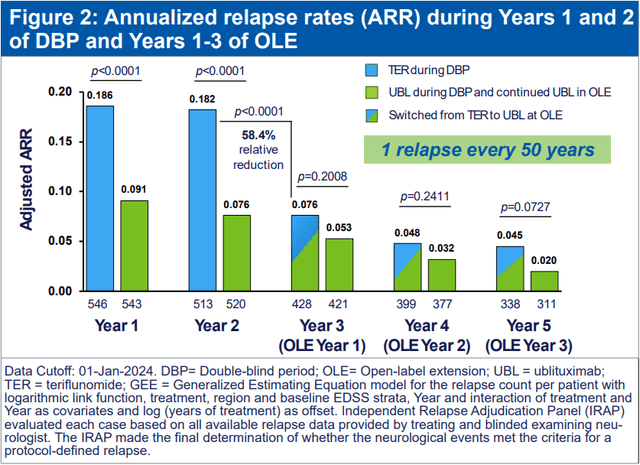

TG also presented the 5-year follow-up data from Briumvi’s phase 3 trials that show excellent annualized relapse rates that are as low as 0.02 in the fifth year on the drug (in other words, a relapse would occur every 50 years). Patients switching from teriflunomide, which served as the control arm in the phase 3 trial, also experienced significant reductions in relapse rates and experienced an improved ARR trajectory that started to catch up to patients who were on Briumvi from the start of the trial. Briumvi was also safe and well tolerated in extended follow-up with no new safety signals.

TG Therapeutics ECTRIMS poster presentation

None of these are groundbreaking or investment thesis-altering updates, but they should serve the sales team well going forward and help physicians and patients make better informed decisions.

Conclusion

The approval of Ocrevus Zunovo was widely expected and does not change Briumvi’s long-term outlook, and this week’s data presentations at ECTRIMS by TG Therapeutics further reinforce Briumvi’s long-term efficacy and safety profile and show that patients can safely switch from Ocrevus and other disease-modifying therapies for relapsing forms of multiple sclerosis, and that even a 30-minute infusion is possible. A 30-minute infusion would bring the time it takes to complete the maintenance dosing process to approximately one hour, right next to the time it takes to complete the maintenance dosing process for Ocrevus Zunovo (55 minutes).

The focus now turns back to the earnings reports of TG and its key competitors, Roche and Novartis. I will be looking for updates from Roche on how the launch of Ocrevus Zunovo is going so far in Europe, where it was approved in June, and qualitative comments on how the first few weeks on the U.S. market look like. I expect Novartis to report strong Y/Y growth of Kesimpta.

TG expects a lighter third quarter due to seasonality (primarily summer vacations), followed by a stronger fourth quarter, and while I do not expect to see the magnitude of the beat-and-raise that we saw after the first quarter report, I believe a similar outcome to the August update is possible – a decent revenue beat of $2-5 million ($83-86 million) and an increase in the full-year net sales guidance range for Briumvi of approximately $10 million, and $15-20 million if the Q3 beat is above my estimate range.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TGTX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article reflects the author's opinion and should not be regarded as a buy or sell recommendation or investment advice in any way.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

I publish my best ideas and top coverage on the Growth Stock Forum. If you’re interested in finding great growth stocks, with a focus on biotech, consider signing up. We focus on attractive risk/reward situations and track each of our portfolio and watchlist stocks closely. To receive e-mail notifications for my public articles and blogs, please click the follow button. And to go deeper, sign up for a free trial to Growth Stock Forum.