Summary:

- TG Therapeutics exceeded Q2 Street consensus estimates, with Briumvi net sales of $72.6 million and total revenues of $73.5 million.

- Positive cash flow achieved one quarter ahead of my expectations, and full-year guidance range raised by $15 million at the mid-point of the range.

- TG secured a new $250 million credit facility to retire the old one, and it will use $100 million to buy back shares.

- The phase 1 trial of subcutaneous Briumvi is now enrolling multiple sclerosis patients, with topline data expected in early 2025 and followed by a phase 3 trial starting in mid-2025.

- Continued positive growth trends of Briumvi and an improving financial position strengthen the long-term outlook for TG Therapeutics.

iQoncept

TG Therapeutics (NASDAQ:TGTX) beat Q2 Street consensus estimates and my $67-69 million estimate range by reporting Briumvi net sales of $72.6 million and total revenues of $73.5 million. The company also achieved positive cash flow one quarter ahead of my expectations, the full-year guidance range was raised by $15 million at the mid-point, and the company secured a new $250 million credit facility to retire the existing facility with Hercules Capital (HTGC) and to initiate a $100 million buyback program.

Every update was either within my estimate range, or better, and positions TG well for the second half of the year. On the pipeline side, the phase 1 trial of subcutaneous Briumvi is enrolling multiple sclerosis patients with topline results expected in early 2025, adding a clinical catalyst to what was predominantly a commercial story in the last two years.

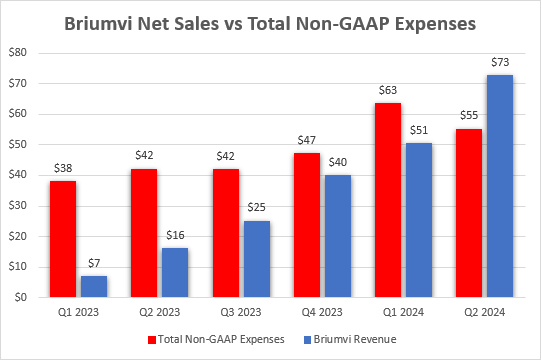

Strong sequential growth of Briumvi in Q2 and an increased full-year net sales guidance range

Let’s go over the numbers:

- Briumvi net sales grew 44% sequentially to $72.6 million and total revenues were $73.5 million. This was better than my $67-69 million estimate range, the Street consensus of $65.9 million and the company’s guidance of $65 million. There were no unusual items in the report to boost or reduce net sales.

- The full-year net sales guidance range was increased from $270-290 million to $290-300 million, or $15 million at the mid-point of the range. This was at the high end of my expectations for a $10-15 million increase at the mid-point.

- Total number of new patient starts going through the TG hub was more than 1,400. This number was at the low end of my 1,400-1,500-estimate range. Management explained on the earnings call that there is an increasing number of new patient starts outside the hub now that there are more prescriptions coming from academic centers, which are less likely to use the hub.

- Management noted the negative seasonal impact on Q3 net sales because of summer vacations, but also because the ECTRIMS conference is in Q3 this year instead of Q4, and prescriptions tend to be lower during the conference. As such, TG expects lower sequential net sales growth in Q3, followed by a greater increase in Q4.

Overall, it was a positive update with the numbers either coming within my estimate ranges, or above them and I expect a strong second half of the year that will build a foundation for strong growth in 2025 and beyond.

Financial overview – positive cash flow in Q2, new credit facility and a $100 million buyback program

TG generated positive cash flow in Q2, a quarter ahead of my expectations. This was achieved through a combination of higher Briumvi net sales and lower-than-expected spending, which is trending below the company’s $250 million expense guidance for the year.

TG Therapeutics earnings reports

Management expects some fluctuations on a quarterly basis, but we should see steady increases in quarterly cash flow going forward.

The improving financial position and outlook have motivated the company to initiate a $100 million buyback program. The cash position at the end of Q2 was $217 million, and TG secured a $250 million credit facility from HealthCare Royalty and Blue Owl Capital. $107 million will be used to retire the existing credit facility with Hercules Capital, and this means the pro forma cash position is $360 million with a $110 million net cash position.

I am usually not a fan of buybacks, but believe it is the right call because of the high short interest and as it provides an opportunity for the company to buy back shares if and when the shares are at attractive levels – and I believe they are very attractive at current levels, and to potentially reduce volatility and downside moves going forward.

TG should also have plenty of capital left to increase spending to support Briumvi’s sales growth, and to build the pipeline with it and around it.

Pipeline updates – phase 1 trial of subcutaneous Briumvi enrolling patients with topline data in early 2025 and phase 3 trial start in mid-2025

The phase 1 trial of subcutaneous Briumvi (SC Briumvi for convenience) is now enrolling patients and the topline results are expected in early 2025. This is a bioequivalence trial that will compare SC Briumvi to the IV administered version, and TG expects to initiate a phase 3 trial in mid-2025.

This is a good timeline and the phase 3 trial should be a straightforward one mirroring the phase 3 trial of subcutaneous Ocrevus – I expect enrollment of 200 to 250 patients, a 12-week non-inferiority primary endpoint and believe SC Briumvi could hit the market between mid-2027 and early 2028. It took Roche (OTCQX:RHHBY) approximately two years from the start of the non-inferiority phase 3 trial of SC Ocrevus (May 2022) to EMA approval in late June, and the PDUFA date in the United States is in mid-September. Briumvi’s previous trials enrolled patients rapidly, and I do not expect TG to be any worse on enrollment than Roche.

The other two pipeline projects are on track – the expected start of a trial of Briumvi in a second undisclosed autoimmune indication, and the start of a clinical trial of azer-cel in progressive multiple sclerosis.

TG’s pipeline has evolved from essentially nothing last year to three programs, one of which (SC Briumvi) having the potential to significantly increase the long-term peak sales potential through improved convenience.

I expect the pipeline to further expand in 2025 with one or two additional in-licensing deals and I believe TG will not deviate too much from autoimmune diseases, and I expect the company will make additional steps to strengthen its long-term positioning in multiple sclerosis. The azer-cel deal shows TG is actively doing that, and If I were them, I would start looking to in-license a preclinical or early-stage anti-CD40 ligand antibody.

I noted the promising data Sanofi’s (SNY) frexalimab generated in the phase 2 trial earlier this year in my article on Sanofi in June. Yes, the annualized relapse rate (‘ARR’) is a bit all over the place, but the high dose data look strong. And an anti-CD40 ligand antibody could be a pipeline in a drug type of product, as Sanofi is testing frexalimab in type 1 diabetes, Sjogren’s syndrome, and systemic lupus erythematosus.

Conclusion

The second quarter results showed continued positive growth trends of Briumvi, an improving financial outlook, and the company secured a new $250 million credit facility to retire the old one and to initiate a $100 million buyback program.

This type of execution would otherwise prompt an upgrade in future expectations, but Briumvi is now catching up to my long-term expectations after last year’s slip-up that prompted a big correction. I believe the growth trend is not too far from my estimate of Briumvi hitting 15% global revenue share of the anti-CD20 class by the end of 2027. I expect the class to grow from $9.4 billion in 2023 to $14-15 billion in 2027 and if Briumvi captures 15% of the global market, its global sales would be in the $2.1-2.3 billion range with at least 75% and likely more than 80% being generated by TG in the United States and the other 20-25% outside the U.S. by partner Neuraxpharm.

I remain bullish on TG’s medium- and long-term growth prospects, and I am looking forward to seeing the quarterly sales updates and the SC Briumvi data in early 2025.

The main near- and medium-term risks are commercial execution, and longer-term, pipeline and business development risks in the form of clinical trial failures and/or TG overpaying for underperforming clinical or commercial assets.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TGTX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article reflects the author's opinion and should not be regarded as a buy or sell recommendation or investment advice in any way.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

I publish my best ideas and top coverage on the Growth Stock Forum. If you’re interested in finding great growth stocks, with a focus on biotech, consider signing up. We focus on attractive risk/reward situations and track each of our portfolio and watchlist stocks closely. To receive e-mail notifications for my public articles and blogs, please click the follow button. And to go deeper, sign up for a free trial to Growth Stock Forum.