Summary:

- Shares of TG Therapeutics had a volatile journey in the last 12 months and have hit resistance levels in the low 20s again.

- I expect the company to report strong sequential growth of Briumvi, but with less room for significant increases in the full-year guidance after a large increase in May.

- New patient starts should exceed 1,400 in the second quarter, and we should hear management comments on how they are preparing for the launch of subcutaneous Ocrevus in Q4.

- With cash flow breakeven and profitability approaching in the next 2-3 quarters, the company should have more cash and could initiate a buyback program or continue to expand the pipeline through business development.

Apiruk

After a volatile journey in the last 12 months, shares of TG Therapeutics (NASDAQ:TGTX) have recovered and hit resistance levels in the low 20s again. The company will report second quarter results within the next 10 days (the earnings report is not scheduled yet as TG gives very short notice about the timing lately) and while I wrote that there is now less room for doubt about Briumvi after the first quarter earnings report, it needs to continue to outperform Street expectations if the stock is to reach new 52-week highs.

I expect TG to report strong second quarter results, based on the strong momentum in the first few months of 2024, the company’s brief but conservative guidance history, and also based on the continued expansion of the anti-CD20 class, led by Ocrevus and Kesimpta, both of which performed well in the second quarter.

TG’s brief guidance history and lessons learned by the management team

The share price of TG was riding high last year following Briumvi’s launch and while the management team did not provide revenue guidance during the initial launch period, their comments were (with benefit of hindsight) interpreted as Briumvi performing much better than it, in reality, was.

The hard landing happened when the company announced second quarter results in early August 2023, slightly missing the revenue consensus and announcing an ex-U.S. partnership with Neuraxpharm. The updates were seen as a disaster as the underlying sales expectations were much higher and as the ex-U.S. partnership killed near-term buyout hopes.

A period of consolidation followed, for the share price and for the management team led by CEO Michael Weiss, and a far more measured tone about Briumvi’s trajectory ensued (this is, of course, my subjective assessment). When that did not appear to work, the company finally decided to provide Briumvi net sales guidance for Q4 2023 when it reported Q3 2023 results, and then the full-year net sales guidance for 2024 along with the net sales guidance for the first quarter of 2024 at the start of the year.

This meant that the company was finally taking control of Briumvi’s growth narrative, and while that does not guarantee the stock will go up, evidenced by the negative reaction to the full-year guidance and the azer-cel in-licensing deal at the start of 2024, it certainly helps keep market expectations between the conservative and the realistic side.

Below is the company’s brief guidance history and how Briumvi performed during that period:

- In early November 2023, the company provided net sales guidance of $33-37 million for Q4 2023, and it delivered $39.9 million.

- In January 2024, the company guided for Q1 net sales in the $41-46 million range and full-year net sales in the $220-260 million range. On the Q4 2023 earnings call in March, management noted Q1 sales are trending at the high end of the guidance range and that if these trends persist in March, Briumvi net sales would exceed the high end of the range. And that happened as Q1 net sales were $50.5 million.

- In early May, the company guided for Q2 net sales of $65 million and increased the full-year net sales guidance range to $270-290 million.

So far, so good, and there are no indications the second quarter would be any different.

Q2 2024 preview – expecting a good quarter for Briumvi, but with less room for upside revisions for the full-year net sales guidance range

The second quarter of 2024 is so far looking like a very strong one for the anti-CD20 drug class.

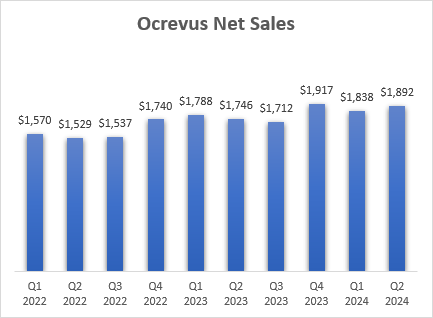

Roche’s (OTCQX:RHHBY) Ocrevus grew 9% Y/Y to CHF1.7 billion, or 8% in U.S. dollars to $1.89 billion. This was Ocrevus’ best quarter in reported currency since Q1 2023 and shows the resilience of an IV-administered product in the face of increased competition from a more convenient subcutaneously administered Kesimpta.

Roche earnings reports, author’s calculations based on CHFUSD exchange rates each quarter

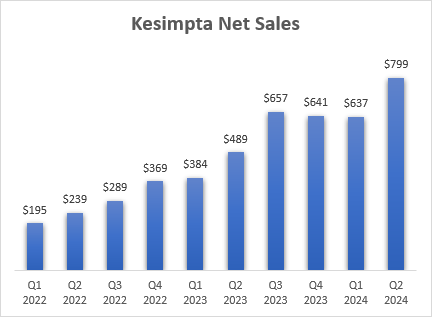

Kesimpta itself had an excellent quarter as Novartis (NVS) reported 63% Y/Y growth with net sales reaching $799 million.

Novartis earnings reports

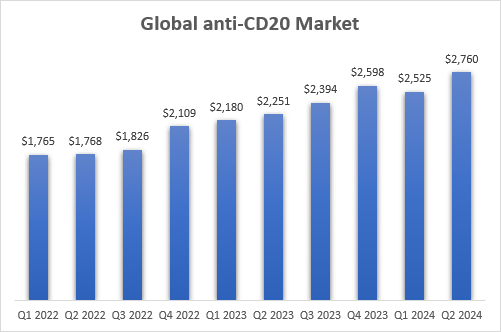

As you can see from the quarterly sales numbers shown above, there is some lumpiness in the numbers, but overall, the anti-CD20 class continues to grow rapidly and take share from other classes of drugs for the treatment of multiple sclerosis. If I include Briumvi’s estimate for Q2, the annualized net sales run rate of the anti-CD20 class has reached $11 billion in the second quarter, and it grew 23% Y/Y, up from 16% Y/Y in the first quarter.

Roche, Novartis, TG Therapeutics earnings reports

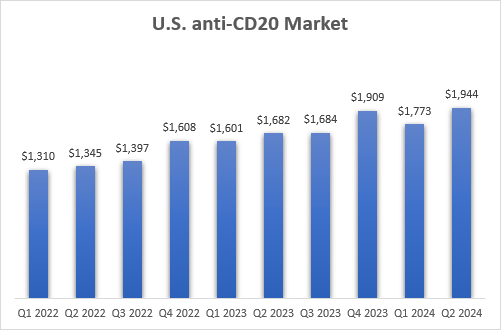

The U.S. market is also growing and remains, by far, the largest one in the world. If Briumvi’s estimate is included, the Y/Y growth in Q2 is 19%, up from 11% in Q1, with an annualized net sales run rate approaching $8 billion.

Roche, Novartis, and TG Therapeutics earnings reports

The U.S. market remains the one where substantially all of Briumvi sales will come from in 2024, as it will take time for partner Neuraxpharm to secure proper pricing and reimbursement across Europe.

From the company’s brief guidance history, we can see that blowout quarterly numbers are unlikely, and that is why my estimate range for Q2 is $67-69 million, or $68 million at the mid-point, and it compares favorably to the company’s guidance of $65 million. The Street consensus is just above TG’s net sales guidance at $65.9 million.

Regarding the full-year guidance, I see less room for a big surprise after the large increase in May, when the full-year net sales guidance range went from $220-260 million to $270-290 million. If Q2 net sales are in the high 60s (in line with my estimate range) or low 70s, I would expect a $10-15 million increase in the full-year guidance range at the mid-point.

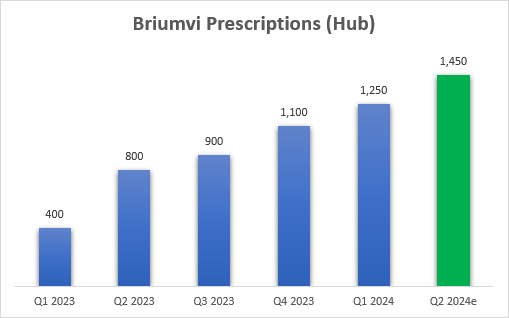

The other important metric is the new patient starts. As a reminder, TG provides a number that is only based on patients enrolled in its patient hub and approximately 10% to 20% of patients are being prescribed Briumvi outside the hub.

I expect new patient starts in Q2 to be in the 1,400 to 1,500 range, or 1,450 at the mid-point, and believe this would represent a strong foundation for the second half of the year and 2025, as it would indicate Briumvi’s new patient market share in the anti-CD20 class would approach 15% (based on the estimate of 40,000 multiple sclerosis patients starting a CD20 antibody product a year in the United States) based on the TG hub numbers, and it would approach/exceed 16% if we add the 10-20% patients starting therapy outside of the hub.

TG Therapeutics earnings reports, author’s estimates

The downside risk in the second quarter earnings report is that the strength of Ocrevus and Kesimpta put more pressure on Briumvi than management anticipated when it provided the $65 million net sales guidance for Q2 and when it increased the full-year net sales guidance range, with potential negative read-through for the second half of the year. However, I see no indication that this is happening and believe the strength of the anti-CD20 class will carry through to Briumvi.

And the downside risk in the medium-term is the greater-than-anticipated impact of the launch of subcutaneous Ocrevus on Briumvi’s growth trajectory.

Other potential updates

Beyond the quarterly results and the potential changes in the full-year guidance range, qualitative comments by the management team will also be important, as well as the sales guidance for Q3, if one is provided.

If Briumvi net sales meet or exceed my $67-69 million estimate range, I would expect the Q3 guidance to be in the low- to mid-80s.

Other comments of interest would be:

- How the uptake in academic centers looks like after a slow start versus the strong uptake in community centers.

- What the promotional evolution looks like – I believe we should see a steady sequential increase in sales and marketing spending along with the increases in Briumvi net sales and the accompanying positive effects on the growth trajectory in the following quarters.

- What to expect if/when subcutaneous Ocrevus is launched in the fourth quarter (the PDUFA date is September 13), how the company is preparing to address it in the field, and any comments on what partner Neuraxpharm might be seeing in Europe where SC Ocrevus is already available. Roche itself sees SC Ocrevus as an incremental $2 billion peak sales opportunity, and I have been saying repeatedly in my previous articles that the fears of SC Ocrevus are overblown. We should finally see that in the following quarters, as I do not expect a meaningful impact of SC Ocrevus on Briumvi’s growth trajectory.

- Pipeline updates – on subcutaneous Briumvi, the new indication for Briumvi outside of multiple sclerosis, and potential updates on azer-cel. However, other than study start or data timing updates, I do not expect to hear anything else in the Q2 report or on the earnings call.

- On the financial side, we might hear some comments on when the company expects to achieve cash flow breakeven and non-GAAP and/or GAAP profitability. Based on the current growth trajectory of Briumvi and the expected increases in spending, I believe this could happen as soon as Q3 for cash flow breakeven, as soon as Q4 for non-GAAP profitability, and Q1 2025 for GAAP profitability.

- With an improving financial outlook, we may also hear CEO Weiss talk more about capital allocation. Should the share price go back to the mid-teens, low double-digits, or stay in the 20s in the following quarters, I think a share buyback would be the next step for the company to take as I believe the stock is still undervalued at current levels. I would also expect the pipeline to continue to expand with opportunistic in-licensing deals such as the one we saw with azer-cel at the start of the year.

Conclusion

With TG’s share price near 52-week highs, the pressure on Briumvi to perform is increasing, and I believe we will see the company beat Q2 estimates with at least 1,400 new patient starts (through the hub) and potentially increase the full-year net sales guidance range.

Based on this growth trajectory, we may see the company reach cash flow breakeven and non-GAAP profitability before the end of the year and this would provide another tool for the management team to increase shareholder value, by buying back shares and/or further expanding the pipeline through in-licensing of preclinical, early or mid-stage clinical candidates.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TGTX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article reflects the author's opinion and should not be regarded as a buy or sell recommendation or investment advice in any way.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

I publish my best ideas and top coverage on the Growth Stock Forum. If you’re interested in finding great growth stocks, with a focus on biotech, consider signing up. We focus on attractive risk/reward situations and track each of our portfolio and watchlist stocks closely. To receive e-mail notifications for my public articles and blogs, please click the follow button. And to go deeper, sign up for a free trial to Growth Stock Forum.