Summary:

- Shares of zinc-based energy storage solutions provider Eos Energy Enterprises, Inc. rallied upon news of an up to $315.5 million strategic investment by an affiliate of Cerberus Capital Management LP.

- However, a closer look at the transaction terms reveals a highly dilutive transaction, with Cerberus grabbing up to 49% of the company’s equity in return for providing an expensive loan.

- Even worse, the loan is governed by harsh covenants and funding of additional tranches will be dependent upon the company achieving a number of complex milestone requirements.

- With the loan secured by substantially all the company’s assets, Cerberus might end up owning the business at some point going forward.

- Given the massive dilution associated with the Cerberus loan agreement and considering the very real risk of the company failing to achieve complex milestone requirements or comply with harsh covenants, I am downgrading Eos Energy Enterprises common shares from “Hold” to “Sell.”

PhonlamaiPhoto

Note:

I have covered Eos Energy Enterprises, Inc. (NASDAQ:EOSE, NASDAQ:EOSEW) previously, so investors should view this as an update to my earlier articles on the company.

On Monday, shares of controversial zinc-based energy storage solutions provider Eos Energy Enterprises, Inc., or “Eos Energy,” rallied more than 20% upon news of a major “strategic investment” by an affiliate of Cerberus Capital Management LP (“Cerberus”):

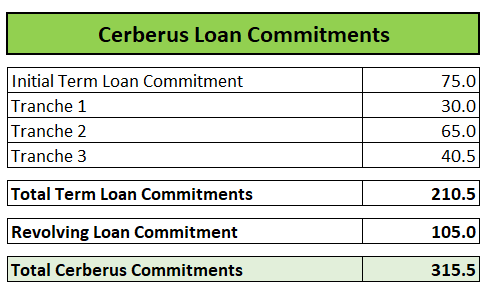

The investment by Cerberus is structured as a $210.5 million delayed draw term loan that is partially based upon achieving operational milestones, and a $105 million revolver that the Company may draw upon, if required, at Cerberus’ discretion. In addition, Eos will utilize a portion of the proceeds to retire its existing $100 million senior secured term loan on favorable terms, strengthening the Company’s balance sheet. The Company reached an agreement to extinguish this debt for $27 million, of which $20 million has been paid and the remaining $7 million will be payable over the next twelve months.

However, a deep dive into the details of the “strategic investment” reveals a highly conditional and substantially dilutive transaction:

Following the Initial Draw, on three separate predetermined draw dates, upon the achievement of the corresponding performance milestone for each such draw date, the Company will receive additional funds under the Credit Agreement and will issue securities under the Securities Purchase Agreement in an amount equal to the Applicable Percentage, up to an aggregate of 33.0% ownership limitation on a fully-diluted basis at such time the Delayed Draw Term Loan is fully drawn.

Upon subsequent draws under the Delayed Draw Term Loan and the achievement of the applicable milestones, the Company will issue Warrants and/or Preferred Stock in accordance with the SPA Issuance Structure.

The performance milestones include measures related to the Company’s automated line, materials cost, Z3 technology and backlog/cash conversion. Performance milestones related to the Company’s automated line, materials cost and Z3 technology have not yet been achieved but are in line with the Company’s internal business goals through April 30, 2025. The milestones related to backlog and cash conversion approximate the cash that would be expected to be received related to certain customer milestone payments at the lower end of the Company’s previously released revenue guidance for 2024 and potential 2025 revenue scenarios in its December 2023 strategic outlook as adjusted through April 30, 2025.

In the event the Company fails to achieve any milestones on any predetermined draw date or the one additional milestone measurement date, the Company will not receive the specific draw unless waived by the Lenders and will be subject to a penalty represented by an up to 4.0% increase in the Applicable Percentage at each missed milestone measurement date, which could result in the issuance of additional shares of Preferred Stock or Warrants up to an Applicable Percentage increase of up to 16.00% for all missed milestones, or up to a 49.0% overall Applicable Percentage taking into account the 33.0% Applicable Percentage described above.

In layman’s terms:

Funding the initial $75 million tranche provided Cerberus with a 33% equity stake in Eos Energy (on an as-converted basis). Remember that Cerberus does not purchase the equity – the penny warrants and preferred stock are issued solely in return for Cerberus’ commitment to loan money to the company at an annual interest rate of 15%.

Credit Agreement

Please note that all tranches will be issued at an undisclosed discount to face value (“original issue discount”) which increases the effective interest rate even further.

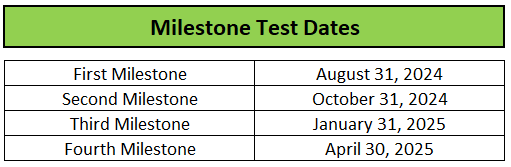

Even worse, the funding of additional tranches will be dependent on the achievement of certain operational milestones as outlined in the credit agreement.

Credit Agreement

To avoid penalties or even defaults and get access to additional tranches, the company will also have to fully achieve certain sub-milestones:

- Automation Milestones (cycle time and yields)

- Cost Milestones

- Sales Milestones

- Technology Milestones (product performance).

Should the company fail the first milestone test on August 31, all remaining loan commitments will be automatically terminated.

In addition, the loan will be subject to harsh minimum consolidated EBITDA and revenue covenants as well as a cash sweep mechanism.

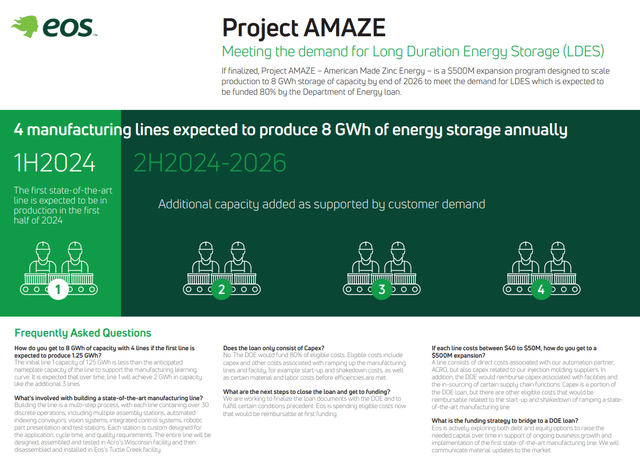

Please note that the funds provided by Cerberus are earmarked for production line one of the company’s Turtle Creek facility.

Funding of additional production lines will be dependent upon the company’s ability to close on the U.S. Department of Energy’s (“DOE”) up to $398.6 million conditional loan guarantee announced last year.

According to the press release, the company is still working with the DOE “with respect to closing on the previously announced conditional commitment for a loan guarantee.“

Quite frankly, considering Eos Energy’s execution history, I am struggling with the company’s ability to deliver upon required milestone combinations and comply with harsh loan covenants.

In addition, with the loan being secured by substantial all the company’s assets, the agreement could easily turn into a loan-to-own transaction.

On a more positive note, the company is likely to record a massive accounting gain from the extinguishment of the legacy Atlas Credit Partners term loan at a fraction of face value.

Bottom Line

While Eos Energy Enterprises appears to have figured out a way to satisfy its short-term capital needs, the terms of the agreement with Cerberus are just plain ugly.

In return for providing a highly conditional and very expensive loan, Cerberus will grab up to 49% of the company’s equity.

Even worse, with the loan being governed by a number of harsh covenants, secured by substantially all the company’s assets, and funding of additional tranches being subject to the achievement of complex milestones, Cerberus might very well end up owning the business while current shareholders face the risk of holding the bag.

Given the massive dilution associated with the Cerberus loan agreement and considering the very real risk of the company failing to achieve complex milestone requirements or comply with harsh covenants, I am downgrading Eos Energy Enterprises common shares from “Hold” to “Sell.“

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Massively Outperform in Any Market

Value Investor’s Edge provides the world’s best energy, shipping, and offshore market research. Even during turbulent market conditions, our long-only models have outperformed the S&P 500 by more than 30% YTD.

We also offer income-focused coverage geared towards investors who prefer lower-risk firms with steady dividend payouts. Our 8-year track record proves the ability of our analyst team to outperform across all market conditions. Join VIE now to access our latest top picks and model portfolios.