Summary:

- Hudson Technologies fell short of consensus estimates in Q3 FY2023 due to lower selling prices for refrigerants. It reports again on March 6 – what to expect? Read on.

- Now that Hudson is close to being debt-free, the company can continue to grow and develop while maintaining its relatively high level of profitability.

- Today’s regulatory environment in the US and around the world provides more and more opportunities for business expansion in a market where Hudson remains the undisputed leader.

- I expect the company to reach $400 million in revenue in FY2025 – the low end of the management’s target. If I’m right, the stock is 18% undervalued at least.

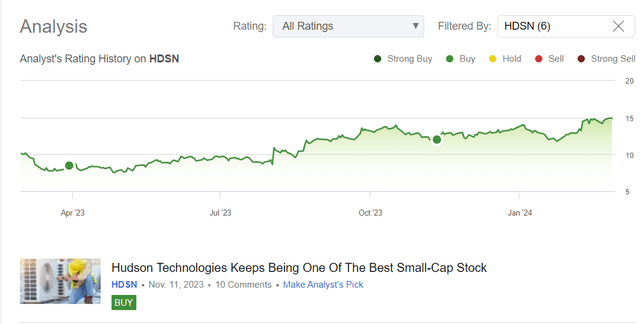

- I therefore reiterate my previous ‘Buy’ rating and look forward to Hudson’s seasonally weak fourth quarter results.

JulPo

Introduction

You’re reading my 7th article on Hudson Technologies, Inc. (NASDAQ:HDSN) here on Seeking Alpha. The company, with a current market capitalization of ~$681 million, is up 270% since I started covering it (compared to the S&P 500 Index, which is up 7.81% over the same period), making it one of my most successful stock picks on the platform.

Seeking Alpha, the author’s coverage of HDSN

It’s been more than a quarter since I last looked at the company, and in that time Hudson Technologies has managed to do a lot. At the time, I argued that Hudson was well-positioned for the industry shift and had a strong long-term gross margin target, while its peers were trading at a larger valuation premium, having higher leverage.

According to Seeking Alpha, the company is set to report Q4 FY2023 on March 6, 2024. So let’s preview HDSN’s earnings and try to figure out how has my thesis changed.

Quick Q3 Report Review

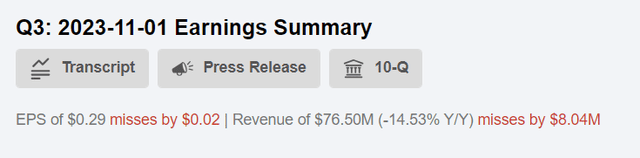

Unfortunately for Hudson Technologies’ shareholders, the company fell slightly short of consensus estimates in terms of both EPS and sales in the third quarter.

Hudson’s revenue decreased 15% YoY to $76.5 million in Q3 FY2023 because of lower selling prices for certain refrigerants. But that was partially offset by increased refrigerant sales volume and revenues from the HDSN’s Defense Logistics Agency (DLA) program during the period, according to the press release. This program is a secured 5-year fixed-price contract (with an additional five-year renewal option) which makes Hudson serve as the prime contractor responsible for the management and supply of refrigerants, compressed gasses, cylinders, and related items to the US Military commands. The contract is set to expire in July 2026, but given Hudson’s dominant position in its niche market (~35%, based on the recent IR materials), it will most likely be renewed, but at higher prices. The fact is that a lot of time has passed since 2016 – when this contract was first signed – and the refrigerant market has changed significantly, which favors HDSN as a niche leader. I’ll get into that a bit later, but for now, I suggest keeping in mind that the positive revenue offset from the DLA program was not a one-time tailwind of just 2-3%.

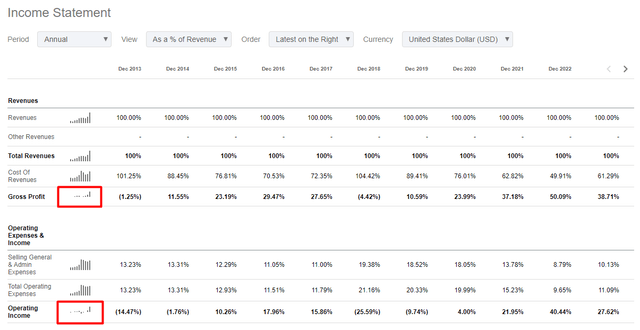

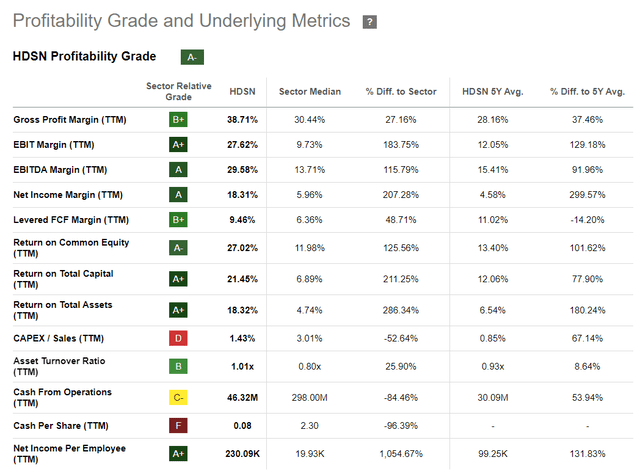

Coming back to the quarter’s basics: Hudson’s gross margins in Q3 FY2023 fell to just 40% from 49% last year. Q3 FY2023 EBIT margin amounted to 30.23% vs. 40.58% in Q3 FY2022. This was primarily due to pricing, which was impacted by the high base effect of 2022 as well as the late arrival of warmer weather in many parts of the US. Taking these circumstances into account, Hudson’s gross margin of 40% for Q3 FY2023 is, in my opinion, a more than solid result. Especially when we look at the TTM basis:

Seeking Alpha, HDSN’s income statement, author’s notes

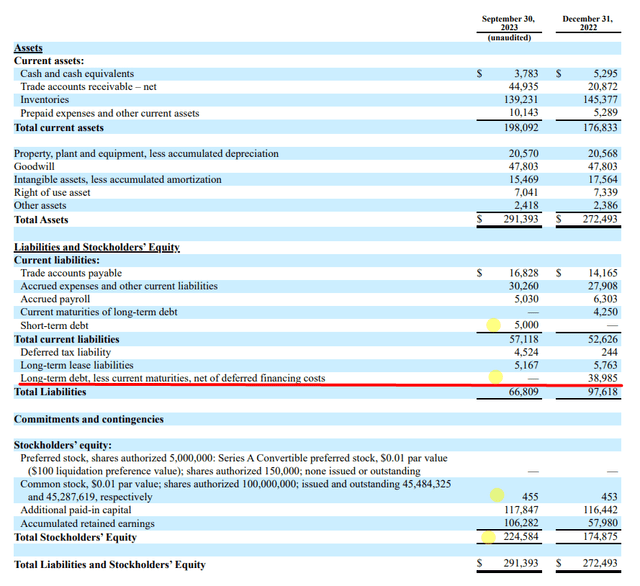

What attracted me to Hudson Technologies in December 2021 still applies today: the management is committed to keeping the company’s balance sheet super clean. This was a very pressing issue many years ago, and HDSN does not want to repeat the mistakes of the past. In Q3 FY2023, Hudson paid out its long-term debt of ~$39 million in full and now only needs to pay out the remaining $5 million (placed in the short-term debt). The cash balance as of the last reporting date is $3.7 million, which is not bad after the company repaid such a large amount of debt.

Hudon’s balance sheet, author’s notes

The repayment of long-term debt in 9M 2023 was a cash flow headwind of $47.1 million, without which Hudson could have generated more than $45 million in cash for the period, bringing the cash balance to almost $51 million. That’s a pretty impressive amount for Hudson – almost 7.5% of its market cap.

Now that Hudson is close to being debt-free, the company can continue to grow and develop while maintaining its relatively high level of profitability.

But why have I decided that HDSN will be able to keep its profitability relatively high?

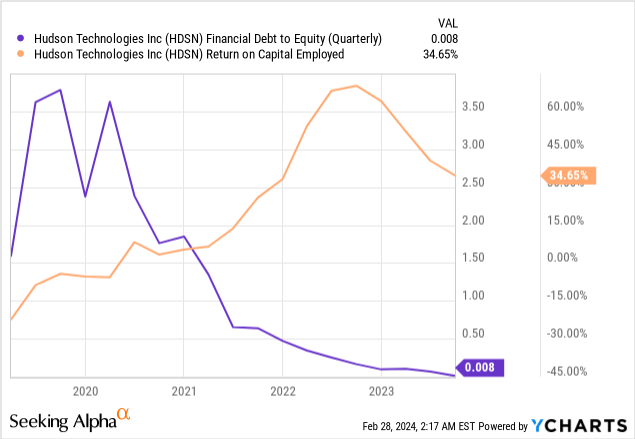

I believe that EPA’s new initiatives, which mandate the use of reclaimed refrigerants in new systems and servicing activities, should drive a substantial increase in demand for reclaimed volumes, particularly for high GWP HFCs like 404A and 410A. And Hudson seems to be uniquely positioned to capitalize on this, as a) its operational model ensures a closed-loop system where refrigerants are reused/reclaimed without any emissions, and b) as I said before, it’s a market leader with a market share of ~35%.

Therefore, I believe that despite the cyclical nature of its business, HDSN has been able to deleverage in time to ride the new wave of demand growth for its products in 2024-2025.

All that remains is to understand whether the undervaluation of the company that I noted in my previous articles is still relevant today.

Valuation And Expectations

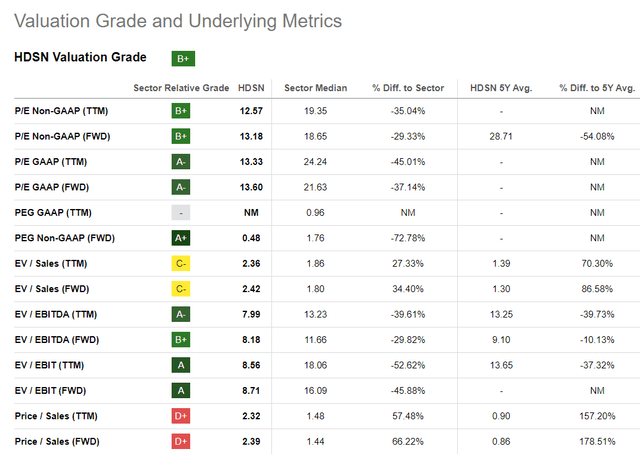

According to the Seeking Alpha Quant System, the stock’s Valuation grade has not changed in the last 3 months and is still rated “B+”, which is not bad, in my view.

Seeking Alpha, HDSN’s Valuation grades

The relatively high P/S ratios – both TTM and FWD – are most likely explained by the fact that although HDSN’s margins are lower than in FY2022, they are still above the industry median. Therefore, the market gives the P/S ratio of the stock a kind of premium, the fairness of which is difficult to measure.

Seeking Alpha, HDSN’s Profitability grades

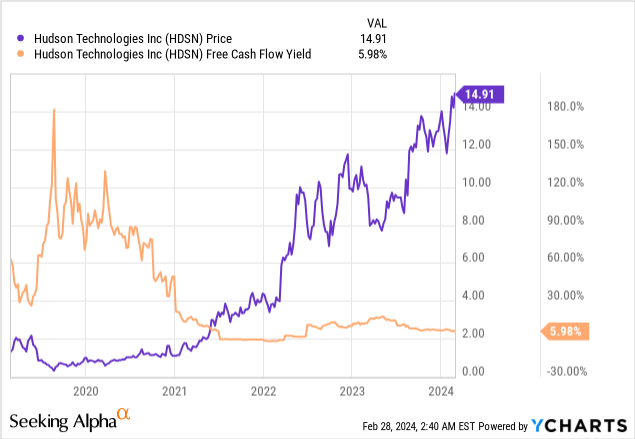

When I try to determine the “fairness” of a company’s valuation, I usually look at FCF yields as they reflect the true discount or premium, depending on how the market views the FCF generation potential of that particular firm. HDSN is trading at an FCF yield of ~6% (YCharts data), well below historical levels. According to Tom Robinson’s calculations from September 2021, the mean basic FCF yield for the S&P 500 Index was 6.5% and the median was 4.7%. Hudson is therefore currently trading relatively “fairly” compared to the overall market.

But we are interested in the future, not the present. How much can HDSN earn in 2-3 years? The management has ambitious plans: more than $400 million in sales and a GP margin of ~35% by the end of 2025.

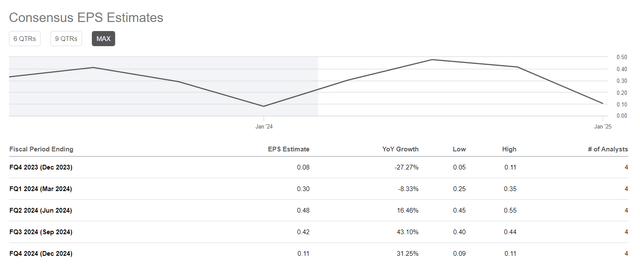

In terms of sales, this is an increase of 37.17% compared to the current TTM figure (if realized). That’s a lot, but the problem is that the market already prices this estimation in its forecast and “believes the management”, so to speak:

The “power reserve” to beat Wall Street’s implied estimate is <$4 million, which is relatively low. However, watch how the implied P/S ratio changes – it falls from 2.39x in FY2023 to 1.71x in FY2025. Let’s recall why Hudson has a premium to the P/S ratio in the first place – most likely it’s due to the higher margins of the business. However, management is forecasting a GP margin of ~35%, which is not materially different from the current 38.7% (TTM). Another important point is that the company will now have no debt. This means that interest payments will also be eliminated in 2025. This in turn should have a strong positive impact on the bottom line and support the net profit margin and return on equity.

I don’t know if I’ve ever done this on Seeking Alpha, but I’m going to value HDSN via its price-to-sales ratio. I expect the company to reach $400 million in revenue in FY2025 – the low end of the management’s target. At the same time, HDSN’s current P/S ratio of 2.32x will decline due to an expected margin contraction, but the decline shouldn’t be as steep as it’s priced in today. Based on history and common sense, I’d assume 2x. This results in a fair valuation of the company of around $800 million, which is around 18% above the current equity value.

Risks To Consider

The first serious risk is cyclicality. I’ve written about Hudson’s cyclicality before – the business varies widely by season, price dynamics and a few other factors. If Wall Street estimates are to be believed, HDSN’s EPS figures are likely to fall again soon, which could be a reason for uninformed investors to sell their position and pressure the market. It’s important to understand that Hudson is, after all, a small-cap company – any selling pressure may become a significant headwind for investors’ paper profits.

Also, there’s risk of a deeper decline in margins than is currently priced in by Street. Assuming the company’s gross profit margin falls to 25-30% in FY2025 instead of the 35% forecast, HDSN stock will immediately become overvalued.

Another risk lies in the valuation method I have chosen today – P/S ratios are a very rare choice in the analytical arsenal due to the mass of uncertainty surrounding the financials of companies “under revenue line”.

The Verdict

Despite the risks, I believe in the best for Hudson Technologies. I like management’s approach to deleveraging, which I forecast should maximize benefits for the company in 2024-2025. In addition, today’s regulatory environment in the United States and around the world provides more and more opportunities for business expansion in a market where Hudson remains the undisputed leader. In my opinion, HDSN stock is undervalued by about 18% over the next couple of years – and that’s just relative to its price-to-sales ratio. If the company manages to keep its gross margin above 35%, the upside potential will be much greater. I therefore reiterate my previous ‘Buy’ rating and look forward to Hudson’s seasonally weak fourth quarter results.

Thanks for reading!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of HDSN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!