Summary:

- AAPL’s fundamental performance shows mixed signals, with the strong Services expansion negated by the decelerating overall sales – leading to its impacted growth prospects.

- While it may continue generating rich Free Cash Flows while returning great value to its long-term shareholders, the management’s FQ1’25 overall guidance seems underwhelming.

- AAPL’s continued stock price outperformance has also triggered the premium valuations, with it offering interested investors with a minimal margin of safety.

- These developments underscore why the recent profit taking may have been well justified, with the stock likely to trade sideways in the near-term, similar to historical trends.

PM Images

Apple’s Fundamentals & Valuations Offer Mixed Investment Story – Downgrade To Hold

We previously covered Apple (NASDAQ:AAPL) in May 2024, discussing the company’s highly unique investment thesis, as it continued to report growing installed base of active devices along with accelerating Services revenue growth.

With it contributing to the company’s growing Free Cash Flow generation and consequently, tighter share count along with expanded shareholder equity, we had believed that the stock remained a compelling Buy at every dips.

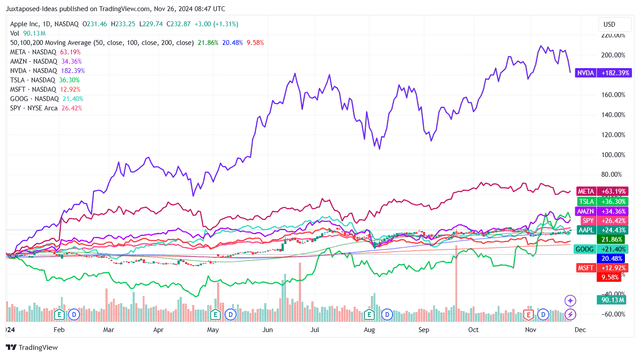

AAPL YTD Stock Price

Since then, AAPL has also generated excellent total returns of +28.1%, compared to the wider market at +16.4% – with the same outperformance also observed in many of its Magnificent 7 peers to varying degrees.

The stock’s bullish support is impressive indeed, as it signals its next leg up after the two rounds of sideways trading observed between August 2020 to April 2023 and the April 2023 to June 2024.

Much of AAPL’s tailwinds are also partly attributed to robust FQ4’24 results, with Services revenues continue growing to $24.97B (+3.1% QoQ/ +11.9% YoY) and Services gross margins expanding to 73.8% (-0.2 points QoQ/ +3 YoY/ +10.1 from FY2019 levels of 63.7%).

The same has been observed in the management’s highly promising commentary, with “our installed base of active devices reached an all-time high across all products and geographic segments, thanks to very high levels of customer satisfaction and loyalty and a large number of customers who are new to our products.”

These developments further confirm AAPL’s investment thesis through the Services segment, with the well-diversified smart device offerings across phones, tablets, laptops, smartwatches, TVs, and smart home systems, have been a means to an end, which is to attract users to its highly sticky iOS ecosystem.

These have led to the “over 1 billion paid subscriptions across the services on our platform, more than double the number we had only four years ago,” as more users are entrenched in its iOS ecosystem, including Apple Pay and Apple Store, amongst others.

The star of the show is naturally AAPL’s iPhone at FQ4’24 sales of $46.22B (+17.6% QoQ/ +5.5% YoY), with it responsible for 48.6% of the company’s overall sales (+2.8 points QoQ/ -0.3 YoY) and likely, main driver to the highly successful services penetration.

Market reports continue to highlight 38.4M of iPhone 15 units sold in Q3’24, with the iPhone 15/ Pro Max/ Pro being the best-selling smartphone range globally in Q3’24. This is on top of the pre-orders for iPhone 16 going strong – thanks to the robust demand in China.

The Consensus Forward Estimates

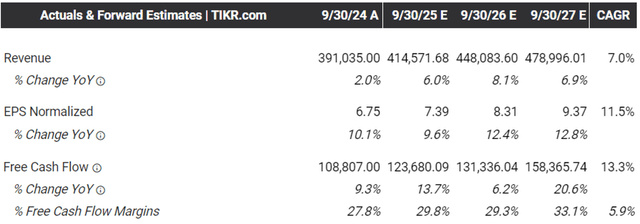

Therefore, while AAPL may have guided a relatively underwhelming FQ1’25 revenue guidance growth at “low- to mid-single digits” YoY, we are not overly concerned indeed, since it has been well balanced by the FQ1’25 Services revenues guidance growing at “double-digits at a rate similar to what we reported in the fiscal year 2024,” along with the richer gross profit margins of 46.5% at the midpoint (+0.3 points YoY).

Even so, it is unsurprising that the decelerating sales growth may have already contributed to the consensus downgraded forward estimates, with the Cupertino giant expected to generate a top/ bottom-line growth at a CAGR of +7%/ +11.5% through FY2027, compared to its 5Y CAGR of +8.5%/ +17.8%, respectively.

Even so, we want to highlight the other silver lining to AAPL’s investment thesis will be the increasingly rich Free Cash Flow generation of $108.81B in FY2024 (+9.2% YoY) and margins of 27.8% (+1.9 points YoY/ +5.2 from FY2019 levels of 22.6%).

Combined with the robust consensus Free Cash Flow estimates over the next few years, we believe that the giant remains well position to return great value to its long-term shareholders, with -2.7% of its shares already retired over the LTM and -17.4% since FY2019.

This is on top of the potential boost in AAPL’s balance sheet, as observed in the improving net debt situation at $31.5B in FY2024 (-27.6% YoY/ -20% from FY2018 levels of $39.39B).

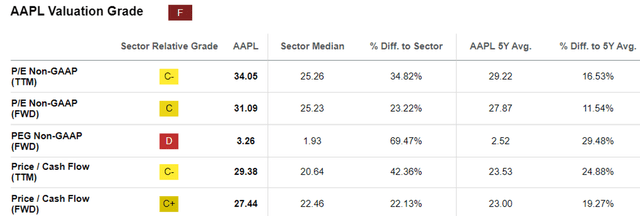

AAPL Valuations

On the other hand, it is undeniable that AAPL’s decelerating sales growth and constant stock price appreciation have contributed to its relatively premium FWD P/E non-GAAP valuations of 31.09x, compared to its 1Y mean of 29.23x, 5Y mean of 27.87x, and the 10Y mean of 20.67x.

The same may be observed in its FWD PEG non-GAAP ratio of 3.26x, compared to the 1Y mean of 2.89x, 5Y mean of 2.52x, and the 10Y mean of 1.34x, with it potentially contributing to the stock’s recent selling pressure.

Even when comparing AAPL to its Magnificent 7 peers, such as Amazon (AMZN) at FWD PEG non-GAAP ratio of 1.66x, Google (GOOG) at 1.26x, Meta (META) at 1.32x, Microsoft (MSFT) at 2.42x, Nvidia (NVDA) at 1.28x, it is undeniable that the former is rather expensive here, aside from Tesla (TSLA) at 17.26x – with it offering interested investors with a minimal margin of safety.

So, Is AAPL Stock A Buy, Sell, or Hold?

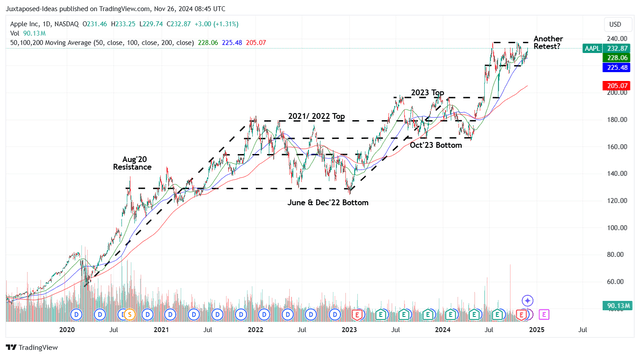

AAPL 5Y Stock Price

For now, AAPL has finally broken out of the 2023 sideways trading while charting a new trading range since June 2024.

For context, we had offered a fair value estimate of $169.60 in our last article, based on the LTM adj EPS of $6.43 ending FQ2’24 (+9.1% sequentially) and the previous FWD P/E valuations of 26.39x (near to the previous 5Y mean of 26.29x).

Based on the FY2024 adj EPS of $6.75 (+10.1% YoY) and the updated 5Y mean of 27.87x, it is apparent that AAPL has ran away (yet again) from our updated fair value estimates of $188.10.

Based on the consensus FY2027 adj EPS estimates of $9.37, there appears to be a minimal margin of safety to our updated long-term price target of $261.10 as well.

While we typically avoid referring to whale sales, namely Warren Buffett’s and Berkshire Hathaway’s (BRK.A) (BRK.B) ongoing AAPL sales worth $36.1B, it appears that the recent unlocking of gains has been rather prudent at current heights indeed, as similarly observed in numerous active ETFs, mutual funds and hedge funds.

While AAPL is unlikely to experience a deep pullback from the recent selling, as observed in the stock’s robust bullish support at $210s, there appears to be a minimal capital appreciation prospect in the intermediate term as well.

We are of the opinion that the stock is likely to continue trading sideways before eventually growing into its premium valuations as similarly observed in its historical trading trends, resulting in our downgraded Hold rating.

Despite AAPL’s robust performance metrics in the Services segment, we do not encourage anyone to chase the rally at these heights.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.