Summary:

- IQ’s collaboration with BIDU is technologically, strategically and financially beneficial.

- The company can potentially benefit from a perceived rising tailwind in consumption of C-drama.

- IQ’s unique strength in long-form video contents suggest it does not directly compete with short-form video providers in the long run.

- The stock is undervalued, presenting a good investment opportunity.

Robert Way

Investment Thesis

The talks about Baidu (BIDU) selling iQiYi (NASDAQ:IQ) that started in 2022 is uncalled for based on current developments that saw Baidu officially establishing technological collaboration with IQ on AI. IQ is also the most formidable competitor to “Tencent Video” (owned by Tencent, Baidu’s rival) based on subscriber counts, implying a strategic incentive for Baidu to continue supporting IQ even if the latter is not doing well in the short term. Financially, IQ’s revenue contribution to Baidu is a significant 1/3 of Baidu’s core business revenue suggesting a financial incentive for Baidu to not sell IQ.

IQ faces significant competition from short-form video prompting the management to plan for the release of complementary features to mitigate such competition without losing focus on its core business in long-form video.

While IQ uses AI to enhance its content creation, so do its competitors. However, IQ appears to leverage AI to enhance its content generation “process” as opposed to its competitors that focus on the “technical” aspects. Hence, in the long run, IQ may not directly compete with its competitors (especially its short-form rivals) strategically in the long run.

The company’s subscriber revenue appears to be waning from a quarterly perspective but it is on a rising trend and even achieved new highs from an annual perspective. This suggests IQ’s strengths lie in attracting new paying customers and for loyal existing customers to stay subscribed to its service. To this end, I believe it can greatly benefit from a perceived rising trend in Chinese Drama (C-Drama) consumption.

The stock is very undervalued, presenting a good opportunity for investors looking for a deep value play.

Content and Technology Synergy With Baidu

Previously, Baidu was reportedly in talks to sell IQ back in 2022, when Baidu regards QI to be a “non-core asset”. Currently, not only was this potential sale not followed up after 2 years, but Baidu has recently strengthened its relationship with IQ in a recent strategic partnership in AI collaboration, contrary to the perception that the company is a non-core asset.

Generally, IQ has a rich amount of content and Baidu has AI technologies that feed on it:

- iQiYi has more video-related data that Baidu’s AI engine can be trained on to make it more accurate.

- When Baidu’s AI capability improves, iQiYi can make use of Baidu’s improved search results to improve users’ experience by providing targeted content that is more accurate than without Baidu’s AI

Such collaboration creates a synergistic relationship with IQ. Therefore, in my opinion, even if IQ is not doing well in the short term, Baidu is likely to continue supporting it to its long-term advantages.

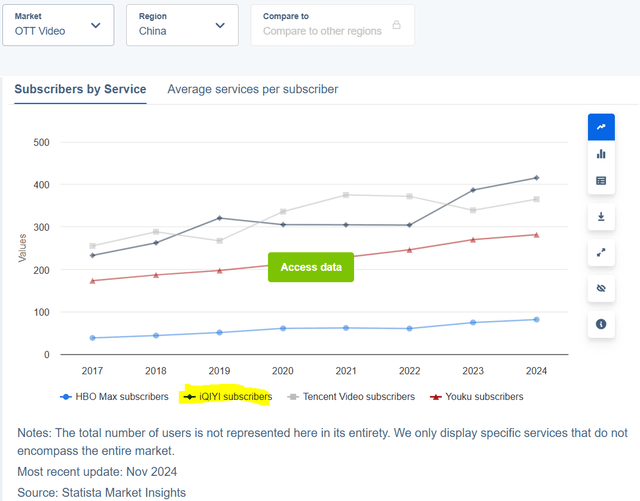

Strategically, Baidu competes with Tencent, which owns Tencent Video. According to Statista’s data of subscriber counts, we can observe Tencent Video and iQiYi’s subscribers have consistently led other players in the market. Right now, iQiYi has led Tencent Video but its lead has been fluctuating since 2017.

Subscribers (Statista)

With a market share rivalled only by Tencent Video in the Chinese OTT market, iQIYI is the most formidable competitor to Tencent Video, which is also a key competitor to Baidu. From this perspective, it is more likely for Baidu to continue supporting iQIYI to compete against a common rival effectively.

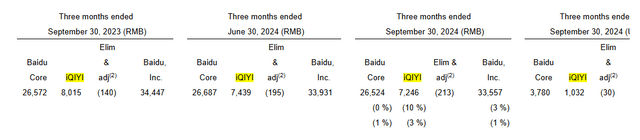

IQ’s revenue contribution to Baidu is relatively small but significant. According to Baidu’s Q3 2024 earnings call, revenue from IQ is about 1/3 that of Baidu’s core business:

Revenue (Baidu Investors Relations)

Overall, Baidu is technologically, strategically and financially incentivized to support Baidu rather than selling it to other companies, possibly competitors.

Challenges from Short-Form Video Content

IQ needs to deal with significant challenges from short-form video content platforms in China, which Douyin and Kuaishou currently dominate in terms of monthly active users (“MAU”):

Douyin, the original Chinese version of TikTok developed by Bytedance, remained as the leader in China’s short-formed video scene. In September 2024, the app boasted to have 748 million active users across the country. Its closest rival, Kuaishou saw a rapid active user loss down to 471 million.

Both market leaders in the short-form video market boast MAUs above 470m. In contrast, while IQ is still one of the leaders in longer forms of online video apps, with an MAU of 413M, it trailed behind both the leaders of short-form video apps and its long-form rivals of Youku and Tencent video:

As of February 2024, Youku was the leading online video app in China with about 461 million monthly active users. Tencent Video trailed with almost 435 million active users while iQIYI secured its third place with around 413 million active users. Short video apps – one of the driving forces in China’s online video industry – were not included in this ranking.

Despite leading in subscriber counts over its competitors, IQ lags in terms of MAU. From the company’s earnings call, while the management plans to add features to benefit from the rising popularity in short form video. However, these are meant to complement its core long form content model rather than replace it.

The main iQIYI App will maintain its focus on long-form video content and subscription-based model, complemented by free mini and short dramas and advertising model.

With the potentially game-changing use of AI in its content creation, especially with its collaboration with Baidu, investors should consider whether IQ can effectively leapfrog over its rivals in MAU.

Leverage Of AI In Content Production

QI is not alone in the use of AI to improve productivity. So do its rivals of both long and short-form video:

- Tencent Video uses AI for a diverse range of use cases that revolve around technical enhancement, production and quality detection.

- Douyin is known for using AI for interactive features. Their AI-driven features like the “V Project” provide personalization by allowing users to create avatars that mirror their personalities, enhancing user interaction and engagement, and making the platform more dynamic.

- Kuaishou has developed its own AI models of “Kling” and “Kolor” for content creation. Kling is a text-to-video model comparable to OpenAI’s Sora while Kolor is a large-scale text-to-image AI generation model available on Hugging Face. This allows users to generate content more efficiently using advanced AI models.

Generally, IQ’s rivals use AI to improve the “technical” aspects of its content production and user engagements.

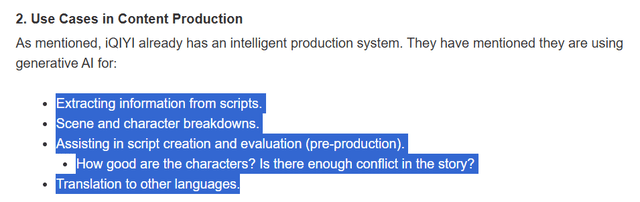

In contrast, IQ uses AI to improve its production “process” to produce high-quality, long-form content efficiently and enhance marketing efforts. According to this article by Jeffrey Towson, the production tasks that IQ used AI for appear to span across a broader spectrum of the overall workflow:

Use Cases (Jeffrey Towson)

iQiYi appears to position itself to excel in generating content with more artistic depth as opposed to simply getting users’ short-term attention like what its competitors in the short-form video seem to be more interested in doing.

As mentioned in the article:

Keep in mind, iQIYI wants to create entertainment that is high quality. And, if possible, that sets cultural trends. They want to have the kind of impact shows like Game of Thrones and House of Cards had. They want the shows that everyone is talking about. And that people buy merchandise for. That requires a lot of advanced prediction, which AI should be very good at.

IQ is also the first to adopt Extended Reality (XR) in its full-length production:

iQIYI, an innovative market-leading online entertainment service in China, announced recently that parts of its drama series Fox Spirit Matchmaker (Yuehong Chapter) will involve Extended Reality (XR) Virtual Production, making the show China’s first drama series that adopts the kind of technology in its production.

In contrast, competitors like Tencent Video use a similar “mixed reality (XR)” mainly for the building of virtual worlds in the metaverse, rather than full-length movie/drama production:

Tencent previously bet heavily on the metaverse concept of virtual worlds. In June 2022, the company announced the official formation of XR unit, which was tasked with building up the extended reality business for Tencent including both software and hardware that time, the Reuters reported.

In my opinion, if IQ aspires to use AI to produce quality content with intangible depth in its movie/drama, it may not be directly competing with its competitors and hence presents a unique competitive advantage in the market.

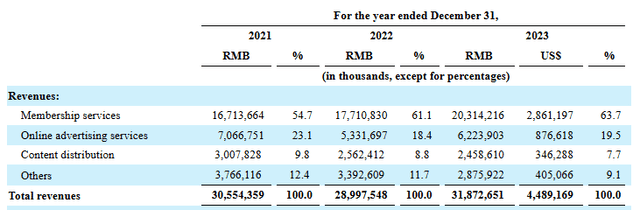

Revenue Trend By Segments

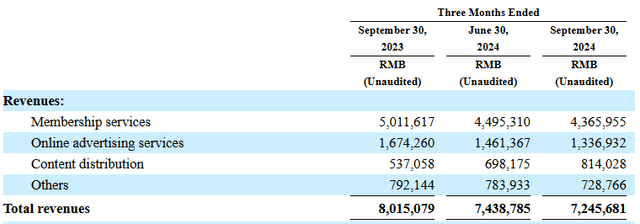

From the company’s Q3 2024 earnings, revenue from the membership and advertising segments appears to be falling while content distribution seems to be the only segment experiencing a sustained increase in revenue:

Revenue Trend By Segments (Q3 2024 earnings)

However, from the company’s 2023 annual earnings, an opposite trend can be observed where membership revenue is the only segment that has experienced a consistently rising trend over the years:

Annual Report (Revenue Trend By Segments)

The company’s business is still highly reliant on its membership revenue to drive its overall top line growth.

From the latest earnings call, the management provides 3 reasons why membership revenue dropped in the latest quarter:

First, as I previously mentioned, although we launched good quality titles in the quarter, there’s room for improvement in the supply of premium female-oriented and ancient costume dramas, which are especially appealing to members driven by hit titles.

Second, amid the current macro headwinds, users drawn to hit titles have grown more cautious in spending, and a broader selection of entertainment options is also seeking to capture their budget and attention.

Lastly, the high base effect from last year continued to play a part in our current figures.

For the second point, while macro headwinds can persist for an extended time, they are generally not permanent. For the last point, it is reasonable as we can observe how membership revenue surged from RMB 17M to RMB 20M in 2023.

The first point was about this earlier remark made in the same earnings call:

While we are proud of our performance in crime and reality drama genres, we recognize certain areas where we could improve. For example, the limited supply of key female-oriented costume dramas in the third quarter impacted hit title-driven members.

As consumer sentiments keep changing, I assumed the management has correctly identified “female-oriented and ancient costume dramas” as a forward-looking consumer demand based on reliable feedback received.

Investors should monitor whether the company can eventually act on this feedback and improve their content offerings. If the company is committed to such continuous improvements, the long-term trend of rising membership should persist.

Potential Emerging Tailwind Of C-Drama

A rising tide lifts all boats. Generally, in my opinion, IQ is in the business of producing and exporting Chinese pop culture products of C-drama. If there is a “rising tide” of pop culture in East Asia that tilts towards the consumption of C-drama, it will benefit all producers of C-drama, including iQiYi.

In East Asia, pop culture has evolved significantly since the 1970s. The exact area of popularity of each phase of its evolution can be subjective, but in my opinion, these are the key events:

- The 1970s to 1980s saw the rapid rise of Cantopop originating in Hong Kong, creating A-list stars like the “Four Heavenly Kings” of “Jacky Cheung, Andy Lau, Leon Lai and Aaron Kwok”. Aside from their singing career, all of them have an extensive portfolio of highly sought-after Hong Kong drama/movie content at that time. These events benefitted companies like Television Broadcasts Limited (“TVB”) and Asia Television Limited (“ATV”), operating in the Hong Kong TV broadcasting industry.

- In the 1990s to 2010s, Cantopop reached its peak and began to share the spotlight with Mandopop, with the later experiencing increasing popularity over Cantopop. Mandopop originated in Taiwan and experienced a breakthrough in popularity in the early 2000s with the release of teenage-oriented dramas like Meteor Garden. This drama is popular even in non-Chinese-speaking regions like the Philippines, benefitting Chinese Television System (“CTS”) of Taiwan. In music, Jay Chou became so popular that it received extensive coverage from Time magazine in 2003 and again in 2011 after he starred in his first Hollywood movie. Jay Chou’s success benefitted GHY, an entertainment company responsible for organizing Jay’s high profile events.

- The 2010s to now saw the rise of K-pop, originating from South Korea, led by the musical groups BTS and Blackpink. In drama production, “Squid Game” released in 2021 became the most-watched Netflix drama of all time during at that time. According to a 2023 survey from Statista, Korean dramas (K-dramas) were popular in 41% (close to half) of the countries where the respondents came from. These events benefitted the “Big 4” entertainment companies in South Korea.

In all the points above, popular culture was concentrated within most of the “Four Asian Tiger” economies, except Singapore. Although multiracial Singapore enjoyed some mild success in the Chinese pop music scene in the 1980s, the success was short-lived and declined in the 1990s.

In my opinion, 2 common traits can be observed in the regions where popular culture flourished:

- The economy is developing very fast, creating a consumer base with enough disposable income to splurge on discretionary entertainment expenditures.

- The population is culturally homogeneous, allowing it to pool together enough talents to create a cohesive and appealing cultural output that resonates locally first, before exporting it internationally.

As described in the Wikipedia article cited earlier:

- “The Hong Kong economy was the first out of the four to undergo industrialization with the development of a textile industry in the 1950s.”

- “Taiwan and South Korea began to industrialize in the mid-1960s with heavy government involvement including initiatives and policies.”

The sequence of industrialization (resulting in economic development) correlates to the successful output of pop culture products, with Hong Kong first, followed by Taiwan and South Korea. Singapore also developed rapidly during the same period, but it is culturally diverse and thus faced unique challenges in creating a unified cultural identity that could be easily exported.

Right now, I observed China seems to have fulfilled the above 2 traits. First, the Chinese economy grew rapidly over the decades, shortly after joining the WTO, creating a consumer base with enough disposable income to spend on entertainment. Second, its population is relatively homogeneous, unlike Singapore. Recently China released the game of Black Myth: Wukong, an export of gaming pop culture built on Chinese mythology, which has become highly successful internationally. Can China replicate such success with dramas and movie content?

Assuming the Chinese entertainment industry is entering such a macro tailwind of flourishing Chinese pop culture, can iQiYi ride on such a tailwind to its advantage in C-drama export, potentially replacing the dominance of K-drama?

Why are K-dramas so popular? Can its popularity be replicated by iQiYi? According to Paste online magazine:

Korean content contains diverse genres and kinds of stories, but the romance-driven, female-centric “K-drama” format that has been successfully exported to countries around the world for decades has been integral to Hallyu, and it has been driven by women fans.

K-drama’s focus on a “female-centric” genre for K-drama is aligned with IQ’s management’s plan to focus on producing “premium female-oriented” dramas (as discussed earlier), suggesting the company is on the right track to replicate K-drama’s success, if the plan is executed well.

The management also have the intention to produce “ancient costume dramas”. These are dramas produced in the context of certain historical period, characterized by its feature of elaborate costumes and backdrop that are reflective of the era being depicted. In my opinion, the most successful Chinese pop cultural products built on this genre is the “Wuxia” genre, popularized by the late Louis Cha. I describe how it has the potential to benefit Chinese gaming products in another article:

Wuxia characters are often portrayed to possess exaggerated superhuman abilities through the practice of exotic/mystical Chinese martial arts and use these gifted abilities to embark on heroic adventures. The popularity of this genre of popular culture helps to spin off successful comics, movies, and other popular entertainment products among the Chinese community, including computer games.

If IQ decides to produce “female-oriented costume dramas” base on the same genre, it has a higher chance of succeeding since it is building on an existing cultural popularity.

Overall, iQiYi appears to enjoy several potential tailwinds in C-drama production:

- It operates in a market with a huge consumer base with disposable income, facilitating the consumption of discretionary pop culture products.

- The market is culturally homogeneous.

- The management made a strategic decision to focus on the production of content belonging to a genre that led to contemporary K-drama success.

- The focus on “ancient costume dramas” allows IQ to leverage on an existing culturally well known Wuxia genre.

Investors should observe whether such perceived potential tailwinds can play out eventually to the benefit of iQiYi.

Financial

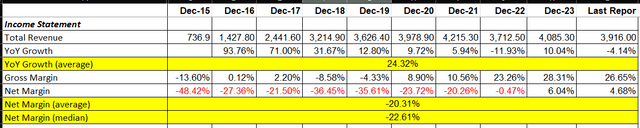

We have observed IQ’s revenue trend from a quarterly perspective. This section will observe how the company performed from a longer-term, annual perspective up to the latest TTM. Seeking Alpha’s compilation of financial data over the last 10 years (available only to premium/pro users) is a great resource to begin with.

Author tabulation (Seeking Alpha)

IQ has experienced high 2-digit growth in percentages on its top-line revenue in most years, averaging more than 24%. However, the company was loss-making for most years until recently when it achieved relatively small but positive net margins only in the last 2 annual periods.

The average/median loss in the long run is more than 20%. Investors should consider whether the company’s recent profits can be maintained and even increased further in the long run.

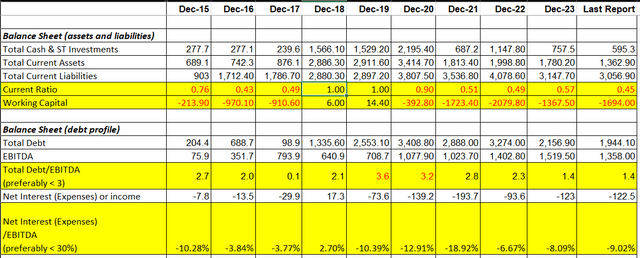

Author Tabulation (Seeking Alpha)

In my opinion, looking at the balance sheet, debt is significant but not overwhelming for the company.

While “total debt” makes up most of its “Total Current Liabilities” resulting in its working capital being negative on most years, the debt level is still less than 3 times its EBITDA on most years. Moreover, debt/EBITDA multiple has been on a downward trend since 2021.

Since 2015, the company’s net interest expenses on its debt is always low at less than 30% of its EBITDA. This is true even when its debt/EBITDA multiple peaked in 2019 and 2020.

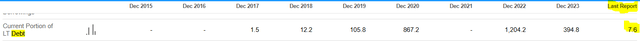

Debt (Seeking Alpha)

Most of IQ’s short-term debt has been paid off or refinanced as of the last reported debt figure. At $7.6M, it is insignificant compared to its EBITDA of more than $1B, implying the company has effectively got its immediate short term debt under control.

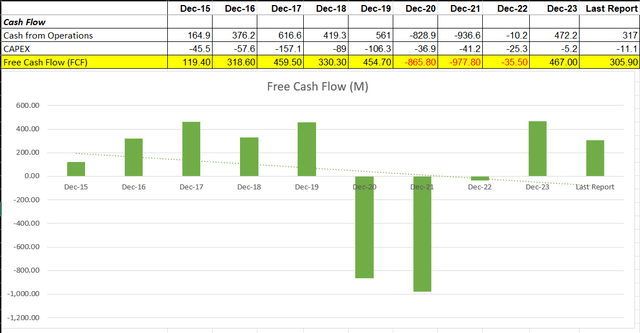

Cash Flow (Seeking Alpha)

IQ’s cash flow has been positive on most years. Most importantly, cash flow is positive in the last 2 annual periods. However, it does not seems to be increasing.

Overall, IQ’s financial profile is stable. Despite its significant debt volume, it has proven to be able to consistently service its debt obligations using less that 30% of its EBITDA. With a bottom line that has started to turn positive in recent years, investors should observe whether the company can reduce its debt further to achieve a positive working capital on its balance sheet. Ideally, the fee cash flow should also be on an increasing trend in the long run.

Valuation

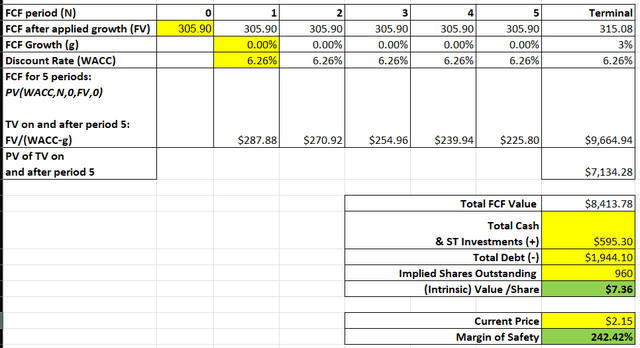

Using the following information and other figures from Seeking Alpha, the intrinsic value (“IV”) is calculated using the DCF model:

- WACC of 6.26%.

- Starting FCF of an estimated $305.9M, as calculated from the last reported figures.

- As discussed previously, the company’s FCF appears to be flat over the last 10 years despite revenue growing significantly. Hence, I will assume the current trend persists meaning its future FCF growth in the next 5 years remains flat (0%).

- Thereafter, the company sustains a terminal growth rate of 3% which is within the “historical inflation rate (2–3%)”

Author’s IV (Seeking Alpha)

The IV is $7.36 suggesting that even with a conservative assumption that there is no growth in FCF in the next five years, the current price of $2.15 implies it is deeply undervalued.

Previously, the price of IQ achieved this IV during the first quarter of 2023. Now, the current price appears to be trading near a visible support of $2.

price trend (Tradingview)

With an IV that is deeply undervalued even with the assumption that the company has no growth for the next 5 years, this stock appears suitable for medium to short-term investors looking for a deep value play opportunity.

This buy scenario is similar to another deep value play opportunity of another stock that I have written on previously.

Risk

Operating in the Chinese market, IQ is exposed to the same regulatory risks as other Chinese stocks due to the government’s track record of implementing sweeping measures on targeted companies, forcing them to comply even if it means significantly hurting their bottom line for the benefit of the public’s welfare. This practice persisted until recently in 2023.

Investors should only invest in IQ if they are comfortable with this risk.

Conclusion

The continued long-term success of iQiYi’s business lies in its ability to produce high-quality long-form videos for its loyal paying subscribers.

“Quality” does not simply refer to technically advanced video graphics but also to the intangible depth behind the storyline of each video content. For example, can it emulate the success of low-budget but massively successful dramas like Squid Game from South Korea?

The management’s intentions to target the production of “premium female-oriented” dramas appear to be in the right direction, as discussed earlier. A perceived potential tailwind of a cultural tilt towards the consumption of C-drama might also play out to IQ’s advantage together with IQ’s leverage of AI in its production process.

The stock is currently deeply undervalued presenting a good opportunity for short to medium-term investors. Investors can buy the stock at the current price level and sell progressively as it approaches the price level near the IV which is around $7.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.