Summary:

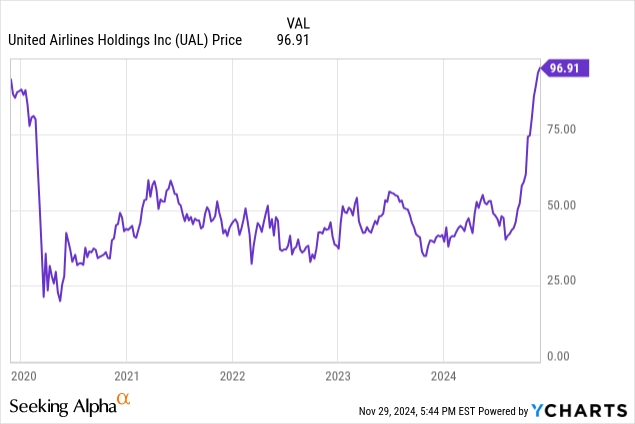

- United Airlines shares have surged 94% so far this year, driven by strong results and robust flight demand.

- In Q3, despite a 1.6% decline in revenue per available seat mile, United’s revenue rose 2.5%, with net income hitting $1.4 billion.

- United’s valuation is attractive, trading at a discount to peers, with higher margins and lower debt ratios, suggesting further upside potential.

- Risks include fuel price volatility, economic downturns, and labor relations, but stable fuel prices and strong fundamentals make United a buy.

Ryan Fletcher

Introduction

I previously covered United Airlines (NASDAQ:UAL) back in June where I discussed my bullish view on the shares. Since then, the shares have risen 94%, significantly beating the wider S&P 500 (SPX) which has only returned 10.5%. This comes as the company reported a strong set of third-quarter results, beating expectations and launched a share buyback even as it continues to invest in and deleverage the business. Combined with falling interest rates, strong flight demand, and reduced fuel expenses, United looks like it’s in a strong position.

In this article, I want to explore in more detail the company’s latest results, the factors that could propel United higher, and why, despite an 80% increase in the share price, I believe United Airlines is still a buy.

Q3 Results

United Airlines released its Q3 results in mid-October. Revenue came in at $14.8 billion, up 2.5 percent compared to the previous year and slightly beating expectations by $70 million. This increase in revenue was largely due to a 5% rise in revenue from premium travel and a 20% increase observed in basic economy revenue.

Despite this growth in revenue, total revenue per available seat mile, a key metric in the airline industry, declined 1.6% year on year, due to an increase in capacity. Overall operating expenses were flat on a per-seat basis, and only up 4.2% overall. This was despite salary costs, United’s largest expense category, increasing 10.4% year on year, with this increase being offset by the fuel price falling to $2.56 a gallon meaning fuel expenses fell 10.4% year-on-year despite an increase in capacity.

All this translated into net-income of $1.4 billion and earnings per share of $3.33, ahead of expectations by $0.16, and exceeding management’s guidance for the quarter. On the balance sheet side, the company continued to deleverage with total debt decreasing to $33.3 billion from $34.2 billion in the previous quarter and $36.7 billion a year earlier.

These results were driven by the continued strong demand for air travel. United experienced its busiest July 4th and Labor Day holidays. In July it experienced its busiest day on record with 552,000 passengers, and a new record average number of daily customers for a month at 474,000 per day in September. This shows that strong demand for travel continues to drive airline’s results, and it is set to continue into the future. Looking ahead, United continues its strategy of reducing unprofitable domestic routes and focusing on the more lucrative international routes. The airline recently launched a swathe of new routes, adding eight destinations across Europe, Africa, and Asia for 2025, meaning the airline now has over 800 daily flights to 147 international destinations.

Overall, United showed a solid performance in the third quarter. Despite a 1.6% decline in revenue per available seat mile due to increased capacity, the airline’s 2.5% rise in revenue and record passenger volumes during peak holiday season demonstrates resilient demand. Combined with the strategic shift towards more lucrative international routes, and ongoing deleveraging United Airlines looks well positioned for the future. This quarter also gave management the confidence to launch a $1.5 billion share buyback program, the first since the pandemic, whilst continuing to invest in and deleverage the business. This relaunched buyback program gives me further confidence that United is in a strong position, with a positive outlook, and is willing to provide returns to shareholders.

Growing The Business

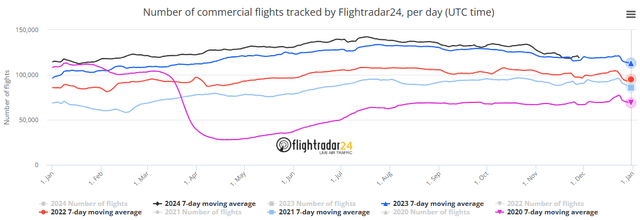

United over the past few years has seen demand grow significantly coming out of the pandemic. This has been seen both around record setting passengers carried on important holidays, but also throughout the year. Over the past 4 years we can see that total commercial flights worldwide have increased year over year every year.

Total commercial flights graph, flightradar24

This phenomenon has not just occurred in other countries but also across the US, United’s home market, and the start or end point of almost all their flights. TSA Volumes have continued to rise year on year, and as of 28th of November were up 4.7% year over year.

With all this demand United has responded by recently launching a swathe of new routes, adding eight new destinations including Mongolia, Taiwan, Greenland, Italy, and boosting capacity on other routes. This growth in demand has been met by expanding capacity using more planes. There is however a problem, a shortage of planes.

With delays in deliveries at Boeing and Airbus for multiple different regions, there is now anticipated to be a deficit with demand exceeding supply. This puts aggressive growth plans under strain and puts a limit on capacity growth across the industry as a whole. What happens when demand is rising faster than supply? Prices rise. These capacity constraints should result in higher fares benefitting United Airlines, placing it in a position to grow revenue faster than costs increasing profitability. At the same time, United has a large order book of aircraft, enabling it to increase market share compared to its competitors, and improving its competitiveness by offering greater connectivity. Overall, this means that United can continue to benefit from rising demand, both through increasing capacity and higher airfares due to supply constraints on aircraft.

Valuation

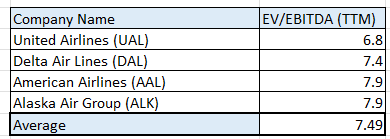

United Airlines currently trades at x9.39 forward earnings, significantly lower than the wider market, and its competitors. It trades at an EV/EBITDA of 6.8 a notable discount compared to peers such as Delta Air Lines (DAL), Alaska Air Group (ALK), and American Airlines (AAL), all fellow large American Airlines. Although United Airlines has faced issues with their fleet of Boeing aircraft and other operational issues, I believe this significant discount cannot be justified given United’s positive outlook.

Table of EV/EBITDA comparisons with data from Seeking Alpha

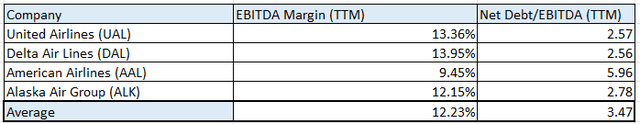

When we compare United Airlines to its peers, we also see that on other key financial metrics such as EBITDA margin and Net Debt/EBITDA, it is among the best performing. It offers the second highest EBITDA margin and the second-lowest Net Debt/EBITDA, while also remaining significantly below the industry average.

(Table of Key Metric comparisons with data from Seeking Alpha)

Given its higher margins and lower debt multiple compared to peers, and combined with its positive outlook, I believe United Airlines shares do not warrant to trade at such a discount to its peers. Additionally, current forecasts suggest growth in earnings per share over the next few years. I therefore rate United Airlines’ shares a “Buy”.

Risks

As with any investment, there are several risks, I believe it is important to consider. The main risks are near universal across the airline industry, and I covered them in more detail in my previous article on American Airlines. These are the impact of fuel prices, the cyclical nature of the industry, and labor relations.

Currently, I see fuel prices as lower risk. Although conflict in the Middle East does provide some uncertainty, fuel prices have remained stable over the past year and fell slightly in the 3rd quarter. Even though OPEC has delayed the unwinding of their oil production cuts, demand remains weak, especially with a global manufacturing slowdown. This ensures significant excess capacity, putting a cap on how high the price could rise. Combined with the incoming administration in the US supporting greater oil production, I see the prospect of rising fuel prices unlikely.

As with any airline, United Airlines operates in a highly cyclical industry and is incredibly sensitive to economic downturns. During recessions, demand for both business and leisure travel declines significantly, which often leads to significant reductions in revenue. As such, United Airlines’ financial performance is closely tied to overall economic health. Although the American economy appear strong, this may change, and, as an international operator, United can also be impacted by weaker activity in other regions.

Finally, labor relations remain an ongoing issue that can impact United given its heavily unionized workforce. With the flight attendants union authorizing strike action the prospect of strikes looms, which would force United to ground flights. Contract negotiations have been suspended to 2025, but only time will tell if an agreement is reached. Strike action is not the only form of labor action that could affect United, with large pay rises often demanded, significantly adding to labor costs.

Conclusion

In conclusion, I believe that United Airlines continues to offer an opportunity for investors despite the more than doubling in the share price so far this year. With demand for air travel holding strong, stable fuel prices, solid third-quarter results, and the restart of share buybacks, United is well positioned.

Compared to its peers, its valuation remains attractive, with strong EBITDA margins, lower debt ratios, and the lowest EV/EBITDA multiple in its peer group. While the risk of worsening labor relations with the flight attendant union remains, United’s ongoing growing route network, and the company’s solid fundamentals, suggest further potential upside. As such, I believe the shares remain a buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.