welcomeinside/iStock via Getty Images

Investors face a contradiction going into 2025 as they expect the Federal Reserve to cut interest rates and for U.S. businesses to boost profits. One of these expectations has to be wrong, according to analysts at financial-services firm Societe Generale.

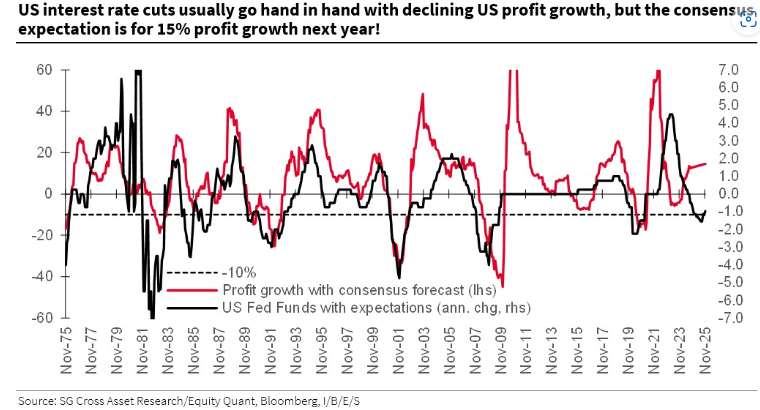

“Historically, when U.S. interest rates are cut by the extent expected by markets next year, U.S. profits decline by 10%, yet the consensus is for 15% EPS growth next year!” Andrew Lapthorne, analyst at Societe Generale, said in a November 30 report.

Source: Societe Generale

As inflation this year fell to the Fed’s target of 2%, the central bank began cutting rates amid signs of a weakening labor market. The Fed in September cut its key interest rate by 0.5 percentage point, and again by 0.25 percentage point in November. Investors expect the Fed to cut rates from the current target range of 4.5% to 4.75% to a range of 3.75% to 4% as soon as September 2025, according to CME Group’s Fed Watch Tool.

“Interest rates are expected to be cut because inflation has fallen back towards the Fed’s target. But, of course, by decelerating inflation you are also reducing sales growth,” Lapthorne said. “And because costs are slower to adjust than prices and volumes, margins decline as sales growth slows.”

There may be some distortions in the data because of the outsized effect of the Magnificent Seven stocks that make up a significant part of the stock market’s total value, he said. Those companies are Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL), Amazon (NASDAQ:AMZN), Apple (NASDAQ:AAPL), Meta Platforms (NASDAQ:META), Microsoft (NASDAQ:MSFT), Nvidia (NASDAQ:NVDA) and Tesla (NASDAQ:TSLA).

“The choice for 2025 then appears to be strong profits growth and therefore less rate cuts or the other way around, but it’s hard to envisage both!” Lapthorne said.