Summary:

- NVIDIA’s AI-driven growth is surging, with sales hitting a $150 billion annual run rate despite supply constraints and production delays with new Blackwell GPUs.

- The company is reporting unsustainable margins that will normalize over the long term; however, current momentum suggests further upside over the next 1 to 2 years.

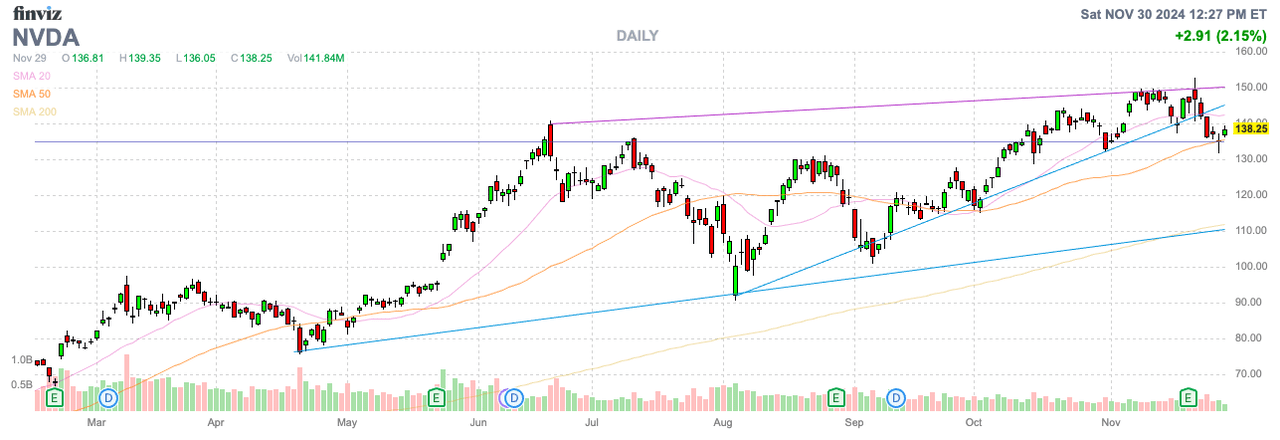

- The stock should have more upside based on the cheap valuation compared to growth rates with the stock only trading at 31x FY26 EPS targets.

Morsa Images

The world continues to charge into AI data center demand that NVIDIA Corporation (NASDAQ:NVDA) (NEOE:NVDA:CA) has easily hurdled a couple of apparent hiccups with their new Blackwell GPUs. The chip company will face major long-term margin compression, but for now, the business should charge ahead. My investment thesis remains Bullish, with the market somewhat fighting the expected strong results ahead.

Still Supply Constrained

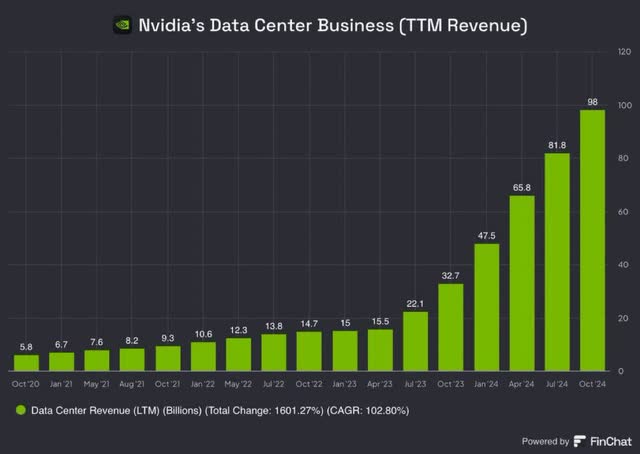

Nvidia just reported a quarter where sales grew an astonishing $5 billion sequentially. The GPU company reported revenues of $35 billion, beat consensus estimates by nearly $2 billion.

The company had only reported a sequential quarterly beat of $4 billion in FQ2 to reach $30 billion after hitting $26 billion in FQ1. Nvidia shows no signs of slowing down, despite apparent manufacturing issues with the new Blackwell GPUs and issues with ongoing supply constraints.

The incredible part is that Nvidia went into the FQ2 earnings report back in September with guidance for revenues of $28 billion and ended the recent quarter with guidance for FQ4 sales of $37.5 billion. Within a 3-month period, quarterly sales exceptions surged to nearly $10 billion.

The GPU company is growing at unprecedented levels for a company now hitting an annual run rate of $150 billion in sales. Nvidia has grown trailing data center revenues 6-fold in just a couple of years, with quarterly revenues now double prior annual revenues.

The interesting part of the story is that the new Blackwell GPUs are so complex, investors shouldn’t have really been surprised with any production delays. The Blackwell GPU is a marvel of modern chip design with 208 billion transistor manufactured using a custom-built TSMC 4NP process.

The big hyperscalers have apparently ordered a massive amount of the GB200 chips. Google (GOOG) has ordered 400K chips valued at $10 billion, while Meta Platforms (META) ordered 360K chips for $8 billion. Regardless of these volume levels, Morgan Stanley recently reported Blackwell chips were already sold out for the next 12+ months.

Despite the staggering sales numbers, Nvidia is still predicting supply constraints for an extended period. On the FQ3’25 earnings call, CFO Colette Kress made the following statement about demand levels:

Blackwell demand is staggering and we are racing to scale supply to meet the incredible demand customers are placing on us. Customers are gearing up to deploy Blackwell at scale.

Back on the FQ3’25 CFO letter, Ms. Kress suggested the supply issue would extend far into 2025 as follows:

We will be shipping both Hopper and Blackwell systems in the fourth quarter of fiscal 2025 and beyond. Both Hopper and Blackwell systems have certain supply constraints, and the demand for Blackwell is expected to exceed supply for several quarters in fiscal 2026.

A few quarters into FY26 is at least the July quarter before supply catches up with demand. Nvidia is forecast to reach upwards of $51 billion in quarterly revenues by FQ3’26. At this point, the company might finally catch up with supply, with revenues already running at a $204 billion annual clip.

Ultimate Margin Story

A big key to investing is understanding where a stock will ultimately end up when growth and margins normalize. Stocks regularly trade from $50 to $200 and back down to $100, or even lower, due to normal business cycles.

In our view, Nvidia likely sees a similar trading pattern, though one never knows the ultimate high and how low the stock trades after AI GPU demand peaks. What investors do know is that AI demand continues to soar, leading to inflated profits and margins.

As The Next Platform highlights, the Blackwell GPU takes more than twice the Hopper GPUs to complete the work, but the Blackwell GPU is only forecast to generate 1.7x the revenues. The device is clearly more expensive to develop.

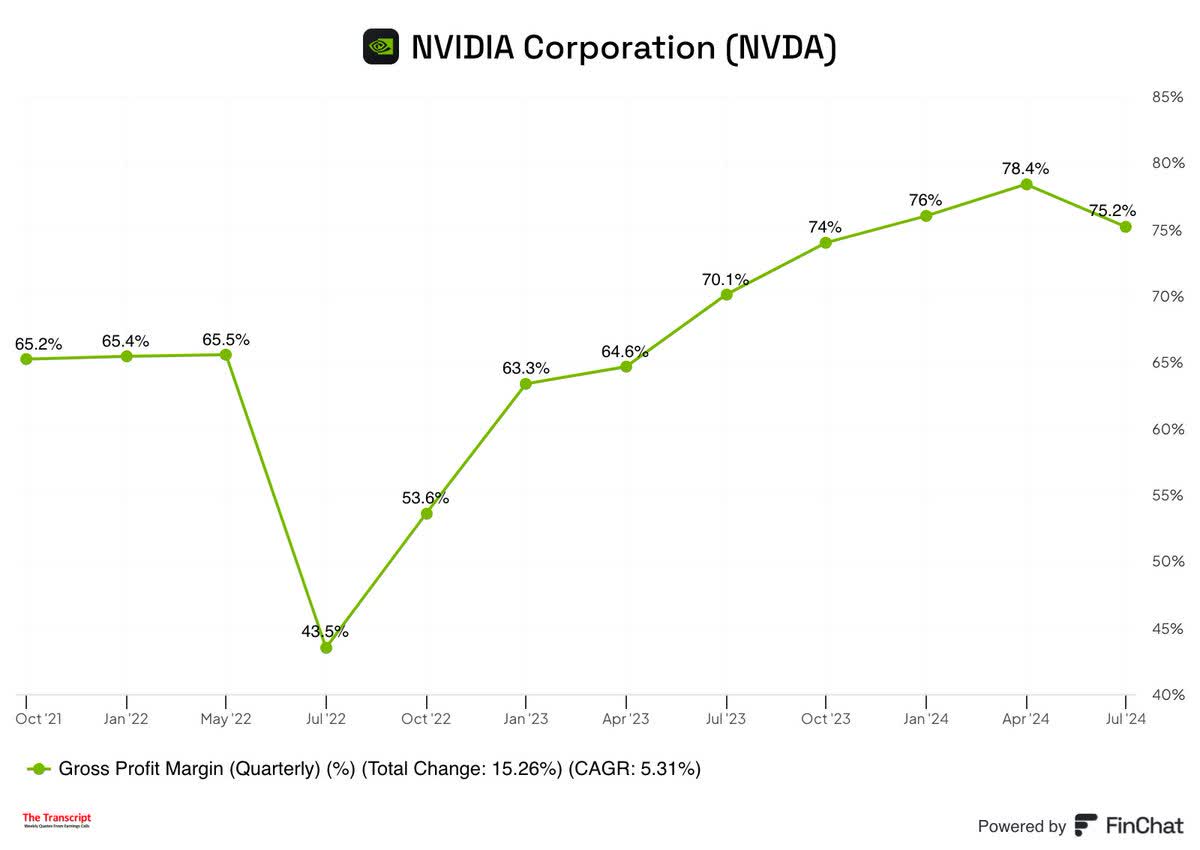

Nvidia just reported a quarter where gross margins were a very strong 75% with insane operating margins of 66%. At some point, these gross margins will likely normalize more in the mid-60% range with operating margins in the mid-40% range, at best.

Source: The Transcript Twitter/X account

Prior to the AI surge, Nvidia was already the dominant player in GPUs. The company regularly reported 65% gross margins

Back on the FQ3’25 earnings call, the CFO highlighted an interesting gross margin impact from the Blackwell chip has follows:

As Blackwell ramps, we expect gross margins to moderate to the low-70s. When fully ramped, we expect Blackwell margins to be in the mid-70s.

Nvidia is already seeing gross margins pull back due to the huge costs and complexity of the Blackwell chips. What typically occurs is that the company runs into competition in the future, pressuring gross margins and ultimately leading management to dramatically increase operating expenses to hold on to market share.

Currently, Nvidia only trades at 31x FY26 EPS targets of $4.42. The stock actually still appears cheap with sales targeted to grow over 50% next year to reach an insane $195 billion more than supporting the rich multiple with the EPS having a similar targeted growth rate.

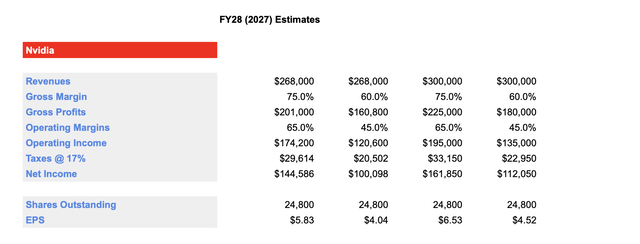

The issue that Nvidia ultimately faces is that a normalization of margins will cause EPS to remain virtually flat with the current FY26 target. Using the current FY28 revenue target of $268 billion, along with factoring in upside potential to $300 billion, investors can see how the EPS turns out based on both margin scenarios.

Source: Stone Fox Capital estimates

The EPS jumps to a high of over $6.50 on max margins with $300 billion in revenues, while the EPS actually plunges to nearly $4 on the current FY28 revenue target with margins normalizing. Remember, an operating income margin of 45% is still historically strong and difficult to maintain, and this is the worst-case scenario for now.

What an investor doesn’t really understand is when Nvidia runs into the peak revenues and margins scenario. The stock currently trades at $138 and could easily trade upwards of $200 with the way revenues are still surging with constrained Blackwell supply.

The stock could easily trade at 35x FY27 EPS targets of $5.58 in about a year when the market starts looking forward to the next year. At that point, Nvidia is still growing earnings at a rate faster than the valuation multiple, suggesting the stock could still be viewed as cheap by the market. If the company still grows FY27 earnings at a 26% clip, Nvidia could easily trade at a higher multiple than the 35x forward earnings number needed to reach $200 next year.

The big question is what happens when margins normalize and the stock is looking at a year with EPS declining. In the future, Nvidia might be lucky to trade at 25x a forward EPS target of $4, or just $100. The risk is high, if the company fails to execute, or AI GPU growth stalls.

The scenario could definitely play out with Nvidia running all the way up to even $300 before falling to $100 when margins normalize. Either way, investors should stick with the trend and ride the stock higher for now.

Takeaway

The key investor takeaway is that investors should continue riding the trend with Nvidia. The momentum is too strong to jump off the ship now. Eventually, the margin story will wreck the earnings growth, but investors could be years away from facing that scenario.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to start December, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial to started finding the best stocks with potential to double and triple in the next few years.