Summary:

- Palantir’s stock is driven by unrealistic expectations rather than fundamentals, despite impressive growth in AI-driven government and commercial segments.

- Indeed, the company’s Q3 performance was strong, with a 30% YoY revenue increase and an 8th consecutive quarter of margin growth.

- Despite robust financials and AI advancements, excessive share dilution and insider selling raise concerns about long-term sustainability.

- The last time I looked at PLTR in early September this year, the stock was trading at 86.7x forwarding P/E. Now, it’s trading at 177.2x – 104% higher.

- I maintain my “Hold” rating on Palantir this time as I believe that the current overvaluation might not end well for today’s buyers in 2-3 years.

hapabapa

Intro & Thesis

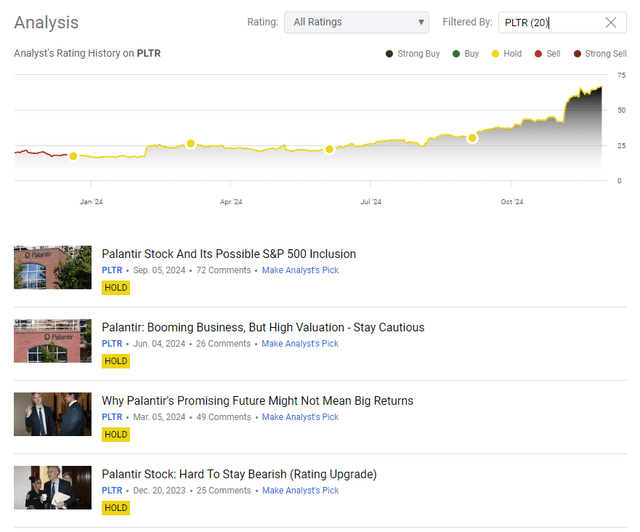

I’ve been covering Palantir Technologies Inc. (NASDAQ:PLTR) here on Seeking Alpha since October 2021, initially rating the stock as a “Sell” due to its overvaluation and seemingly limited growth at the time. My bearish calls were successful for about a year – until market expectations shifted towards rapid growth through artificial intelligence, allowing PLTR stock to recover quickly. Due to the persistent overvaluation, I couldn’t upgrade PLTR to “Buy,” although the positive impact of the then-new AIP boot camp program seemed quite obvious. So I upgraded the stock to “Hold” in February 2023 and have written about the company once a quarter since then, coming to mostly neutral conclusions.

Seeking Alpha, the author’s coverage of PLTR stock

Last time, I argued that the inclusion of PLTR into the S&P 500 Index (SPX) (SPY) could give bulls another catalyst to enjoy. However, I still thought that PLTR’s glowing overvaluation at the time suggested limited returns for investors in the years ahead. As you might see from the above screenshot, my assumption and cautious stance didn’t age well, as the stock managed to more than double since my last neutral call.

Today we see the company is growing by bounds and leaps indeed. But I believe that the current PLTR’s valuation is primarily driven by unrealistic hope and overextended expectations, rather than tangible fundamentals. The market seems willing to overpay for Palantir based on this optimism, assigning an excessive premium that, in my view, is unsustainable. For these reasons, I maintain my neutral rating unchanged.

Why Do I Think So?

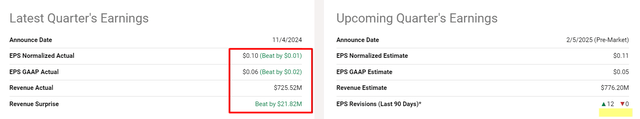

Palantir Technologies exhibited exceptional performance during fiscal Q3 2024 and experienced robust growth across its government (+33% YoY in sales) and commercial business (+54% YoY) segments with increasing use of its AI-based solutions. The consolidated Q3 revenue increased 30% year-over-year to $726 million, topping guidance by $24 million (the market consensus was beaten by almost $22 million as well). This represented a dramatic increase from the 17% YoY growth rate in Q3 2023, which clearly shows the company’s readiness to take advantage of the AI revolution.

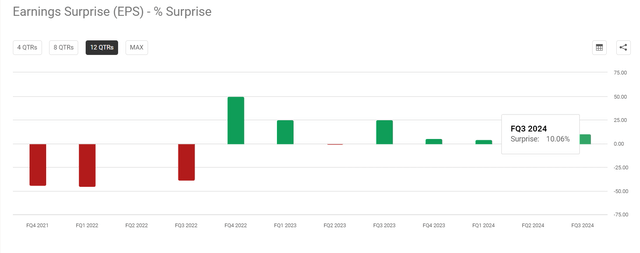

The adjusted operating margin for the quarter was 38%, from 29% in Q3 2023, making this the 8th consecutive quarter of margin growth. As a result, the beat of consensus on the bottom line amounted to about 10%. So the strong dynamics of earnings surprises since last year kept going well, leading to unambiguous positive earnings revisions for Q4 EPS and sales expectations:

As was the case in the last few quarters, the solid expansion of the commercial segment was driven by the use of Palantir’s Artificial Intelligence Platform (AIP), a critical component of the company’s strategy. In case you haven’t heard of it, simply put, AIP allows organizations to make AI work by embedding it in workflows, this way basically offering an edge over peers. As a prime example of how AIP may be essential for businesses, during the Q3 earnings call, Palantir featured cases including automating underwriting processes for a large insurance company, reducing response time from 2 weeks to just 3 hours, and creating a $30 million bottom-line impact for Trinity Rail within 3 months. The company’s success in turning boot camp students into value customers looks impressive indeed, with a handful of clients making seven-figure ACV commitments within 2 months of their first sign-on, according to the company. Total commercial customers in the US rose 77% over the prior year to 321, demonstrating strong demand for the company’s offering.

The government segment saw strong performance as well, with revenue up 33% YoY to $408 million. U.S. government revenues, in particular, rose to $320 million, a 40% YoY and 15% QoQ increase. That increase came primarily through robust program execution, new contract signings, and good deal timing. The management said their Maven Smart System has helped the U.S. military shrink the number of targeting cells from 2,000 to 20 while maintaining effectiveness. Palantir also announced a new 5-year agreement to further leverage Maven’s AI/ML platform for all branches of the US military, further consolidating its position as a premier defense partner, so I think the growth in this segment is likely to be sustained in the next few years. On the other hand, I think there is one risk factor here that suggests no acceleration in growth: U.S. military support for Ukraine could potentially decrease under a Trump administration. A potential de-escalation or pause in military actions between Russia and Ukraine may also negatively impact future growth rates for PLTR’s government segment.

I like the fact that PLTR’s adjusted free cash flow totaled $435 million, a 60% margin, and trailing 12-month FCF was above $1 billion for the first time in the company’s history. Palantir ended the quarter with $4.6 billion in cash and no debt. When we see no debt, we shall keep in mind that there’s likely another form of financing – otherwise, the rapid growth in financials PLTR managed to boast of couldn’t be real. And so we find that PLTR’s diluted shares outstanding increased by 1.8% and 5.76% QoQ and YoY, respectively and that’s although the firm repurchased ~1.8 million shares during the quarter, with $954 million under the current authorization. That’s a lot of dilution, in my view, and the heavy sales of insiders don’t help brighten this picture at all.

TrendSpider Software, PLTR, notes added

As it is, share-based compensation (a quarter in which it accounted for 22% of revenue) continues to be an issue as it effectively promises more dilution. I’m not against increasing the number of shares in circulation if it helps accelerate growth and the net-net impact is positive for expansion. But to be honest, it’s also concerning that insiders seem to be selling off their positions at every opportunity (as far as I can see it).

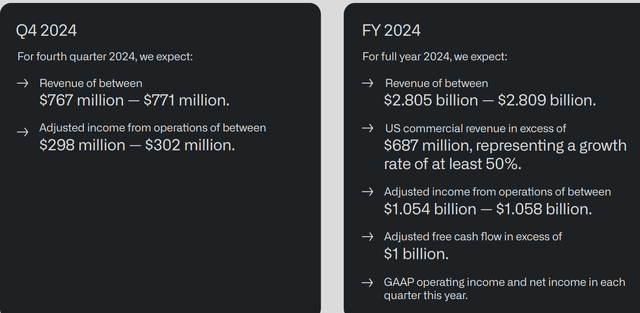

Anyway, looking ahead, Palantir’s executives have boosted their full-year 2024 revenue guidance to a midpoint of $2.807 billion (up 26% YoY). The firm also raised adjusted EBIT guidance to more than $1 billion and adjusted FCF guidance for the year to over $1 billion. For Q4 2024, Palantir expects revenues of $767-771 million and adjusted operating income of $298-302 million as they seem to be confident in AIP’s long-term growth and that it’s going to be driving customer acquisition and growth further.

Let’s take a realistic look at how a strong company like Palantir can grow in the future and assess whether its current valuation is justified. According to Grand View Research, the global enterprise AI market size was estimated at $23.95 billion in 2024 and is expected to grow at a CAGR of 37.6% from 2025 to 2030. Similarly, the U.S. aerospace and defense AI market is estimated at $7.82 billion in 2024 and is expected to reach approximately $20.50 billion by 2034, growing at a CAGR of 10.09%, according to Precedence Research.

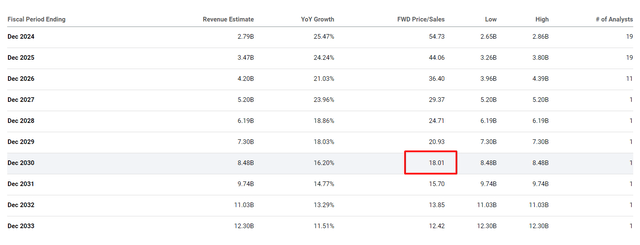

In an optimistic scenario, the total market volume (TAM) for AI in companies could reach $150 to 200 billion annually by 2030. However, the market’s projected revenue for Palantir by FY2030 is estimated at just $8.5 billion. This means that the implied price-to-sales ratio for FY2030 would be around 18x based on the company’s current market cap of approximately $150 billion – an extremely high multiple.

Seeking Alpha, PLTR, notes added

Clearly, the market is pricing in the expectation that Palantir will remain a key market leader in the AI space. However, even according to analysts’ optimistic forecasts, the company is unlikely to capture more than 10% of the overall market. A more realistic estimate assumes that Palantir’s market share will be closer to 4-6% under favorable conditions. So given this, the current market cap of $150 billion appears to be significantly overvalued even with today’s optimistic growth assumptions.

The company needs to exceed current forecasts for revenue and net income per share growth by approximately 25-30% annually to justify the market’s high level of optimism. However, in reality, we see that, at best, this year’s performance might exceed expectations by only 9-11%. This indicates that, despite its impressive growth, the company is already falling significantly short of the lofty expectations placed upon it. At least, this is how the situation appears to me from an outside perspective.

Seeking Alpha, PLTR, notes added

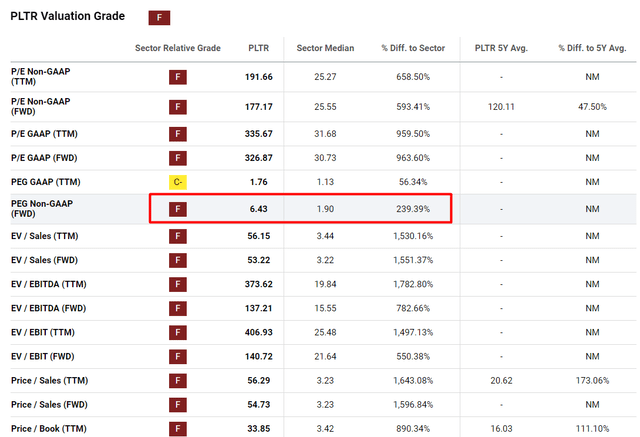

Analysts from Argus Research (proprietary source) share my view that Palantir is extremely overvalued: Compared to its peers, PLTR’s key valuation multiples are several times higher:

Palantir’s lagging EV/revenue multiple of 42.4 is more than double the four year historical average of 20. On a forward basis, Palantir’s EV/revenue multiple of 33.6 is a multiple of the peer average of 7.1.

Source: Argus Research (proprietary source)

I know that many bulls justify Palantir’s current valuation by arguing that the market doesn’t fully grasp its high potential for future profit growth. However, let’s be realistic: Even if we consider the PEG ratio, which compares the price-to-earnings ratio to the EPS growth rate, on a forward-looking basis Palantir’s PEG stands at 6.4x. This is nearly 3.5 times higher than the IT sector median. It’s worth noting that the IT sector as a whole is already trading near peak valuation levels. In this context, Palantir isn’t only overvalued but is trading at a significant premium – 3.5 times higher – relative to an already overvalued sector.

Seeking Alpha, PLTR, notes added

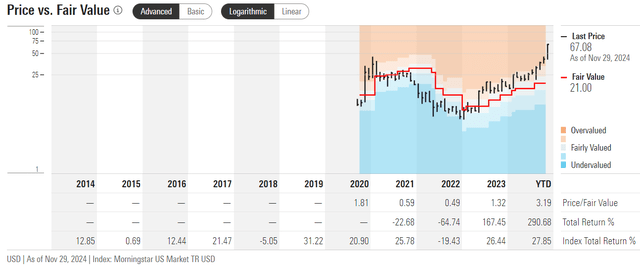

Analysts from Morningstar Premium confirm that a potential overvaluation of PLTR could amount to tens of percentages:

Morningstar Premium, PLTR’s fair value model (proprietary source)

Based on all that, I wouldn’t take the risk today, as buying into this strong rally in PLTR stock seems irrational.

The Verdict

Palantir’s commitment to deploying AI, growing its commercial and government enterprise operations in the United States, and strong financial controls will likely make it an excellent candidate for business growth. As management reiterates its guidance for Q4 and FY2025, the company expects to remain in growth mode with additional investments in AIP and strategic alliances. On the other hand, all that potential growth seems to be already reflected in the stock price. So investors have to be wary of the high price and possible downside risk from the firm’s dependency on massive, difficult contracts and global expansion – maybe it’s finally time to follow the insiders and keep trimming.

While Palantir continues to evolve and penetrate different end markets, its high valuation multiples seem to be irrational. The last time I looked at PLTR in early September this year, the stock was trading at 86.7x forwarding P/E. Now it’s trading at 177.2x, 104% higher, which explains the explosive growth in the quotes. The upside from here seems to be irrational, in my view.

I maintain my “Hold” rating on Palantir this time, as I believe that the current overvaluation might not end well for today’s buyers in 2-3 years.

Thank you for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!