Summary:

- PayPal’s revenue quality is improving with increased value-added services, growth in active accounts, and better credit quality of merchant loans.

- PYPL’s outlook for transaction margins is positive, driven by better monetization of Braintree and expanded service offerings.

- Valuation is at a 15.5% discount to the median comps, which is attractive given the context of improving operational metrics.

- I’m waiting for proof of revenue growth acceleration under new CEO Alex Chriss.

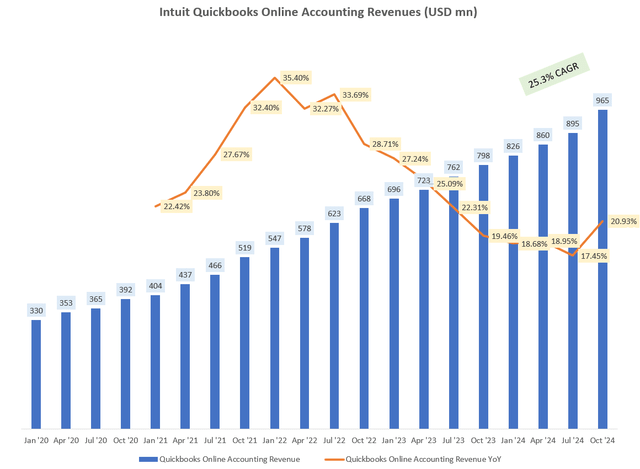

- CEO Alex Chriss has a good track record of delivering on growth, as evidenced by how he helped Intuit’s Quickbooks grow at a 25% CAGR. However, a similar revenue growth acceleration in PayPal is yet to materialize.

bizoo_n

Performance Assessment

I’ve had a ‘Sell’ view on PayPal (NASDAQ:PYPL) (NEOE:PYPL:CA), but that has not worked out well as the stock has handily outperformed the S&P 500 (SPY) (SPX) (IVV) (VOO) since then:

Performance since Author’s Last Article on PayPal (Seeking Alpha, Author’s Last Article on PayPal)

Thesis

After the last couple of quarters of results, I am upgrading my view to a ‘Neutral/Hold’:

- There is some improvement to revenue quality metrics

- There are transaction margin tailwinds

- Valuation is at a discount to the median comps

- Relative technicals remain bearish

- New management team’s progress is a key monitorable

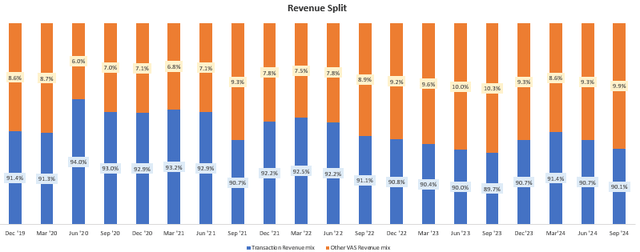

There is some improvement to revenue quality metrics

In my last note, I had expressed my dismay that the quality of revenue growth metrics was weak as the proportion of value added services was decreasing, which increased reliance on transaction and take rates as opposed to stickier revenue streams arising from PayPal’s commerce ecosystem.

Revenue Split (Company Filings, Author’s Analysis)

However, the last 2 quarters have shown an improvement in this regard as the proportion of value added services (VAS) revenues has started to increase back toward the historical peak levels of ~10%.

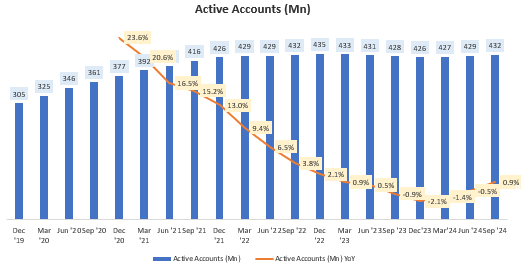

Another crib I had was regarding the stagnancy and decline of active accounts. And here too, PayPal is showing early signs of increase or at least an arrest to the declines:

Active Accounts (Mn) (Company Filings, Author’s Analysis)

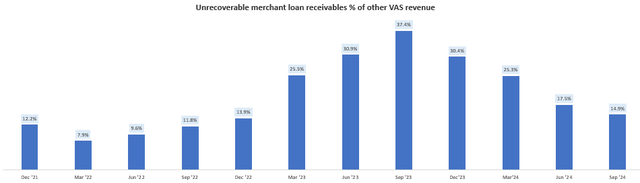

Thirdly, the credit quality of the merchant loans has also dramatically improved particularly over the last couple of quarters because the proportion of unrecoverable merchant loan receivables has also shown a steady decline to 14.9%; down from peak 37.4% levels at the same time last year:

Unrecoverable Merchant Loan Receivables as % of Other VAS Revenue (Company Filings, Author’s Analysis)

Due to these factors, I believe PayPal’s revenue quality metrics are slowly improving. If there is a continuation of these trends, I anticipate some multiple expansion to occur in the pricing of the stock.

There are transaction margin tailwinds

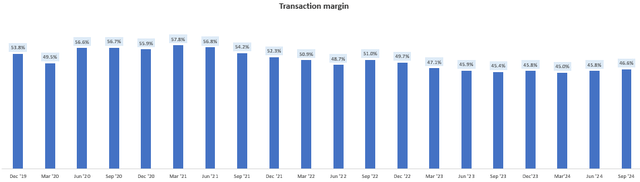

PayPal’s transaction margins have dipped more than 10% over the past 3 years from the mid-high 50% levels to the mid 40% levels:

Transaction Margin (Company Filings, Author’s Analysis)

But more recently in the last couple of quarters, this metric too is climbing steadily, driven particularly by renegotiations of Braintree contracts with merchants that is improving monetization via the offering of a more expanded suite of services:

This is now the second consecutive quarter in more than two years, that Braintree is meaningfully contributing to transaction margin dollar growth. We’re having very constructive conversations with our merchants, focused on ways we can enable strategic growth opportunities that drive long-term upside for both of us. What is different today is that we now have a suite of value added services, including payouts, risk as a service, orchestration, guest checkout and personalization capabilities that help attract new customers and convert them more effectively, in addition to world-class payment processing.

– CEO Alex Chriss in the Q3 FY24 earnings call

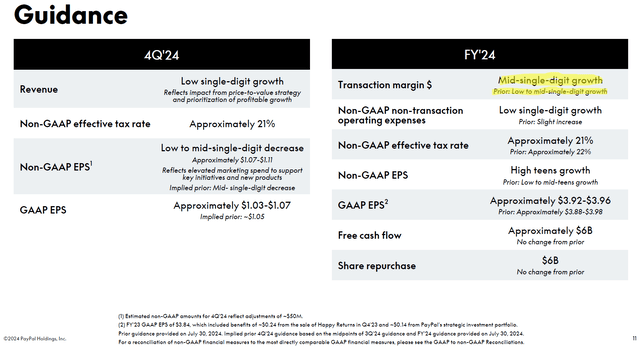

Hence, I expect further transaction margin improvement in the upcoming quarters. Indeed, management has also raised FY24 transaction margin guidance from low-mid-single-digit YoY growth to mid-single-digit YoY growth:

Q3 FY24 Guidance Update (PayPal Q3 FY24 Investor Presentation, Author’s Highlights)

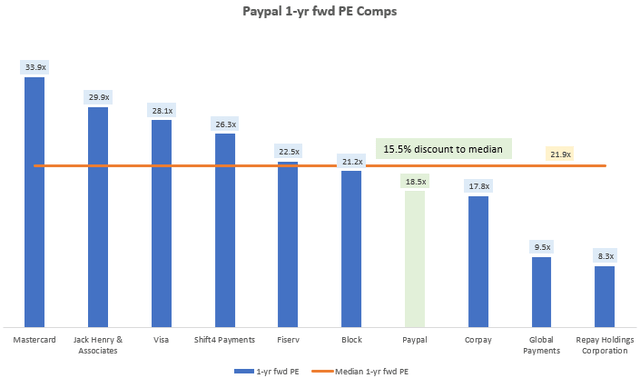

Valuation is at a discount to the median comps

PayPal 1-yr fwd PE Comps (Capital IQ, Author’s Analysis)

Relative to its payment peers, PayPal is currently trading at a 1-yr fwd PE of 18.5x, corresponding to a 15.5% discount to the median 1-yr fwd PE of 21.9x. Given the positive turn of revenue quality and margin developments, I believe this discount valuation improves the attractiveness of PayPal stock.

Relative technicals remain bearish

If this is your first time reading a Hunting Alpha article using Technical Analysis, you may want to read this post, which explains how and why I read the charts the way I do. All my charts reflect total shareholder return as they are adjusted for dividends/distributions.

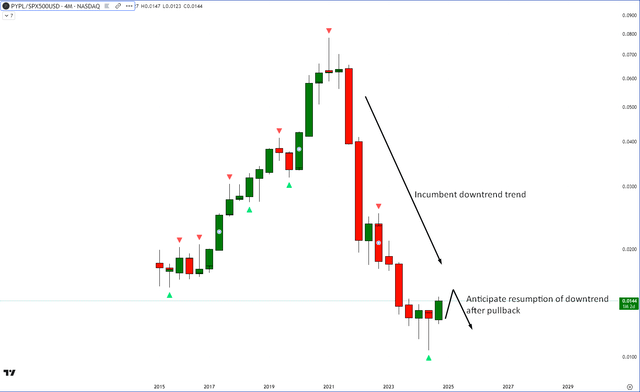

Relative Read of PYPL vs SPX500

PYPL vs SPX500 Technical Analysis (TradingView, Author’s Analysis)

On the 4-monthly (multi-quarter) charts, PYPL vs SPX500 is still in an incumbent downtrend. There is some basing going on recently that has paused further declines. However, my technical analysis interpretation suggests that another leg down can be expected as the ratio prices react off the sellers’ supply area.

Management team’s progress is a key monitorable

Since the current CEO Alex Chriss’ appointment last year in Sep 2023, PayPal has had a revamp of its broader management team as well, with new heads in finance, marketing and technology. This team is executing on a strategic shift to diversify beyond the payments business into more value-added-services associated with a full-fledged commerce platform.

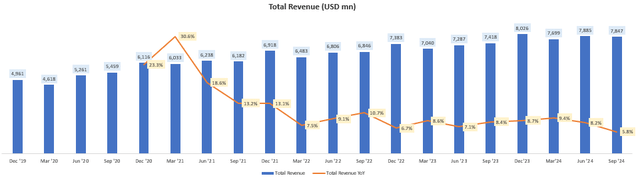

Now so far, the results are not yet apparent in the overall revenue profile of PayPal, which is growing at a decelerating rate of 5.8% YoY:

Total Revenue (USD mn) (Company Filings, Author’s Analysis)

However, there is reason to be optimistic since at his last position as Executive Vice President and General Manager of Intuit’s Small Business & Self-Employed Group at Intuit (INTU), Alex Chriss was responsible for the Quickbooks Online Accounting business, which has grown handsomely at 25.3% CAGR since he took over effectively since 2020:

Intuit Quickbooks Online Accounting Revenues (USD mn) (Intuit Company Filings, Author’s Analysis)

Currently, I am inclined to wait for early signs of a similar growth acceleration in PayPal before considering buy positions in the stock.

Takeaway & Positioning

My earlier ‘Sell’ view on PayPal has not worked out well, as the stock has handily outperformed the S&P500 since my last update. Looking at the last couple of quarters of results, I do notice some improvement in key operational metrics. The quality of revenues seems to be steadily improving as the value added services mix is increasing, reflecting greater monetization of stickier revenues associated with PayPal’s ecosystem, there is a small increase in active accounts growth, and the credit quality of merchant loans has dramatically improved as evidenced by a lower proportion of unrecoverable loans. On the margins side, better monetization of Braintree is leading to upgrades in the outlook for transaction margins.

Given these positive developments, I believe the 15.5% discount valuation vs comparable peers makes the stock more attractive. However, relative to the S&P500, the technicals still point bearish on the multi-quarter charts.

Compared to my last update, I do lean more bullish on PayPal and have some confidence in CEO Alex Chriss to drive a growth revival since he has a good track record in growing Intuit’s Quickbook business in his last leadership position. However, I am still waiting for some proof in the numbers via an acceleration in PayPal’s overall revenues growth rate.

Overall, I rate the stock a ‘Neutral/Hold’.

How to interpret Hunting Alpha’s ratings:

Strong Buy: Expect the company to outperform the S&P500 on a total shareholder return basis, with higher than usual confidence. I also have a net long position in the security in my personal portfolio.

Buy: Expect the company to outperform the S&P500 on a total shareholder return basis

Neutral/hold: Expect the company to perform in-line with the S&P500 on a total shareholder return basis

Sell: Expect the company to underperform the S&P500 on a total shareholder return basis

Strong Sell: Expect the company to underperform the S&P500 on a total shareholder return basis, with higher than usual confidence

The typical time-horizon for my views is multiple quarters to more than a year. It is not set in stone. However, I will share updates on my changes in stance in a pinned comment to this article and may also publish a new article discussing the reasons for the change in view.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VOO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.