Summary:

- Rocket Lab’s rapid growth, disciplined strategy, and innovative capabilities position it as a serious contender in the space industry, with a 55% revenue increase and 80% backlog surge.

- Despite its high valuation at 32.5x sales, Rocket Lab’s focus on premium contracts and reliable execution supports its long-term potential.

- The upcoming Neutron rocket and diverse revenue streams from components and launches enhance Rocket Lab’s market position as an end-to-end space player.

- New investors should approach with caution due to valuation risks, competitive pressures, and the speculative nature of this volatile, growth-focused investment.

anilakkus/iStock via Getty Images

Introduction

“David Vs. Goliath: Rocket Lab Is Coming For The Big Boys”

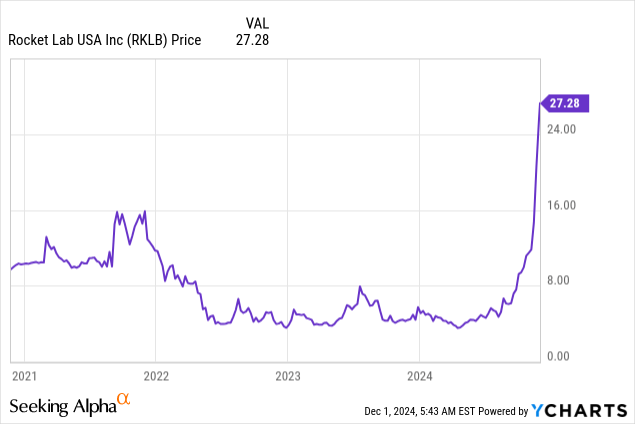

This is the title I used for my August 23 article about Rocket Lab USA (NASDAQ:RKLB), the “mini-SpaceX” that has turned into my best pick ever. Since then, shares have returned 295%, annihilating the 7% return of the Standard & Poor’s 500.

Unfortunately, I’m not in it, as I decided to stick with the conservative aerospace companies I already had in my portfolio.

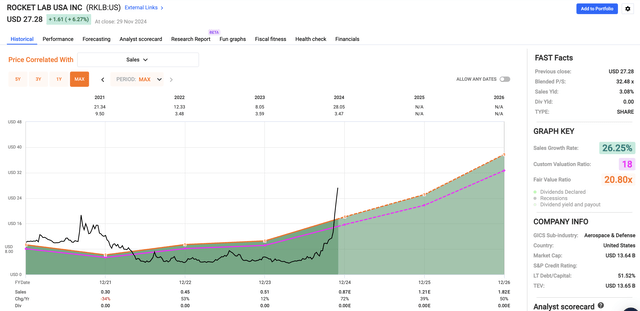

The only reason why I do not own RKTL is my focus on larger, dividend-paying, defense companies. These have close to 20% exposure in my portfolio. RKLB is the only company on my radar I value on a price/sales basis.

The good news is that I know for a fact that many of my readers own Rocket Lab, which is why it is so important to keep an eye on this surge. After all, we don’t want to fall victim to “easy come, easy go.”

Hence, in this article, I’ll update my thesis, using its latest earnings and new developments in its industry that explain why the market continues to be so upbeat.

So, let’s keep this intro short and get right to it!

Rocket Lab Is Making Headlines

The most spectacular space company on the planet may be SpaceX. After all, its launches are watched by millions, especially the ones where the company demonstrates its ability to recycle parts of the rocket. This included the part where the tower caught the booster, something that was truly unheard of.

With that said, SpaceX is expected to be worth roughly $250 billion, based on recent financing rounds. Rocket Lab is worth $13.6 billion. Comparing the two is fine, as long as it’s on a relative basis.

After all, just like SpaceX, Rocket Lab is making headlines.

The other day, I watched a Bloomberg segment that discussed the increasing number of rocket launches by Rocket Lab. Essentially, the point was made that the newcomer is quickly gaining ground, diversifying its supply chain, and winning new contracts from private players and government agencies.

One day later, industrial and transportation expert Thomas Black wrote a piece with the title, “Rocket Lab Shows SpaceX Isn’t the Only Game in Orbit.”

The company is proving that SpaceX is not an outlier when it comes to offering efficient launches with strong internal supply chains and attractive contracts. This is a huge headwind for players like Boeing (BA), which needs to rethink the way they approach the space business due to less efficient production processes and bigger dependence on large government contracts.

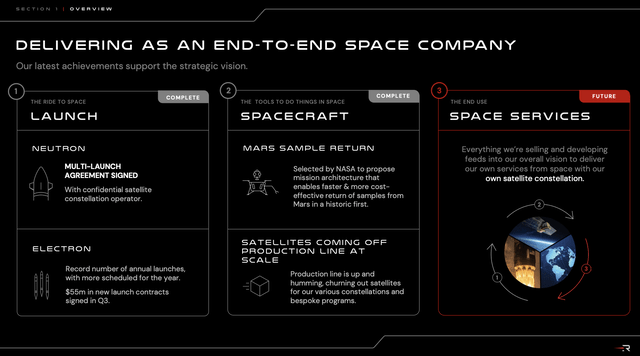

That’s where Rocket Lab comes in, as it not only flies its own missions but also captures an increasing part of the value chain outside of its own company.

The company also makes components that are used by other space companies, a business that now makes up most of its revenue. The goal is to be an “end-to-end space company” that plays in a $320 billion total addressable market, said Peter Beck, the flamboyant New Zealand entrepreneur who’s the driving force behind the company’s torrid pace. – Bloomberg (emphasis added)

On top of that, there’s what Bloomberg described as a “Trump and Musk premium,” as the incoming president is a fan of the industry and supported by the SpaceX founder, who seems to have become his right-hand man.

Rocket Lab Is Firing On All Cylinders

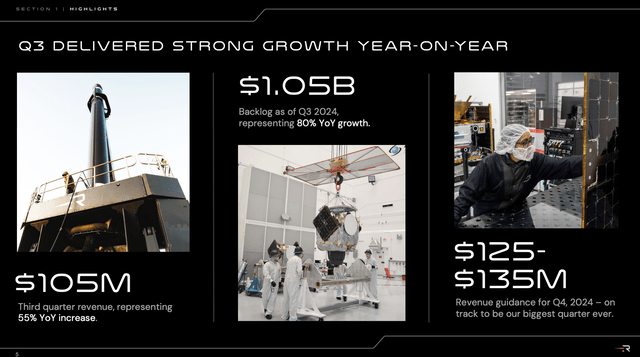

The best thing about Rocket Lab is that its bull case does not rely on a fancy outlook alone. The company’s results are promising, as its third-quarter revenue rose by 55%, with future growth being supported by an 80% backlog increase to $1.05 billion.

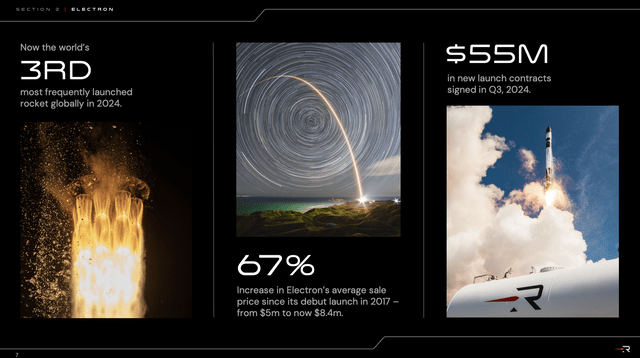

Through the third quarter of this year, it has launched its Electron rocket a record 12 times, making it the third-most active rocket behind SpaceX’s Falcon 9 and China’s Long March.

During the third quarter alone, the company secured roughly $55 million in new launch contracts, with a massive 60% increase in its pricing, which is a great confirmation that customers are willing to pay for the quality Rocket Lab brings to the table. Since its debut, the average price of a launch has risen from $5.0 million to $8.4 million.

Even more important, major achievements include back-to-back launches within eight days and a rapid turnaround of just ten weeks from contract signing to launch.

These operational improvements matter because they cause minimal impact from launch delays, as Rocket Lab collects up to 90% of contract revenue pre-launch.

Next year, the company will (literally) launch its Neutron rocket, supported by the fact that Rocket Lab has built a good reputation. This comes with multi-launch agreements with a commercial constellation operator that fits the company’s initial pricing targets.

Then there’s its Space System segment, which reached multiple milestones in the third quarter. According to the company, its Long Beach facility is now producing spacecraft at a “faster rate than ever,” supported by a backlog of more than 40 units.

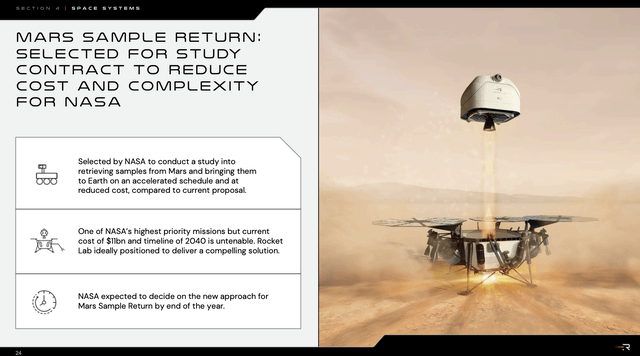

Additionally, this segment includes a study contract for NASA’s Mars Sample Return mission, where the company is tasked with finding solutions to reduce costs and timelines. It also works on its own constellations through projects that are not yet revealed to the public.

With regard to government contracts and the aforementioned pricing gain, the company is not taking on as many contracts as it could potentially handle.

Unlike some of its competitors, the company makes the case that it refrains from signing speculative, nonbinding launch agreements. Instead, it focuses on delivering proven, reliable services.

Essentially, this disciplined approach allows Rocket Lab to demand premium pricing and establish itself as a trusted partner for both commercial and government customers. This includes launching 50 Electron rockets faster than any other commercial rocket.

It’s comparable to a contractor who only takes on jobs he knows he can finish within budget and within the discussed time frame. While they may not get the total revenue they are technically capable of, they build better relationships with customers.

Even better, going forward, the company’s Neutron launch will add new capabilities, allowing the company to address more national security operations, commercial constellations, and scientific missions.

What Does This Mean For Shareholders?

Unlike almost every single stock I discuss on Seeking Alpha, Rocket Lab is not profitable. For the fourth quarter, it expects an adjusted EBITDA loss of up to $29 million. That’s not a bad thing. It’s typical for a company as young as Rocket Lab.

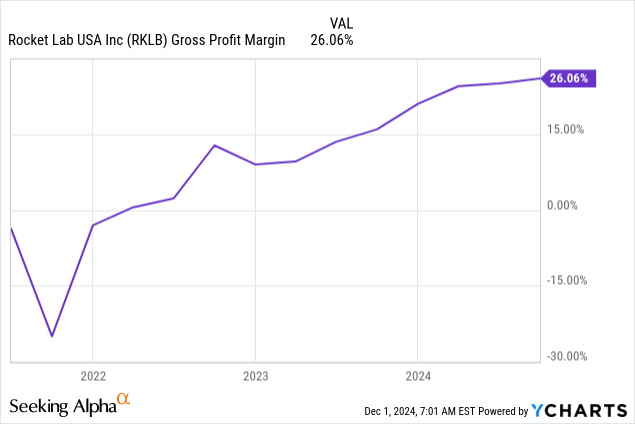

Moreover, the company is expected to boost its gross margins to 26-28% in the last quarter, which would mean a further extension of its longer-term uptrend in gross income profitability.

Right now, the consensus is that Rocket Lab will generate positive net income in 2026 when analysts expect $0.06 in EPS (via FactSet).

With that said, I was way too conservative in the past when I valued Rocket Lab (better safe than sorry was my motto) when I applied a 5x sales multiple. Right now, the company trades at a blended P/S ratio of 32.5x. SpaceX trades at roughly 19x its 2024 sales, assuming $13 billion in sales and a $250 billion valuation.

Applying that number to Rocket Lab would give us a fair stock price target of $33, 20% above its current price.

Hence, I will remain bullish.

However, the bull case is not as strong as it was in August. The recent rally was simply breathtaking and has priced in a lot of good news.

Nonetheless, the company remains on track for greatness if it keeps innovating, improving its supply chain footprint, and if general secular growth in the industry remains strong.

And yes, I absolutely regret not buying the stock in August.

Takeaway

Rocket Lab continues to impress with its rapid growth, disciplined strategy, and innovative capabilities, proving itself as a serious contender in the space industry.

Despite its breathtaking rally and my regret of not buying earlier, I remain bullish on its long-term potential, as the company’s ability to demand premium pricing, secure significant contracts, and improve operational efficiency supports its path toward becoming an even bigger player.

However, because its current valuation includes a lot of good news, new investors should approach this stock with caution.

All things considered, Rocket Lab’s focus on reliability, innovation, and strategic growth makes it a standout in an industry poised for expansion, but patience and timing will be key to maximizing returns.

Pros & Cons

Pros:

- Explosive Growth: Rocket Lab has achieved massive revenue growth, with a 55% increase last quarter and an 80% surge in backlog.

- Strategic Discipline: The company avoids speculative deals, as it focuses on premium contracts and reliable execution.

- Strong Market Position: With a diverse revenue stream from components and launches, Rocket Lab is positioning itself as an end-to-end space player.

- Industry Tailwinds: The space sector’s secular growth, supported by government and commercial demand, provides fertile ground for long-term growth.

- Neutron Rocket Potential: Its upcoming Neutron rocket could unlock more profitable national security and scientific missions.

Cons:

- Valuation Risks: At 32.5x sales, the stock is expensive, with much of the good news already priced in after its massive rally.

- Competitive Pressures: Players like SpaceX and traditional giants like Boeing are always looking to make Rocket Lab’s life tougher.

- Execution Risks: Any misstep in launches or delays in scaling its Neutron program could hurt its premium valuation (stock price).

- Speculative Stock: As much as I love the company, it’s a volatile, growth-focused investment, which is not right for everyone. Please keep that in mind

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.