Summary:

- Shares of Snap have underperformed the broader market this year, and with poor U.S. user growth, I fear the stock has more to lose. I’m downgrading Snap to a sell.

- To me, Snap faces potential obsolescence as other social media companies like Reddit and Instagram compete for viewing time.

- Snap’s valuation multiples are onerous (at >30x adjusted EBITDA), making it best to move to the sidelines and lock in any gains.

Klaus Vedfelt

As the S&P 500 continues to cling nervously near its records, I continue to advocate for active portfolio monitoring as the best way to beat the markets in 2025 and beyond. My macro view is that we’re likely to see a correction of ~10% or more in the next 3-6 months, as I believe investors who are nervous about valuations are waiting for January to lock in gains on some winning positions to defer tax obligations by another year (and possibly at favorable rates, thanks to the expected incoming extension of the Republican tax deals).

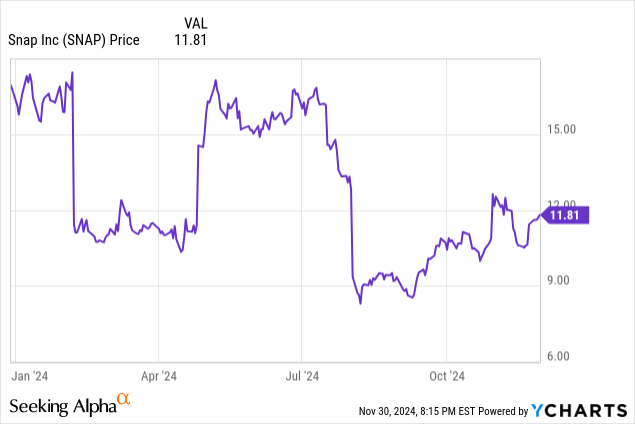

One stock that I find particularly vulnerable is Snap (NYSE:SNAP). Despite an impressive slew of new feature releases over the past year, the company hasn’t been able to reenergize user growth in its core market, the U.S. Amid the rising popularity of competing social media platforms, I believe Snap is in the slow fade portion of its lifecycle. Against this backdrop, shares of Snap have shed nearly 30% of their value this year: but the stock is still trading at expensive bottom line multiples, and I fear a further fall is possible.

I actually upgraded Snap to a hold rating in September, when the stock was crashing post-Q2 earnings and had hit roughly $9 per share. Snap fell again after reporting Q3 results (earnings have frequently been a negative trigger for Snap in recent days, which is a good thing to keep in mind ahead of Q4 earnings sometime in late January), and yet it has been a beneficiary of the “everything rally” and I don’t find the stock’s valuation particularly compelling. As such, I’m downgrading Snap down to a sell rating.

In particular, here are the risks that I find to be the most threatening for Snap:

- Weak U.S. user growth. The company seems to be “stuck” at 100 million North American users. This is critical as the region drives substantially better ARPU than the rest of Snap’s markets.

- There’s a chance Snap fades as a fad. Snap is always at risk of a newer and more in-the-moment platform (like TikTok) taking over eyeball share and stealing users away, perhaps permanently. Snap doesn’t have the same messaging/connecting-with-old-friends appeal that Facebook and Instagram do, putting it at risk of obsolescence.

- Enormous infrastructure costs. Snap’s investments in machine learning have dramatically increased its server costs, which have taken a hit to gross margins and overall profitability. It has introduced a new metric, infrastructure cost per DAU, which is just under $1 – almost the ARPU itself of a user in the “Rest of World” region.

- Net debt. Unlike many mid-large cap tech peers, Snap is actually in a net debt position. Snap is investing in a number of initiatives, including augmented reality, virtual reality, new app features, and an upgraded advertiser platform: it may be spreading its resources too thin.

Of course, it’s not all bad news for Snap. I find it encouraging that the company managed to achieve double-digit ARPU growth in the “rest of world” segment in Q3 (to be discussed in greater detail in the next section). At the same time, however, I find the risks outweigh the potential rewards here, especially when considering Snap’s current valuation.

At current share prices north of $11, Snap trades at a market cap of $19.47 billion. After we net off the $3.19 billion of cash and $3.65 billion of debt on Snap’s latest balance sheet, the company’s resulting enterprise value is $19.93 billion.

Meanwhile, for next year FY25, Wall Street analysts are expecting Snap to generate $6.08 billion in revenue, or 14% y/y growth; and $0.41 in pro forma EPS (+58% y/y). Assuming the company can hit a 10% adjusted EBITDA margin next year (flat to Q3 margins, and 4 points higher than YTD’24 margins of 6%), adjusted EBITDA would be $608 million. This puts Snap’s valuation multiples at:

- 3.3x EV/FY25 revenue

- 33x EV/FY25 adjusted EBITDA

- 29x FY25 P/E

To me, paying a ~30x earnings multiple for a company that faces a number of growth risks is quite onerous. In my view, it’s best to move to the sidelines for Snap and lock in any gains earned from the company’s mid-summer rebound.

Q3 download

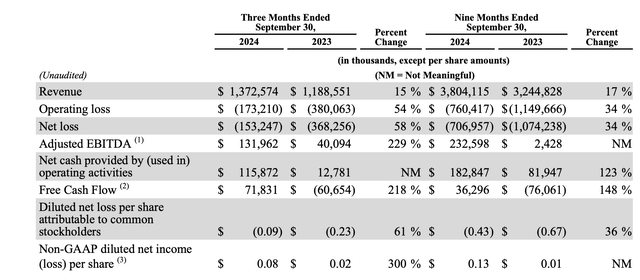

Let’s now go through Snap’s latest quarterly results in greater detail. The Q3 earnings summary is shown below:

Snap Q3 highlights (Snap Q3 shareholder letter)

Snap’s revenue grew 15% y/y to $1.37 billion, slightly ahead of Wall Street’s expectations of $1.36 billion (+14% y/y). However, we note that revenue also decelerated slightly from 16% growth in Q2.

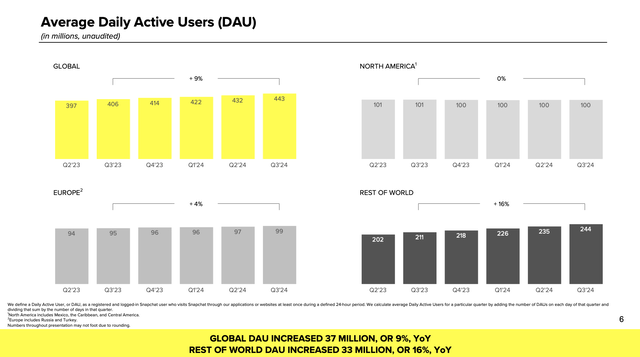

As usual, to understand Snap’s monetization and revenue, it’s important to understand how user trends are faring. DAUs (daily active users) in Q3 grew 9% y/y to 443 million, adding 11 net-new DAUs in the quarter.

Snap DAUs (Snap Q3 shareholder letter)

This was almost entirely driven by the “Rest of World” region, which added 9 million new users.

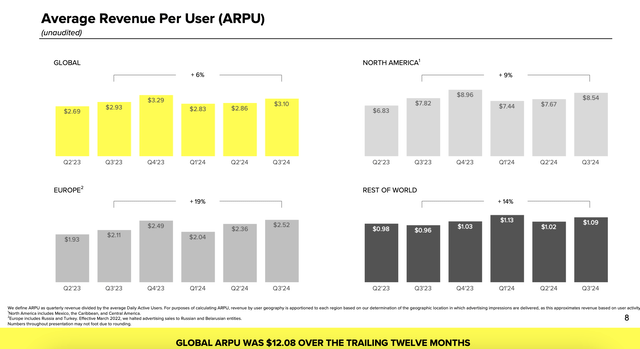

Another item to put in the “good news” column for Snap: monetization for the Rest of World region is improving, with ARPU of $1.09 growing 14% y/y and accelerating over just 4% y/y ARPU growth in Q2. Since this region now represents over half of Snap’s overall users, it’s important that the company continues to aggressively monetize this growing user base.

Snap ARPU trends (Snap Q3 shareholder letter)

Sadly, North America is seeing very flat trends from a user count perspective. This region generated 62% of Snap’s revenue in Q3, and its ARPU is also ~8x higher than that of a “Rest of World” user and more than 3x the ARPU of a European user.

We had hope that the company would improve user additions. In Q2, the company noted that it had started to see improving trends in U.S. driven by additional communications frequency between users. My hopes for a pickup in user growth were dashed, with users sequentially flat (and also at 0% y/y) for the quarter.

It’s important to note that the company rolled out a major app redesign in Q3. It’s splitting its app into three core services: “Simple Snapchat,” which is the original disappearing-message feature, alongside entertainment content and messaging. In my view, Snap’s twin goals here are to establish the app as a messaging platform and to segregate the company’s core camera function from its new offerings, to prevent users from getting confused.

Still: so far, it appears these features have done little to raise user activity in its highest-revenue region.

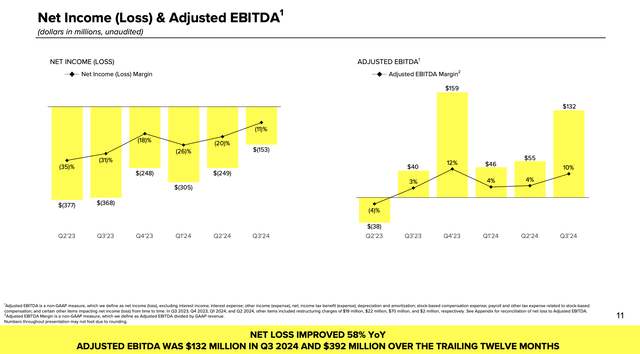

On the bright side, Snap generated $132 million in adjusted EBITDA in Q3 at a 10% margin, raising its margin profile by 7 points y/y.

Snap adjusted EBITDA (Snap Q3 shareholder letter)

Higher infrastructure costs, in part to support new AI-driven content, continues to weigh on the company, with total cost of revenue growing 16% y/y, slightly faster than revenue growth. However, the company more than made up for this by managing opex well, with adjusted opex (excluding stock comp) growing only 1% y/y despite the mid-teens pace of growth in revenue.

Key takeaways

In my view, an investment in Snap has become quite unappealing again, as the company continues to fail to stimulate North America user growth despite new products and new initiatives. Despite stronger monetization in the “Rest of the World,” the lack of growth in North America is holding back Snap’s total company growth rates. At the same time, a >30x multiple of adjusted EBITDA and a debt load also weigh on this company and make it a far less attractive stock in a more conservative, risk-wary stock market. Sell this stock and invest elsewhere.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.