Summary:

- 3M Company stock has corrected post recent earnings miss and disappointing guidance.

- There is a risk to the 3M Company guidance.

- I have discussed why this correction in MMM stock is not a buying opportunity.

Education Images/Universal Images Group via Getty Images

3M Company (NYSE:MMM) reported weak Q4 2022 results with adjusted EPS of $2.28 missing consensus estimates by 11 cents and revenue of $8.1 bn almost in line with street expectations. The guidance was also disappointing with FY23 adjusted organic sales expected to decline between 0% and 3%. Including -1% to -2% impact from FX headwinds and -1% impact from divestitures (primarily food safety and Aearo Technologies), sales are expected to decline between -6% and -2% versus the pre-earning consensus estimate of -2.29%. Adjusted EPS guidance of $8.50 to $9.00 for FY23 was even worse when compared to the pre-earnings consensus of $10.23.

The only silver lining was the company’s adjusted free cash flow (“FCF”) conversion guidance of 90% to 100% which means the dividend yield is safe for now. However, this should not come as a surprise, as the company’s FCF will benefit from inventory reduction during the current slowdown.

3M’s Segment-wise Revenue Performance and Outlook

Coming to the segment-wise performance, the Safety & Industrial segment’s sales were down 4% Y/Y. Excluding FX headwinds of 530 bps Y/Y, organic sales were up 1.3% in Q4 FY22 due to the low double-digit growth in the electrical markets and automotive aftermarket, partially offset by the mid-single-digit decline in the personal safety business due to the decreasing demand for disposable respirators. Management is anticipating organic sales growth to be down low single digits in 2023. This includes $450 mn to $550 mn or ~400 bps impact from the disposable respirator demand returning to pre-pandemic levels. Based on this estimated decline in disposable respirator demand, it appears that 3M Company management is expecting flat to slightly positive organic sales growth for the rest of the business (ex-respirator) in this segment. This appears optimistic, given the Industrial Production Index (IPI) is expected to decline further in the coming quarters due to the weakening demand.

In the Transportation & Electronics segment, sales were down 5.9%. Excluding the FX headwind of 620 bps Y/Y and 110 bps Y/Y impact from divestitures, organic sales were up 1.4% in the quarter, driven by mid-teen growth in auto OEM and low double-digit growth in advanced materials. The sales also benefited from favorable comparisons due to the channel inventory drawdown in Q4 2021. This growth was partially offset by a 10% organic decline in the electronic business due to the significant end-market weakness, particularly for smartphones, tablets, and TVs.

For FY23, management has guided for the adjusted organic sales growth (excluding the impact of PFAS manufacturing exit) to be down mid-single digits in 2023 to flat organically due to the weak demand for TVs, tablets, and smartphones along with the impact of the shift in display technology from LCD to OLED. This impact is expected to be partially offset by healthy trends in the automotive market related to the electrification of vehicles.

In the Healthcare segment, sales were down 6.7%. Excluding 450 bps Y/Y impact from FX headwind and 410 bps impact from divestitures, organic sales were up 1.9% in the quarter due to low single-digit growth in oral care, mid-single-digit growth in the Health Information Systems business, and high single-digit growth in the separation and purification business. The elective procedure volumes were at approximately 90% of pre-COVID levels, as nurse labor shortages and strained hospital budgets continue to impact the pace of recovery. Management is anticipating the segment’s organic sales growth to be up low to mid-single-digits in 2023, driven by the gradual improvement in healthcare procedure volume as the nurse labor shortage improves. This benefit is expected to be partially offset by the decline in oral care as consumers continue to decrease their discretionary spending.

In the Consumers segment, sales were down 10.4% Y/Y. Excluding 310 bps Y/Y impact from FX headwinds and 160 bps Y/Y impact from net divestitures, organic sales declined 5.7% in the quarter due to the pullback on discretionary spending by consumers and the reduction in inventory levels by retailers, especially in the U.S. 3M Company management has guided for the segment’s organic sales to be down low single digits to flat in 2023 as U.S. consumers remain cautious and retailers continue to aggressively reduce excess inventory levels. Management is expecting some recovery in the back half of 2023 in this segment. However, I believe it is too early to bet on it.

Margins

The adjusted operating margin in Q4 2022 declined 90 bps Y/Y to 19.1% due to the 70 bps headwind from the sales decline in disposable respirators and the Russia exit and the 140 bps headwind from increased raw material costs. This was partially offset by a 110 bps benefit from the pricing actions, strong spending discipline, reduction in manufacturing output, and restructuring actions. The margins also benefited by 10 bps from foreign currency translation.

On a segment basis, the adjusted operating margins in the Safety & Industrial and Transportation & Electronics segments improved by 270 bps and 60 bps Y/Y to 22.4% and 17.8%, respectively. This was due to the pricing actions and strong spending discipline, which more than offset the raw material and logistics costs and manufacturing productivity headwinds. The adjusted operating margins in the Healthcare and Customer segments declined 290 bps and 330 bps respectively, Y/Y to 20.6% and 17.9%, due to manufacturing productivity headwinds and increased raw material and logistics costs, partially offset by pricing actions and strong spending discipline.

Looking forward, 3M Company management is taking steps like implementing strict controls on hiring and discretionary spending and reducing 2500 global manufacturing roles to offset some of the impacts of weakening revenues. However, if we look at management guidance for FY23, these actions don’t seem to be enough to prevent a meaningful decline in margins.

My Concerns

One of the biggest disappointments for investors from the Q4 earnings release was the implied margin guidance for FY23.

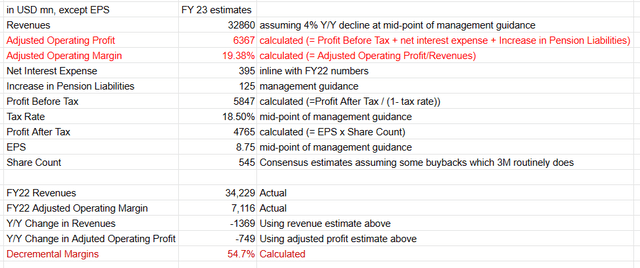

Prior to the earnings release, the sell-side consensus was baking in some margin improvement in FY23 despite revenue decline as easing supply chain constraints was a potential tailwind. While the company didn’t give FY23 operating or decremental margin guidance, if we try to back-calculate it using the other numbers management has provided, FY23 estimated operating margin comes to around 19.4% (down ~140 bps Y/Y) with decremental margins in the mid-50s. Below are my calculations.

3M’s FY23 margin and decremental margin estimates based on management guidance (Management Outlook, GS Analytics Research)

Such high decremental margins are definitely concerning, especially if one considers that management is baking a recovery in the back half of FY23 in their revenue numbers, which may not pan out. For Q1 2023, management expects revenue to decline in the 10% to 15% range. However, as the year progresses, management believes easing comparisons and recovery in consumer business in the back half of the year should help contain the annual sales decline in the 2% to 6% range. However, I don’t see much chance of improvement in the consumer business. If we look at the recent news around layoffs in the technology and other sectors, it appears like consumer confidence should get worse in the coming quarters and there is a risk of the company posting lower revenue numbers than management guidance.

Further, for the company’s industrial segment, it appears that management’s guidance is implying flat to slightly positive growth if we exclude the impact of respirator sales. Given the weakening demand, I see some risk to the management’s outlook for this segment as well.

If the back half of recovery management is modeling for consumer business and resilient safety and industrial segment sales (excluding disposable respirators) didn’t fructify, decremental margins in the mid-50s should mean even worse margin and EPS performance.

MMM Stock Valuation & Conclusion

If we take the mid-point of 3M Company management’s FY23 guidance of $8.50 to $9.00 in EPS and the current stock price of $115, the stock is trading at a P/E of 13.14x. It also has a dividend yield of 5.18%. The valuation isn’t expensive, and the dividend yield is attractive.

However, the stock has been under pressure over the last couple of years as investors are worried about the Combat Arms and PFAS liabilities, and this has resulted in the stock’s P/E multiple re-rating lower. There were some positive initiatives by management in the back half of the last year, like potential health care divestitures plans and ear plug unit bankruptcy, but even those got embroiled in the litigation.

Now, the weakening macros, declining earnings, and potential for the downward revision in estimates (especially if 2H 23 consumer recovery and resilient industrial demand didn’t pan out as expected) have resulted in additional uncertainty for 3M Company. Hence, I believe it is best to wait on the sidelines for now rather than buy 3M Company stock after post-earnings corrections.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article is written by Ashish S. and Sanket B.