Summary:

- GME’s recent 55% rally is characterized by a slow, sustained uptrend, unlike the rapid spikes of 2021 and early 2024.

- The backdrop to the rally is also different. It hasn’t been fuelled by memes or a Roaring Kitty post. Management is making some decent moves.

- Despite shrinking revenues, GameStop’s improved margins and potential return to profitability this fiscal year are positive signs, but the $13B valuation remains questionable.

- I rate GME a “hold” due to the potentially sustainable uptrend and potential for new investments, but I’ll sell if it spikes into the $40s.

Dennis Diatel Photography

“This time is different” could be the four most dangerous words in trading. Markets rarely change. However, I have noticed a different pattern of behaviour in GameStop (NYSE:GME) as it is making a more sustained uptrend rather than the previous meme-inspired spikes higher. This article looks at why GME could be changing.

An Analysis of Trend

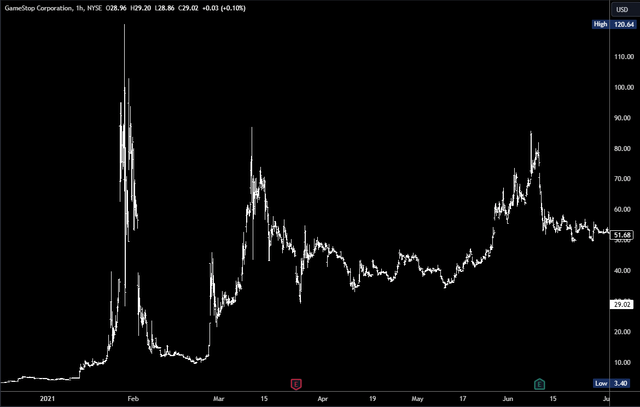

The meme-inspired moves of 2021 are easily recognisable. A rapid spike higher collapses almost as quickly. These are not the kind of moves seen in mature stocks. The smart money was selling into strength rather than holding on for more sustained gains.

TradingView

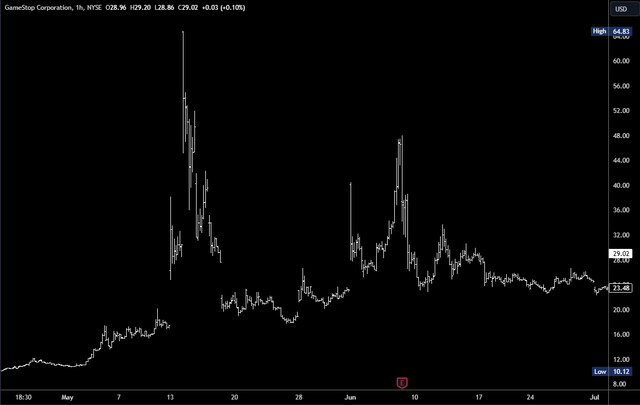

GME was seen as a trade, not an investment. The same behaviour could be seen earlier this year.

TradingView

Again, those fortunate enough to own the stock during the rapid climb higher, took the opportunity to sell. After all, there seemed little point to hold as GME was a loss-making company with a negative outlook.

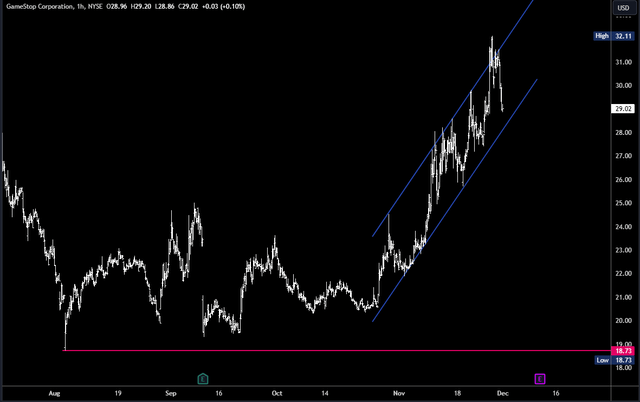

When I last wrote about GameStop in July, I took a small position as I was “Prepping for the Next Pump.” In other words, I thought the stock could spike up again on a new rumor or meme and let me trade out at a profit. However, that hasn’t happened, and GME has developed a slower but more sustained trend.

TradingView

The stock is up 55% from the August low and has formed a clear trend channel. This reflects a different character – dips are now being bought and traders seem to be viewing GME as an investment rather than a quick trade to be dumped as soon as possible.

A Fundamental Change

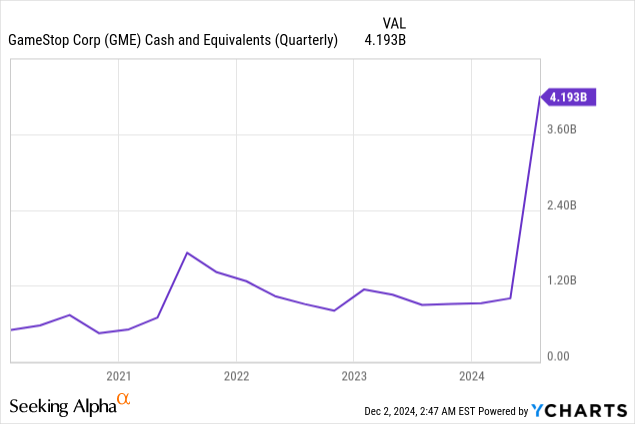

GME management played the inflated prices just as well as any trader and raised over $3B by issuing new shares and selling them in the open market earlier this year. They now have plenty of cash to explore new ventures.

There was some excitement and speculation about what the company would do with the new capital – crypto investments, mining, AI? An announcement on October 15 finally revealed the first venture; GME would become an authorized dealer in sports and hobby trading cards.

It was a bit of a letdown for those (like me) waiting for something exciting to ignite another spike higher in the share price. Indeed, there was almost no movement following the announcement. However, the stock made higher lows in October and formed a trend higher in November. It seems the market welcomes the new direction.

I think it is a decent move by management. It won’t lead to huge profits, but it is a logical addition that utilizes the brand name and the physical locations. As the announcement said, “customers can drop off ungraded trading cards at a participating GameStop location.” Collectors may be reluctant to send valuable cards through the mail, so the network of locations and trusted, recognisable brand is an attraction. There is a synergy with the existing business and a potential overlap between collectors and gamers. More customers in the stores is always a good thing.

The announcement also displays some maturity from management. They didn’t go for the headline-grabbing speculative investment in something like crypto or alt coins. This is an attempt to turn the existing business around. Plus, the cash pile shouldn’t be too depleted. Hopefully, the next earnings release on December 10 should provide more details on how much GME plans to invest in the card trading segment.

The Outlook

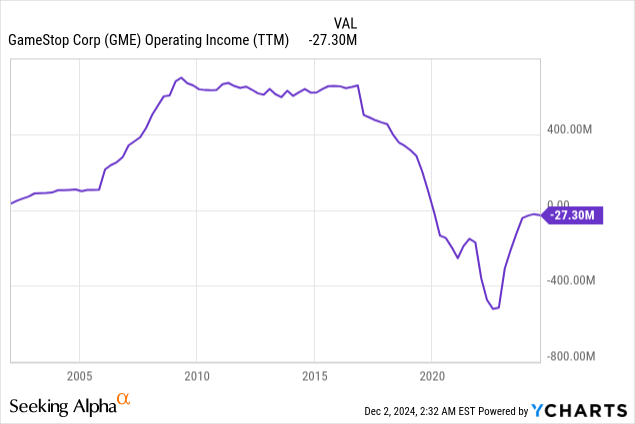

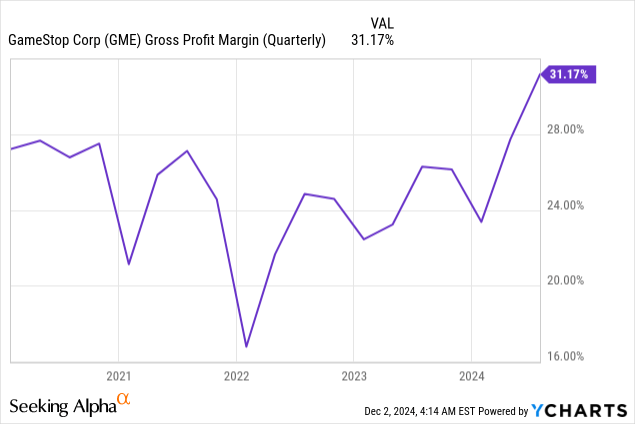

While revenues have shrunk and GME has not posted a profit since 2019, they have improved margins.

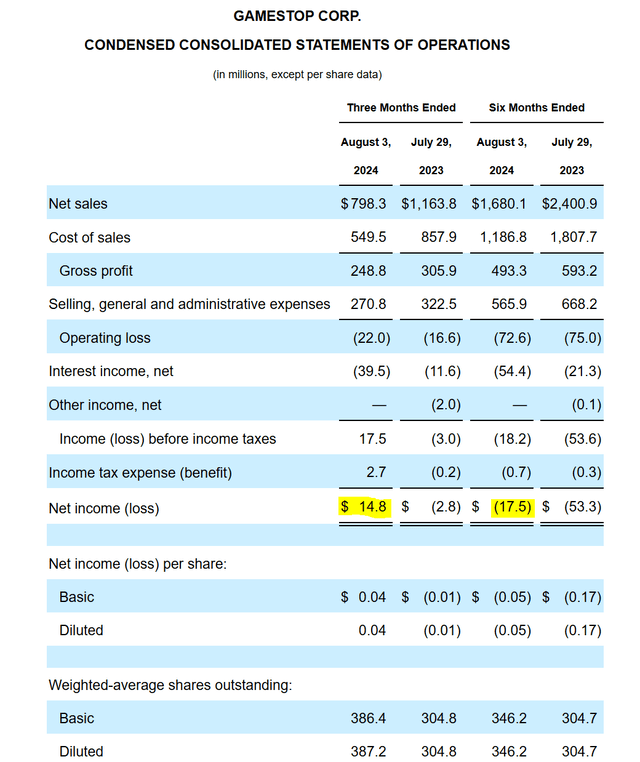

The September earnings release showed a modest profit for the second quarter, and a small loss for the first six months. If the Christmas period is positive, GME may get back to profitability in this fiscal year.

Company 10-Q

Obviously, the shrinking revenues are a concern, but the point is the company is not hemorrhaging money, and management doesn’t need to rush into an all-or-nothing roll of the dice with their cash pile. That said, they need to do something else apart from card trading to justify the current valuation. The current market cap of just under $13B has a lot of optimism priced in for a company with $4B in cash and shrinking revenues.

The prospect of another announcement could keep investors interested, and the slower uptrend looks more sustainable than the rapid advances of old, but there will be a limit to the gains as GME does not yet merit a $13B valuation. I’ll hold on to my small speculative investment and watch with interest where this all goes, but the risk is that GME fades from view again and the share price fades back towards the 2024 lows near $10. Should it spike into the $40s like previous times, I’ll be quick to take profit.

Conclusions

This GME rally is different than the rapid gains and equally fast collapses seen in 2021 and early 2024. It is slower and dips are being bought so that a trend channel has developed. That is encouraging and suggests investors are replacing the traders.

The backdrop is also different. The rally is not fuelled by memes or short squeezes, but by a profitable Q2, the new venture into trading cards, and the promise of new investments.

Whether any of this justifies GME’s $13B market cap is another matter, though. I see the potential for a turnaround, but the company needs to expand into other areas to maintain the trend in its share price. I rate GME a “hold” and a “sell” if it spikes higher into the $40s.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GME either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.