Summary:

- INTC continues to report an uncertain turnaround, underwhelming FQ3’24 performance, and missed opportunities in the AI/ foundry sectors.

- Despite a +30% recovery from its August 2024 low, the stock has underperformed the broader market and semiconductor peers, highlighting its ongoing struggles.

- INTC’s restructuring, including layoffs and reduced capex, contrasts sharply with its competitors’ intensified investments during the AI capex boom, further dampening its growth prospects.

- The management’s $100B foundry ambitions are likely to trigger further headwinds in its Free Cash Flow generation and balance sheet health over the next few years.

- This is also why we believe INTC may be a potential value trap, with its seemingly low stock prices coming with mixed growth potential.

xefstock

Intel May Be A Value Trap – Minimal Growth Prospects

We previously covered Intel (NASDAQ:NASDAQ:INTC) in August 2024, discussing its uncertain turnaround story, which had triggered the drastic pullback by -30%, or the equivalent -$39B in market capitalization losses then.

Much of the pessimism was attributed to the underwhelming FQ2’24 financial performance, dividend suspension, and drastic layoffs through 2025, with its reversal hanging in balance. This was on top of the uncertain monetization of its foundry ambitions and deteriorating balance sheet, resulting in our reiterated Hold (Neutral) rating then.

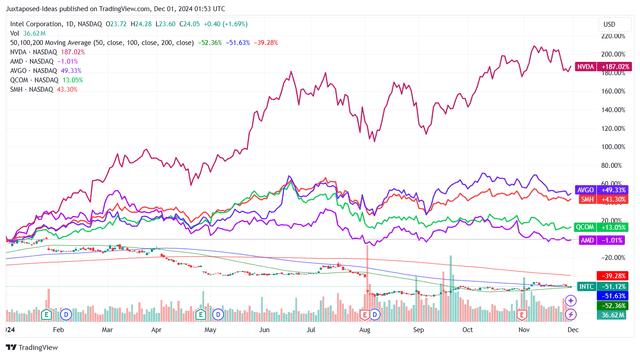

INTC YTD Stock Price

Trading View

Since then, INTC has seemingly found a floor at $18.50, with the stock also charting an impressive recovery of +30% since the August 2024 bottom.

Even then, based on the overall YTD stock price performance, it is undeniable that the stock has underperformed the wider market and its semiconductor peers to a large extent – with it underscoring its uncertain reversal.

Part of our pessimism naturally lies in INTC’s ongoing restructuring, which has resulted in over 15% of its headcounts laid off and over 20% of its capital expenditures reduced in FY2024, despite the supposed generative AI boom and the resultant data center capex boom.

These developments paint a very different picture to the intensified capex and R&D efforts both reiterated by the world’s largest global foundry by market share, Taiwan Semiconductor Manufacturing Company (TSM), along with the clear leader in the AI accelerator race, Nvidia (NVDA) in their recent earning calls.

It is apparent from these developments that INTC has painfully missed out on both opportunities as a foundry and semiconductor company during the ongoing cloud super cycle, with the same poor results also observed in the FQ3’24 earning results.

For reference, the legacy company reported underwhelming revenues of $13.3B (+3.9% QoQ/ -6.3% YoY), gross margins of 18% (-20.7 points QoQ/ -27.8 YoY/ -40.6 from FY2019 levels of 58.6%), and adj EPS of -$0.46 (-2400% QoQ/ -212.1% YoY).

Most importantly, INTC reported disappointing Data Center and AI [DCAI] revenues of $3.3B (+10% QoQ/ -13.1% YoY), despite Gaudi’s supposedly improved price to performance ratio, with it naturally pointing to its inability compete with the market leader and its peers.

If anything, the management has highlighted that the demand headwinds are partly attributed to the lack of “software ease of use,” with it also underscoring NVDA CUDA’s highly sticky computing and programming platform.

These developments are also why INTC has lowered their Gaudi FY2024 revenue target to below the original guidance of $500M, while reporting YTD DCAI revenues of $9.3B (-19.1% YoY).

When compared to Advanced Micro Devices’ (AMD) YTD data center revenues of $8.6B (+105.2% YoY) and NVDA’s YTD data center revenues of $79.7B (+173.8% YoY), it is painfully apparent that some players have been relegated to the far second during the ongoing generative AI boom.

Moving forward, despite the ongoing AI PC boom and the PC refreshed cycle, INTC has continued to lose x86 market share to 61.6% by Q4’24 (+0.1 points QoQ/ +0.6 YoY/ -6.8 from Q4’19 levels of 68.4%), as AMD continues to gain.

At the same time, market analysts already expect ARM-based PCs to continue growing in market share from 15% in 2023 to over 25% of all SoC types by 2027, thanks to the “lower overall power consumption and customization enabling richer features and higher performance,” with it potentially triggering further growth headwinds for INTC.

If anything, INTC’s foundry prospects remain speculative, with its silicon wafers supposedly failing Broadcom’s (AVGO) tests, with the former’s “manufacturing process is not yet viable to move to high-volume production.”

These rumors naturally trigger further pessimism in INTC’s ability to emerge as a viable foundry in the intermediate term, despite the management’s optimism surrounding the segment as “a key part of our strategy is returning to process leadership through disciplined execution of our roadmap.”

If anything, the management has highlighted underwhelming Intel Foundry revenues of $4.35B (+1.1% QoQ/ -8% YoY) and widening adj operating loss margins of -65% (-1 points QoQ/ -38 YoY) in the latest quarter.

This is after discounting the $3B non-cash impairment charges related to “excess COVID era spending that we have concluded cannot migrate to more advanced nodes now that we have fully transitioned to EUV processing.”

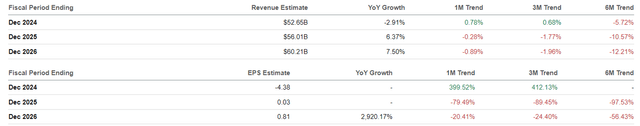

The Consensus Forward Estimates

Seeking Alpha

Combined with the management’s mixed commentary surrounding the underutilized Intel Foundry and delayed foundry profitability by 2030, it is unsurprising that the consensus forward estimates for INTC appear to be underwhelming, with FY2024 to be a trough year.

Even so, with FY2026 only expected to bring about an adj EPS of $0.81 compared to FY2019 levels of $4.37, we believe that its investment thesis appears to be rather speculative at current levels.

If anything, INTC continues to report hefty net debt levels of -$26.15B (-10% QoQ/ -9.6% YoY), worsened by the negative Free Cash Flow generation of -$15.05B over the LTM (-44.7% sequentially).

These developments imply that the legacy semiconductor company is likely to continue underperforming expectations in the near-term, with the only silver lining being the suspended dividends as the management attempts to turn the big ship around.

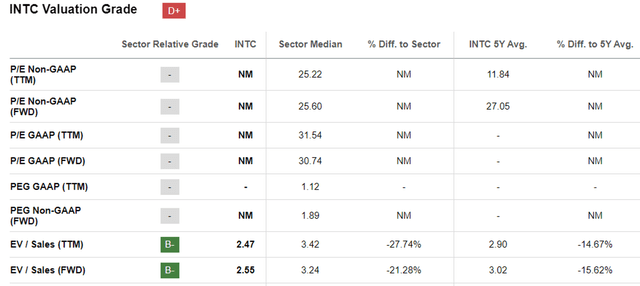

INTC Valuations

Trading View

Even based on the current stock prices of $23.97 and the consensus FY2026 adj EPS estimates of $0.81, it is undeniable that INTC appears expensive at FY2026 P/E non-GAAP valuations of 29.5x, attributed to its uncertain growth prospects.

This is compared to its 5Y mean of 22.40x, 10Y mean of 17.62x, and the sector median of 25.60x, with it offering interested investors with a minimal margin of safety.

So, Is INTC Stock A Buy, Sell, or Hold?

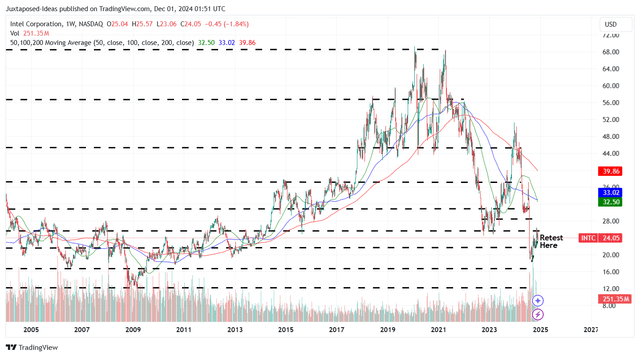

INTC 20Y Stock Price

Trading View

For now, INTC appears to have bounced off the $18s, while consistently charting higher highs and higher lows over the past three months – exemplifying the robust support enjoyed by the stock thus far.

Even so, we are uncertain if it is wise to upgrade our previous Hold rating, given the company’s painful turnaround and uncertain long-term prospects as it is increasingly left behind in the AI chip/ foundry race.

If anything, readers must note that INTC has reiterated their “plans to invest more than $100 billion in the U.S. to expand chipmaking and advanced packaging capacity and capabilities critical to economic and national security,” with the company unlikely to reinstate dividends anytime soon.

At the same time, with NVDA already ramping up the production of Blackwell from Q4’24 onwards, while looking to launch the next-gen AI chips, Rubin, from 2026 onwards, we believe that INTC may face an ever widening gap to close.

While the stock price may appear to be cheap, we believe that INTC may be a value-trap here, attributed to the minimal growth prospects. As a result, we prefer to maintain our Hold rating here.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA, TSM, AVGO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.