Summary:

- Medtronic remains a buy due to its attractive valuation and steady EPS growth, despite recent sector-wide selling pressure and modest losses.

- Q2 results beat Wall Street expectations, with revenue up 5% year-over-year, and management raised FY 2025 revenue and earnings estimates.

- Key risks include supply chain issues, competition, policy changes, and currency fluctuations, but MDT’s free cash flow yield and technical support levels are strong.

- Resistance is seen near $92-93, with support between $82-83.55, indicating a potential upside if key resistance levels are breached.

JHVEPhoto

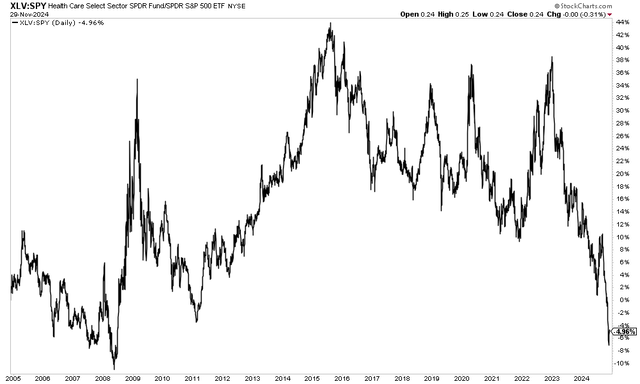

The Health Care sector has taken it on the chin in the past month. President-elect Trump’s win, and subsequent pick to lead the Department of Health and Human Services (HHS), was met with selling pressure in November across much of the pharma and life science space. Shares of Medtronic (NYSE:MDT) endured some pain, but losses have been relatively modest compared to other companies seen as in RFK Jr.’s crosshairs.

With MDT up 3% since my August analysis, I still see the Health Care Equipment industry stock as a buy on valuation, and a key resistance level has emerged on the chart heading into 2025. I reiterate a buy rating. The dividend aristocrat now yields 3.2%.

Health Care Sector ETF (XLV) Falls to Multi-Year Relative Lows Versus the S&P 500 (SPY)

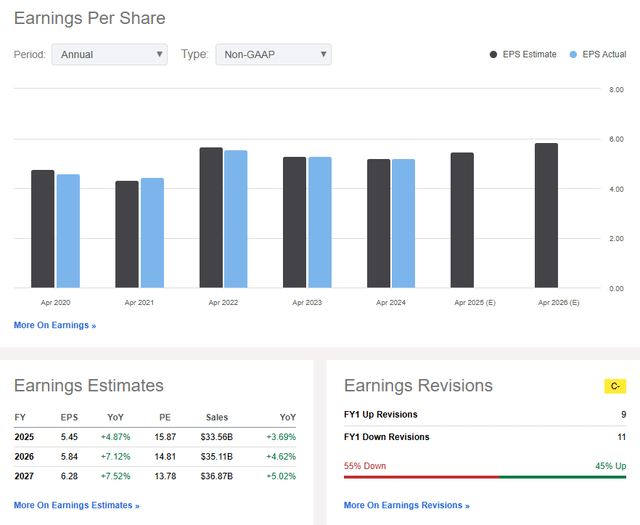

Back in November, MDT reported a solid set of quarterly results. Q2 non-GAAP EPS of $1.26 topped the Wall Street consensus forecast by a penny while revenue of $8.4 billion, up 5% from the same period a year earlier, was a material $130 million beat. The management team raised its FY 2025 revenue growth and earnings guidance, but MDT still fell by 3% in the session that followed.

The company now expects top-line growth in the 4.75%-5% range, a hike of 25 basis points from the last update. As for the new earnings estimate, an operating EPS range of $5.44 to $5.50 is the internal target, which includes a 5% negative impact from currency movements. The Ireland-based MedTech firm expects EPS growth in the high single digits looking out to the back half of the fiscal year, which helps to support a decent P/E multiple in my view.

Its Cardiac Ablation Solutions’ (CAS) growth was just flat from Q2 of last year due to lingering supply chain issues, but those troubles are seen as having abated as of the end of the reporting period. As Affera production increases (its Afib ablation business), appears on track which should contribute to earnings and its margin going forward.

On the earnings outlook, analysts forecast an EPS acceleration to above 7% in the out year and through 2027 (an increase from less than 5% bottom-line growth in FY 2024). Revenue growth is seen as more stable in the 3% to 6% range for the foreseeable future. Since my previous analysis, there has been a mixed bag of sell-side revisions. Despite the strong Q3 numbers, 11 Wall Street analysts have downgraded their EPS estimates compared to just 9 earnings upgrades.

Still, Medtronic is highly profitable – evidenced by $4.21 of free cash flow per share over the last 12 months, resulting in a free cash flow yield just slightly below 5%.

MDT: Revenue & Earnings Forecasts, EPS Revision Trends

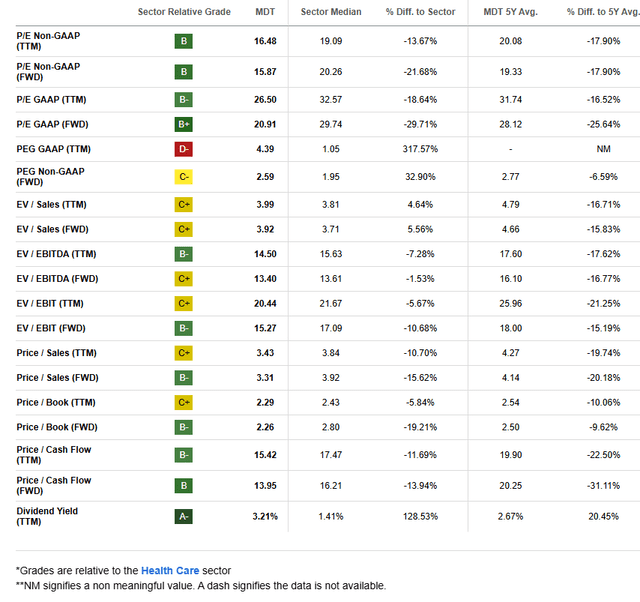

On valuation, since we are about halfway through MDT’s FY 2025, if we assume forward non-GAAP EPS of $5.65 and apply the stock’s 5-year average earnings multiple of 19.3, then shares should trade near $109. While that intrinsic value target is the same as what I estimated in the summer, there may be slight downside risks to the valuation amid uncertainty in the Health Care sector, though MedTech should be less impacted by RFK’s possible policies.

Also, a 7% long-term EPS growth rate would imply a PEG above 2 for the stock, which is above the S&P 500’s average. Of course, MDT has historically traded with a 2.77 PEG.

MDT: An Attractive Valuation

Key risks for Medtronic include disappointing sales from its Symplicity Spyral renal denervation system, slow adoption of its new products, additional supply chain problems, heightened competition in the MedTech space, and policy risks.

Furthermore, additional strength in the US dollar could ding EPS, but currency moves are often transitory and mean reverting.

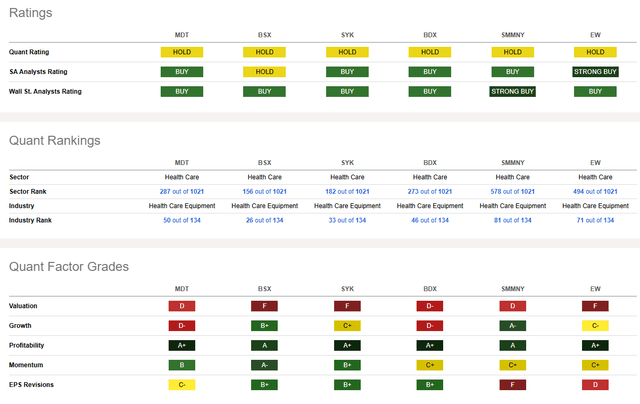

Competitor Analysis

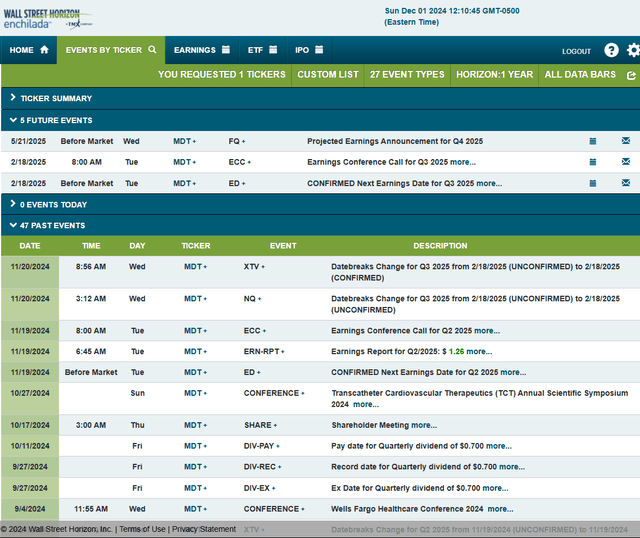

Looking ahead, corporate event data provided by Wall Street Horizon show a confirmed Q3 2025 earnings date of Tuesday, February 18 BMO with a conference call immediately after the numbers hit the tape.

No other volatility catalysts are seen on the calendar.

Corporate Event Risk Calendar

The Technical Take

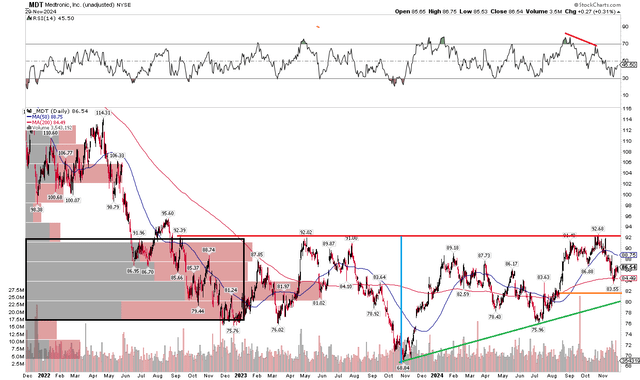

With shares still materially undervalued and with improved guidance from the company’s management, MDT’s chart continues to show potential. Notice in the graph below that the $92 to $93 has emerged as critical resistance. In my previous analysis, I highlighted a downtrend resistance line that, if broken through, could spark a significant upside. Though a breakout took place shortly after my mid-August write-up, the rally stalled at the Q3 2022 and Q2 2023 highs. There have been bouts of selling pressure not too far from $92 in the past 18 months, too.

But take a look at a rising support line that comes into play near $82. With the long-term 200-day moving average in the mid-$80s and ample volume by price down to the mid-$70s, there should be a solid cushion if we see a protracted dip. I also spotted a gap from mid-August that the MDT bulls have thus far defended – that’s an encouraging sign. With a near-term low at $83.55, the bearish RSI divergence may have resolved itself with shares back above the 200 dma.

Overall, resistance is seen between $92 and $93 while support is between $82 and $83.55.

MDT: Resistance Apparent in the Low $90s, Shares Hold Gap-Fill Support

The Bottom Line

I have a buy rating on MDT. I see the stock as fundamentally undervalued with steady EPS growth this year through the ensuing two fiscal years. The chart, meanwhile, has potential with key resistance lying near $93.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.