Summary:

- United Airlines’ stock has surged 84%, significantly outperforming the broader market’s 9% gain, raising concerns about its current valuation.

- Recent market news from other airlines and United’s financial results suggest potential risks, leading to a HOLD recommendation.

- United’s capital allocation and network growth strategies are scrutinized, highlighting potential vulnerabilities.

- Despite positive performance, risks associated with the broader airline industry and United’s specific challenges justify a cautious stance.

Laser1987

United Airlines (NASDAQ:UAL) has seen its share price almost double since we last recommended it 2-months ago, going up more than 84% versus 9% for the broader market. That strength, though, combined with recent news in the market from other airlines, presents a concern.

As we’ll see throughout this article, we view United as NEUTRAL at this time, as we expect it to generate reasonable FCF within the bounds of its valuation but not overall strong returns.

United 3Q 2024 Financial Results

United achieved strong financial results in the quarter, as the airline industry continues to be cyclical.

The company announced a $1.5 billion share repurchase program and annualized FCF at $4.5 billion. Annualized based on the company’s current market capitalization, that puts it at just over a 14% FCF yield, a strong double-digit FCF yield in of itself. However, the global airline industry has had an incredibly strong rebound, driving that.

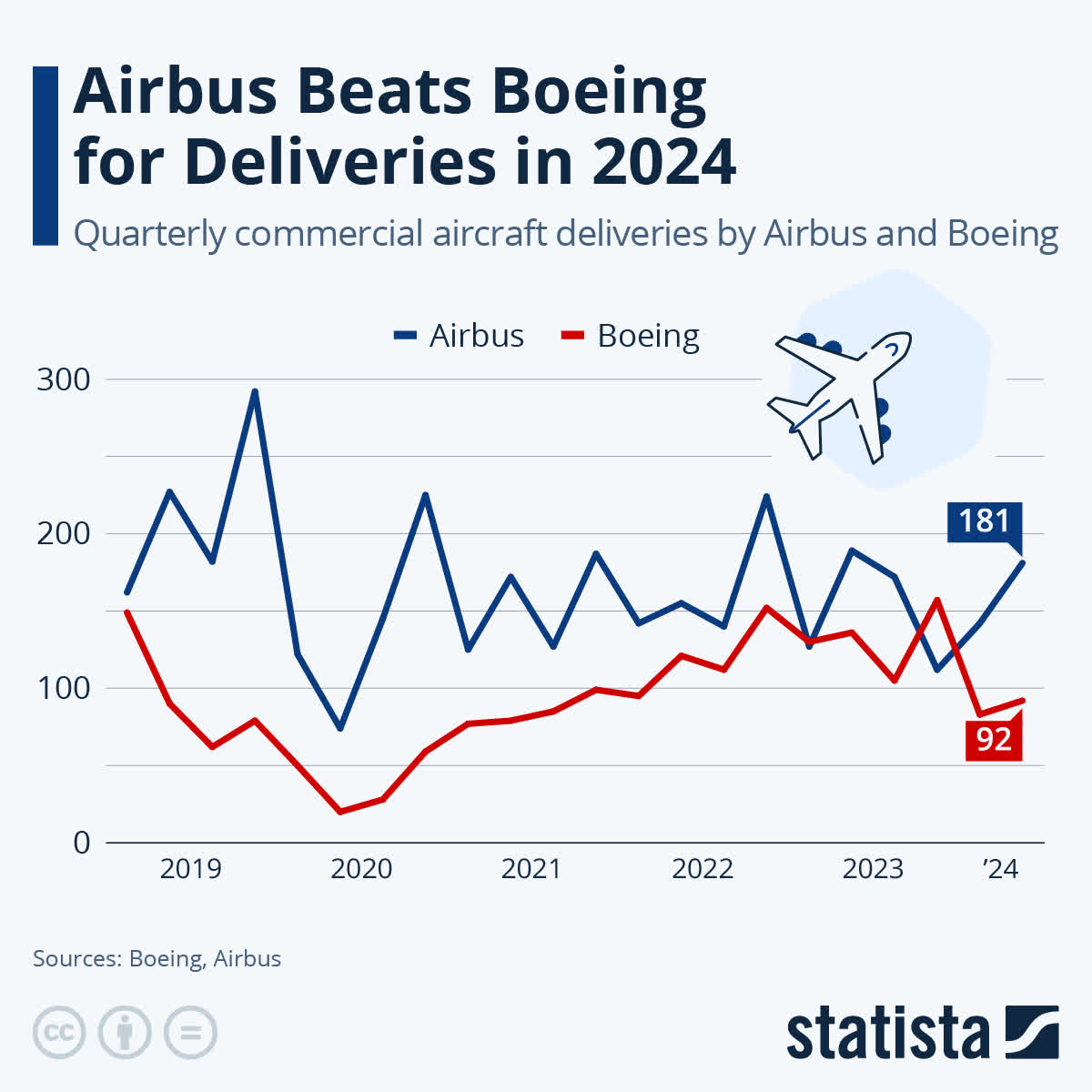

Plane Shortage

The airlines have also been benefiting from a shortage of planes. That has enabled the prices on popular routes to increase as demand has remained sky-high.

Statista

The weakness in aircraft deliveries is especially evident from Boeing, which has continued to struggle. The company is working to bring more of its supply chain in-house and clean that up, and both are expecting deliveries to increase substantially going into 2025/2026. A recovery in deliveries would help to expand capacity substantially.

Given an incredibly volatile aircraft industry, we expect that to put additional pressure on demand in upcoming years and pricing power of airlines. Business travel has declined from COVID-19, but more individual passengers are upgrading in the meantime. With experts foreseeing an increased chance of a recession under Donald Trump’s policies, that could put substantial pressure.

That could hurt the company’s FCF substantially. It’s also worth noting that while FCF remains strong, the company has almost $26 billion in debt and lease obligations. That lofty level will hurt the company’s ability to take on additional debt.

United Network Growth

At the same time, United’s network growth appears to us that the company is starting to reach limits of demand.

The company has added 8 new cities and plans to expand past 800 daily international routes on a schedule that’s approaching 5000 daily flights. However, as can be seen from the above, most of these routes are seasonal and to much less major cities. These aren’t high traffic routes and in our view indicates that the company is struggling to find new routes.

Low-cost airlines filing for bankruptcy in the U.S. as unproductive capacity might increase the company’s potential in the short term, but in the long term we don’t see any clear routes for it to expand. It’s also worth noting that other major U.S. customers are also expanding substantially, along with the domestic carriers of other countries.

Our view is the company does not have a path to substantially grow FCF past current levels. Combined with the risk of a general market downturn, that could quickly make the company’s FCF negative, as COVID-19 did, we are now moving to a neutral rating on the stock.

Thesis Risk

The largest risk to our thesis is air travel remains and will be for the foreseeable future the most effective way to move around. Demand remains high and customers are moving into more premium seating configurations, which is supporting profitability. That could justify United’s valuation for the long term.

Conclusion

United Airlines has an impressive portfolio of assets and the company has continued to invest in its business. We recommended investing in the company before, and the company remains our favorite U.S. carrier with one of the strongest available markets. Despite all that, we feel its share price has outgrown a reasonable valuation.

As a result, the risk-reward is shifting such that we are changing to a neutral rating on the company’s stock, based on its financials and route expansions. Let us know your thoughts in the comments below.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of UAL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.