Summary:

- Adobe’s Q3/24 results show solid performance, with 10.6% YoY revenue growth and 23.3% YoY increase in diluted net income per share.

- Despite high growth rates, Adobe’s stock remains a “Hold” due to its current overvaluation and slowing growth projections.

- Adobe’s economic moat, driven by brand strength and high switching costs, supports stable revenue growth and pricing power.

- Intrinsic value calculation suggests Adobe is slightly overvalued, making it prudent to wait for a potential lower stock price.

JHVEPhoto

It has been almost two years since I published my last article about Adobe Inc. (NASDAQ:ADBE) and in my last article I claimed that Adobe was still not a “Buy” and wrote in my conclusion:

While Adobe might be fairly valued at this point, I still see the risk for lower stock prices and would still be a bit cautious about an investment. To be honest, I am a little more bullish about Adobe than I was when my last article was published. Nevertheless, I personally would not invest in Adobe at this point. And I really don’t like the idea of Adobe acquiring Figma for $20 billion as I have extreme trouble in seeing Adobe achieving any meaningful return on this investment in the foreseeable future. For now, I will remain to the sidelines.

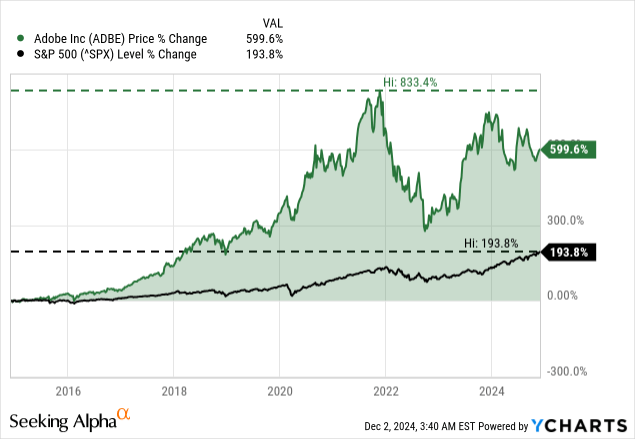

I must admit that I was wrong in my last article and actually published the article rather close to the bottom. In the meantime, the stock was only moving higher and gained a little more than 50%. And this was “only” in line with the overall market, as the S&P 500 also gained about 53% in value. Let’s look at the stock and business once again to answer the question if the stock is a “Buy” now or still a “Hold”.

Quarterly Results

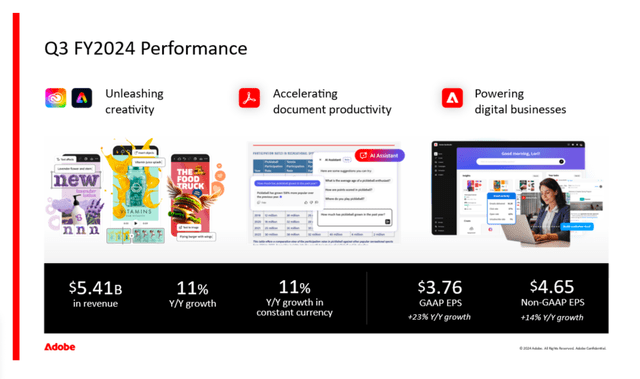

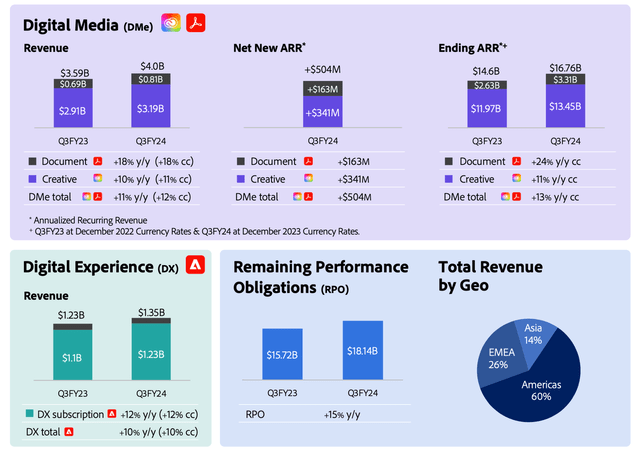

When looking at third quarter results, Adobe is still performing solidly and reporting high growth rates. Total revenue increased from $4,890 million in Q3/23 to $5,408 million in Q3/24 – resulting in 10.6% year-over-year top-line growth. Operating income increased 17.4% year-over-year from $1,697 million in the same quarter last year to $1,992 million this quarter. And finally, diluted net income per share increased even 23.3% YoY from $.305 in Q3/23 to $3.76 in Q3/24.

When looking at the three different segments, the two major segments both contributed to growth. Only Publishing and Advertising reported a 10.6% YoY decline to $59 million. However, this segment is only responsible for 1% of total revenue. More important is Digital Experience, which increased revenue 10.2% YoY to $1,354 million and account for about 25% of total revenue. The most important for Adobe, however, is still Digital Media, which generated $3,995 million in revenue in Q3/24. Not only is the segment responsible for 75% of total revenue, it also reported the highest growth rates among the three segments (11.2% YoY growth).

Adobe Q3/24 Financial Highlights

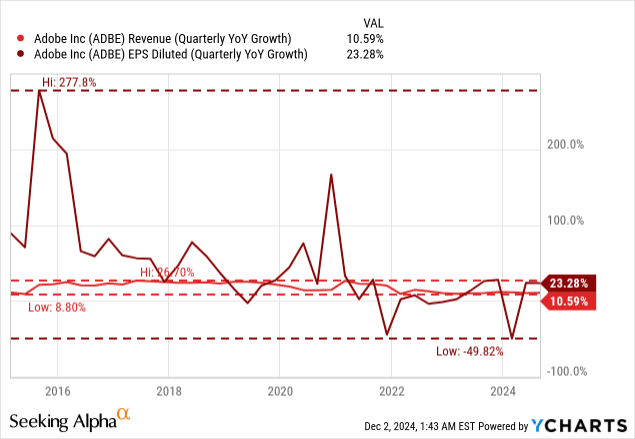

Growth

The major question for Adobe and investors in Adobe is if the company can maintain its rather high growth rates. And in the last few quarters, we clearly see growth rates for Adobe slowing down. Nevertheless, revenue is still growing in the double digits and earnings per share – despite fluctuating over the years – are also growing with a high pace.

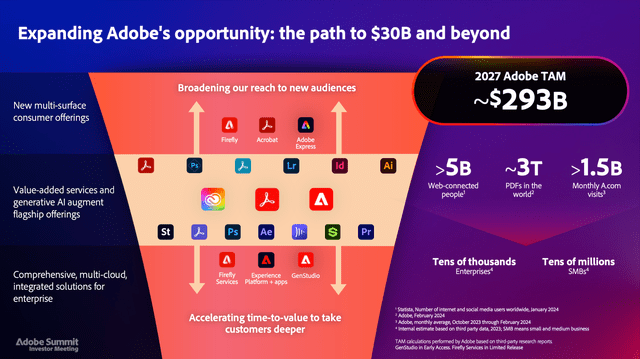

But the more important question is if Adobe can continue to grow with a high pace in the years to come – or at least maintain current growth rates. For starters, Adobe is still seeing a huge total addressable market and during its last Investor Day, it projected a TAM of $293 billion in 2027. Management also expects to capture about 10% market share, generating approximately $30 billion in annual revenue.

And although Adobe is in a very good position to grow its revenue even without major innovations (we will get back to this), the company must innovate and introduce new products – otherwise the growing market might be taken by competitors. In the last two years, one of the major topics when talking about growth for software and technology companies was generative AI. Adobe Firefly is one of the tools to generate images or text effects by using a Gen AI model and was introduced by Adobe in the last two years. During the last earnings call, management was pleased with the progress it is making:

Overall, we’re delighted to see customer excitement and adoption for our AI solutions continue to grow and we have now surpassed 12 billion Firefly-powered generations across Adobe tools.

Also during the earnings call, management talked about the new Firefly Video model, which was introduced recently:

As we integrate Firefly innovations throughout our tools, usage continues to accelerate, crossing 12 billion generations since launch. The introduction of the new Firefly Video model earlier this week at IBC is another important milestone in our journey. Our video model, like the other models in the Firefly family, is built to be commercially safe, with fine-grained control and application integration at its core. This will empower editors to realize their creative vision more productively in our video products, including Premiere Pro.

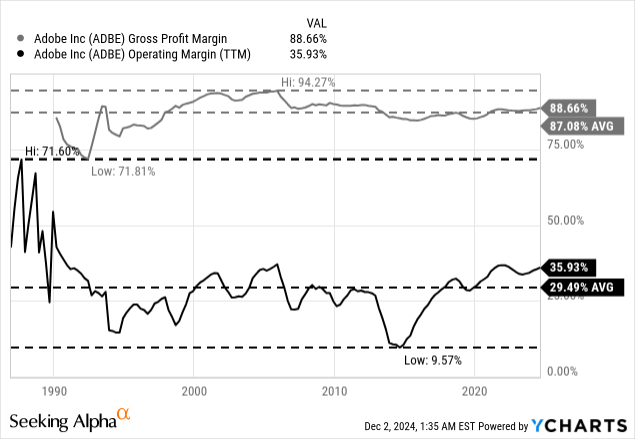

Aside from growing the top line by introducing new products and taking additional market shares, Adobe can also grow by improving its profitability and increase margins. And Adobe has very stable gross margins (which is good and a sign of a wide economic moat), but when looking at operating margin the current margins are rather high and it is at least questionable if Adobe can increase its margins further.

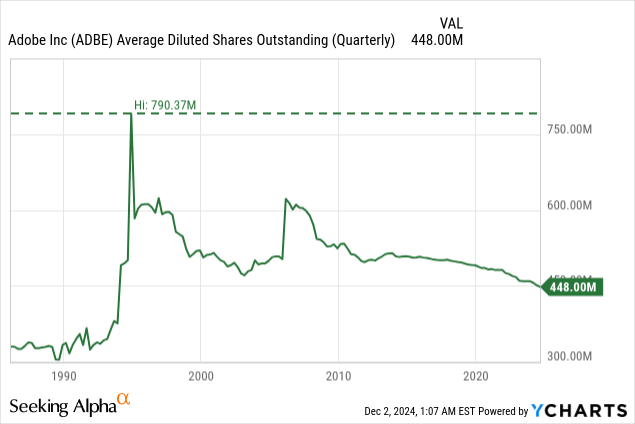

And finally, Adobe is also growing by using share buybacks as a tool, but considering the fact that Adobe is mostly trading for rather high valuation multiples, share buybacks are not so effective.

In the last ten years, Adobe decreased the number of outstanding shares constantly, but only with a CAGR of 1.24%. Of course, this can contribute to growth, but only a little bit.

During the last earnings call, Adobe also announced it entered into another $2.5 billion share repurchase agreement – adding to $20.15 billion remaining for the existing share repurchase program, which was authorized in March 2024. This is leading to $22.65 billion that can be used for share repurchases. Considering the market cap of $227 billion at the time of writing, it is possible to repurchase about 10% of outstanding shares. And certainly, this would have an impact, nevertheless, Adobe can’t repurchase these amounts right away.

On August 30, 2024, Adobe had $7,193 million in cash and cash equivalents as well as $322 million in short-term investments. These $7.5 billion can be used for share repurchases. Additionally, Adobe is generating about $6.5 billion in free cash flow annually. Even when Adobe can spend its entire free cash flow for share repurchases, it will take several years to repurchase shares worth of $22.5 billion. And although Adobe is not paying a dividend, it still needs cash to repay outstanding debt. On August 30, 2024, the company also had $1,499 million in short-term debt as well as $4,128 million in long-term debt, and the annual free cash flow is enough to repay the total debt right away. Nevertheless, we should not expect Adobe to spend more than $7-8 billion annually on share repurchases in the next few years.

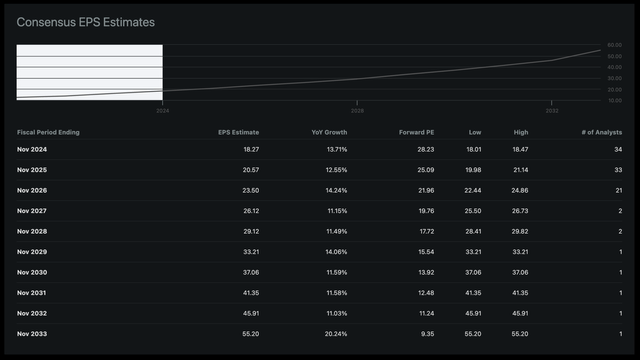

Adobe: EPS Estimates for the next 10 years (Seeking Alpha)

When combining the different aspects, analysts seem to be rather optimistic for the years to come. Until fiscal 2033, they are expected the bottom line to grow with a CAGR of 13.07% and of course, estimates for fiscal 2029 and the following years are based only on the estimates of one single analyst. And when comparing this to an annual growth rate of 35.66% in the last ten years for earnings per share, we clearly see a slowdown for EPS growth but still a double digit growth rate.

Wide Economic Moat

And we will come back to the fact that Adobe needs (high) growth to justify current valuation multiples. To achieve these growth rates, innovation and new products are necessary, and the company has to tap into new markets or take its share of the growing total addressable markets for its products.

However, we should not ignore the wide economic moat Adobe has around its business, making the business difficult to attack. And in case of Adobe, I would argue that it can at least grow its revenue in the low-to-mid single digits due to its economic moat. The company has pricing power and can raise its price in the low-to-mid single digits annually without losing many customers.

In my first article about Adobe, I already described the economic moat and I mentioned that the moat of Adobe is mostly based on two different sources. On the one hand, we have the brand name and the intangible assets Adobe has. This is also including the fact that Adobe has achieved for one of its major products to become a verb – “to photoshop” is used in a similar way as “to google” and is not only describing the product of Adobe or Google but is used by a wide public – independent of the products.

Additionally, and more importantly, Adobe’s moat is based on the switching costs it creates. In my first article about Adobe, I wrote about the switching costs:

While many of the products are creating switching costs, this can be demonstrated quite well when looking at Photoshop. Not only does it take a lot of time to “learn” Photoshop and become very experienced in working with the program, but it is also the industry standard and is already part of design curriculums at universities. And this is generating extremely high switching costs for everybody. Companies will continue to work with Photoshop when students are already familiar with the program. Companies will also think twice about switching to the product of a competitor when hundreds or thousands of employees must be trained to use a new program.

And when looking at the numbers, it still seems possible to measure the economic moat in quantitative ways. Despite huge stock price fluctuations in the last few years, Adobe has outperformed the S&P 500 in the last ten years – as it has in the previous decades.

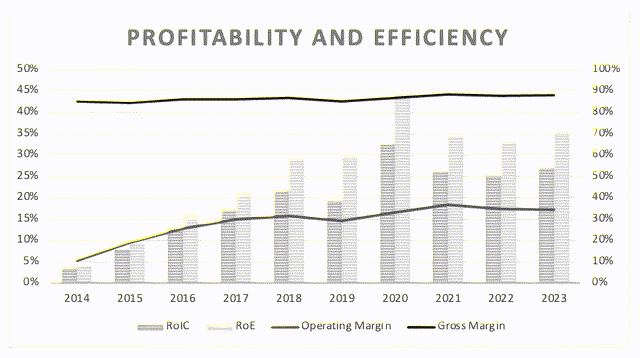

I already mentioned the stable margins above – especially the gross margin of Adobe is not only extremely high (close to 90%) but also with any major fluctuations, which is a strong hint for pricing power.

Adobe: Margins and Return on Invested Capital (Author’s work)

Additionally, when can look at return on invested capital – one of the most important metrics to determine if a company might have an economic moat or not. In the last ten years, Adobe reported a RoIC of 19.38% on average and in the last five years it increased even to 26.05%.

In the third quarter of fiscal 2024, Adobe once again generated the biggest part of revenue from subscriptions ($5,180 million, which is resulting in more than 95% of total revenue) and this is also leading to stability and consistency for the business in its cash flows.

Intrinsic Value Calculation

A final step in our analysis is to determine if Adobe is over- or undervalued at this point. In my last article, I considered Adobe to still be a “Hold” at best and with the stock price now trading more than 50% higher, it seems reasonable to classify the stock still as a “Hold”. However, a closer look is necessary as intrinsic value calculation can be wrong.

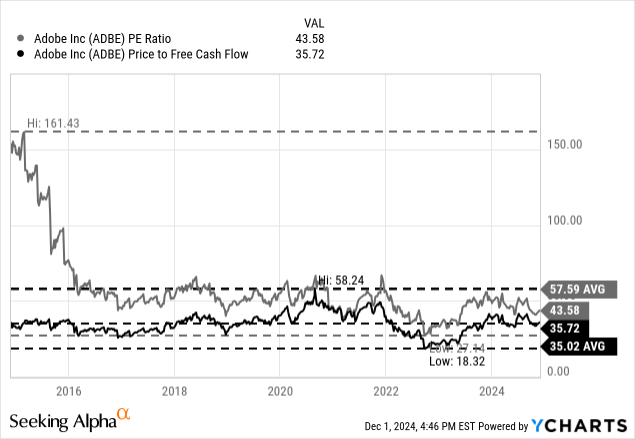

When looking at the two major simple valuation multiples – the price-earnings ratio as well as the price-free-cash-flow ratio – we see multiple expansion in the last two years. Right now, the stock is trading for a P/E ratio of 43.6 and although this is below the 10-year average of 57.59 I would still argue that such a valuation multiple can only be justified with constant and high growth rates. When looking at the price-free-cash-flow ratio, Adobe is trading for a multiple of 35, which is a little lower but still no multiple that is justifying the label “cheap” for a stock.

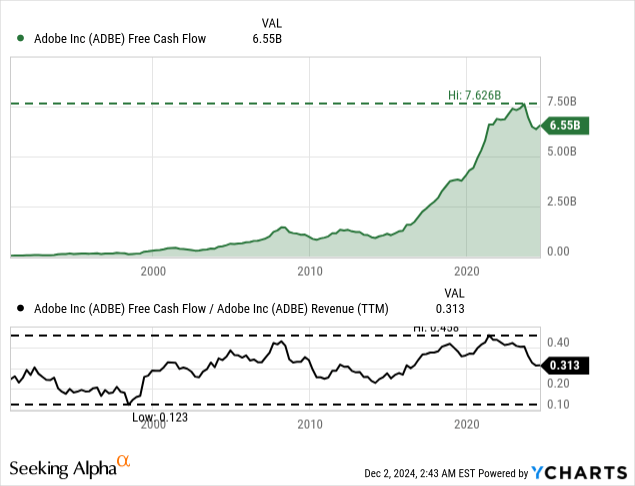

While the valuation multiples are telling us something about the stock and how cheap or expensive it is, we can also use a discount cash flow calculation to determine a more precise intrinsic value. As always, we are calculating with a 10% discount rate (as this is the annual return we like to achieve) and the last reported number of diluted shares outstanding (448 million). As basis for our calculation, we can use the free cash flow of the last four quarters, which was $6.55 billion and for the next ten years we assume 13% annual growth – in line with analysts’ assumptions (see section above). And for perpetuity, we assume 4% growth. When calculating with these assumptions, we get an intrinsic value of $443.98 – making the stock overvalued.

We can look at free cash flow a little bit closer. In the last four quarters, 31.3% of revenue the company generated ended up as free cash flow. And without doubt this is a high amount and margin of which many other businesses can only dream about. Nevertheless, we see that Adobe was able to generate even higher free cash flow margins in the past, and therefore we could argue that the current free cash flow is not describing the business accurately. We could argue for a little higher free cash flow amounts in the years to come. But in my opinion, 13% growth is already optimistic for Adobe for the next ten years, and I would not calculate with higher numbers.

Conclusion

In my opinion, Adobe is slightly overvalued and remains a “Hold” at best. The business is certainly high-quality and probably a long-term investment for decades to come. But it could make sense to wait a little bit, and maybe we are able to purchase Adobe again for a lower stock price.

In less than two weeks from now – on December 11, 2024 – the company will report its fourth quarter earnings and analysts are estimating $5.54 billion in revenue and earnings per share of $3.68. In the last three months, revenue estimates were mostly lowered and earnings per share estimates rather increased. And not only will the next report tell us more about the business, it could also move the stock in both directions.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.