Summary:

- CleanSpark stock is up 68% since October, showing strong potential despite a 6% pre-market drop after Q4 results, maintaining a bullish outlook.

- CLSK stock valuation remains attractive, with significant capacity growth and a substantial Bitcoin treasury, suggesting further upside potential if Bitcoin prices rise.

- CleanSpark’s high short interest (19%) could lead to volatility but also offers potential for swift stock movement upon an upside breakout.

- Despite risks like rising Bitcoin difficulty and volatility, CleanSpark’s strategy and bullish Bitcoin outlook support a Strong Buy rating.

luza studios

CleanSpark overview

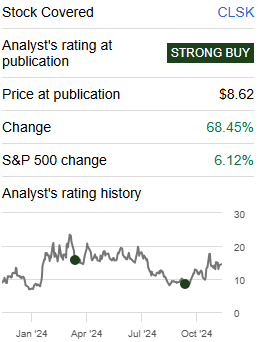

Bitcoin miner CleanSpark (NASDAQ:CLSK) posted fourth quarter earnings on Monday night, and the stock is off about 6% pre-market following the report. The last time I covered CleanSpark was in early October, and the stock is up 68% since then.

Seeking Alpha

At the time, I called out a bottoming pattern in the chart that looked like it had strong potential, as well as a compelling valuation. The bottoming pattern certainly worked out as the stock has added two-thirds to its value since, but the valuation hasn’t really budged. As we dig into the fourth quarter results, the fact that the valuation hasn’t moved has me remaining quite bullish. Let’s dig in.

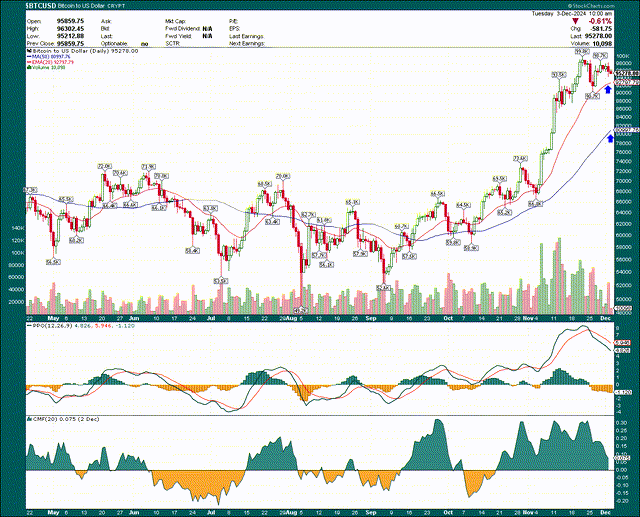

CLSK stock – Resistance overhead, but only a matter of time

That’s how I’m viewing the price chart today, following that huge advance. We have what should be a strong resistance level right around $15, which was the bottom of the trading range from February to July. When that broke, it was a nasty development. However, if the stock can sustainably reenter that range, I think it could be off to the races.

We can see the stock closed on Monday right under that level after a failed move in November. For now, we have the PPO in positive territory, and a neutral Chaikin Money Flow index. The stock is trading right at the 20-day EMA pre-market, and just over the relative high from October. This is a decision point for investors as we are either going to see it bounce from these levels, or suffer a larger breakdown. My absolute line in the sand in terms of short-term support is the rising 50-day SMA, currently just under $12.

Obviously, the direction of Bitcoin itself is critical, and I detailed my views on the OG alt-coin recently.

Bitcoin is obviously consolidating after its parabolic move following the US election. We have a lower high in place now, so unless and until we get a move over $100k, Bitcoin is drifting sideways to down. This is normal after parabolic moves, so I’m not concerned; investors have to take moves like this into account, and you’ll get sellers into profit. The first level to watch is the 20-day EMA at ~$93k, and then the 50-day SMA at ~$81k. I don’t think we’re going to see the 50-day SMA anytime soon, but I would not be surprised to see the 20-day EMA taken out temporarily during this consolidation phase.

While the short-term looks choppy, I absolutely remain bullish on Bitcoin, and believe it is only a matter of time before we get a bunch of new highs. Should that be the case, it stands to reason CleanSpark and the other miners should follow suit.

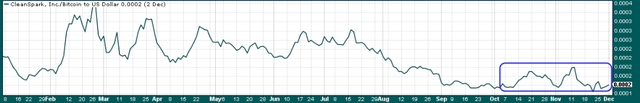

On the valuation front, I’ve recreated the chart I showed back in October noting that CleanSpark’s valuation relative to Bitcoin had plummeted.

The blue rectangle is the time that has elapsed since my October article, and we can see the valuation really hasn’t moved. By extension, that means I’m still just as bullish on the valuation as I was then, fueling my still-bullish view on CleanSpark.

Finally, CleanSpark’s short interest is a staggering 19% of the float, meaning that if we do get an upside breakout, we could see the stock move quite swiftly. Short interest is not the reason to buy or sell CleanSpark on its own. Short interest makes a stock extremely volatile, and stocks with high short interest often have it for a reason. But it’s a potential help for the bull case if and when we do get the breakout.

A record year

CleanSpark’s full-year results showed revenue more than doubling year-over-year to $379 million, although it did miss expectations by about $7 million. GAAP earnings came to a loss of 69 cents per share, again missing estimates. However, I’m not particularly concerned about current results with CleanSpark; it’s in a high-growth phase where it’s rapidly investing in and deploying capacity, as well as building its Bitcoin treasury for future value.

The company’s strategy has been to continue to prioritize owned infrastructure in building its hashrate, which is now on course for 37 EH/s by the end of the year, and 50 EH/s into 2025. In the past year, the company has added 423 MWs to its portfolio, which more than doubled its capacity over that period to 726 MW. CleanSpark noted it has hundreds of MW in the near-term pipeline ready to deliver, which will continue to boost its capacity to mine. CleanSpark’s capacity helped it produce about 7,100 Bitcoin.

Adjusted EBITDA for the year was $246 million, up enormously from $25 million in the prior year. While GAAP earnings were negative, the company’s EBITDA number shows sustained progress on building capacity profitably.

As we’ve seen corporations hold Bitcoin as a store of value, the balance sheets of miners have taken on new significance. CleanSpark ended the year with $122 million in cash and equivalents. In addition, it held just over 8,000 Bitcoin, and produced 655 more in October, subsequent to the end of the quarter. Just the balance at the end of September is worth about $760 million at today’s Bitcoin price, so it’s a massive portion of the company’s market cap. Keep in mind that as CleanSpark continues to build its Bitcoin balance – which it can do given it has plenty of cash to operate and build its mining capacity – its correlation to Bitcoin’s price should rise. That helps drive the bull case given the relatively low valuation of CleanSpark to Bitcoin.

While CleanSpark showed a net loss for the fiscal year, the company continues to build capacity, as well as its Bitcoin hoard. Q4, then, shows in my view, continued progress for the bulls, and a share price that doesn’t yet fully reflect the company’s potential.

Risks to consider

Obviously, CleanSpark is not exactly a safe and stable stock, as it carries with it significant risk. However, with significant risk comes significant potential reward, and I suspect that if you’re looking for a blue chip to park retirement money, you wouldn’t be here. Any potential position you might take should be carefully considered, and prudently sized.

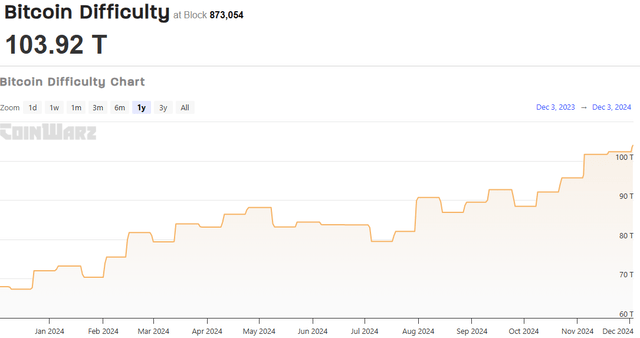

One of the things that is out of CleanSpark’s control that can impact the bull case is its ability to add Bitcoin to its balance sheet. Bitcoin difficulty continues to rise – as it will forever – meaning it takes more capacity to mine the same amount of Bitcoin, all else equal.

Difficulty is at its highest-ever level once again, and this will simply continue to rise over time. The rate at which it rises is of particular interest to miners, CleanSpark included. The risk here is that if difficulty moves a lot higher, it means the number of Bitcoin that can be added to the balance sheet declines.

Another risk is that the price of Bitcoin itself falls significantly. I’ve made it clear I don’t think that’s likely to happen, but it definitely could. If it does, CleanSpark shares are likely to suffer meaningfully.

Lastly, volatility and short interest are factors here. I touched on this earlier, but wanted to drive the point home. For some context on CleanSpark’s volatility, the implied volatility of at-the-money options for one month from now is about 150%. That’s 15X the S&P 500, so that’s what you’re dealing with here. That level of volatility in and of itself is a risk to shareholders. I mentioned short interest earlier, and we have nearly one-fifth of the float shorted today.

However, with all factors taken into account, I believe CleanSpark is likely to continue its bull run, particularly given my bullish stance on Bitcoin itself. CleanSpark should benefit from higher Bitcoin prices, and potentially from its extremely low valuation relative to Bitcoin normalizing. I’m reiterating my Strong Buy on CleanSpark after FQ4 results.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CLSK either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.