Summary:

- Intel’s CEO Pat Gelsinger steps down amid Board dissatisfaction, signaling a major leadership shift.

- A potential business split and strategy overhaul loom as Intel explores new directions under interim co-CEOs who do not come from a technology background.

- Wall Street analysts speculate a breakup of Intel’s foundry business could unlock shareholder value.

- Uncertainty around Intel’s new strategic direction prompts a rating change from buy to hold.

hapabapa

Intel Corporation (NASDAQ:INTC) has gone through radical changes in the last few years, and the company seems to be on the brink of major changes with the departure of Pat Gelsinger. When Intel announced the appointment of Gelsinger as CEO in January 2021, I thought it was the right decision given his technology background compared to former CEO Bob Swan’s background in finance. However, I cautioned investors of the pitfalls of being overly optimistic, and I decided to stay on the sidelines until I saw tangible progress. With INTC stock down almost 60% since January 2021, I do not regret this decision.

Last September, I turned bullish on Intel as I thought the company’s restructuring efforts, including cost-reduction measures, asset divestitures, and the focus on its core semiconductor business, would steer the company in the right direction in the long run. INTC is up 23% since then. The CEO change comes as a surprise for me, although one could argue that Pat Gelsinger failed to turn things around for Intel.

Intel’s Leadership Shuffle

Intel announced Pat Gelsinger’s departure early yesterday, confirming that he has retired from the CEO position and stepped down from the Board effective December 1. More details emerged later in the day, asserting that Gelsinger was given an ultimatum – to retire or be removed. According to a Bloomberg report, the Board of Directors had lost confidence in Gelsinger’s turnaround strategy.

Intel is on the lookout for a new CEO. In the meantime, David Zinsner and Michelle Johnston Holthaus will act as interim co-CEOs. Given that poor leadership choices have played a critical role in Intel’s struggles, I hope the company will find a suitable candidate with technology expertise to fill Gelsinger’s shoes sooner rather than later. For context, appointed interim co-CEOs do not hail from a technology background. David Zinsner comes from a finance background, while Michelle Johnston Holthaus hails from a product marketing background. As an investor with exposure to many tech stocks, I strongly believe that a tech company should be led by a technology expert, except in rare instances when a certain tech company is focused on asset divestitures and M&A deals.

What Does Intel’s CEO Change Mean For Investors?

Pat Gelsinger’s departure from Intel is likely to mark the beginning of a new phase for the chipmaker, where the company may look for ways to split its manufacturing and product design businesses. Gelsinger envisioned Intel returning to its former glory by restoring its technological prowess while keeping all business units under one roof. However, with his departure, the Board of Directors may find a new CEO who would be more receptive to the idea that Intel needs to split its business units to achieve higher efficiencies while focusing on one key area.

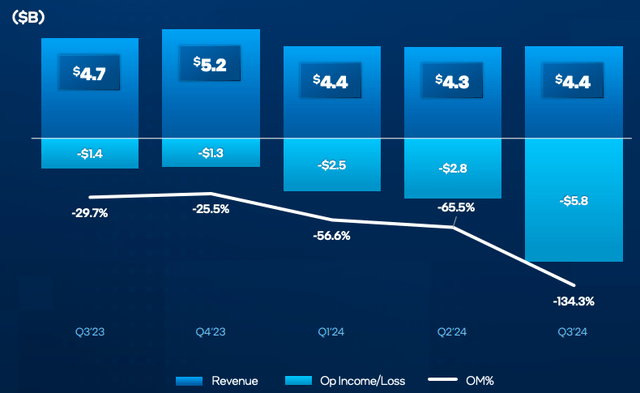

Another major strategy change could come in the form of walking back the ambitious plans for the foundry business. Despite Pat Gelsinger’s strong conviction in the foundry business, this unit has returned abysmal financial results. The incoming CEO may rethink the foundry strategy and potentially separate this unit from the core business.

Intel foundry revenue, operating income, and operating margin

I believe Mr. Market will react positively to a separation of the foundry business, given the challenges faced by this segment. In fact, a few Wall Street analysts have raised concerns about the sustainability of the foundry business despite Pat Gelsinger’s predictions for operating margins of 30% by 2030. In September, Citi analysts wrote:

While in our view Intel manufacturing for CPUs is on track, we continue to believe it should exit the foundry business in the best interest of shareholders.

Bank of America analysts also claimed yesterday that Intel may consider a potential breakup under a new CEO, and wrote:

Both businesses are undergoing their own strategic, structural, financial, and competitive issues, with no near term solution in sight.

Although the separation of the foundry business is on the cards, the company may find it difficult to attract a reasonable price for this business unit in the foreseeable future. In addition, Intel may face regulatory barriers as the company has secured nearly $8 billion in funding through the CHIPS Act, which aims to support domestic chip manufacturing.

The departure of Gelsinger may also encourage rivals to approach Intel’s Board of Directors with new offers to potentially acquire the company or one of its business units. Intel rejected a few advances by rival chipmakers in recent times, but things may change in the future under a new CEO.

- Intel rejected an offer by Qualcomm Inc. (QCOM) to explore a sale of the PC design business in September.

- Intel rejected advances by Arm Holdings (ARM) to acquire the product business in September.

- Apollo Global, despite showing interest in investing up to $5 billion in Intel, has yet to secure a deal with the company.

Under Pat Gelsinger’s leadership, Intel was determined to remain independent and was more focused on internal restructuring to turn things around. This may change in the future, but everything depends on Intel successfully procuring a capable leader to steer the company toward a successful turnaround.

The new CEO will have a lot of questions to answer, including the company’s strategy on AI chips, an important market segment where the company has performed poorly.

Takeaway

Pat Gelsinger’s sudden departure suggests Intel is on the brink of changing its strategic direction once again, given the lackluster progress the company has made in the last four years. There is a lot of uncertainty, and I believe we may see a reversal in some of the strategies introduced by Pat Gelsinger under the leadership of a new CEO. In light of this uncertainty, I am changing my stance on INTC stock to hold from buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.