Summary:

- Intel Corporation announced the retirement of Pat Gelsinger; we think it was a right guy, wrong time kind of situation.

- We also believe INTC stock is trading below its intrinsic value at current levels and that new management coupled with PC TAM expansion in 2025 could bode well for the company.

- Intel’s undervaluation, new management and potential business break up, presents a compelling trade opportunity for the first half of 2025, in our opinion.

- We reiterate a buy on INTC stock as a trade, rather than a long-term investment.

Adam Taylor/DigitalVision via Getty Images

Intel Corporation (NASDAQ:INTC) stock shot up after news of now ex-CEO Pat Gelsinger’s abrupt retirement amid what looks like internal disputes about INTC’s strategic direction and lackluster performance under Gelsinger. Our take is that Gelsinger was the right man for the job, but two things worked against him: time and the macro backdrop. Gelsinger, who is now rumored to be stepping back with $10M in severance pay, was a core part of the company’s founding team and has served most recently as CEO since February 2021, spearheading INTC’s IDM 2.0 turnaround plan (that hasn’t gone so well).

INTC stock lost around 30% of its valuation since August with a hefty net loss of $16.6B this quarter compared to a net profit of ~$300M in a year ago quarter due to restructuring. We think INTC is no longer a name to invest in, but one to trade. Consistent with our last article on INTC, “Outlook Too Easy To Miss, Buy For The Honeymoon Phase,” we continue to believe INTC’s trading below its intrinsic value at current levels and see a window to trade the stock on Gelsinger’s exit.

A door closes, and a window opens

The market’s initial reaction to Gelsinger’s retirement was positive, with the stock popping 5% on Monday, but come around Tuesday, the stock is trading down 5% so far. Part of the mixed reaction can be attributed to the INTC board apparently losing confidence in Gelsinger’s turnaround plan, which is costly and time-demanding. We think that INTC remains in a tough spot, and Gelsinger’s removal won’t be a magical fix, but we do think it opens room for new ways forward.

The first way forward has to do with Intel Foundry, which the company announced in September will be established as an independent subsidiary; federal funding of $7.86B followed the September announcement in November aiming to “enhance the company’s manufacturing and packaging capabilities.” Gelsinger was against breaking up the company and strongly advocated for keeping its internal manufacturing business and foundry branch together. This strategy tested shareholder confidence and didn’t bear any fruit. New management is expected to be more welcoming to the idea of restructuring and break-offs.

This could be a turnaround trigger for INTC, considering its benefit from U.S. federal funding attempting to move chip-making to U.S. soil. Not to mention that INTC also has innovation to offer, a primary example of which is its A18, which is being manufactured in 2H24 and could bring upside surprise, particularly considering how negative the market is on INTC at the moment. A18 is an “industry-first implementation of backside power delivery architecture that improves standard cell utilization by 5-10% and ISO-power performance by up to 4%.” A18 node offers an “increase of up to 10% performance per watt.” We think there are possible green shots here.

For now, CFO David Zinser and general management Michelle Johnston Holthaus act as interim co-CEOs until the board appoints a CEO. And, it’s no secret that the decision is not apolitical, i.e., the macro backdrop plays a role in strategic management appointments. We’ve seen how relevant CEO political positioning can be with Tesla’s (TSLA) stock price performance post election. With that in mind, the new management is expected to have more friendly ties to the Republican Party, with Republican president-elect Donald J. Trump taking office early next year. Gelsinger was a strong proponent of the Democrat Party and closely tied to the outgoing Biden administration. The careful and intentional political positioning of the new CEO could prove important for INTC’s revival in today’s America; this is our opinion and not fact.

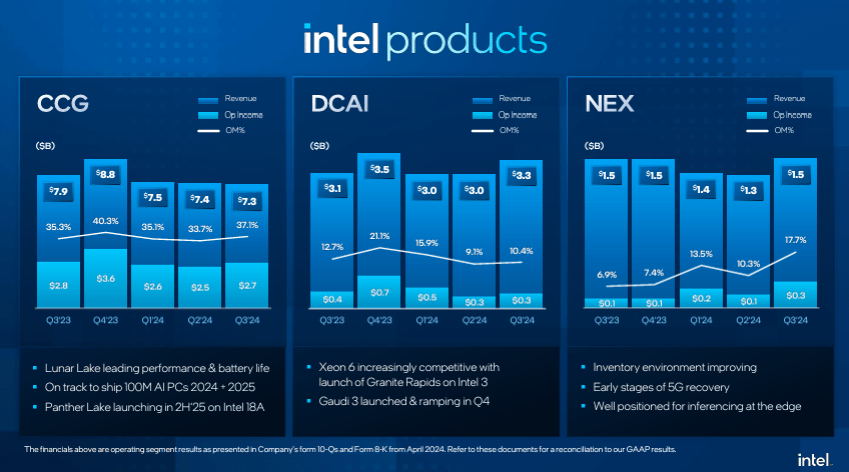

The second potential positive here is from the end-demand outlook. The following chart showcases INTC business segments from 3QFY24 earning results. Client Computing Group or CCG, which accounts for the bulk of INTC’s total sales at 55.2% this quarter, has struggled in FY24 due to lackluster PC end demand. We don’t think we’ll see any PC recovery this year, but we strongly expect one next year. Let’s start with why we don’t see any uptick in demand for Q4, and then explain why the case looks better for 2025. This year, we agree with Digitimes’ sentiment that:

“PC chip demand has already passed its peak for 2024, and suppliers’ sales already started declining in September with little hope of a seasonal uptick during the fourth quarter.”

INTC 3QFY24 earning results

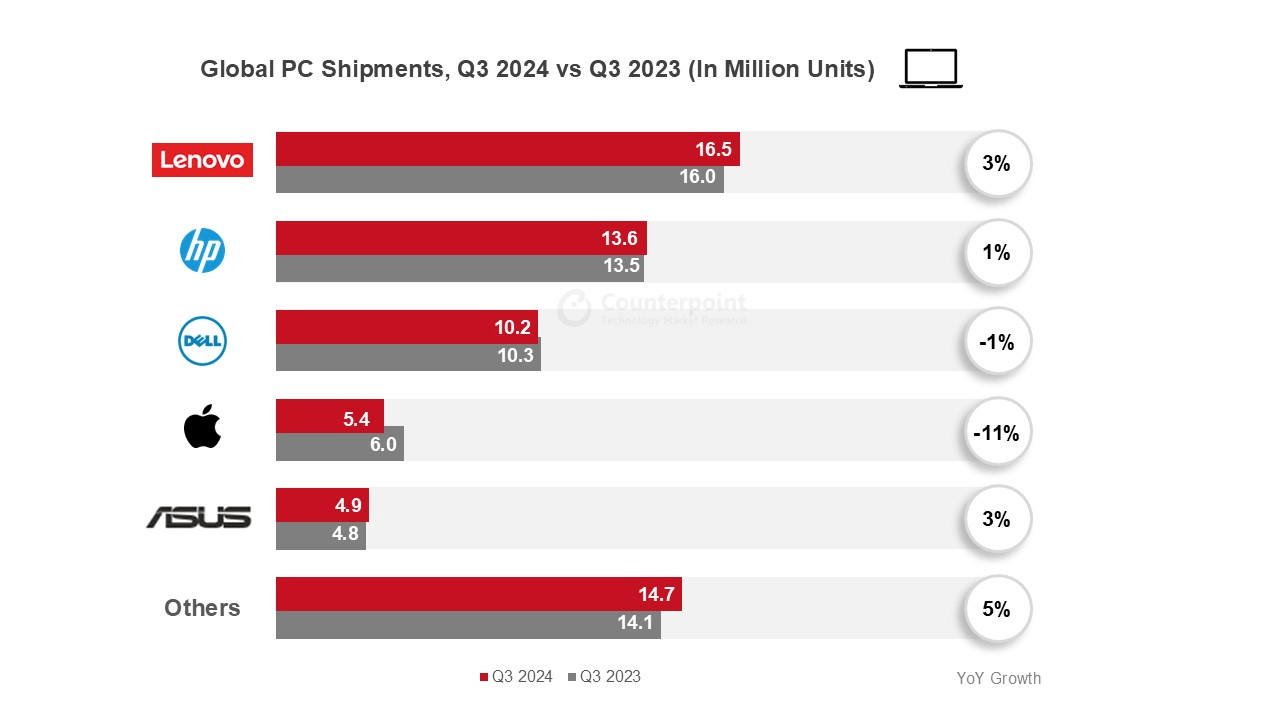

There has also been no near-term catalyst to accelerate the pace of recovery. The chart below shows the Y/Y comparison of global PC shipments from top vendors in 3Q24 versus 3Q23.

Counterpoint

Now, 2025 should see PC TAM expansion because there are already two triggers set in place. The first is a more favorable interest rate environment, which should ease the tight belt around enterprise budgets, leading to workforce expansion and a refresh PC cycle. The second goes hand in hand with the PC refresh cycle and is the Microsoft Windows End of Life, which is up in October 2025. For reference, End of Life “means that the product will no longer receive any form of support from Microsoft, including security updates and patches” and will require an upgrade. We expect these two factors, coupled with the AI PC moment, to expand the PC TAM more substantially in 2025, and INTC is still positioned to benefit from this, even more so with Lunar Lake ramping.

Word on Wall Street

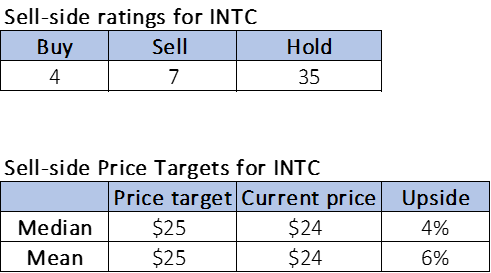

Wall Street continues to be bearish on the stock. Four of the 46 analysts covering the stock are buy-rated, 35 are hold-rated, and the remaining seven are sell-rated. Sell-side price targets are also not too positive on the stock; INTC stock currently trades at $24 with the median and mean price target at $25 for a 4-6% potential upside. We think Wall Street’s caution is not ill-founded; INTC has struggled to keep up with rivals Advanced Micro Devices (AMD) and Nvidia (NVDA) on the PC and server front, not to mention losing Apple’s (AAPL) business and is paying the price of the lagging innovation in the past. Having said that, we firmly believe that INTC is priced below its intrinsic value at current levels, with a current market cap of $103.21B versus close competitor AMD at $231.44B. Hence, we think that the stock makes for an attractive trade for 1H25 at current levels.

The following outlines Wall Street’s sentiment on the stock.

TechStockPros

What to do with the stock?

We think Gelsinger’s efforts weren’t entirely lost. Now new management will steer the company to what the market wants to see and maybe give up on the vision of INTC being what it once was, i.e., through breaking up the company. We think there will be a good trade in that transition. In the near term, management will likely focus on rebuilding INTC’s financial stability and regaining investor confidence.

The company will be at the UBS Global Technology Conference this Wednesday, two days after the news about Gelsinger. It should provide investors insight into what to expect and, more specifically, give investors something to hold on to. We believe INTC is trading below its intrinsic value at current levels, and that new management and PC TAM expansion in 2025 will bode well for the company.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Tired of losing money? Our Tech Contrarians team of Wall Street analysts sifts through the noise in the tech industry and captures outperformers through a coveted research process. We let the work speak for itself here.