Summary:

- Investigation revealed no evidence of misconduct by management or the Board, confirming financial integrity and governance independence.

- SMCI expects no restatements for FY2024, reducing risks of severe accounting disruptions or investor confidence loss.

- The board adopted the Special Committee’s recommendations, including hiring a new CFO, Chief Compliance Officer, and General Counsel to strengthen oversight.

- SMCI commits to filing overdue reports for FY2024 and Q1 FY2025 by early 2025, addressing delisting risks.

- SMCI aims to finalize the CFO hire by January 2025, addressing governance concerns and ensuring timely SEC filings.

alvarez

Investment Thesis

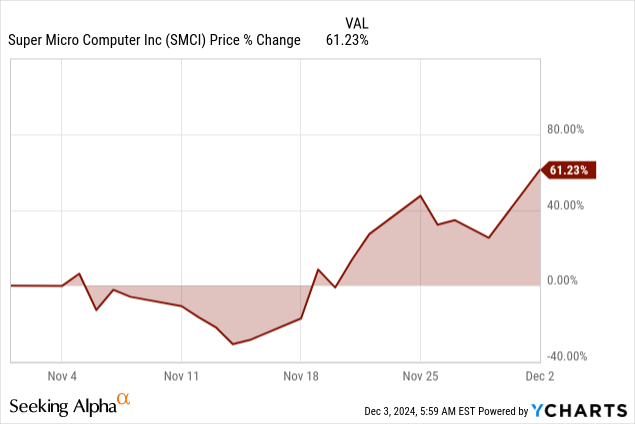

Recent events at Super Micro Computer, Inc. (NASDAQ:SMCI) have met our prior assumptions very well. We anticipated stabilization after the appointment of a reputable auditor, and, sure enough, the Special Committee investigation is complete with no evidence of misconduct by management or the Board. This confirms our expectation that governance issues were overblown. The lack of intended restatements further limits the possibility of material accounting issues, reinforcing the view of operational integrity.

Our probabilistic scenarios placed strong emphasis on an appointed credible auditor and resolved governance-related concerns that would strongly de-risk delisting prospects. With SMCI having filed its compliance plan and its financial filings due, within the discretionary timeline available to Nasdaq, we now estimate that the probabilistic scenario for a successful outcome exceeds 80%. The significant challenges include timely filing within the discretionary timelines allowed under Nasdaq rules and persistent regulatory scrutiny.

Since our previous bullish call, when I initiated a position in SMCI, it was clear that the risk/reward ratio was favorable, supported by the company’s strong AI infrastructure positioning and progress on addressing governance concerns. Recent developments with the findings of the Special Committee, have further de-risked the investment thesis, upgrading to a strong buy rating. With no expected financial restatements and credible measures to enhance corporate governance underway, the company’s path toward compliance and stability is becoming clearer.

Independent Review Clears Governance Concerns

The Special Committee was established after the resignation of EY, on concerns over governance and financial practices. It has just concluded the investigation, with the help of legal experts at Cooley LLP and forensic accounting specialists from Secretariat Advisors, LLC. The review entailed extensive data collection, analysis, and interviews.

More than 9,000 hours of legal work and 2,500 hours of forensic accounting were dedicated to the review of management integrity, revenue recognition practices, export controls, and related party disclosures. The results were unequivocal: no evidence of wrongdoing by senior management or the Board of Directors. Also, the Audit Committee performed its duties independently and properly for the oversight of financial reporting. Other reviews of key sales transactions, export compliance, and re-hiring of former employees had no material consequences.

While minor lapses in some processes were noted, these have been considered to result from operational shortcomings rather than being viewed as acts of bad faith or improper motives. These conclusions run directly contrary to the issues that EY raised in their letter of resignation and lend the much-needed validation of the internal practices at SMCI.

As a result of the Special Committee’s recommendations, the Board of Directors of SMCI has undertaken wide-ranging governance reforms. This includes naming Kenneth Cheung as Chief Accounting Officer, and launching searches for a new Chief Financial Officer, Chief Compliance Officer, and General Counsel. Such leadership changes are expected to bring added oversight and make sure that the financial and compliance functions of the company are well-equipped to support the rapid growth and operational complexity.

The Board further committed to refining the processes for monitoring guardrails, enriching training programs, and increasing the company’s legal and compliance resources. These actions answer identified lapses in the investigation and are designed to support the company’s ambitions in the fast-growing AI infrastructure market. The reforms signify SMCI’s intent to rebuild trust and position itself for long-term success.

SEC Filings and Nasdaq Compliance Going Forward

SMCI remains listed on Nasdaq, pending the filing of the overdue financial reports. It has submitted a compliance plan to Nasdaq indicating its intention to file its Annual Report, Form 10-K for Fiscal Year 2024, which ended June 30, 2024, and its Quarterly Report on Form 10Q for Q1 FY2025 within a discretionary extension period. Based on this indication, filings are expected at the very start of 2025.

Importantly, the company believes that no restatements of previously issued financial statements are expected. This could lower any potential for serious disruptions to the company’s finances and also speaks to how seriously the Special Committee worked. At this point in time, however, SMCI is still a target of this regulatory scrutiny. Any prolonged delays or increased findings could possibly complicate a path that is supposed to be taken. The stakes are extremely high, as delisting from Nasdaq will materially impact liquidity, investor confidence, and access to capital markets. Yet, the company’s progress toward addressing governance concerns and its proactive steps towards bolstering internal controls provide reason for cautious optimism.

What’s Next? Milestones Update:

- Appointment of a New CFO (Expected by End of December 2024/ early January 2025): SMCI is likely already in discussions with suitable candidates for the CFO role, given the urgency of meeting SEC filing deadlines. A shortlist of candidates is expected soon, making it plausible for the appointment to be finalized by the end of this year or early January 2025. This move will address governance concerns, reinforce financial oversight, and facilitate overdue filings. A well-regarded CFO could stabilize investor sentiment and potentially boost the stock price by at least 10-15%.

- Timely SEC Filings (Targeted by Q1 2025): Filing the delayed FY2024 10-K and Q1 FY2025 10-Q reports is critical for regaining Nasdaq compliance. These filings, supported by the new auditor BDO, would demonstrate progress in financial transparency. Meeting these deadlines could drive another (at least) 15-20% upside.

Takeaway

While the findings and subsequent reforms of the Special Committee were an important step forward, challenges persist. For SMCI to trade back in all-time highs, it needs to regain full investor and regulatory confidence, through continued compliance, increased transparency, and governance enhancement. Its strong positioning in AI infrastructure certainly provides a compelling growth narrative, but the risk factors from regulatory pressures and corporate restructuring cannot be entirely ignored.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SMCI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.