Summary:

- Super Micro Computer’s internal review found no misconduct, no need to restate financials, and implemented stronger guardrails, significantly de-risking the stock.

- Despite recent financial woes, SMCI’s core business remains strong, driven by high demand for Nvidia-enabled compute servers.

- SMCI’s valuation has become attractive, trading at lower multiples, presenting a compelling buying opportunity given the company’s growth potential.

- While risks remain, including the need for an external audit and potential supply chain issues with Nvidia, the risk-reward ratio appears positive.

Monty Rakusen

Boy oh boy, what a year Super Micro Computer (NASDAQ:SMCI) investors have had.

After an incredible run-up of more than 1,400% between January 2023 and the spring of 2024, SMCI’s stock began trading lower through this summer on the back of decelerating financial results.

Then, in August, Hindenburg Research put out a short report on the company, and one day later management stated that they wouldn’t be able to file their 10-K on time. After months of questions around the company’s long-term prospects, in September, the DOJ announced a probe into the company’s accounting practices, and in late October, Ernst & Young, SMCI’s auditor, resigned.

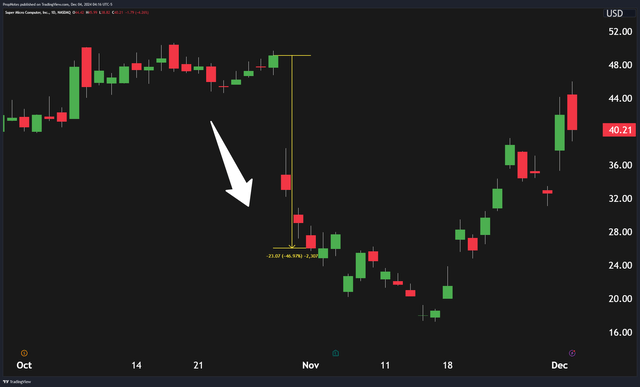

Through this period, peak to trough, SMCI’s shares fell nearly 85%, in what can only be described as a ‘fall from grace’ for a once red-hot stock:

For our part, we’ve largely held off from commenting on SMCI since our ‘Buy‘, and subsequent ‘Hold‘ ratings towards the start of this year:

The reason behind our silence is largely due to the lack of clarity we’ve had around the company’s financials and compliance, given all the news we’ve linked above.

In recent weeks, SMCI’s share price has once again shown signs of life as the company announced that it had found a new auditor, alongside filing a compliance plan with Nasdaq. More good news came out on Monday, as management announced that an internal review found no signs of misconduct. While this report did also include the news that the company would be replacing the CFO, we ultimately see it as another concrete step towards righting the ship.

Today, in this article, we’ll explore the company’s recent announcements, analyze where SMCI’s potential financial results may end up, and explain 3 key reasons why we now find the stock highly ‘buyable’.

Let’s dive in.

Reason 1: Positive Internal Review

As we just mentioned, on Monday, SMCI management announced that the company’s internal review found no evidence of misconduct:

Special Committee, supported by outside counsel Cooley LLP and forensic accounting firm Secretariat Advisors, LLC, finds no evidence of misconduct on the part of management or the Board of Directors and that the Audit Committee acted independently.

No restatement of reported financials expected.

Board adopts recommendations of the Special Committee and appoints new Chief Accounting Officer, approves the transition to a new CFO and authorizes additional executive hires, along with other measures to strengthen the Company.

(emphasis and italics ours)

In our view, the largest overhang for the stock – especially among analysts – has been the trustworthiness of the company’s financial statements.

Missing filing deadlines and getting dropped by an auditor doesn’t paint a pretty picture, and many analysts, both here and elsewhere, have taken issue with the company’s financial integrity. To us, this internal review goes a long way toward allaying those concerns.

While we would have preferred an outside review, the internal review had three key takeaways in our view:

- No evidence of misconduct

- No restating of reported financials

- Stronger guardrails in the future

Again, it’s hard to overstate the impact of these announcements when taken in unison.

No evidence of misconduct obviously reduces investor risk on the legal and regulatory front.

No restating of reported results removes risk on the financial front.

Finally, stronger guardrails in place going forward, with new executive hires, remove risk on the operating front.

As a result, we see SMCI’s story, going forward, as significantly de-risked.

When news broke that Ernst & Young dropped SMCI as a client, the stock tumbled 46% over the next three days:

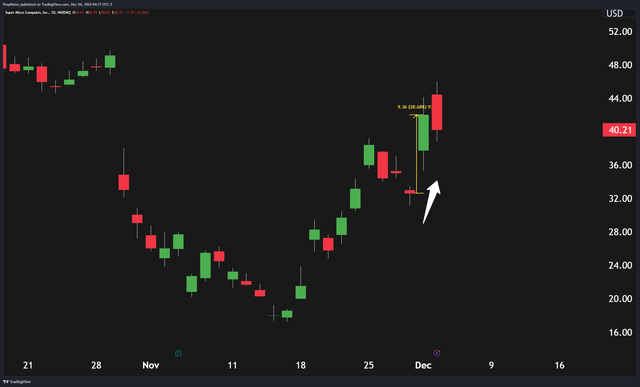

On Monday, upon the announcement of the internal review’s findings, SMCI’s stock popped nearly 30%:

In our view, this is the market aggressively re-pricing, in real dollars, SMCI’s risk profile after the positive news.

If this announcement were just fluff, we don’t expect it would have had as much of an impact as it did.

As a result, following continued reforms, we expect SMCI to begin reporting financial results on a regular basis going forward. Out of the three reasons we’ll cover, SMCI’s positive announcement on Monday is a key point to our bullish thesis.

Reason 2: SMCI’s Financials

So, we’re less concerned about the company’s financials than we were prior to Monday’s announcement. But what does the future hold for investors?

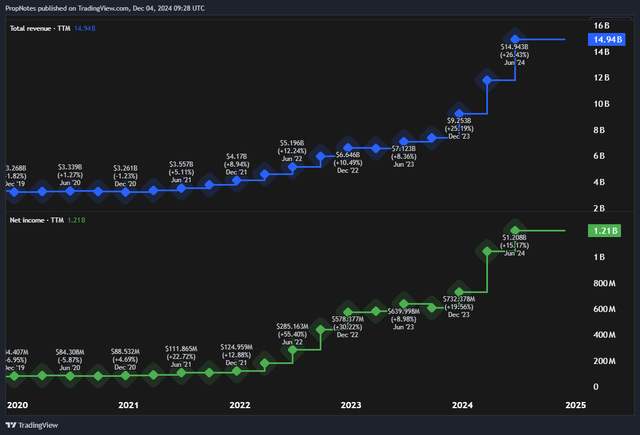

In short, we think the company’s financials, will, for the most part, pick up where they left off when management stopped reporting in early August:

As you can see, the company’s historical top and bottom-line performance has been growing steadily on the back of increased interest in Nvidia-enabled (NVDA) compute servers.

In case you didn’t know, SMCI’s core business is taking raw chips from designers and manufacturers, like Nvidia, and assembling them into turnkey server architectures & racks.

Thus, SMCI’s business is highly dependent on end-market demand for data center compute, which has been quite strong.

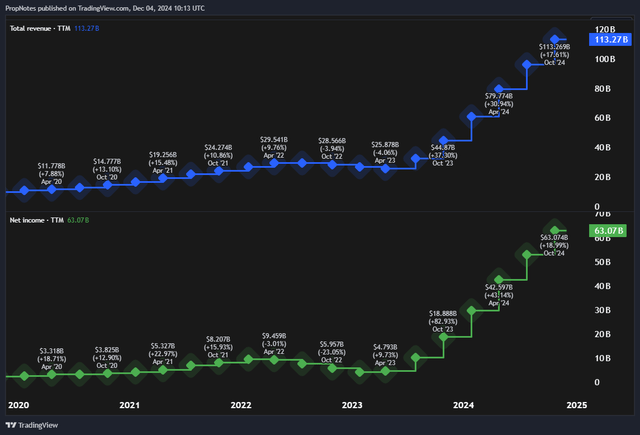

On Nvidia’s end, the company’s results are growing steadily and to the right, which suggests that SMCI’s results may continue to trend in this direction as well:

In November, SMCI released preliminary financials for FY 2025, which showed a slowdown in sales vs. guidance:

Preliminary First Quarter Fiscal Year 2025 Highlights

The Company expects to report the following financial information for the quarter ended September 30, 2024:

- Net sales in a range of $5.9 billion to $6.0 billion compared to its previous guidance range of $6.0 billion to $7.0 billion

- GAAP and non-GAAP gross margin of approximately 13.3%

- GAAP diluted net income per common share in the range of $0.68 to $0.70 compared to its previous guidance range of $0.60 to $0.77

- Non-GAAP diluted net income per common share of $0.75 to $0.76 compared to its previous guidance range of $0.67 to $0.83

However, we expect that these results are largely impacted by Blackwell’s Q4 release, which may have pushed back end-market demand.

Charles Liang, SMCI’s CEO, said as much on the recent call:

Indeed, last quarter, revenue reduced a little bit. I guess the major reason because there are some customers waiting for the new chip, the Blackwell chip, as you know. So people are waiting for the new solution. And the new solution, the Blackwell-based liquid cooling, air cooler, or GP200, our solution is ready. That’s waiting for a chip.

While the financial woes and issues we’ve seen in 2024 have clearly impacted the company to some degree, and the retracting of guidance for 2025 appears negative, we think that SMCI is still capable of putting up great numbers, and remains positioned in a key growth market we see continuing for years to come.

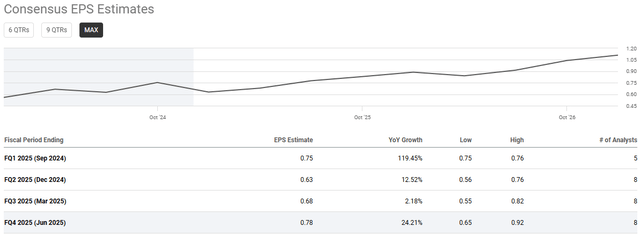

If SMCI experiences parallel, if somewhat diluted financial growth to the demand NVDA is seeing (which stands to reason), then we’d expect to see SMCI’s FY 2025 numbers coming in around $3.00, which is somewhat above analyst midpoint estimates of $2.83:

Remember, some analysts are predicting $10 billion alone in Q4 sales for Blackwell, which means that SMCI should see considerable growth on both the top and bottom lines, as a result of its position in the supply chain.

Our key point in talking about SMCI’s financials is that the company remains in a strong position in the market, despite the high-level accounting concerns. If this continues, then we don’t see why the company’s real results won’t continue to charge higher.

Reason 3: The Valuation

Finally, we come to the valuation question.

In our view, there’s no question that SMCI was ‘overvalued’ back in the spring of this year.

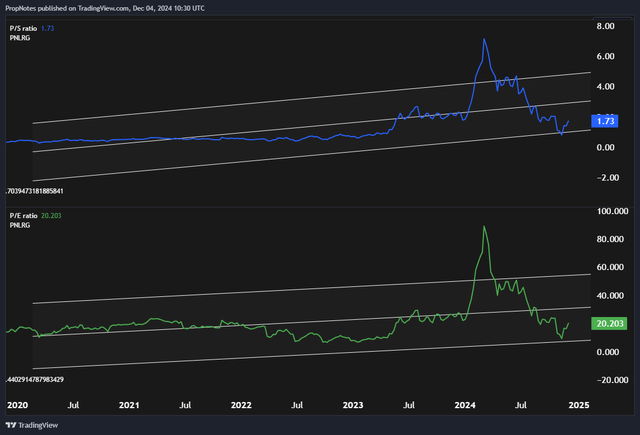

Trading at a massive multiple of 7x sales and 90x income, SMCI’s shares appeared overpriced, relative to the market, as well as itself, historically:

For evidence of this, have a look at the company’s top and bottom-line multiples above, each overlaid with standard deviation bands. The spike above ended up trading back into the range, partially due to a lower share price, but also due to growing underlying results.

We know the ‘official’ results haven’t yet come in for Q1 ’25, and that guidance remains withdrawn, but looking historically, this would have been a good time to get in, at roughly 20x income and 1.7x sales.

For a company in the opportunity zone that SMCI is in, this appears well-priced.

In our view, this is something to be exploited given our underlying confidence that the company’s problems will get sorted in the coming months and quarters.

Risks

That said, while we’re bullish on SMCI at this price, and at this point going forward, there are still a LOT of risks to consider.

We see two key risks at present.

First off, while SMCI’s internal review published positive findings, the veracity of the review is perhaps less strong than a full external review. While an internal review is quicker, which was of paramount importance in this case, an external review, like the one done by an auditor, hasn’t yet been completed.

We expect BDO to get quite in the weeds given how many eyeballs are on this audit, but there’s no certainty that SMCI’s accounting concerns are in the rearview mirror at this point.

Compounding this fact is that BDO took on SMCI as a client without previewing the financials or speaking with EY, which means that the signing of BDO, in and of itself, doesn’t say as much as one may think.

Secondly, there have been reports circulating that allege that NVDA is shuffling some Blackwell inventory away from SMCI to avoid supply chain disruptions.

The size of this negative depends on a lot of the scope of the changes. If NVDA removes significant supply away from SMCI, then it would significantly reduce the attractiveness of shares. However, given that the reports around this dynamic only allege this, we don’t want to count it as too large of a concern. The bigger risk here, really, is that NVDA could consider something like this if SMCI’s problems continue.

Summary

Overall, though, we think the risk-reward ratio for SMCI is firmly tilted to the positive following the company’s announcement on Monday, and we expect that shares will likely be trading higher, perhaps significantly higher, a year from now.

Hence, our ‘Buy’ rating.

Stay safe out there!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SMCI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.