Summary:

- Intel’s CEO Pat Gelsinger’s abrupt departure raises concerns about the company’s future as INTC struggles near 10-year lows.

- Interim Executive Chair Frank Yeary and two co-CEOs are overseeing the leadership transition, but many questions remain.

- Intel’s failure to capitalize on AI growth and its inability to convince investors of its transformation dealt Gelsinger a severe blow.

- INTC faces monumental challenges in supplanting TSMC while attempting to catch up with AMD and Nvidia.

- I argue why investors should avoid INTC as its troubles are far from over.

JHVEPhoto

Intel Corporation (NASDAQ:INTC) dropped a bombshell this week, as the dethroned King of semis announced that former CEO Pat Gelsinger has “retired” from the company (effective December 1). As a result, it marks the end of an era for Gelsinger since he returned to head the company in early 2021. However, he left the company with much less fanfare, as compared to his then “triumphant” return, as INTC surged to a high in early 2021.

At the time of his departure this week, the stock is still struggling near lows last seen in 2014, after its brief recovery from its September 2024 bottom. As the early optimism on the news of his departure filled the financial media on Monday, the gains petered out toward the end of the December 2 trading session. Therefore, it’s clear that the market remains uncertain about the direction of the company, as Gelsinger’s abrupt departure has likely led to more questions than answers for INTC investors.

I urged investors to avoid INTC in my previous article. I highlighted the market’s concerns over Intel’s competitiveness in the AI age, as Nvidia’s incredible rise could threaten Intel’s ability to regain investor confidence.

Interim Executive Chair Frank Yeary has been appointed to oversee Intel’s pivotal leadership transition. Two co-CEOs have been appointed, as Gelsinger didn’t seem interested in staying behind to help with the transition. While his departure isn’t believed to be acrimonious, there is discernible tension between the Intel board and its former CEO, as the board was said to have lost confidence in his leadership.

The questions for Intel investors are aplenty. The company is navigating a highly complex environment as it seeks to rejuvenate its data center business against share losses to AMD (AMD). Concurrently, it has failed to partake markedly in the AI infrastructure investments surge over the past year, allowing Nvidia (NVDA) to hog the limelight and bask in its glory while replacing Intel stock in the Dow Jones Industrial Average (DJI) (DIA) in early November 2024.

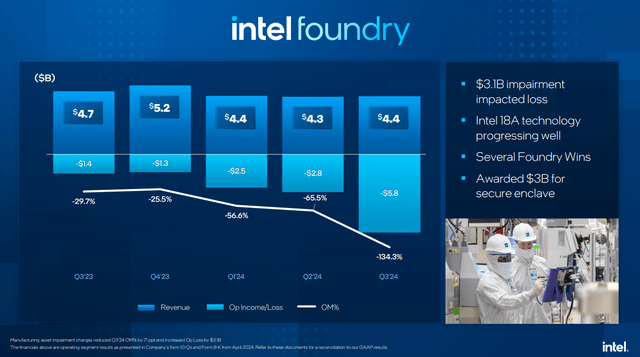

Intel foundry Q3 performance (Intel filings)

I believe the board’s decision to replace Gelsinger is clearly tied to the poor performance of the centerpiece of his strategy: Intel Foundry. As seen above, the company’s inability to compete against TSMC (TSM) allowed the Taiwanese foundry to benefit from the AI growth inflection. Intel’s lack of competitive advantages was laid bare, as the American chipmaker even needed to depend on TSMC to fab some of its advanced chips. In addition, the poor yields from Intel Foundry have failed to attract sufficient customers to drive its long-term goal of reaching $15B in revenue.

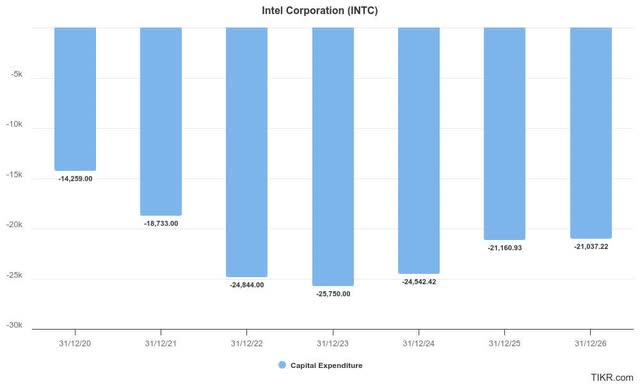

Intel CapEx estimates (TIKR)

Although the company is confident in its technology breakthrough as it progresses toward Intel 18A in 2025, investors are justified to demand more proof. Notably, Intel has secured about $7.9B in Chips Acts funding, with an “aggregate award of nearly $11B.” However, it pales in comparison to its estimated CapEx requirements through 2026, although management has committed to reining in spending at Intel’s Q3 earnings conference. As a reminder, Intel lowered its 2025 CapEx forecast to between $20B and $23B as it undertakes a restructuring program to improve its efficiencies.

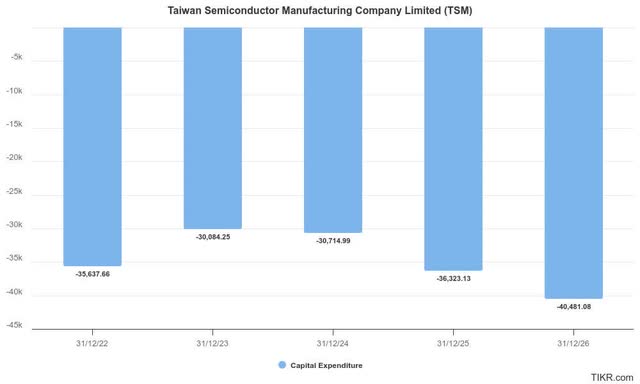

TSMC CapEx estimates (TIKR)

However, it pales in comparison to TSMC’s decision to raise CapEx for 2025, as it assessed the sustainability of its AI growth inflection. Hence, I believe the writing was already on the wall for Gelsinger, as the market has little patience for “losers” in the rapidly evolving race for AI supremacy.

None of the leading AI semiconductor companies and hyperscalers are expected to bet on the wrong horse as they invest even more aggressively in AI infrastructure. Therefore, the board is justified to decide that “enough is enough.” However, with INTC languishing at a 10Y low, Intel investors are likely asking what took the board so long to realize Gelsinger’s folly.

The financial media has started to circulate possibilities of splitting up Intel’s products and manufacturing businesses, in the post-Gelsinger era. That idea briefly gained traction with Broadcom (AVGO) and Qualcomm (QCOM) recently, although it hasn’t gone further. There are restrictions in place to disallow the company “from selling off its Intel Foundry Services unit and forces it to maintain a controlling stake.” Therefore, I believe a deal for its foundry business is assessed to be less likely. Also, which chipmaker has the required competitive advantages to compete effectively against TSMC while needing to convince investors of the massive CapEx spending in the process? Notwithstanding Gelsinger’s pedigree, even he has failed to undertake the transition successfully, as America’s leading chipmaker stutters in its ambition to supplant TSMC’s market leadership.

As a result, the potential divestitures are expected to emanate from its main design/products business. However, the assessed antitrust challenges could hamper a quick resolution to Intel’s troubles. Despite that, Intel still retains the flexibility to divest other assets, such as Altera and Mobileye (MBLY), potentially unlocking more value for shareholders. However, it is highly uncertain how the partial or full divestiture of its design business could transpire. Moreover, would investors be willing to hang on to a foundry business that remains well behind TSMC? Intel also still needs to convince the government that it can meet the scheduled milestones to receive its full funding allocation as it seeks to sign up more customers for Intel Foundry. In other words, the market is right to assess that the mess wouldn’t end with Gelsinger’s departure while the board looks for his replacement to fill the “hot seat.”

Given Intel’s pedigree and pride as America’s leading chipmaker, I believe the leadership transition issue will be resolved expeditiously. However, the challenges seem well beyond the next CEO, as Intel’s transformation plan is likely “ten years too late.” While I still believe that INTC’s September 2024 lows are expected to hold for now, I urge investors to avoid taking the plunge in the stock, as INTC could be mired in its malaise for some time.

Rating: Maintain Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing, unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMD, NVDA, TSM, AVGO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!