Summary:

- Coca-Cola’s stock price has dropped 13% in three months after a strong growth period, presenting a potential ‘buy the dip’ opportunity. As of today, the stock is falling another 2%.

- Despite the recent stock decline, Coca-Cola’s global presence and market share growth through positive volume and pricing effects remain solid.

- The company’s extensive reach in over 200 countries and deep-rooted brand awareness make it a resilient consumer staple.

- As a long-time holder and regular buyer – I trust this Dividend King.

Fotoatelie/iStock Editorial via Getty Images

Coca-Cola (NYSE:KO) is one of my all-time favorite consumer staples and dividend-paying businesses. Its most prominent brands have rooted themselves deep within global consumer awareness. Coca-Cola sells its products in over 200 countries and still manages to increase its market share through positive volume and pricing effects.

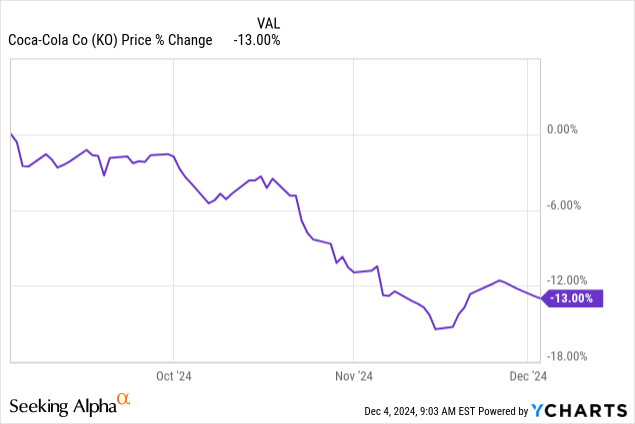

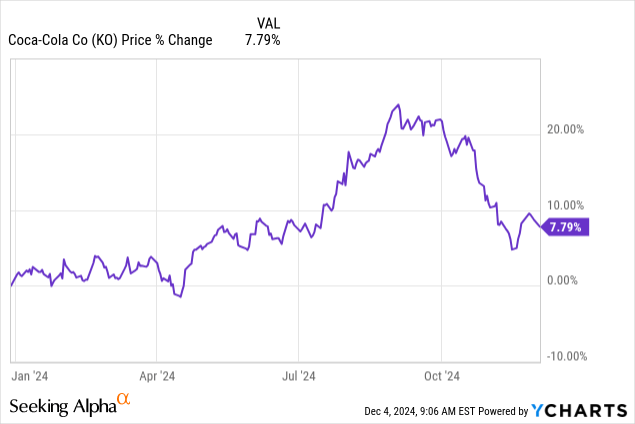

However, its stock price has lost around 13% during the last three months after recording a solid growth period. As you can see in the chart below, KO’s YTD performance exceeded 20% in September when its stock price took a turn and went back to the low-$60 levels.

The Business Is Up And Running – Hinting That KO May Be A ‘Buy The Dip’ Opportunity

KO

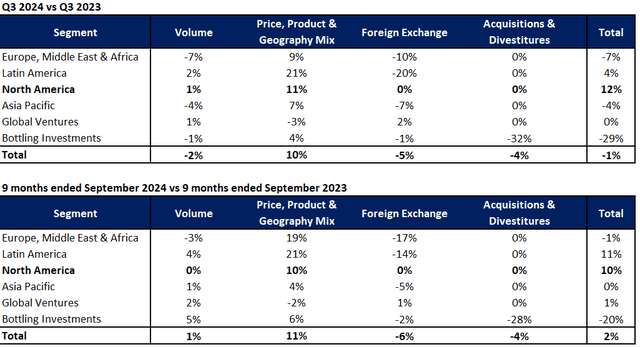

The business showed some struggles in Q3 2024, reflected in:

- Substantially negative Foreign Exchange impact on EMEA, Latin America and Asia Pacific segments.

- Negative volume effects of -7% and -4% were recorded in EMEA and Asia Pacific, respectively.

- Barely sufficient Price & Mix effect in EMEA to offset the negative volume effect.

However, North America remained a bright spot in KO’s Q3 performance, delivering 12% of organic growth (volume, price & mix effects) compared to the analogical period of 2023. Overall, Coca-Cola’s sales fell 1% short of the level recorded last year, but the positive note is that the performance for the Nine Months ended September 2024 vs the analogical period of 2023 remains positive, with 2% overall revenue growth, close to net-zero performance in Asia Pacific and EMEA, and strong growth recorded in Latin America (despite solid FX headwinds). Please review the tables below for details.

Author

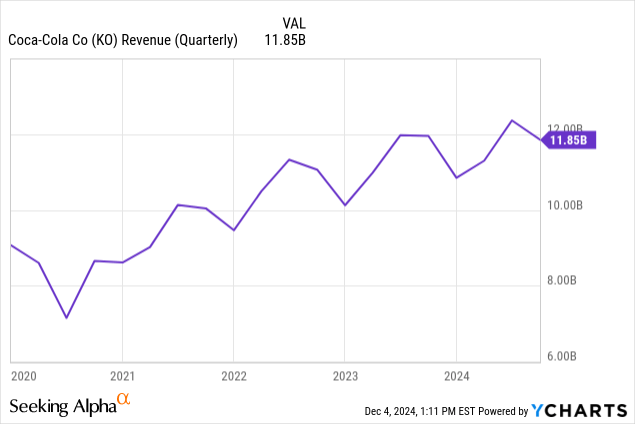

While the last quarter wasn’t ‘perfect’, one still has to recognise that KO is a global organisation with multiple forces driving its performance (e.g. FX fluctuations, which significantly limited the upside in EMEA and Latin America). Over the last five years, the Company delivered ‘better’ and ‘worse’ quarters, but still managed to grow the scale of its business.

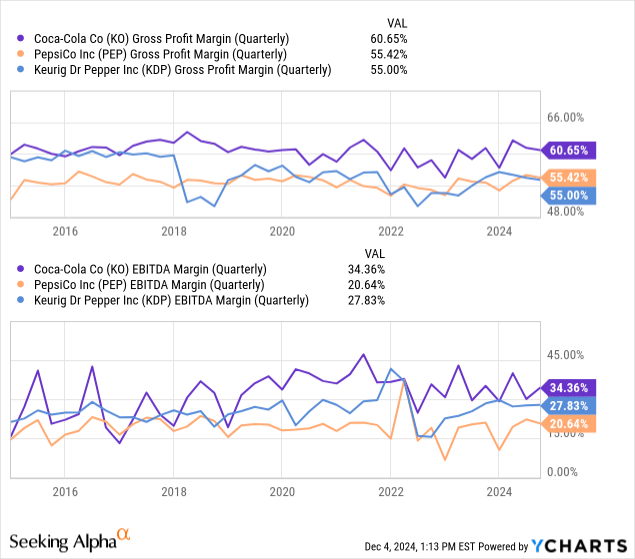

Another aspect of KO’s business worth recognising is its profitability, which clearly distinguishes it from peers in terms of gross profit margin (exceeding 60%) and EBITDA margin (exceeding 34%).

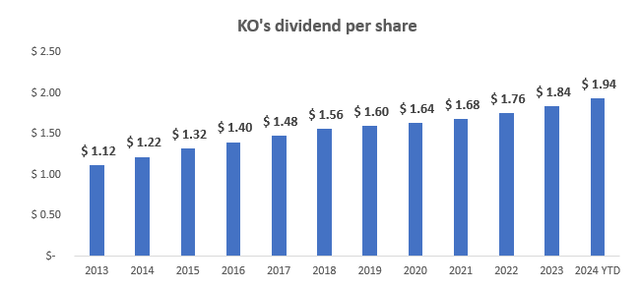

Its profitability facilitates shareholder rewards through attractive, ever-growing dividends (4.7% 10y CAGR and 3.9% 5y CAGR), as well as meaningful share repurchases, which amounted to over $8B since 2018.

KO

An Attractive Entry Point

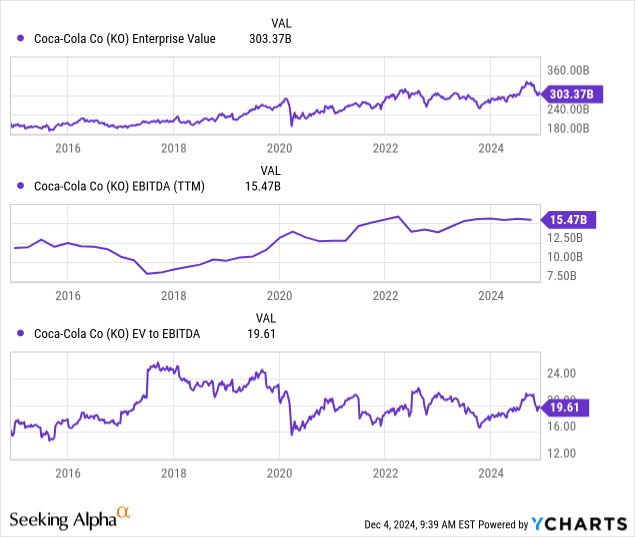

After recent decreases in KO’s valuation, it’s worth taking another look at the business’s EV/EBITDA multiple history. Over the past 10 years, KO’s Enterprise Value has increased tremendously, which was also reflected in its stock price, which delivered a 50% upside. At the same time, KO’s EBITDA has also delivered solid increases, but the pace of EBITDA growth has naturally been different from its Enterprise Value growth.

As a result, KO’s EV/EBITDA multiple fluctuated within the 16-24x range offering numerous attractive opportunities to build a position. As a long-time holder and regular buyer, I built my KO position at an average price in mid-$40s, consequently buying more shares. Even though my average share price is substantially below the current one; I consider KO attractively valued and am happy to increase my position. It’s not the same business it used to be – the Company keeps growing each year and providing shareholders with meaningful rewards, including dividends and share repurchases.

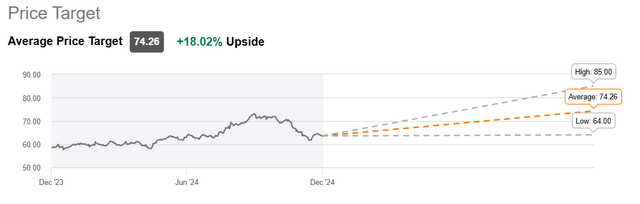

I believe that KO has much room for upside from its current $62.40 per share and forward-looking ~20x EV/EBITDA valuation. I rarely find top-tier businesses like Coca-Cola that trade below my expectations and the low end of Wall Street expectations. I’ll summarize the reasons why I consider KO a top-tier business to own and a great investment at its current valuation at the end of the article, but for now – let me briefly conclude that I believe that KO’s bears are missing out. Its multiple (along with financial performance) is set to expand, driving the valuation upwards. I consider its return to $70s in a timely manner a realistic scenario.

Seeking Alpha

My Thesis: Loading Up The Truck!

There are several points I’d like to mention that drive me to such a conclusion:

- I trust the management, which is one of the most crucial aspects of evaluating any investment decision.

- KO has a strong ‘brand’ component, driving its value and ensuring positive organic growth.

- KO is an undisputable industry leader with much room to enhance its position further, as it has a different share in specific markets.

- The Company is a cash-flow machine that provides its shareholders with substantial rewards, including dividends and share repurchases (through its above-peer profitability).

As a result, I’ve increased my position in KO and am happy to rate Coca-Cola a ‘buy’.

Regardless, please note that each stock market investment is accompanied by market and company-specific risk factors, which in the case of KO include:

- Risk of political decisions influencing the business.

- Uncertainty regarding the state of the economy and Fed policy.

- Uncertainty regarding geopolitical tensions.

- Risk of failing to uphold positive organic growth or falling out of consumer favor.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of KO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information, opinions, and thoughts included in this article do not constitute an investment recommendation or any form of investment advice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.