Summary:

- Meta Platforms is a dominant social media giant with nearly 4 billion monthly users, driving significant advertising revenue and profitability.

- Despite its strong performance, Meta’s stock is highly volatile and susceptible to broader market risks, resembling past bubble periods.

- I recommend a tactical buy for Meta, with a potential upside to $1,000, while emphasizing the importance of risk management.

- Current market conditions require a different investment approach, focusing on trading opportunities and income generation through options or ETFs.

Derick Hudson

Meta Platforms (NASDAQ:META), pardon the pun, is performing as advertised. The digital ad giant is well into a new leg of success for its stock price, thanks in large part to the right pivot at the right time. If Howard Stern was the self-proclaimed king of all media, META has at least earned the tag, “king of social media.” Facebook, Instagram, WhatsApp and Messenger are a powerful foursome with nearly 4 billion monthly users. So there’s scale here that makes for an unrivaled brand.

That said, as a market technician, I suspect a lot of that is already in the stock price. And frankly, as a technician, I don’t know. I leave that to other, more well-heeled fundamental analysts here to grapple with. I’ll just apply my own metrics, proprietary and otherwise, to offer my take on a stock I’ve frankly been skeptical of more often than I’ve been enamored with. That’s what happens when you are an income investor (primarily) who has been through the tech bubble and the global financial crisis.

I’ll return to the primary subject, META, in a moment. First, this stock market has me thinking two things, constantly:

1. This is a very dot-com bubble-like period for investing.

2. None of us has no idea what stage of that type of cycle we are currently in.

That leads me to a very straightforward posture toward all of my decisions, be they for the income-driven portfolio I run as the “lead” strategy in the Sungarden YARP investing group, or any of the smaller portfolios I run as trading accounts. Because this is a time in the life of every investor that can both reward richly, and just as quickly set folks back decades. I’ve seen it, I think I’ll see it again. But like investment risk itself, all of the bubble talk means nothing on paper until it bursts.

Or to put it another way, is it December of 1995 December of 1999, or something entirely different? Do not confuse that for an attitude of “hey you never know, anything can happen, we’ll see” and other vague action plans. Just the opposite. I learned my lesson about underestimating bubbles in the past. And as I hope any investor will, each new opportunity is one that can be embraced, no matter how skeptical you are of nosebleed valuations, crypto bro hype, and all of the other things that make bubbles fly, then pop.

And that brings me to the only Magnificent 7 stock I have never covered. Until now. Meta Platforms, formerly known as Facebook, has had a re-emergence after what can best be described as a face-plant in its stock price back in 2022-2023. That’s when a $400 stock became a $100 stock. And no, I’m not talking about Tesla (TSLA), since that stock did the same thing at a different time during the past few years.

But META’s story is one that is more tangible, in that it has already banked a lot of the cash flow that its innovation has produced. So much so that it was able to take a brief “timeout” to pursue ambitions, some of which are still in “jury’s out” mode (metaverse) and some of which have already contributed to the bottom line (Stories, Reels, Threads). Those social media services all attract advertising revenue, which is the name of the income statement game here.

META is likely well behind in the use of generative AI, and it’s one of several tech giants that has looming monopoly-related issues coming in the courts, or with Congress, or both. However, I always go back to what is in the price and what is not. Again, that’s the technician in me. I’ll never be that investor who out-guesses the market on whether a new venture from a behemoth operator like this one will move the stock price. I try to just let the market tell me its story.

The story I get here is that the only thing stopping META is the broader market. The stock and its Mag-7 buddies are such a big part of the S&P 500 and Nasdaq 100 indexes, they are the tail that wags that dog. And while profitability and innovation reign here, markets like the current one have one big potential pain point: When something either exogenous occurs that makes investors quickly re-think the excessive valuations, and breakneck growth potential. That can happen by osmosis, as in 2000, or via a credit event, as in 2008.

I don’t predict the future, I just try to gauge reward and risk at any time. My conclusion on META is that it has potential to be a leading player in the market melt up… as long as that lasts. That leads me all the way up to a possible $1,000 price level. I’m not calling that a price “target” because any stock can go up at any time, and simply pointing to specific prices is folly to me. I can literally buy a stock like this (which I’d do in a trading account, not in my main portfolio, given my objectives), with $1,000 in my sites, and sell it 5% above where I bought it, if the technical pattern adjusts from a strong reward/risk tradeoff to a weak one.

That might be driven by news, but many stock price adjustments are. What investors tend to miss about charting is that helps more in the way of measuring risk as it evolves, rather than sticking a proverbial finger in the air and committing to a “target” price. So to be sure, there’s a lot of risk here, but it is primarily macro risk. The company is operating well, and with tens of billions in cash on the balance sheet, it’s a strong business with a “wide moat” as the expression goes. That is, no one is going knock them off their perch any time soon.

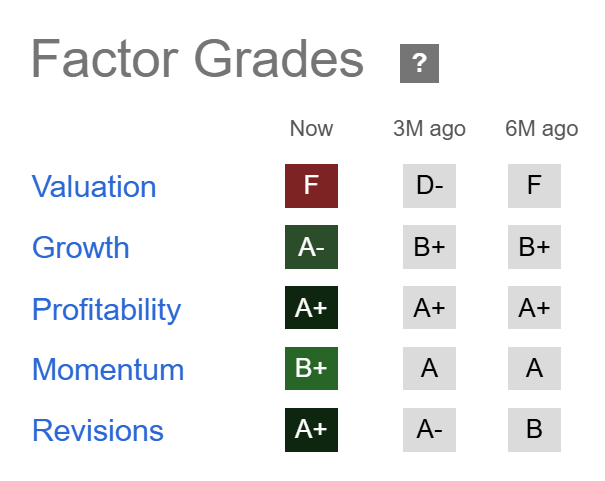

META: Quant analysis

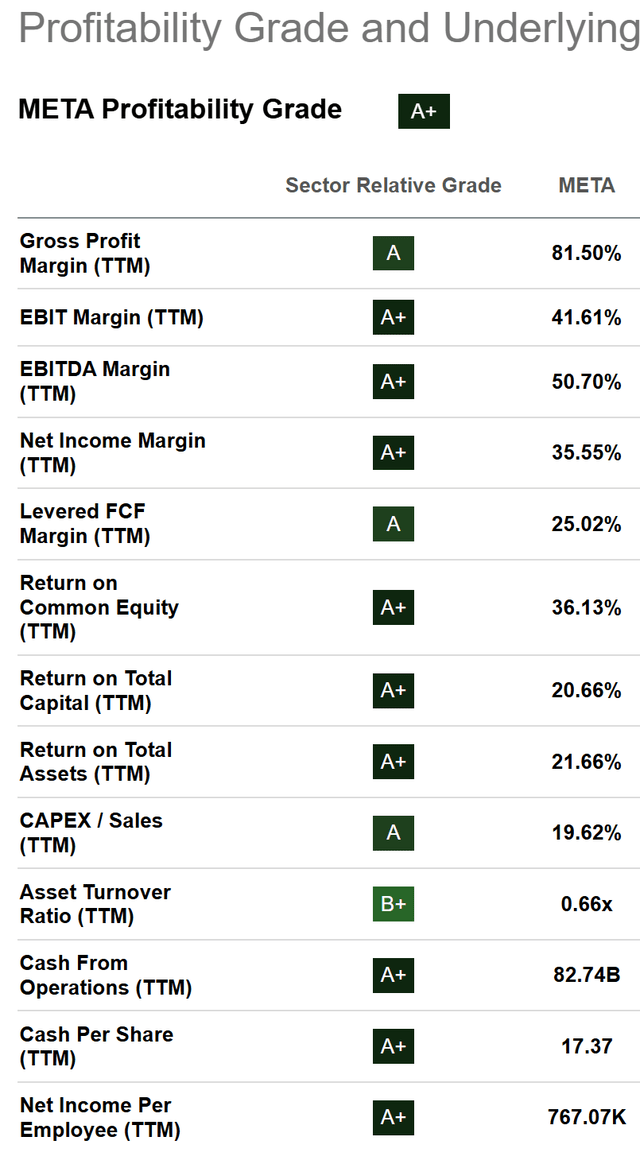

Profitability is what I prioritize, so an A+ grade within the typically high-profitability technology sector is a major box checked for me. Again, this is not a dividend stock, so I’m looking at it without that usual part of my analysis. That said, I will always consider a stock like this as an option-writing candidate, though currently, as I write this, as I am not in META in any form. That could change quickly, given my willingness to follow a stock for a long time, but pick my spots. When it comes to this type of name, my preferred route is via owning things like call options on the S&P 500, or ETFs that have these types of stocks in them. What I might call being a couple of degrees of separation away from owing META directly.

Valuation is an F, and that’s no surprise, given what I show just below. Growth is of course outstanding.

Seeking Alpha

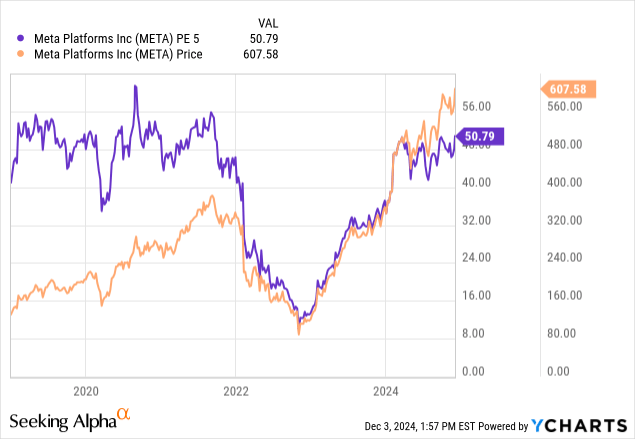

Here are a pair of quant chart items I like to run on stocks, especially those selling at multiples that would choke a classic value investor. Smoothing earnings over a five-year time frame here, META is still at 50x. Not cheap at all. However, in the same way I look at yield stocks through the lens of their own dividend history, so too can I look at that purple line and make some observations.

First, after being a screaming buy at around 10x smoothed earnings, 50 is where the stock has done two things in the past: First, continue to rally for years, then melt down. That’s the story of 2019-2022 for META. And that syncs up with what I would think is a similar case building up for the Nasdaq 100. My most likely scenario, as I’ll explain in some future articles with historical context, is melt up, then melt down, in that order.

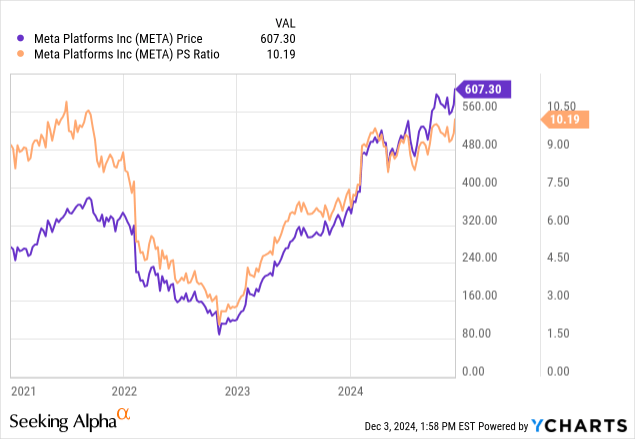

Below, the Price to Sales Ratio has a similar look. 10x sales is extreme, even for a juggernaut like this. But META sends the same signal to me here: it keeps going up until sentiment breaks. Melt up, melt down.

Here’s a quick look at the details behind the Seeking Alpha profitability grade. I show this because finding “straight A’s” is not common. Again, no stability issues here, which I’ll be keeping in mind if the stock gets pummeled on breakup rumors, etc.

Seeking Alpha

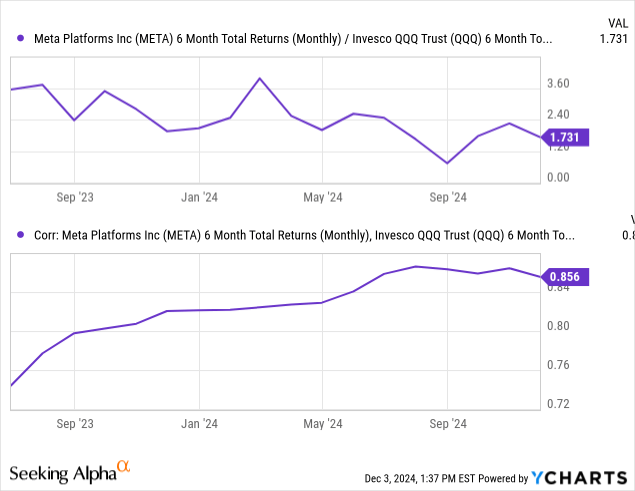

META: Rising correlation and rising volatility

This two-part chart tells me two things about this stock over the past 18 months. First, that it’s acting more like a 2x QQQ ETF than a stock within QQQ. That’s a very consistent pattern of return that is leveraged (without actual leverage employed) to the broader Nasdaq 100 index. So I see META as especially attractive as long as the good times keep rolling.

The bottom part of this chart shows that while that has been going on, the stock has actually become more in sync (correlated) with the zigs and zags of QQQ. Translation for non-chartists: META has developed a “persona” based on the perception by the market of its business, growth and risks that causes it to move more than the market in both directions. These are the types of patterns I scout for. It is all part of risk management.

Seeking Alpha and Ycharts

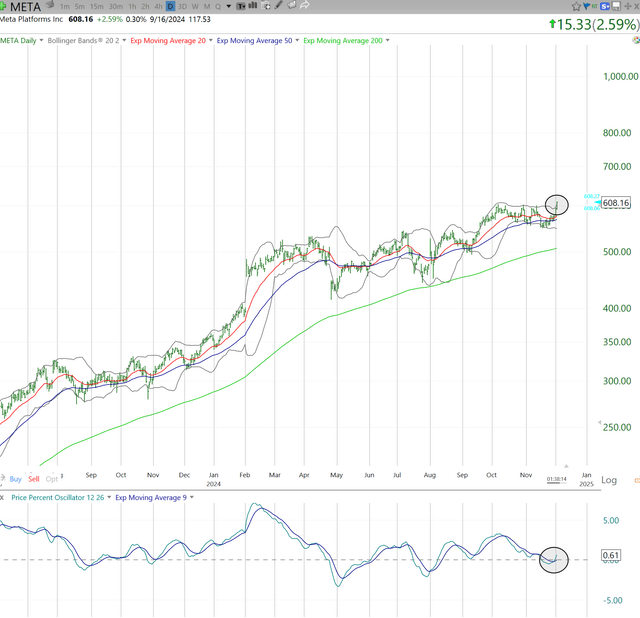

META: Technical analysis

Finally, a quick look at the price trend and my go-to indicators. First, the daily chart. This is what gives me rational optimism that META can take another leg higher in price. That’s a pending breakout to new highs I’ve circled. More importantly, it’s matched by the momentum indicator at the bottom of the chart. Crossing to positive territory like that is a very good sign.

TC2000

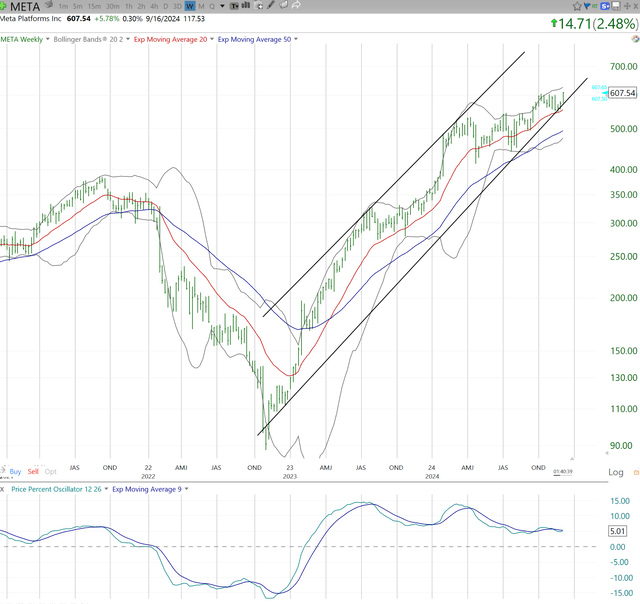

And, here’s the weekly chart. This shows one impressive rally since late 2022, and a well-behaved one at that. And my $1,000 comment above and in the title is where I can map that “trading range” up to if nothing gets in the way. So there’s a path. Just not the only path.

All it would take a market-wide shakeout to break this price “channel” and return META to $300. Does that sound crazy? Not when we consider it was there just 12 months ago. This is how manic markets work. They taketh away what they giveth. We just don’t know when. And I stopped trying to predict that a long time ago.

TC2000

META: Closing thoughts for now

This stock is a great example of why I think investors need to approach modern markets very differently than before. We are literally in “uncharted territory” in so many ways. So, with a stock like META, I approach it as follows:

1. Ready and willing and able to trade it

2. Always looking for ways to earn income off of it (YieldMax has an ETF for that, and there’s also just direct option work I do on my own).

3. Recognizing that a big gain and a big loss in these stock market-dominators is the most likely outcome, so risk management is always my priority.

As noted above, I’m not directly in META, but inching closer to considering it. I’m putting a tactical buy rating on it, as I have that indirect exposure, and because I think the upside-then-downside scenario is most likely. Given that this is not a dividend situation, position size for me will always be modest.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

By Rob Isbitts and Sungarden Investment Publishing

A community dedicated to navigating modern markets with consistency, discipline and humility

Full Access $1,500/year

Legacy pricing of $975 for first 35 subscribers, a savings of 35%

-

Direct access to Rob and his live YARP portfolio, featuring a trademarked stock selection process he developed as a private portfolio and fund manager, and his decades of technical analysis experience.

-

24/7 access to Sungarden’s investment research deck

-

Bottom-line analysis of stocks, ETFs, and option strategies

-

Trade alerts and rationale, delivered in real-time

-

Proprietary educational content

-

You won’t get: sales pitches, outlandish claims, greed-driven speculation