Summary:

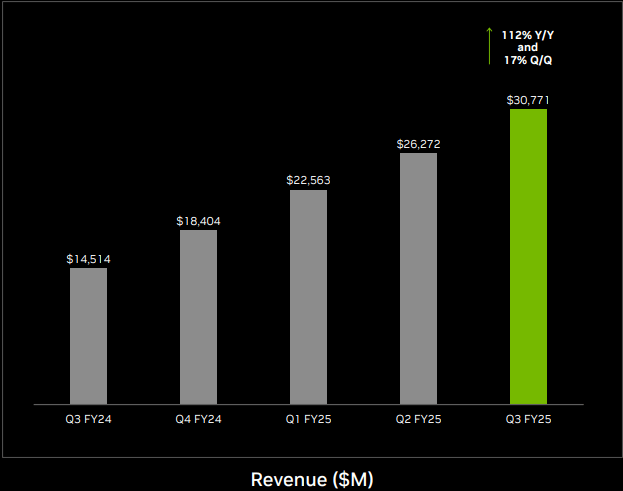

- Nvidia’s Data Center revenue soared 112% YoY in Q3 FY2025, hitting $30.8 billion, driven by Hopper GPUs.

- Blackwell ramp-up reduced gross margins to the low 70s, signaling near-term profitability challenges but long-term stability.

- Revenue diversification across India and Japan counters U.S.-China tensions, doubling regional cloud revenue YoY.

- Nvidia’s H200 and Blackwell GPUs deliver record efficiency, cutting compute costs by 4x and driving adoption.

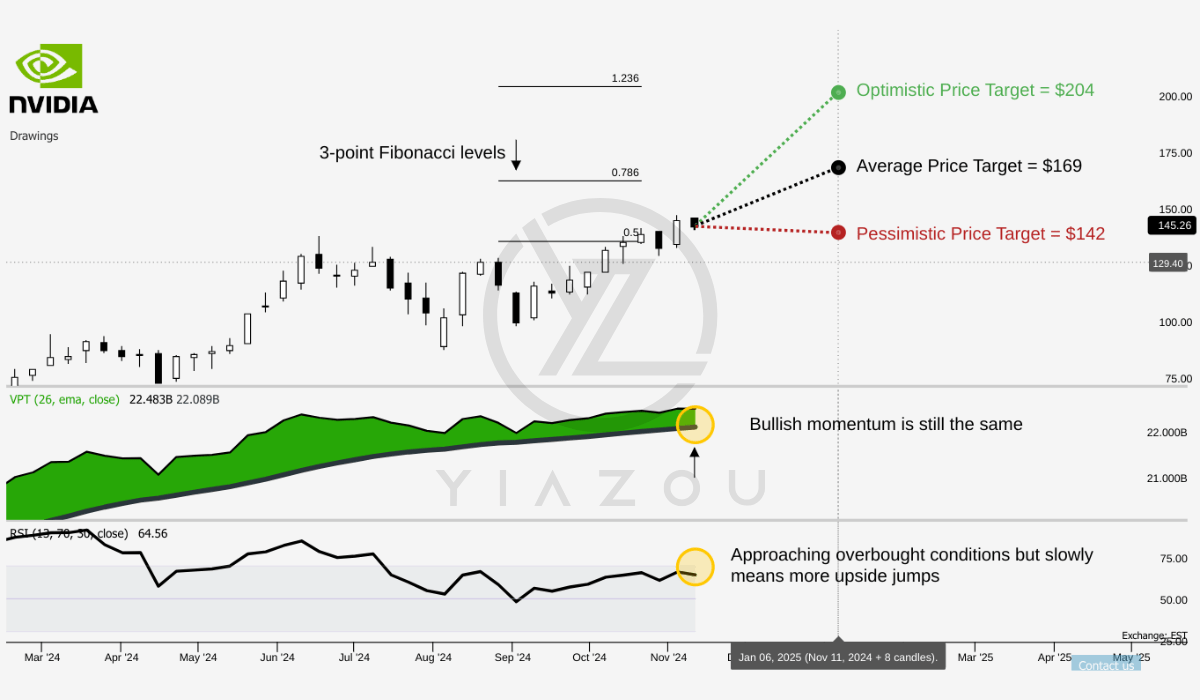

- Nvidia’s stock consolidation sets the stage for a bullish breakout, targeting a $204 price level.

piranka

Investment Thesis

Since our last coverage, we anticipated Nvidia’s (NASDAQ:NVDA) strong Q3 FY2025 results would fuel another bullish run. While Nvidia delivered an earnings beat, with Data Center revenue up 112% YoY to $30.8 billion driven by Hopper H200 GPUs and rising AI workloads, the stock has pulled back due to several factors.

Near-term gross margin compression from the Blackwell ramp, geopolitical risks from U.S.-China tensions, and market skepticism over AI growth sustainability have weighed on sentiment. Concerns over enterprise digestion phases for AI investments and reliance on China despite regional diversification also contributed. While Nvidia’s long-term outlook remains robust, these headwinds have tempered investor optimism, driving the stock’s decline.

However, we believe this pullback is a healthy consolidation phase, providing the stock with a necessary pause to absorb its recent gains and establish a stronger support base. This period of stabilization is crucial before Nvidia can build momentum for another bullish breakout toward our $204 technical price target, driven by the sustained demand for AI infrastructure and its robust market leadership.

Yiazou (trendspider.com)

High Demand for AI and Accelerated Computing

Nvidia’s Data Center segment had a sequential rise of 17% and an impressive YoY increase of 112% in revenue for Q3 FY2025. From $3.8 billion in Q3 fiscal 2023 to $30.8 billion in Q3 fiscal 2025 (in just 2 years) points to an 8X boom in the segment performance. These revenue numbers are the primary driver of the company’s consolidated revenue. 65% of Nvidia’s revenue was derived from the data center segment in Q3 fiscal 2023, but now the segment contribution has hit 88%. The Hopper architecture (mostly the H200 GPU) holds for much of this growth.

Sequentially, H200 sales scaled to double-digit billions and marked the fastest ramp ever for Nvidia. Now, Cloud Service Providers (CSPs) contributed ~50% of the Data Center segment’s revenue, which is >2X YoY and points to the scale of AI workloads demanded by cloud environments. Regionally, Nvidia saw a 2x YoY increase in its regional cloud revenue across North America, EMEA, and Asia-Pacific, reflecting its broad penetration that aligns with CSPs ramping their Nvidia GPU-backed cloud instances.

Q3 Presentation

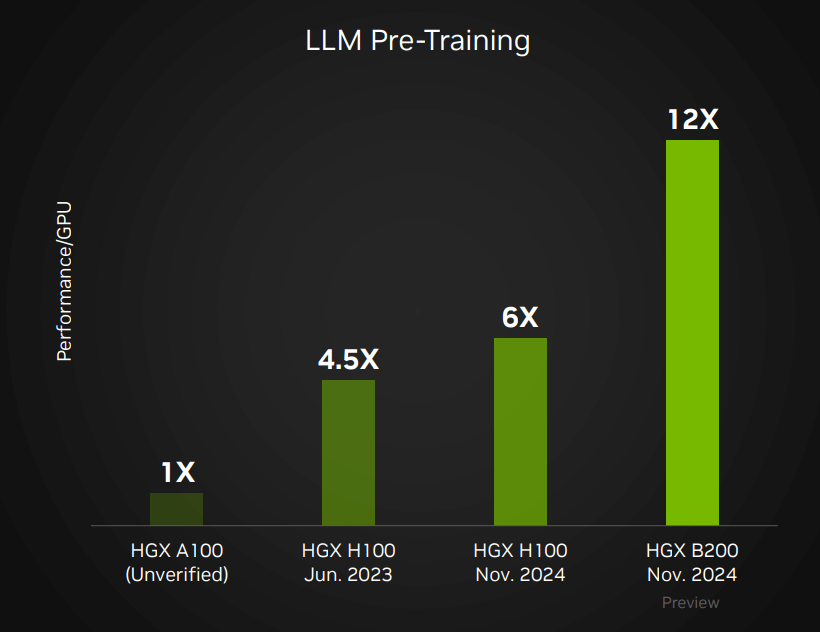

Moreover, enterprise AI demand led to growth in specific areas (like multimodal and generative AI applications) extending Nvidia’s Data Center products. Blackwell’s launch may extend these trends in the upcoming quarters. Why? The initial performance of Blackwells attained a 2.2x leap against Hoppers and cost metrics points that GPT-3 benchmarks run on only ~64 Blackwell GPUs against ~256 H100s that reduce compute costs by 4x. As adoption scales, this cost-efficiency ratio solidifies Nvidia’s business edge in compute markets. Looking forward, $37.5 billion (~70% YoY) in Q4 revenue is based on continued demand for Hopper architecture and the initial ramping of Blackwell.

Q3 Presentation

Regarding the concerns on China-specific Data Center revenue, it grew sequentially in Q3 but remained capped due to export controls.

From a geographic perspective, our Data Center revenue in China grew sequentially due to shipments of export-compliant copper products to industries. As a percentage of total Data Center revenue, it remains well below levels prior to the onset of export controls. We expect the market in China to remain very competitive going forward.

Colette Kress, Executive Vice President and Chief Financial Officer (Q3 2025 Earnings Call).

Now, India has emerged as a potential counterbalance, with CSPs like Tata Communications and Infosys scaling deployments to ~10x GPU capacity within a year. Japan is also a vital growth market. Here, Nvidia’s partnership with SoftBank to build the country’s most powerful AI supercomputer reinforces its market lead in the Asia-Pacific region. These geographic expansions obviously minimize the risk of export restrictions that may intensify more under Trump 2.0. So, Nvidia is diversifying revenue sources across regions with less regulatory friction.

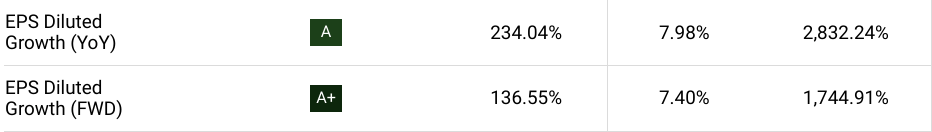

On the bottom-line, Nvidia’s gross margins of 75% non-GAAP reflect a stable cost structure despite rising OpEx due to Blackwell. The sequential uptick in GAAP operating expenses (+9%) is tied to higher development costs for new products (like Blackwell) pointing to reinvestment for prolonged capability. While demand for Blackwell products may temper margins slightly in the near term (low-70s), these will normalize to mid-70s with a full ramp-up. This continued top-line boom with +70% gross margins is good for the stock in terms of valuation.

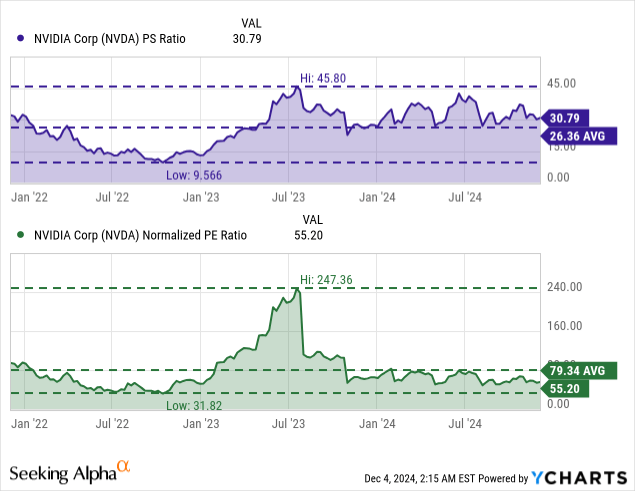

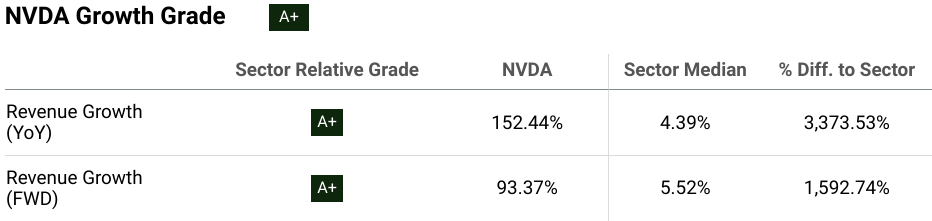

Nvidia’s price-to-sales (PS) ratio stands at 30, near the average of 29.8 (since the AI wave, November 2022). This PS ratio underpins Nvidia’s revenue generation capability at a premium of 1,592.74%. The normalized price-to-earnings (P/E) ratio of 55 is near the lowest level of 46.41 (since the AI wave, November 2022) while the stock offers a 1,744.91% premium on forward earnings. This disparity between current valuation and high growth premiums suggests a potential massive upside in upcoming quarters.

seekingalpha.com seekingalpha.com

Scalability Concerns in Margin Pressures During Product Transitions

Nvidia stock valuations, to some extent (based on the street sentiment), are dependent on the continued scalability of LLMs. There are three modes of LLM scaling for Nvidia—pre-training, post-training, and inference. Here, this dependence raises questions about the limits of scaling, as transitioning from 100K Hoppers to 100K Blackwells for foundation models may require rapid tech iteration with high CapEx cycles from clients again! Mag 7 (ex NVDA) is already under question for the ROI on AI investments. With a new cycle of Hopper to Blackwell replacement will create investor side concerns if the adoption of new scaling methods does not deliver proportional economic and operational benefits.

Additionally, as per the company, inference demand points to a growing installed base requiring upgrades but sustaining this demand assumes a constant appetite for AI-native services across enterprises. If industry enthusiasm for AI tapers and if enterprises face internal budget issues due to increasing bottom-line pressures, Nvidia’s infrastructure sales could encounter headwinds.

As Nvidia transitions from Hopper to Blackwell, gross margin pressure is a weak point. As the CFO projected, gross margins fell to the low 70s at the beginning of the Blackwell ramp, which is down from historically higher levels. The financial impact is critical. Why? First, this marks initial production inefficiencies and client onboarding for Blackwell systems. Further, mid-70s gross margins materialize in H2 2025. For the next quarters, the impact of this margin compression could be significant to dampen profitability (may result in earnings miss). The street may find it troubling as AMD (AMD) is closing the top-line growth gap and outpacing Nvidia in gross profit improvement since Q1 2024.

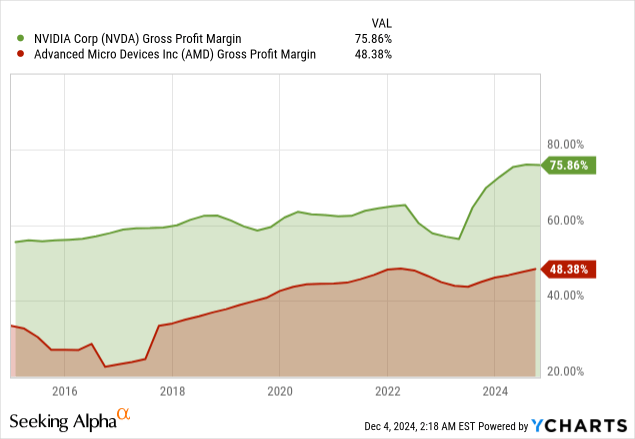

Overall, Nvidia’s “trillion dollars of data center modernization” and “AI factories” assume a continuous upward demand. However, historical patterns in hardware deployment cycles suggest inevitable digestion phases, where clients pause to optimize and absorb CapEx. Nvidia’s projections may not account for these pauses as massive ROIs are also required for AI infrastructure. As Blackwell ramps, there is also the question of how long Nvidia can go on this pace before hitting saturation in major markets. The company assumes modernization will take several years but macro and geopolitical issues (Biden-Putin-Xi-Trump) can lead to reduced budgets and shifting priorities among enterprise clients and there will be a shift toward software-based optimizations that will for sure dilute demand for Nvidia’s hardware-centric products.

Company Overview IR

Takeaway

Nvidia’s recent pullback reflects short-term concerns over margin compression, geopolitical risks, and skepticism about the sustainability of AI-driven growth. However, the company’s exceptional Q3 results, driven by record Data Center performance and accelerating adoption of Hopper and Blackwell GPUs, underscore its leadership in the AI revolution. This consolidation phase is a healthy pause, setting the stage for future growth, as Nvidia remains well-positioned to capitalize on expanding AI infrastructure demand and its strong market foothold across diverse regions. With a $204 technical price target, the long-term investment case for Nvidia remains compelling.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA, AMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.