Summary:

- Palantir has shown exceptional performance with strong revenue growth, but its current valuation is far overstretched, making it a risky investment at this time.

- Despite stellar Q3 results, Palantir’s sales and EPS growth projections do not justify its high market cap and sales multiple.

- Potential risks include an easing of geopolitical tensions and the incoming Trump administration, which could impact both Palantir’s government and commercial segments.

- Retail investors should consider taking profits now and wait for a more opportune time to reinvest, given the stock’s premium valuation and potential headwinds.

hapabapa

Prelude

Palantir Technologies Inc. (NASDAQ:PLTR) is an incredible company, there is no denying that. The company is one of the most hyped AI plays on the market and has greatly rewarded long-term investors. I initiated coverage of Palantir with a Buy rating back in January when the stock was trading below $20. I followed that up at the end of March with a Hold rating on valuation concerns. Clearly, I underestimated the extent to which the market loved this stock, even though my first article was titled “There’s A Lot To Love Here”. I was analyzing the company through the lens of a value investor at a time when the market was pricing this as a hyper-growth stock. This was clearly a mistake.

The market has greatly rewarded Palantir for exceptional execution amidst surging demand for AI products. In the recent Q3 results, Palantir reported several very promising results. These included:

- US revenue grew 44% YoY and 14% QoQ, with US commercial revenue growing 54% YoY and 13% QoQ. US government revenue grew 40% YoY and 15% QoQ.

- Total revenue grew 30% YoY and 7% QoQ.

- The company closed 104 deals over $1 million.

- Customer count grew 39% YoY and 6% QoQ.

- GAAP net income reached $144m, marking a 20% net margin.

- Adjusted income from operations of $276m, representing a 38% adjusted operating margin.

- GAAP EPS grew 100% year-over-year to $0.06.

- Adjusted EPS grew 43% year-over-year to $0.10.

- Cash, cash equivalents, and short-term U.S. Treasury securities of $4.6b.

- Adjusted free cash flow of $435m, representing a 60% FCF margin and over $1 billion on a trailing twelve-month basis.

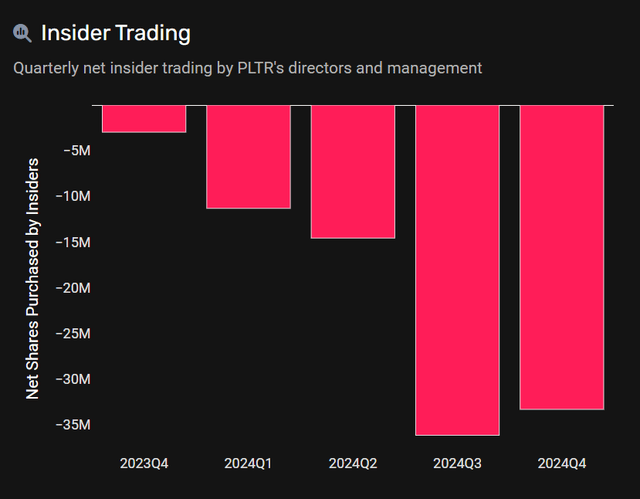

These are definitely stellar results. Despite the quality of the report though, the fact remains that Palantir is not even on track to break $3b in revenue this year. The company is currently trading at a market cap of $150b, leading to a ridiculous sales multiple of 50. Meanwhile, for every share you buy for $66 you are buying only $0.06 in earnings. Palantir is priced for ridiculous levels of growth. If both sales and EPS doubled each year for the next five years, this would bring 2029 sales to $96b and EPS to $1.92. Meaning, the five-year forward sales and earnings multiples respectively are still a ridiculous 1.5x and 34x. These forward multiples require growth to accelerate from its current levels, despite Palantir’s already exceptional performance. This doesn’t seem very realistic. This comes while stock-based comp continues to outpace share repurchases, diluting existing investors, and while management has been dumping shares for several months.

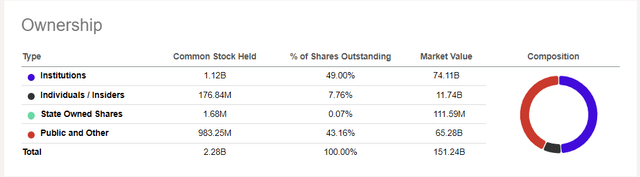

Institution and insider selling alike has been offset by the wave of purchasing from retail, who now owns 43% of the company:

The retail community is chasing a hyped stock, while both insiders and institutions are taking profits. It makes sense for retail investors to take profits too.

With that said, I’m downgrading Palantir again considering the ridiculous run the stock has had and the premium valuation that has resulted from it. The current price leaves very little room for upside and completely ignores the existence of any risks. While the past two years were comprised of exceptional execution by the company and lucrative stock performance, 2025 does not look as promising. The stock is priced for perfection, while the broader macro outlook is not as conducive to continued outsized stock returns.

Risks On The Horizon

The Trump trade has accelerated Palantir’s already fantastic year in 2024. It’s unclear how beneficial the incoming Trump administration will be for Palantir in reality though. There are several reasons that Trump’s presidency could produce meaningful headwinds for Palantir. Demand slowdowns in either the government or commercial end markets can lead to earnings misses, weaker than expected guidance, or a slowdown of growth. Any combination of these will severely hurt a stock with such a stretched valuation.

Palantir is a notable beneficiary of global conflicts because they stoke demand for the company’s Gotham software. While it’s undeniably good for humanity to end the current wars, it actually may not be great for Palantir. Trump has claimed that he will be able to negotiate a swift end to the Ukraine-Russia conflict. Trump has also told Israeli Prime Minister Benjamin Netanyahu that he wants the conflict done by the time he enters office. The company sells Gotham to militaries and has been outspoken in support of Israel. A world that is entrenched in conflict creates a lot of demand for Gotham. Trump’s plans to negotiate peace deals could harm a lot of this demand for Palantir and lead to weak growth in the coming years. While revenues sourced from the US military are likely safe, Palantir’s Gotham sales into foreign markets could be at risk.

Additionally, government sales into non-military use cases are at risk due to the incoming Department of Government Efficiency, which has pledged to eviscerate costs across all levels of the bureaucracy. While I’d expect Elon Musk would recognize the value of enterprise AI software like Palantir Foundry and Gotham, there may be contract re-negotiations or headcount reductions across government jobs. These could become headwinds for Palantir, something the company itself disclosed in the recent 10-Q:

We continue to believe that our government customers remain a meaningful and resilient source of revenue for our business, particularly during periods of economic uncertainty. However, large government customers in particular are generally subject to a number of uncertainties regarding budgets and spending levels, changes in timing and spending priorities, and regulatory and policy changes, which can make it difficult to predict when, or if, we will make sales to such customers or the size and scope of any contract awards

While this risk is unlikely to cause an outright decrease in sales, it could harm either sales growth or sales growth expectations in 2025. Something that, again, can really harm the performance of a stock with such stretched valuation.

On the other hand, the commercial segment has been turbocharging the stock this year. Many investors believe Palantir AIP (“Artificial Intelligence Platform”) is the product to beat for enterprise AI. It’s true that Palantir has a big lead in this space and there are very few true competitors. The company says so itself in its annual report, in which it says that internal software development projects are the principal competitor. There are very few companies even capable of commercializing enterprise AI in the way that Palantir has done so far. However, the narrative around commercial has also hinted at Palantir AIP becoming the ‘AI Operating System’, something that would dethrone the Microsoft (MSFT) Windows OS. This is extremely unlikely and not an outcome that investors should expect.

The three dominant operating systems currently are Google’s (GOOG) Android, Apple’s (AAPL) iOS, and Microsoft’s Windows. These companies have a stranglehold on the consumer electronics market and have all begun implementing their own homegrown AI solutions throughout their ecosystem. Meanwhile, Microsoft is by far the market leader in enterprise software with Windows and Office. It has already commercialized Copilot, the AI assistant, which isn’t the same as Palantir AIP but demonstrates the ease at which these companies can implement AI products throughout their stack. To grow into a 100x earnings multiple, Palantir would have to make serious headway against three of the largest and most dominant companies the world has ever seen. This isn’t impossible, but there’s far too much uncertainty to invest with this expectation in mind.

Further, commercial spend on new software can be impacted by an economic recession. There has been euphoria since the election results came in, but Trump has several economic proposals that could harm economic growth. He has adopted a very protectionist geopolitical position, something that can very likely reignite inflation and keep rates higher for longer. On the other hand, tax cuts for businesses and individuals can stimulate spending, but again, could reignite inflation and expand an already problematic deficit. Trump has also made very protectionist comments regarding Taiwanese chip exports, signaling he favors developing a homegrown supply chain rather than this undue reliance on Taiwan. This could accentuate the supply shortages that Nvidia (NVDA) has been constrained by. Supply shortages can lead to rising cost of AI compute, which could ultimately impact Palantir’s gross margin. Additionally, tariffs on Taiwanese chip imports would certainly raise prices on consumer electronics and could, again, reignite inflation.

Investor Takeaway

In this article, I’ve taken on the challenging task of conveying a bearish sentiment on a company that, I believe, is exceptional. Very rarely would I suggest that investors sell such an exceptional stock, but this is an extreme circumstance. Palantir’s valuation has become far too overstretched, and the market will come to this realization sooner than later. It’s better for retail investors to secure some profits now and wait for a more opportune time to accumulate a larger position in the future.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.