Summary:

- AT&T’s stock has surged 41.5% YTD, with a strong buy rating maintained due to promising financial and operational expectations from management.

- The company is healthier than ever, focusing on growing high cash flow segments and exiting legacy operations, enhancing future prospects.

- Significant investments in 5G and fiber have driven revenue growth, with management projecting substantial free cash flow and shareholder returns through 2027.

- AT&T’s current valuation is attractive, offering potential annualized upside of 14.3% to 22.2%, making it a safe, stable, and undervalued investment.

franckreporter

2024 has been a great year for shareholders of telecommunications conglomerate AT&T (NYSE:T). Year to date, the stock is up 41.5%. And that doesn’t even factor in returns from the distributions the business pays out. Since I last rated the company a ‘strong buy’ back in October, shares have risen by 6.9%, handily outperforming the 4.1% rise enjoyed by the S&P 500 over the same window of time. Much of this recent gain came on December 3rd when shares closed up 4.6% after management announced financial and operational expectations for the next few years.

To be honest with you, I have been thinking for a while about when I would finally unload my own personal shares of the enterprise. Since I began purchasing the stock back in 2022, I have enjoyed an upside of 58.2%. And again, that excludes the payout that I get from its quarterly dividend. Even though I have been very bullish about the company for a while, the stock had been rising, and I was thinking that I would start selling out my shares at between $23 and $25. But this recent development from management actually has me thinking that buying additional units would not be a bad idea.

Fundamentally speaking, the conglomerate is healthier than perhaps it has ever been. And with this new outlook by management, which calls for the company to slowly rid itself of its legacy operations while continuing to grow the parts of the enterprise that will create years of strong cash flows, the picture will probably be even better as time goes on. Because of this, I believe that keeping the company rated a ‘strong buy’ is the right choice at this moment. And even though I am all tapped out for now, I likely will add to my shares in the near future.

A look into the future

On December 3rd, the management team at AT&T hosted an analyst and investor day to give analysts and investors alike a glimpse into the company’s thinking regarding its current operations and its future. There were multiple revelations to get excited about. For starters, management talked about some of the successes the company has had over the past several years. From 2020 through what management expects for the rest of 2024, the company allocated around $140 billion into investments. That includes capital expenditures and the investments it has made into spectrum. At the same time, using asset sales, the firm reduced net debt by roughly $25 billion. Plus, over that window of time, it returned around 45% of all free cash flow to shareholders.

For years, the investment community disliked AT&T. And to be honest with you, some of that dislike was warranted. The business had spent years making big and costly mistakes that destroyed shareholder value. And as it began unwinding those mistakes, the worry was that its debt load was too high. I have always rejected the debt argument. Furthermore, while I acknowledge that the company has made some errors as time has gone on, I decided to be forward-thinking when it comes to the company and its potential. That has clearly paid off.

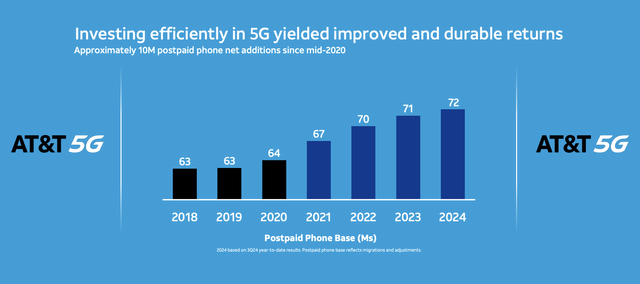

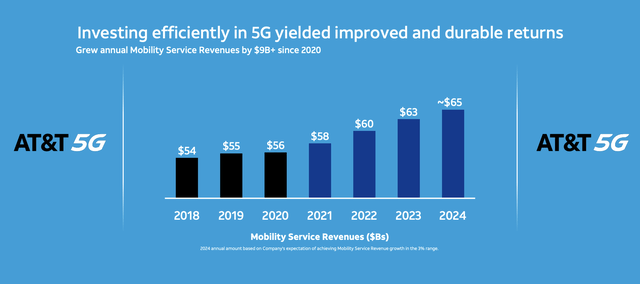

For starters, over the last several years now, the company has succeeded in growing its postpaid phone operations. By investing in 5G, the company has grown from around 63 million postpaid users back in 2019 to 72 million this year. The end result here was an explosion in mobility service revenue. Back in 2018, the firm generated about $54 billion from these operations. But this year, they are forecasting $65 billion in sales associated with them.

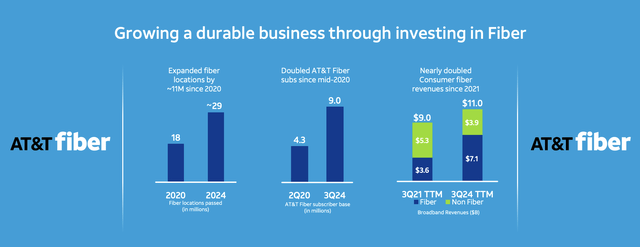

Other investments have also proven to be successful as well. From 2020 through 2024, the company has increased its number of fiber locations by 11 million from 18 million to 29 million. To be clear, this 29 million figure is based on management’s estimate for what the company will hit by the end of this year. As of the end of the third quarter, that number was 28 million. As the number of locations has increased, the number of fiber subscribers also grew, jumping from 4.3 million to 9 million. That helped to grow fiber revenue from $3.6 billion in the trailing 12 months ending in the third quarter of 2021 to $7.1 billion the same time this year.

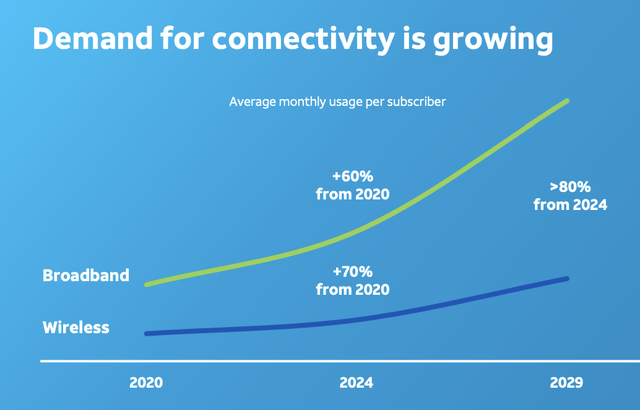

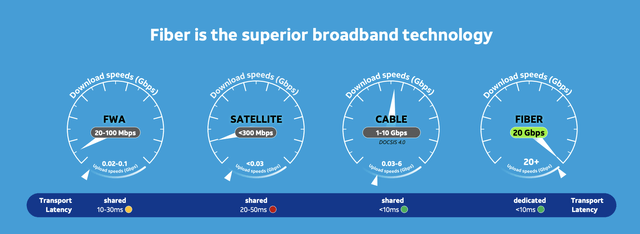

Over the next several years, management expects some major catalysts to propel revenue, profits, and cash flows, higher. For instance, as the first chart below illustrates, both broadband and wireless usage, on a monthly basis per subscriber, is expected to continue climbing through at least the year 2029. Even though there are alternatives to using fiber, these all pale in comparison at the moment. As the second image below illustrates, fixed wireless access, satellite, and cable, are all drastically inferior to fiber from a download speed perspective. So clearly, the future looks great for the enterprise.

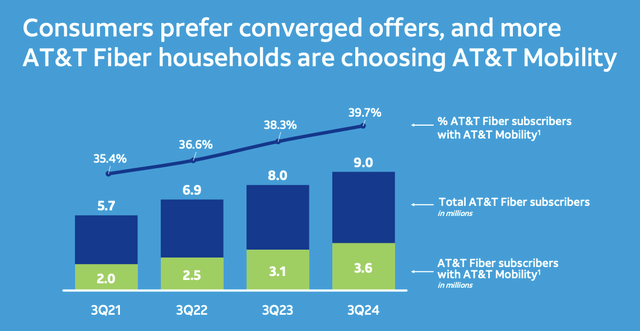

Management has also had a lot of success when it comes to user adoption. Back in the third quarter of 2021, for instance, when the company had only 5.7 million fiber subscribers, it found that only 35.4% of those subscribers also used the company’s mobility solutions. But by the third quarter of this year, with 9 million fiber subscribers, 3.6 million had the firm’s mobility solutions. That’s a total of 39.7%. This adoption curve means that customers increasingly prefer to use multiple AT&T solutions instead of a single one.

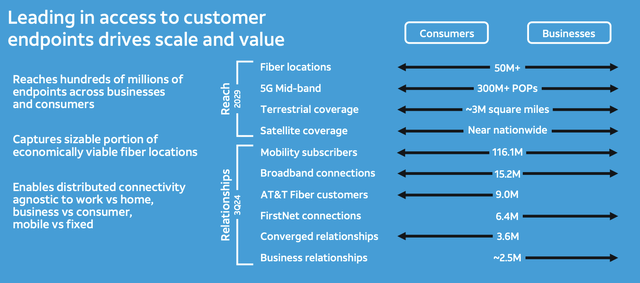

In the years to come, management expects to achieve even more growth. As I mentioned earlier in this article, by the end of this year, it expects its network to pass by 29 million locations. By the end of 2025, that number is expected to be in excess of 30 million. And by 2029, management is targeting over 50 million. Over the same time, the company hopes to have over 300 million 5G PoPs (points or physical locations where at least two networks or communication devices can establish a connection from one place to the rest of the Internet).

This will not be cheap. For the 2025 through 2027 fiscal years, the company is targeting around $22 billion annually in capital expenditures. That is a tremendous amount of cash, no matter what company we are talking about. At the same time, the firm is also going to be focused on moving away from its legacy assets. For instance, it hopes that, by 2029, it will no longer provide copper-based services in most of its territories. But this will be done in phases. By 2027, it plans to exit its legacy services in its wireless first areas. This will touch on about 50% of the land area that the company covers, but only about 10% of the population. By 2029, it will complete its exit of the other 50% of land area that covers 90% of the population. These are areas that the company considers to be fiber first.

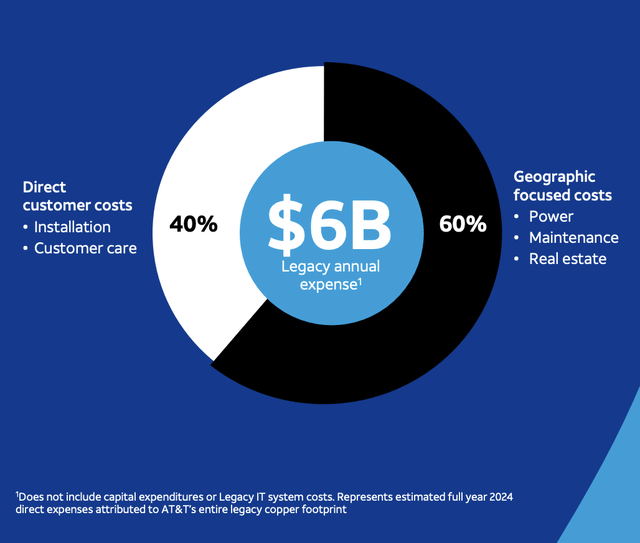

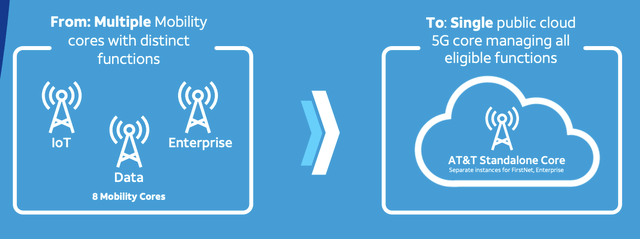

The end result here should be significant for the company. According to management, leaving its copper assets behind should help to reduce annual expenses by around $6 billion. Most of this will be in the form of reduced power, maintenance spending, and real estate. But about 40% will involve installation costs and customer care costs that the company will no longer need to spend. The firm plans for some major changes during this time. For instance, it currently has around 4,600 central offices that operate off of multiple networks that have their own distinct equipment. Over the next few years, management intends to shift all of this into a single intelligent converged cloud-based network. That should help to bring about a 70% reduction in delivery cost per terabyte. The firm plans for something similar to happen when it comes to its mobility operations. That should help to reduce delivery cost per gigabyte by roughly 50%.

If everything goes according to plan, the future for the conglomerate will be bright indeed. As I detailed in my prior article on the firm, its decision to rid itself of DirecTV is creating some changes that are painful, but that will help it by bringing significant cash to it in the near term. Starting in 2025, the company should look quite a bit different. When it comes to the 2025 fiscal year, management expects free cash flow of approximately $16 billion. In 2026, this should grow to $17 billion before climbing to $18 billion or more by 2027. This is all after the aforementioned capital investments that the company plans to make over the next few years. So this will be the capital that management will have in order to pay down debt, buy back stock, and pay out its distribution. The firm also expects, naturally, for its EBITDA to continue growing as well. In fact, they expected to grow by at least 3% per annum during this window of time.

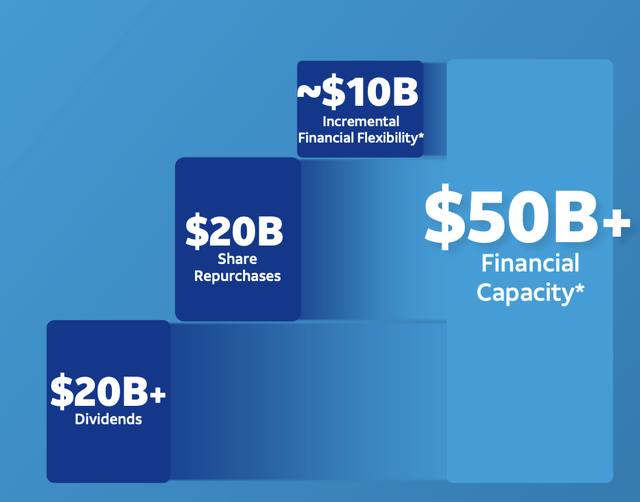

Thanks to this planned growth, management expects to generate over $50 billion in aggregate excess cash flows over the three-year window covered. By my estimate, the free cash flow figure should be $51 billion exactly. $20 billion of this is being earmarked for share buybacks. At least another $20 billion will be dedicated to dividends. That leaves another $10 billion, approximately, that management says will give it ‘incremental financial flexibility’. Technically, this cash has to go somewhere. Either it will mean a further reduction in net debt, or it will be allocated to dividends or share buybacks, or the company will use that capital for making other investments. It’s too speculative to assume that this would be used for other investments. So for the purpose of my analysis of the company, I am going to assume that this capital ultimately finds its way back to current shareholders in the form of dividends. Given how strong the company’s returns are on its investments, I would much prefer that this be used for growth. But only time will tell what happens on that front.

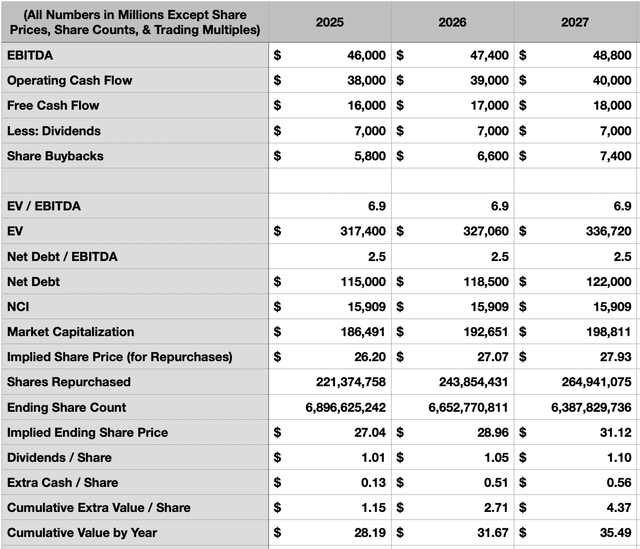

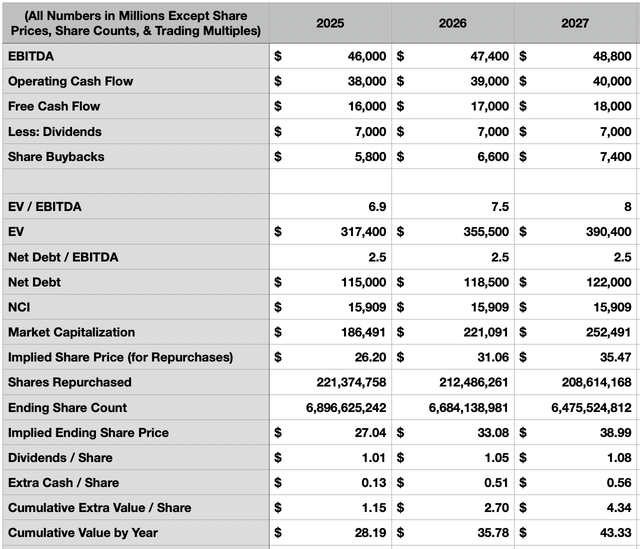

Even with the guidance that we have from management, any sort of forecast regarding the company and its prospects in the long run is subject to a great deal of uncertainty. But for the purpose of analyzing the company and its potential, I decided to create the table below. In it, you can see projected EBITDA, operating cash flow, and free cash flow, for the 2025 through 2027 fiscal years. I’ve made some assumptions about the final quarter of this year and I have factored in debt reduction stemming from excess cash flows and proceeds from its DirecTV transaction in order for the conglomerate to get its net leverage ratio down to 2.5. This is the target for the business that it is aiming for the middle of next year. And according to management, it plans to keep it around this level moving forward.

In this analysis, I assumed that the company would continue trading at the EV to EBITDA multiple that it is currently trading at. That comes in at only 6.9. Based on management’s guidance and my own estimates, if we assume that an even $7 billion a year will be used on dividends, that would leave $5.8 billion for stock buybacks in 2025. By 2027, it would scale up to $7.4 billion. I factored estimated share buybacks into my calculations. What I found was that the share price of the company should climb to $27.04 next year before eventually hitting $31.12 by 2027. But if we look at the extra value that will accrue to investors over this window of time in the form of dividends and the other excess capital that I mentioned previously, we would ultimately see a value to investors of $35.49 per share by 2027. Compared to the $23.74 that shares of the company are currently trading at, this works out to an annualized upside of 14.3%. Considering that the stock market usually gets between 11% and 12% per year, and considering how safe and stable AT&T is, I consider this a win.

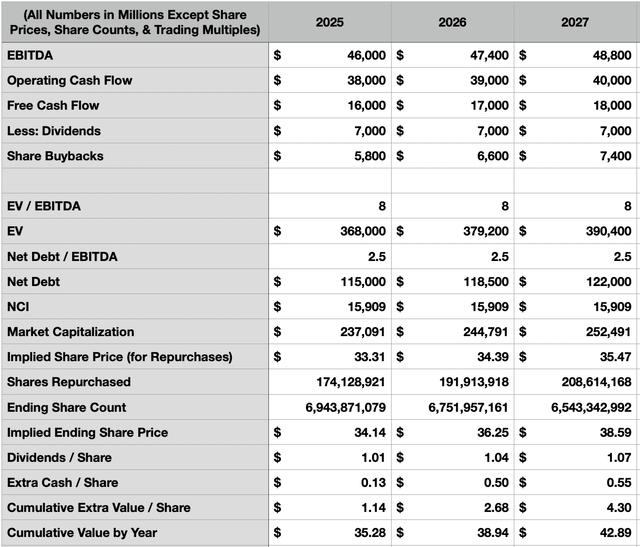

Even though this would be a positive outcome, I also am of the strong opinion that shares of the company are trading on the cheap. Right now, the EV to EBITDA multiple of the company is only 6.9, while its price to operating cash flow multiple is a paltry 4.5. In the table above, I repeated this analysis with the assumption that the EV to EBITDA multiple stays at 6.9 next year before climbing to 7.5 in 2026, and then to 8 in 2027. By this point, the total return to shareholders would be $43.33 per share. That would translate to an upside of 22.2% per annum. And in the table below, I did the same thing under the assumption that the market quickly pushes the stock up higher such that the EV to EBITDA hits and stays at 8 during this window of time. In this case, the stock would naturally be more expensive, which would reduce the number of shares bought back. But still, the end result would be a total value for shareholders of $42.89. That is an upside of 21.8% per annum.

Takeaway

Based on the data provided, I truly believe that AT&T is one of the best companies on the market. No, the stock is not going to double or triple. But it is a safe and stable enterprise that generates significant cash flow and that has a share price that’s trading on the cheap. Even if things just go alright, we should see performance that would outperform the broader market. And honestly, in my opinion, that outperformance would be at a lower risk than what the market would enjoy. And if things go really well and shares trade at higher multiples than where they are at the moment, the upside could be very impressive. Because of all of this, I have decided to keep the firm rated a ‘strong buy’. In all honesty, I regret not buying more of it than I ultimately did. But even though the stock is up quite a bit, I think I will probably end up adding more.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!