Summary:

- AT&T’s 3-5 year plan continues its focus on 5G wireless and fiber broadband, generating 5-10% EPS growth and $1 billion/year free cash flow increases.

- The company aims to double fiber customers, switch to open wireless architecture, and phase out its costly copper network by 2029.

- AT&T plans $20 billion in share buybacks once it hits its debt target, but dividend growth is not a priority.

- AT&T’s strategic shifts and operational improvements should allow it to catch up to T-Mobile’s growth rate once legacy network headwinds have passed.

Art Wager/iStock Unreleased via Getty Images

Ambitious 3-5 Year Plan

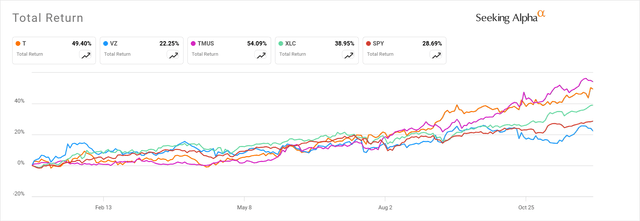

Although there are seven weeks left until AT&T (NYSE:T) releases 4Q 2024 results, the company rolled out financial plans for the next three years and strategic plans going out to 2029. This was done at an Analyst Day presentation at AT&T Stadium in Dallas. The rollout was well received by the market, judging by the 4.6% increase in the share price that day. The stock has been a winner throughout 2024, with returns well in excess of the market (SPY), the communications sector (XLC), and its closest legacy telecom peer Verizon (VZ). It has even performed similarly to T-Mobile (TMUS), which lacks the declining legacy wireline businesses of the other two big carriers.

Seeking Alpha

Investors may be wondering if it is time to take profits, considering the slow-growth, low return nature of the company in the years prior to 2024. However, if the company can deliver on the plans discussed at the analyst presentation, AT&T stock deserves to hold the gains it has made so far.

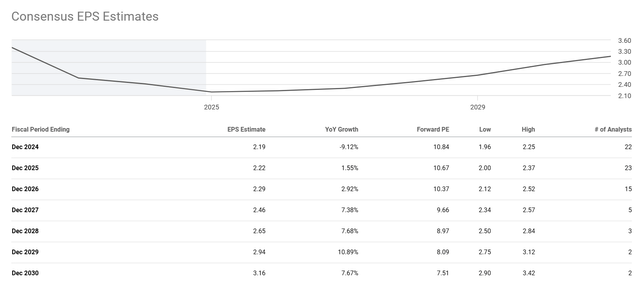

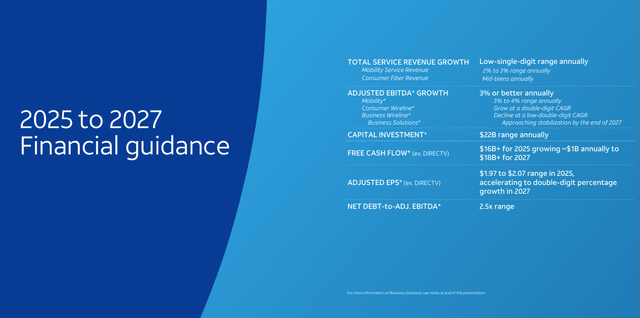

The good news is, nothing is changing in AT&T’s core strategy to focus on its main business of connectivity via 5G wireless and fiber broadband. With the sale of its stake in DirecTV set to close in 2025, AT&T will be done with its work getting out of non-core businesses. With the simpler business, management believes they can grow earnings per share by 5% in 2025 and double-digit percentages by 2027. Free cash flow looks to grow $1 billion per year over the next three years, starting at $16 billion in 2025 and hitting $18 billion in 2027. (These values exclude DirecTV, but AT&T will also receive about $5.9 billion in cash as sales proceeds for that business.) The EPS growth rates are well above the analyst consensus that existed prior to Analyst Day.

Seeking Alpha

AT&T gave analysts some additional detail on how they will grow their two main businesses, including going to open architecture on the wireless network and doubling fiber customers over the next five years. Also, for the first time, the company provided added detail on how it will exit its legacy copper wireline network, largely by 2029. This move will provide considerable cost savings.

This ambitious growth can’t be accomplished without considerable capital spending. AT&T now expects to continue spending about $22 billion per year in capex over the next three years. AT&T is also acting more like a growth company with its capital return plan. The company now expects to buy back $20 billion of stock over the next three years, starting in 2025 when it hits its net debt/EBITDA leverage target of 2.5. Dividend growth, however, now appears to be a lower priority, with no promises made of any increases over the plan period.

AT&T is acting more like a growth business, so the share price appreciation already seen in 2024 seems justified if the company can deliver on its plans.

Wireless And Fiber Growth

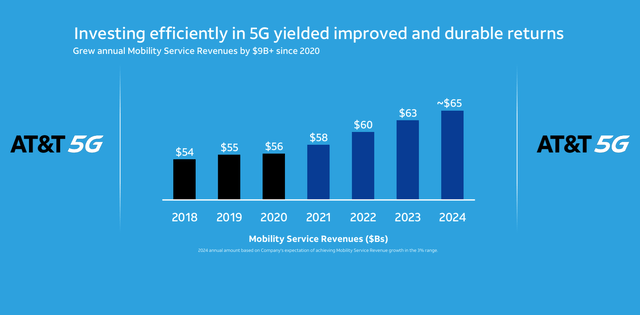

Investors should have the most confidence in AT&T’s wireless growth plans as they have already demonstrated the ability to deliver it over the past four years. After stagnating prior to 2020, the company grew customer count and revenue per user (ARPU), achieving 3.8% per year service revenue growth.

AT&T

AT&T grew ARPU by avoiding promotional pricing and giving its existing customers access to the same rates as new ones. This helped the company maintain the lowest churn rate of the big-3 carriers.

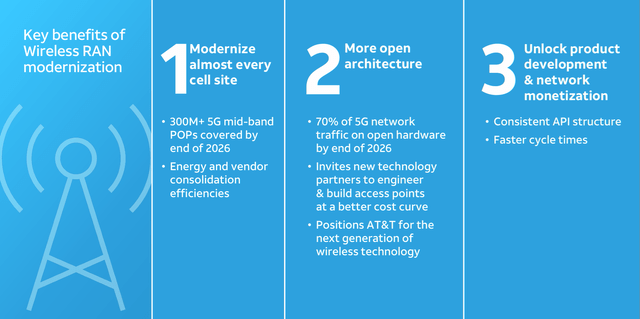

The next step for the wireless business is to switch from proprietary technology to more open architecture on the wireless network. This will save costs by lowering energy usage and consolidating vendors, standardizing hardware, and designing in capability for future generations of wireless technology. Most of the spending on these network upgrades will be done by 2026.

AT&T

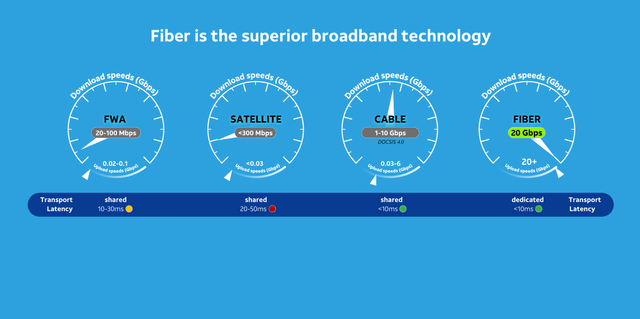

On the fiber side, AT&T has already increased locations reachable by fiber by 60% since 2020. Customer count doubled over the same period, meaning AT&T gains share in broadband when fiber is available. I’ve discussed the company’s unique fiber strategy compared to the other two big carriers previously, but this really drives home the point: Fiber is much faster than fixed wireless internet and offers symmetric download and upload speeds. As data consumption increases over time, AT&T should be well positioned to take share from its rivals despite the higher up-front costs.

AT&T

Over the next five years, AT&T plans another 72% increase in locations serviceable by fiber, reaching 50 million in 2029. 45 million of these will be on AT&T’s network, with just 5% served through the Gigapower JV.

AT&T has observed benefits of offering both wireless and fiber. Customers that bundle both products have higher satisfaction survey scores, less churn, and are more likely to adopt new products and services.

Business wireline unfortunately continues to be a headwind for AT&T, as companies continue to drop legacy voice services. AT&T is pursuing similar strategies with businesses as it does with consumers, selling them fiber and wireless connectivity and using fixed wireless as a bridge where fiber is not yet available. One bright spot in Business wireline is FirstNet, the network designed for public safety authorities, where AT&T has a dominant position.

Cost Savings, Led By Copper Phase-Out

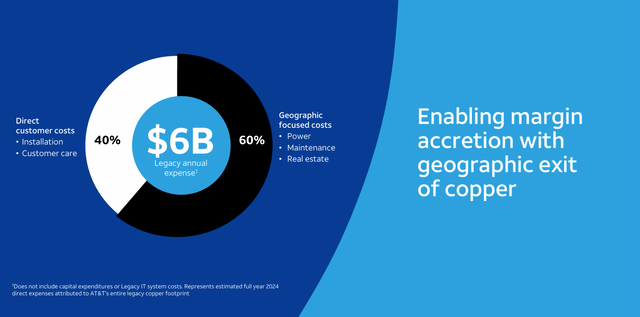

AT&T’s legacy copper wire network requires it to maintain two parallel networks (copper and fiber) over the same huge geographical area. The company estimates it spends $6 billion in costs annually to maintain the copper network. Copper has higher expenses than fiber for installation and customer service activities, as well as energy, maintenance, and real estate costs to maintain thousands of switching offices.

AT&T

Regulations requiring AT&T to provide standard telephone service have long been an obstacle to shutting down the copper network, but the FCC and most states (except California) are now on board. To address the concerns of the regulators, the company is offering “AT&T Phone – Advanced”, which gives customers the experience of a land line phone over fixed wireless or fiber internet. With replacement services in place, AT&T expects to shut down its copper network everywhere except California by 2029.

Other cost savings discussed with analysts had to do with business systems and software. Both the Open RAN wireless architecture and fiber allow for proprietary hardware and software to be phased out and replaced with more standardized products. The company is also looking at consolidating customer service and billing software into company-wide platforms rather than the different ones for different products that exist today.

Financial Plan And Valuation

AT&T took the opportunity to raise 2024 EPS guidance to the top of the prior range, so they are now at $2.20-$2.25 per share. With capex at the high end, free cash flow guidance is unchanged at $17-$18 billion. These figures include DirecTV, which will be sold in 2025. DirecTV accounts for $0.30 of EPS and $2.5 billion of FCF.

For 2025 and beyond, the company is excluding DirecTV from its forecast. On that basis, EPS is expected to be $1.97-$2.07 in 2025, or 4.9% growth. The company is forecasting double-digit EPS growth by 2027. By my calculation, that would take EPS to around $2.39 in 2027.

AT&T

AT&T also expects $16 billion of free cash flow in 2025 without DirecTV, growing $1 billion per year to $18 billion in 2027. AT&T will receive $5.4 billion in proceeds for DirecTV in 2025 and another $0.5 billion in 2029. The company expects to get its net debt/EBITDA ratio down to 2.5 by mid-2025, at which time it will start share buybacks of $20 billion total, with $10 billion by the end of 2026 and another $10 billion in 2027. As I mentioned above, AT&T made no mention of a dividend raise, but did not rule one out when asked, stating they would look at the share price, yield, and other demands for capital before deciding.

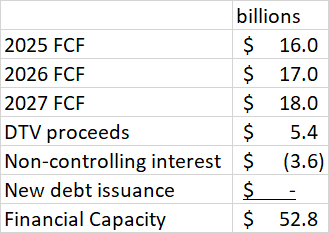

The company put all this together in a financial framework for the next three years featuring “$50+ billion” of financial capacity, $20 billion in share buybacks, “$20+ billion” in dividends, and $10 billion left over for flexibility.

AT&T

This forecast looks a bit sandbaggy to me, as the “+” numbers in the slide clearly have some upside just going off of the rest of the company’s numbers. “Financial Capacity” is defined as free cash flow, plus DirecTV proceeds, minus payments to noncontrolling interests., plus any debt issuance while staying under the 2.5 leverage target.

By my calculation, Financial Capacity should be at least $52.8 billion, even with no new debt issuance.

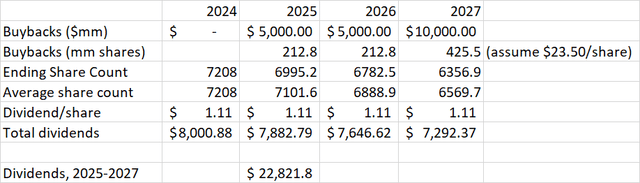

Author Spreadsheet

Similarly, the total dividend payout should be at least $22.8 billion, even if there is no dividend raise in the next three years.

Author Spreadsheet

With both cash flow and dividends $2.8 billion higher, that still leaves $20 billion for buybacks and $10 million of flexibility. I am optimistic that AT&T will not spend the $10 billion on bad M&A, having learned their lessons from the experience of the 2010s. There is a risk that some of the $10 billion will be needed for spectrum licenses. However, after spending $10 billion in 2022 and several billion since, I don’t see as big of a need in the next few years.

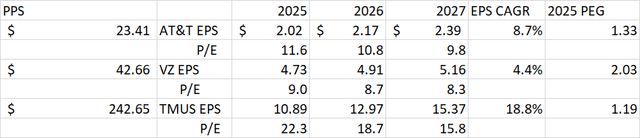

AT&T seems to be positioning itself midway between Verizon and T-Mobile as a growth company. The dividend yield of 4.9% is below Verizon’s 6.2% but above T-Mobile’s 1.2%. With no dividend raises, AT&T would have a payout ratio around 50.6% between 2025 and 2027. Verizon’s payout ratio is currently around 58.9% and T-Mobile is at 36.7%.

When we look at P/E ratios and growth rates, AT&T is also positioned in the middle. Its EPS growth rate over the next three years is double that of Verizon, but just under half that of T-Mobile. (EPS estimates from analyst day commentary for AT&T and consensus estimates for VZ and TMUS) AT&T is also in the middle on P/E and PEG ratio.

Author Spreadsheet

Conclusion

AT&T has improved operationally in the last few years, setting it up for healthy growth in its core businesses of wireless and fiber for the rest of the decade. The strong share price appreciation in 2024 reflects that, as it is now trading with a well-deserved premium to Verizon, but still cheaper than the faster growing T-Mobile.

Income investors, long a key constituency of AT&T shareholders, will probably be disappointed with the lack of a commitment to dividend growth. However, reinvestment in the business through capex as well as share buybacks should drive capital gains in AT&T stock over the next few years. It may be tough in the near term to outpace T-Mobile, at least until 2029 when AT&T’s headwinds from the copper wire network and Business wireline segments should be behind them. The fiber business could start to eclipse fixed wireless for broadband data delivery also, if data usage continues to increase.

Given the improvements we have seen in the business over the last couple of years and realistic plans for the next few years, I don’t believe there is any reason for AT&T stock to give up the gains of 2024. AT&T is more of a growth stock than it was. Investors who have been patient so far may be happy waiting a few more years as AT&T finally sheds its legacy headwinds enabling it to catch up to T-Mobile’s growth rate.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.