Summary:

- The reduction in revenues due to the decline in COVID-19-related products and services is expected to diminish or disappear in 2025.

- Thermo Fisher has been growing by acquiring other companies. This strategy led to the company growing 174% between 2017 and 2024 Q3 TTM.

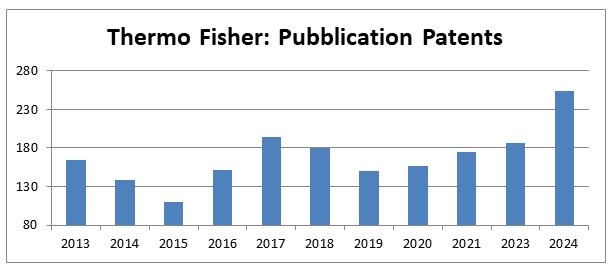

- The company is filling more patents. In the first 11 months of 2024, Thermo Fisher had 254 published patents; its maximum number in a year.

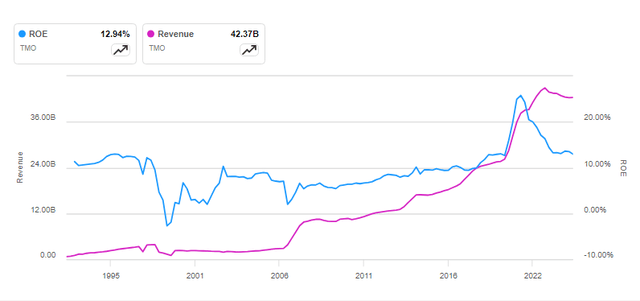

- Thermo Fisher shows a long-term stable growth and its ROEs have been positive since 2000.

JHVEPhoto

Investment Thesis

I think that Thermo Fisher (NYSE:TMO) is a good investment opportunity. The company has grown 174% between 2017 and 2024 Q3 TTM. The strategy of acquiring different companies has been the main factor for such growth. In addition, the Life Sciences Solution and Specialty Diagnostics segments exhibit revenue levels in line with the forecast of what they might have been if COVID-19 had not existed.

Thermo Fisher is filing more patents. Furthermore, the ratio of goodwill to revenues has reached its maximum value since at least 2016. These measures will help Thermo Fisher to innovate and develop new products and services. So, I believe they will contribute to increasing revenues.

Overview

Thermo Fisher is an international company headquartered in Waltham, Massachusetts, U.S. The company has four business segments; namely, Life Sciences Solutions, Analytical Instruments, Specialty Diagnostics, and Laboratory Products and Biopharma Services.

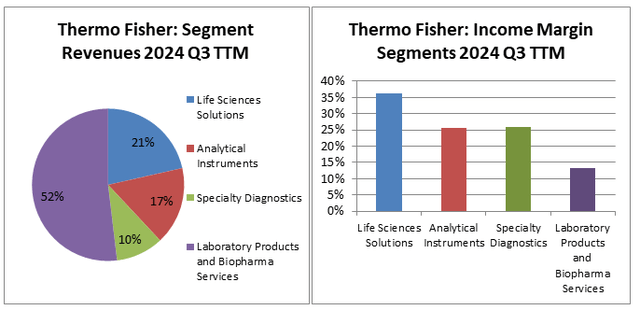

In 2024 Q3 TTM, the Laboratory Products and Biopharma Services segment represented 52% of Thermo Fisher’s revenues, while the other three segments accounted for the remaining 48%, as shown on the left chart below.

Image was created by the author with data from filings

The company exhibits excellent income margins across its business segments. Life Sciences Solutions, Analytical Instruments, and Specialty Diagnostics have income margins over 26%, as depicted on the right chart above. Laboratory Products and Biopharma Services is the segment with the smallest income margin. In 2024 Q3 TTM, the segment reported a 13% income margin.

COVID-19

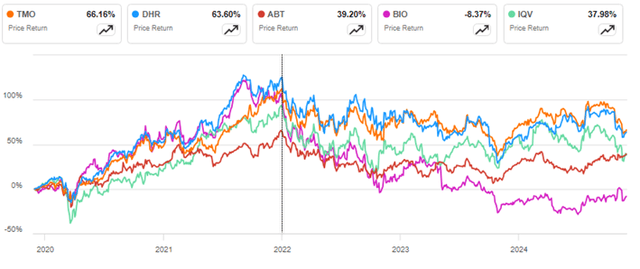

For companies like Thermo Fisher, COVID-19 has been the main factor in their financial performance. Thermo Fisher, Danaher (DHR), Abbott Laboratories (ABT), Bio-Rad (BIO), and IQVIA (IQV) have a sharp increase in their stock prices in common up to Dec 2021, as shown in the chart below. But, since that period, their stock prices have declined.

COVID-19 was the catalyst for the American government to increase the expenditure on healthcare. Before the pandemic, in 2019, the U.S. spent $10,169 per capita on healthcare. One year later, the figure increased to $11,031 per capita. Meanwhile, it declined to $10,331 per capita in 2022. These figures are in constant 2015 U.S. Dollars.

Returning to Thermo Fisher, COVID-19 is still affecting the company’s revenues. In fact, in the 2024 Q3 Earning Report, the firm indicates the following:

During the third quarter of 2024, revenues from pharma and biotech customers declined due to reduced demand for our products and services that support COVID-19 vaccines and therapies as well as a more muted macroeconomic environment, partially offset through strong commercial execution.

Market Expectation

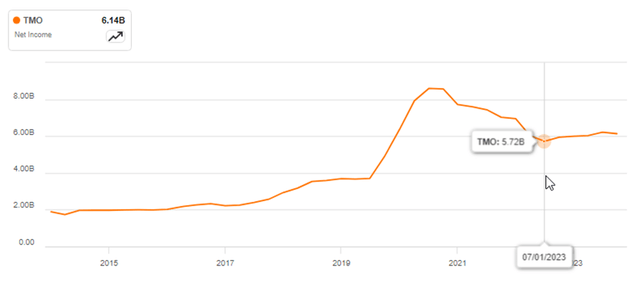

I think, at this moment, COVID-19 is the main factor that holds back Thermo Fisher’s stock price. Since 2023 Q2, the net income has remained relatively flat, as shown in the next chart. Thus, until the firm cannot show signals that its net income has recovered the upward trend perceived up to 2020, investors will likely be cautious about investing in Thermo Fisher.

Financial Data

Up to this point, in my point of view, COVID-19 has marked Thermo Fisher’s financial performance. However, I believe the company is close to leaving that period.

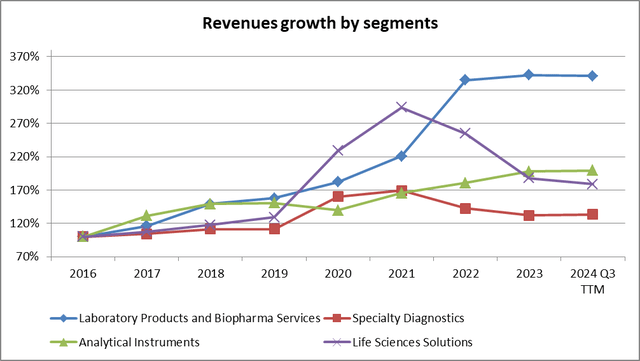

Since 2021, Thermo Fisher’s Life Sciences Solutions segment, and Thermo Fisher’s Laboratory and Biopharma Services have seen a decline in their revenues, as depicted in the next chart. However, I think both segments will see an increase in their revenues in 2025.

Image was created by the author with data from filings

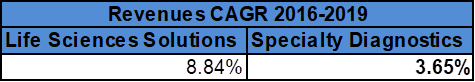

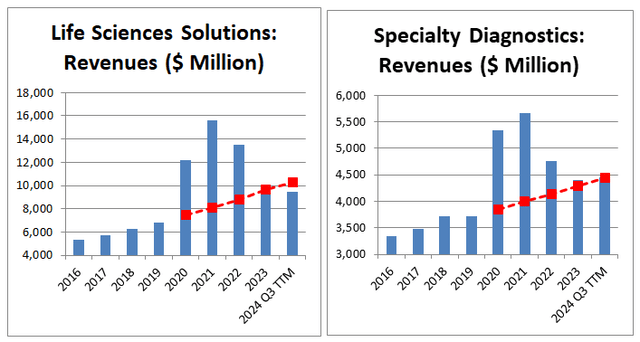

I think a good approximation is to calculate the compound annual growth rate of the revenues for the Life Science Solutions and Specialty Diagnostic segments, between 2016 and 2019. This period ended before the COVID-19 outbreak. Thus, these rates can be seen as a proxy for the real revenue growth rate for both segments, as they are not affected by the pandemic. My assumption is that the projected revenues for the period 2020-2024 Q3 TTM, using the compound annual growth rate calculated during 2016-2019, should have similar values with the real values of 2024 Q3 TTM to consider that the COVID-19 effect has vanished. I try to show the reader what might have occurred with the revenues if the coronavirus had not existed.

The following table shows the CAGR of the revenues for Life Sciences Solution and Specialty Diagnostics, between 2016 and 2019.

Image was created by the author with data from filings

At this point, it is necessary to forecast the revenues. When doing so, the forecasted revenues for Life Sciences Solutions (dotted red line) in 2024 Q3 TTM were $10,254 million, while the real revenues were $9,496. So, for 2024 Q3 TTM, the forecast is in line with the real value, as shown in the next chart.

Image was created by the author with data from filings

When forecasting the revenues of Specialty Diagnostics for 2020 to 2024 Q3 TTM, using the revenues’ CAGR computed during 2020-2023 Q3 TTM, the forecast revenues (dotted red line) in 2023Q3 TTM were $4,448 million. Meanwhile, the actual revenues were $4,460 million, as shown in the previous chart. Both values are similar, which leads me to the conclusion that the revenues have returned to their normal growth rate.

M&A

The previous sections discuss the COVID-19 effect on Thermo Fisher’s financial performance. However, they did not shed light on what successful strategies the company implemented to increase its sales. This section will discuss how Thermo Fisher has grown by acquiring other companies. In fact, the company expects that mergers and acquisitions (M&A) will represent 60%-75% of its capital deployment. This section will discuss some of the most important of Thermo Fisher’s acquisitions since 2017.

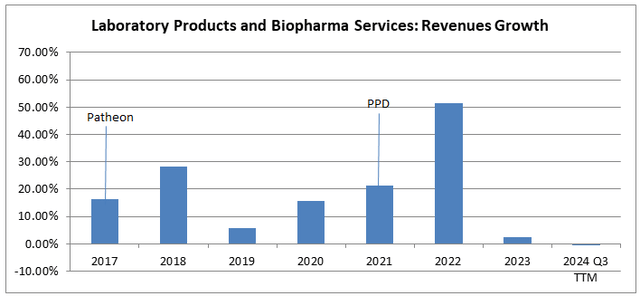

In 2017, Thermo Fisher acquired Patheon for $7,360 million. Thanks to this operation, the revenues of the Laboratory Products and Biopharma Services segment saw a yearly increment of 28.28% in 2018, as shown in the next chart. The other relevant acquisition in this segment was in 2021. That year the company acquired PPD for $16,036 million. The next year, the revenues of the Laboratory Products and Biopharma Services segment increased 51.47% year on year.

Image was created by the author with data from filings

The Laboratory Products and Biopharma Services segment benefited from the acquisitions of Patheon and PPD. The segment accounted for more than 50% of the Company’s revenues in the 2024 Q3 TTM, in part due to these acquisitions.

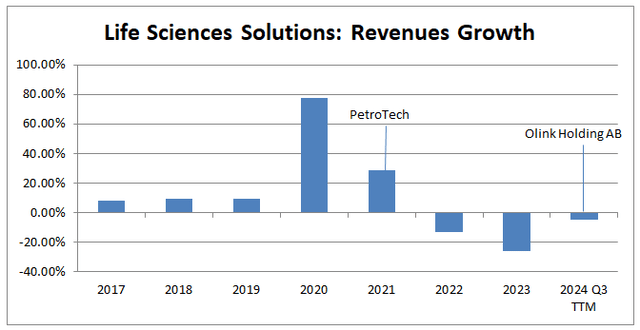

M&A has also played an essential role in the Life Science Solutions segment. In 2021, Thermo Fisher acquired PetroTech for $1,864 million. In the next year, the segment revenues declined by 13.43%, as depicted in the next chart. However, COVID-19 was the main factor of that decline, without the PetroTech acquisition, the drop in sales would have been higher. In 2024, Thermo Fisher acquired Olink Holding for approximately $3,100 million. I think the Olink Holding acquisition could revert the decline of the revenues observed in the Life Science Solutions segment since 2022.

Image was created by the author with data from filings

Services: CRO and CDMO

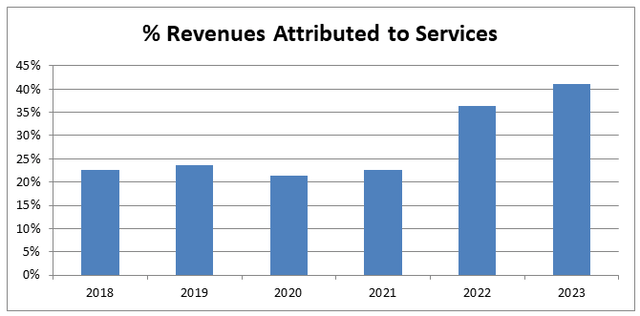

Service revenues are becoming increasingly important to Thermo Fisher. From 2018 to 2023, the revenues attributed to services grew by 221%. In addition, in 2023, services were 41% of the revenues, as shown in the next chart.

Image was created by the author with data from filings

Before moving on, the reader must understand the five phases of clinical research. The development of a new medicine or vaccine is a costly process. Developing a new drug can range from $314 million to $4,460 million. In addition, on average, the development of a new drug takes 10-15 years. The full process is divided into five phases, which are:

- Discovery and development

- Preclinical research

- Clinical research

- FDA review

- FDA Post-Market Safety Monitoring

Thermo Fisher is growing in the five phases of the development of clinical research. The company provides the service and logistics for developing a new medical drug on behalf of other companies. In fact, the most important acquisition of Thermo Fisher (Patheon and PPD) offers these services.

PPD is the leading company offering Contract Research Organization (CRO) solutions. A CRO is a contract in which a third company will provide the research and development of a new drug or vaccine. This service focused on clinical trial services. So, the service corresponds to the second and third phases of developing a new drug. Thermo Fisher’s Revenues from CRO were $8,000 million.

Patheon offers contract development and manufacturing organization (CDMO). A CDMO provides services to implement the five phases of developing a new drug. In 2023, this segment brought $7,000 million to Thermo Fisher. CRO and CDMO are part of the Laboratory Products and Biopharma Services segment.

Intangible Assets

Patent filings is another point that is worth mentioning. In the first 11 months of 2024, Thermo Fisher has 254 published patents, and it is the first time that surpasses the 200 mark in a year, as shown in the next chart. In my article about Bio-Rad (BIO), I explain what a patent publication is.

Image was created by the author with data from filings

Thermo Fisher is doing more research, which means developing or improving its existing portfolio of products and services. These higher patent filings will bring products and services with more innovation to the market. Thus, these innovations could positively influence Thermo Fisher’s revenues and earnings.

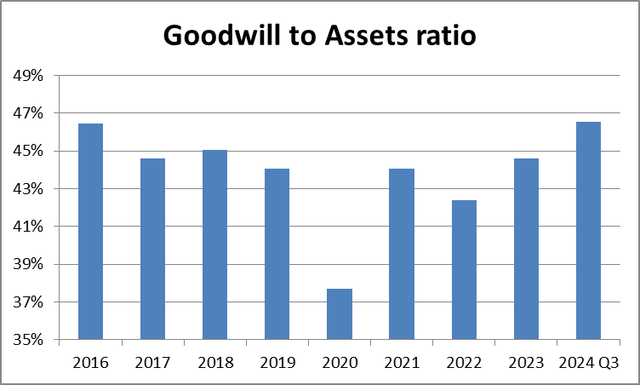

Intangible asset is another area to pay particular attention to. The acquisitions executed since 2020 have caused an increase in the goodwill-to-assets ratio. In fact, in 2024 Q3, as shown in the table below, this ratio reached 47%, which is its highest value since 2016.

Image was created by the author with data from filings

Solid Financial Grounds

I think it is appropriate to start this section by quoting a paragraph from Warren Buffett’s 2023 annual letter to shareholders:

At Berkshire, we particularly favor the rare enterprise that can deploy additional capital at high returns in the future. Owning only one of these companies – and simply sitting tight – can deliver wealth almost beyond measure.

Thermo Fisher is on solid financial grounds. Since 2020, the company has been able to achieve positive returns on equity, as depicted in the next chart. So, Thermo Fisher has been successful in generating positive earnings. The only pitfall is that the ROE has been fluctuating around 10% since 2000, which is not a high return level. In addition, Thermo Fisher has deployed capital by acquiring new companies. The chart shows how the company has seen its revenues increase for several years.

I think the mix between growth and earnings is the main factor. It means the company has been successful in expanding its operation, but without neglecting its earnings.

Risk

The most important companies acquired by Thermo Fisher are in the Laboratory Products and Biopharma Services segments. However, this segment has the lowest income margin, with 13%. I consider that Thermo Fisher is not optimally investing its resources. Thus, if this segment suffers a decline in its income margin, Thermo Fisher’s stock price could suffer a significant drop. The Laboratory Products and Biopharma Services segments accounted for 52% of Thermo Fisher’s revenues in 2024 Q3 TTM.

The long-term obligation is another factor to mention. In 2021, Long-term obligations jumped 69.22% to $32,333 million. Meanwhile, in 2024 Q3, this figure was $31,197 million. The company has not prioritized its effort to reduce this debt. So, if there is a downtrend in Thermo Fisher’s revenues for several years, the company could have serious problems repaying its long-term obligations.

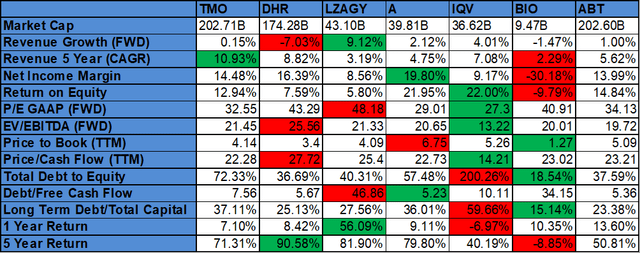

Peer Analysis

This section will implement the peer analysis among Thermo Fisher, Danaher (DHR), Lonza Group (OTCPK:LZAGY), Agilent (A), IQVIA (IQV), Bio-Rad (BIO), and Abbott Laboratories (ABT). I selected these companies because they compete with Thermo Fisher in at least one of its business segments.

Thermo Fisher excels in its 5-year revenues growth and stands as the leader among its peers. However, for 2024, the company expects a 0.15% growth in its revenues. Regarding the return on equity, Thermo Fisher ranks fourth among its peers. Thus, it is on the average side.

In the four valuation metrics presented, Thermo Fisher shows that it’s average among its peers. Thermo Fisher has the third highest P/E ratio with 32.55. In addition, the company exhibits a price-to-book of 4.14.

The ratio of total debt-to-equity is the most important aspect to worry about. Thermo Fisher has the second-highest total debt-to-equity ratio, at 72.33%. However, the debt is still below the equity. In addition, the debt-to-free cash flow ratio is 7.56, which in my opinion is an aspect to be concerned about.

Due to the analysis presented in this section, the market has not rewarded Thermo Fisher. The company exhibits the second-lowest 1-year return with 7.10%. However, when considering a longer time frame, five years, Thermo Fisher’s stock price has grown 71%, while the leader, DHR, has a 90.58% increase in its stock price.

All in all, I think Thermo Fisher is a well-balanced company. The company does not exhibit metrics that indicate red flags. For example, IQV exhibits the highest ROE, but at the same time, is the most indebted company. It is not necessary to have the highest ROE when on the other side of the equation, there is a massive debt. So, the prudence that Thermo Fisher uses to manage its operation is the most important aspect. As Aristotle said, virtue is the mean between two extremes.

Conclusion

In light of the analysis presented in this article, I consider that Thermo Fisher is an excellent investment opportunity. First, the company has been successful in acquiring companies. Partly due to this strategy, Thermo Fisher’s net income grew at an annual compound rate of 16.10%, between 2017 and 2024 Q3 TTM.

COVID-19 is not expected to be a factor that will hold back Thermo Fisher’s revenues. In 2022, the U.S. expenditure per capita in healthcare returned to the values observed before the coronavirus. In addition, when forecasting the revenues of the Life Sciences Solutions and Specialty Diagnostics segments for the period 2020-2024, using the revenues’ growth rate of each segment calculated during the period 2016-2019 enables one to see what might have been the growth of the revenues without the effect of the COVID-19. In 2024 Q3 TTM, the forecasted revenues are in line with the real values observed in that quarter.

The investment in intangible assets is another factor to mention. Thermo Fisher is filing more patents, and in 2024, the company has reached its highest patent publication numbers. In addition, with the acquisition of new companies, the goodwill-to-assets ratio has seen its maximum value since at least 2016. This effort will help the company to develop and improve its portfolio of products and services.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.